So that banks can get the best out of Thought Machine’s Vault, Synpulse has Vault-ready engineers and consultants who play key roles from strategy to implementation.

Synpulse x Thought Machine Operating Requirements Model (STORM)

Synpulse’s product and process excellence combined with Thought Machine’s next-generation core banking engine, Vault, can accelerate your digital banking journey from value proposition to operationalisation.

Are you asking yourself:

- Are you planning to build a digital bank that can be implemented quickly, efficiently and with substantial cost savings?

- How do I build a target operating model fit for a digital bank?

- How can I enhance my organisation’s core banking system?

- How do I build a cloud native platform that serves a highly digital customer base?

- How do I build a plan to steer the transformation of my businesses and operations?

What you will get from us:

- A target operating model and strategy uniquely curated for digital banks of all shapes and sizes with Thought Machine as the core banking system at the foundation

- A model that outlines 100 baseline processes required to set up a new digital bank, mapped and seamlessly integrated with Thought Machine’s Vault

- Processes that are designed such that stakeholders across the bank can analyse, adopt and build on top of them effortlessly

- A 35% reduction in time-to-market compared to a traditional modelling and planning approach, resulting in substantial cost savings

Our Approach

Target architecture with Thought Machine at its core

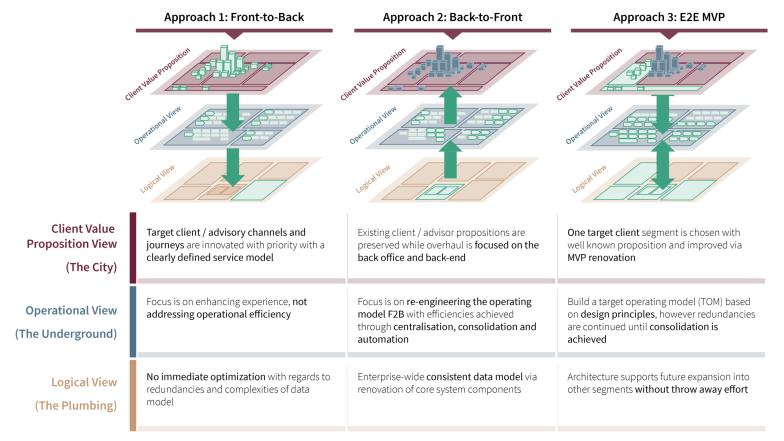

Synpulse helps banks to define and implement an end-to-end digital banking target enterprise architecture, with Thought Machine at the core.

Together, we adopt a unique ‘city-planning’ approach to facilitate complex transformation projects and achieve maximum operational efficiency.