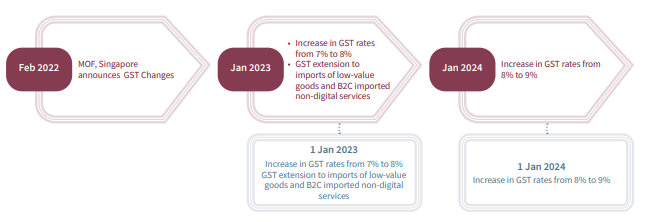

The Singapore Ministry of Finance (MOF) continues to revise the Goods and Services Tax (GST) as a necessary and strategic decision to fund Singapore’s revenue needs. Announced during the Singapore Budget 2022, the changes that will take effect from January 2023 will see progressive changes to the applied tax rate, as well as an expansion in the scope of goods and services which are eligible for GST.

Financial services providers in Singapore will likewise be affected, with those importing services from offshore entities seeing the greatest impact. With the limited time until the rules take effect, financial institutions (FIs) need to ready themselves for the changes.

The changes to the existing GST structure

During the Singapore Budget 2022 annoucement, MOF announce that they will be introducing additional changes to the current GST structure. These changes are centred around:

- Changes in the GST rate

- GST extension to imports of low-value goods and business-to-consumer (B2C) imported non-digital services

- Imported non-digital services supplied in the context of B2C transactions will be subjected to GST by way of extending the overseas vendor regime.

- Reverse charge and overseas vendor GST registration rules for imported services by GST registered business, and digital services supplied by foreign service providers (overseas vendors) to Singapore non-GST registered customers, were initiated on 1 January 2020. The current scope will be expanded to non-digital services and low-value goods from 1 January 2023.

For specific transitional guidelines, refer to the Inland Revenue Authority of Singapore’s (IRAS) guide, “2023 GST Rate Change: A Guide for GST-registered Businesses (Second Edition)”.1

How FIs may be impacted from January 2023

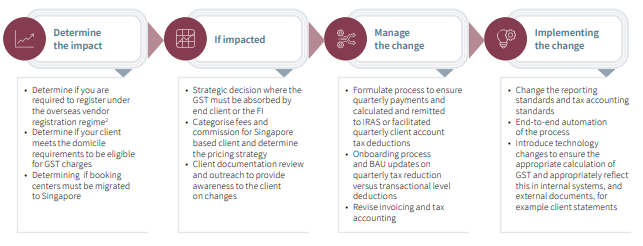

FIs will need to assess the GST changes to determine the level of impact. The legal structures, technology in use, and client domiciles will affect the level of changes that FIs will need to make to ensure compliance.

How Synpulse can help

Synpulse is working with top tier financial institutions to facilitate a smooth integration of the transition in the GST changes. In this capacity we have analysed client populations, legal entity structures, and booking models to prepare detailed impact assessments of the GST changes. Combining subject matter expertise with our end-to-end project delivery capabilities in developing bespoke solutions that best address the individual client's needs, we support our clients every step of the way.

1 IRAS. Overview of GST Rate Change. Assessed 26 August 2022.

2 IRAS. IRAS e-Tax Guide – GST: Taxing imported services by way of an overseas vendor registration regime (Third Edition)