Loading Insight...

Insights

Insights

Cedents are curious to find out how a state of the art new system could transform their outwards reinsurance operations.

Outwards reinsurance has not typically been the focus of digitalisation over the past 30 years, and insurers, more often than not, have relied on Excel spreadsheets to manually calculate ceded premiums, commissions, and recoveries.

There have been some old, inflexible technology solutions available to help reinsurance teams automate and digitalise their processes, but it’s the new generation of Outwards Reinsurance Systems (ORS) that has entered the market over the past two to three years that is grabbing the attention of insurers today.

A key differentiator that sets apart these new products developed by start-ups and scale-ups is a modern technology stack and architecture. What the new generation of systems offers is cloud-native, microservice-based API structures with great UI/UX.

The modern setup makes it easy to connect to an insurer’s application landscape and is flexible to evolve with the business. With easy integrations into insurers’ policy admin systems, automated calculations can be performed, and the output shared automatically downstream. Through the dynamic allocation of computer resources, the operating cost can be optimised through ‘pay as you use’.

Some of these modern system providers have taken advantage of Distributed Ledger Technology (DLT) to further future-ready their solutions. While not always considered a requirement by insurers today, a distributed ledger offers an immutable, auditable transaction history that can be shared by multiple parties.

Sharing data via a distributed ledger promises one version of the truth common to insurers, reinsurers, and brokers. It remains to be seen how these privately held ledgers, each adhering to their own data standards, can solve the bigger challenge around industry-wide data sharing. In any case, what the use of DLT demonstrates is the technology-first ethos that drives the new generation of ORS providers.

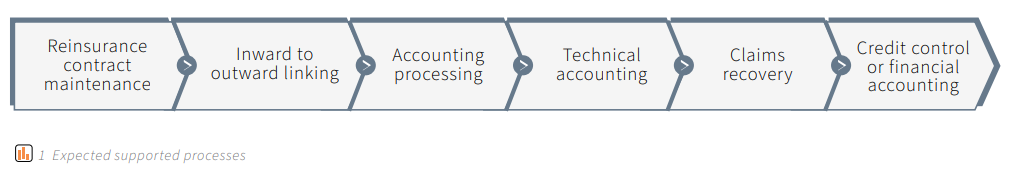

A modern ORS offers a broad spectrum of capabilities over and above contract administration:

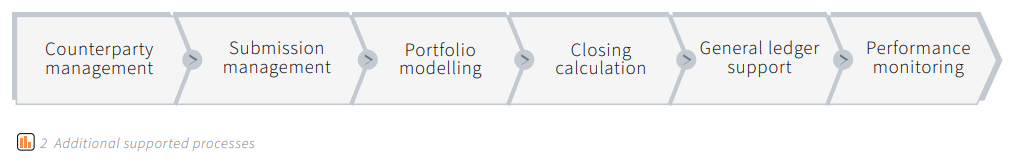

Additionally, an outwards reinsurance system may offer supporting capabilities, such as:

The new generation of ORS set their focus on automated policy to treaty matching, automated calculations and intuitive UI. The insurance market currently has access to more than 16 systems. Even the most established incumbents are being challenged by the new technology-driven generation in RfPs, so insurers are best advised to carefully assess their requirements against the market offering before deciding about the implementation of a new system.

The two crucial success factors for implementing any new outwards reinsurance system are integration and data quality. Efforts targeted at properly designing the integration architecture and building APIs that are consistent and predictable will pay dividends way into the future. As the insurer grows over time, additional landscape complexity will be easily managed. Connectivity between systems will make sense to new joiners, and the efforts and complexity of workarounds will be reduced.

High standards for data quality go hand in hand with integration efforts to ensure that the new system can make sense of the migrated policy and claim records. Inherited historical data can be linked to new data that will be acquired in future. Moreover, high-quality data can be better shared with other parties where needed, such as reinsurers and regulators.

A sophisticated new ORS may not be for everyone, but the benefits far outweigh the initial implementation effort. A ‘new generation’ system can deliver:

1. Better oversight and control over what coverage is in place, driven by seamless inwards to outwards policy linking.

- Underwriters can use reinsurance strategically for growth by knowing their net line position at the point of (or even before) policy inception

- Finance or actuarial know immediately after a loss what the impact will be

- Cost efficiency is improved by not purchasing overlapping reinsurance coverage on the same risks

2. Operational efficiency improvement through automated calculations.

- Underwriters can spend their time on high-value activities that help the insurer meet its strategic objectives

- Manual errors are reduced to a minimum, and for any corrections, a digital audit trail exists

- Reporting to regulators is sped up and made easier

3. Future-proofing the business by using state-of-the-art technology as well as adopting modern data and integration architectures.

- Growth of the business into new product lines and geos, including through M&A, can be seamlessly absorbed

- Data is readily available for MI and to share with internal and external systems

- Employee experience is inspired by user-friendly UI and excellent system performance

- Security is enhanced by easy-to-manage user roles and access restriction

The implementation of a ‘new generation’ outwards reinsurance system does not necessarily require a multi-year transformation initiative. Vendors offer modular system architectures that allow insurers to see quick results of their efforts. Business analysis creates the foundation to help the system providers understand processes and requirements, and a technical designer is required to design, build, and test interfaces. Once the vendor decision has been taken, an agile collaboration with the new tech companies results in quick successes and savings.

If you’re interested in finding out more information about outwards reinsurance systems or would like to discuss your requirements in more detail, feel free to contact us for an initial conversation.

Cedents are curious to find out how a state of the art new system could transform their outwards reinsurance operations.

Outwards reinsurance has not typically been the focus of digitalisation over the past 30 years, and insurers, more often than not, have relied on Excel spreadsheets to manually calculate ceded premiums, commissions, and recoveries.

There have been some old, inflexible technology solutions available to help reinsurance teams automate and digitalise their processes, but it’s the new generation of Outwards Reinsurance Systems (ORS) that has entered the market over the past two to three years that is grabbing the attention of insurers today.

A key differentiator that sets apart these new products developed by start-ups and scale-ups is a modern technology stack and architecture. What the new generation of systems offers is cloud-native, microservice-based API structures with great UI/UX.

The modern setup makes it easy to connect to an insurer’s application landscape and is flexible to evolve with the business. With easy integrations into insurers’ policy admin systems, automated calculations can be performed, and the output shared automatically downstream. Through the dynamic allocation of computer resources, the operating cost can be optimised through ‘pay as you use’.

Some of these modern system providers have taken advantage of Distributed Ledger Technology (DLT) to further future-ready their solutions. While not always considered a requirement by insurers today, a distributed ledger offers an immutable, auditable transaction history that can be shared by multiple parties.

Sharing data via a distributed ledger promises one version of the truth common to insurers, reinsurers, and brokers. It remains to be seen how these privately held ledgers, each adhering to their own data standards, can solve the bigger challenge around industry-wide data sharing. In any case, what the use of DLT demonstrates is the technology-first ethos that drives the new generation of ORS providers.

A modern ORS offers a broad spectrum of capabilities over and above contract administration:

Additionally, an outwards reinsurance system may offer supporting capabilities, such as:

The new generation of ORS set their focus on automated policy to treaty matching, automated calculations and intuitive UI. The insurance market currently has access to more than 16 systems. Even the most established incumbents are being challenged by the new technology-driven generation in RfPs, so insurers are best advised to carefully assess their requirements against the market offering before deciding about the implementation of a new system.

The two crucial success factors for implementing any new outwards reinsurance system are integration and data quality. Efforts targeted at properly designing the integration architecture and building APIs that are consistent and predictable will pay dividends way into the future. As the insurer grows over time, additional landscape complexity will be easily managed. Connectivity between systems will make sense to new joiners, and the efforts and complexity of workarounds will be reduced.

High standards for data quality go hand in hand with integration efforts to ensure that the new system can make sense of the migrated policy and claim records. Inherited historical data can be linked to new data that will be acquired in future. Moreover, high-quality data can be better shared with other parties where needed, such as reinsurers and regulators.

A sophisticated new ORS may not be for everyone, but the benefits far outweigh the initial implementation effort. A ‘new generation’ system can deliver:

1. Better oversight and control over what coverage is in place, driven by seamless inwards to outwards policy linking.

- Underwriters can use reinsurance strategically for growth by knowing their net line position at the point of (or even before) policy inception

- Finance or actuarial know immediately after a loss what the impact will be

- Cost efficiency is improved by not purchasing overlapping reinsurance coverage on the same risks

2. Operational efficiency improvement through automated calculations.

- Underwriters can spend their time on high-value activities that help the insurer meet its strategic objectives

- Manual errors are reduced to a minimum, and for any corrections, a digital audit trail exists

- Reporting to regulators is sped up and made easier

3. Future-proofing the business by using state-of-the-art technology as well as adopting modern data and integration architectures.

- Growth of the business into new product lines and geos, including through M&A, can be seamlessly absorbed

- Data is readily available for MI and to share with internal and external systems

- Employee experience is inspired by user-friendly UI and excellent system performance

- Security is enhanced by easy-to-manage user roles and access restriction

The implementation of a ‘new generation’ outwards reinsurance system does not necessarily require a multi-year transformation initiative. Vendors offer modular system architectures that allow insurers to see quick results of their efforts. Business analysis creates the foundation to help the system providers understand processes and requirements, and a technical designer is required to design, build, and test interfaces. Once the vendor decision has been taken, an agile collaboration with the new tech companies results in quick successes and savings.

If you’re interested in finding out more information about outwards reinsurance systems or would like to discuss your requirements in more detail, feel free to contact us for an initial conversation.