Loading Insight...

Insights

Insights

In this article, we look at the adoption of artificial intelligence and machine learning (AI/ML) across the Asia-Pacific (APAC) region and the steps regulators are taking to ensure its safe and ethical use.

s the financial industry undergoes rapid transformation, staying ahead of the rising competition requires financial institutions (FIs) to leverage cutting-edge technologies, such as AI/ML. However, the increasing adoption of AI/ML raises concerns about potential risks, including the lack of transparency and privacy. To ensure compliance with the existing requirements, FIs must be aware of the relevant guidelines when designing and using AI/ML applications.

Regulatory landscape and sentiment on the use of AI/ML

Strict regulatory oversight plays a significant role in shaping the strategies of FIs in the APAC region. Recognising the potential of AI/ML as key drivers of innovation in financial services, regulators actively promote their development and adoption.

Although no specific regulation exists for AI/ML use, regulators have issued extensive guidance and principles, launched schemes and initiatives, and offered financial incentives to support FIs in adopting advanced technology, promoting innovation and upskilling, and preparing for growth.

1. Singapore

The Monetary Authority of Singapore (MAS) promotes AI/ML and advanced technology to digitise banking operations. To support this effort, MAS launched the Financial Sector Technology and Innovation (FSTI) scheme in 2015, which sanctioned SGD 225 million for FIs to adopt AI for risk management, customer service, and efficiency.1

Additionally, the Artificial Intelligence and Data Analytics (AIDA) Grant programme was launched in 2017, providing up to 50% funding support for AI and data analytics adoption.2 The following year in 2018, Veritas developed a framework for its ethical and responsible use. MAS also partnered with industry players to develop AI solutions in banking, including AI-powered virtual bank assistants and digital advisory tools.

2. Taiwan

Taiwan's government and the Financial Supervisory Commission launched the FinTech Regulatory Sandbox in 2018 to test innovative fintech solutions, including AI/ML. They collaborate with industry players to develop AI solutions, such as an AI-powered chatbot for customer service. Open banking is promoted, and guidelines for implementation have been issued, with several banks launching open banking platforms. The Financial Information Service Platform offers financial institutions access to a centralised data repository for developing AI/ML solutions.3

3. Hong Kong

The Hong Kong Monetary Authority (HKMA) launched the Banking Made Easy Task Force in 2018 to promote AI/ML and Regtech usage across multiple digital journeys for banks in Hong Kong. Measures include the introduction of an open API standard.4

In 2016, the Fintech Innovation Hub was established to provide a platform for Fintechs to collaborate with banks.5 The government actively promotes Regtech solutions, with programmes like the Cybersecurity Fortification Initiative launched in the same year.6 The HKMA also collaborates with industry players to develop AI/ML solutions, such as an AI-powered anti-fraud system with the largest bank in Hong Kong.

4. Malaysia

Artificial Intelligence Roadmap 2021-2025 (AI-Rmap), and the Malaysian Digital Economy Blueprint in 2021 to support the adoption of advanced technologies in the financial industry.7

The Securities Commission's Capital Market Masterplan 3 promotes Regtech adoption, while the Malaysia Digital Economy Corporation collaborates with the banking sector for fintech solutions.8 Efforts to encourage the usage of AI/ML technologies are also reflected when Bank Negara Malaysia (BNM), the central bank of Malaysia, issued guidelines for open banking, resulting in the launch of several banks' platforms.9

5. Australia

Australia has launched the Consumer Data Right in 2019, which allows consumers to access and share their personal data with third-party service providers, including banking data with other banks. This promotes competition and innovation in the banking sector by enabling fintech companies to access bank data and develop innovative solutions using AI/ML.

The Australian government also promotes Regtech solutions to enhance regulatory compliance. They established the Regtech Advisory Group to facilitate collaboration between fintech companies and public-private partnerships and develop an AI-powered financial assistant for customers.10 Additionally, the Organisation for Economic Cooperation and Development published AI ethics principles to address risks to human safety, data protection, privacy, and fairness.

6. The Philippines

The Philippine government has launched several initiatives to promote the growth of the fintech industry, including AI/ML solutions in banking. The Fintech Alliance.Ph and Digital Transformation Strategy aim to drive this growth, while the National Retail Payment System promotes electronic payments and digital financial services.11 Moreover, the Regtech Steering Committee supports Regtech companies and the Fintech Innovation Lab offers funding and support to fintech companies developing innovative solutions.

Governing bodies across APAC are investing heavily to promote the use of AI/ML in their financial sectors through public-private partnerships, subsidies, and initiatives. The implementation of these technologies is encouraged as long as it is done ethically, responsibly, and securely.

AI/ML innovations in the banking sector

AI/ML encompasses diverse technologies that can optimise different banking processes, improve customer experiences, and strengthen financial crime and operational risk management.

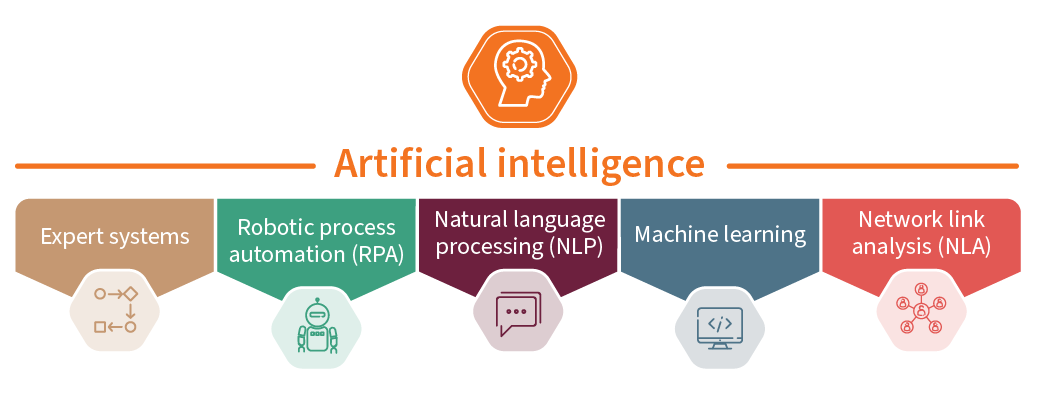

Figure 1: Five pillars of artificial intelligence

Here are the examples:

- Expert systems. Systems that provide decisioning support and automate complex processes that require human expertise. They can be used in loan underwriting where the system analyses credit scores, income, and other financial data to determine the risk associated with a loan application and make a recommendation for approval or denial.

- Robotic process automation (RPA). RPA automates repetitive and routine tasks, increasing efficiency by automating manual processes, such as client lifecycle management in banks. RPA with optical character recognition helps extracts data from customer documents and records it in the bank's systems, reducing the need for manual review during processes like client onboarding and know your customer.

- Biometric matching and natural language processing (NLP). Biometric matching uses unique biological attributes like faces, iris, and fingerprints for identification, while NLP interprets human language. These technologies are used in facial and voice recognition, as well as fingerprint recognition, to identify customers accessing their bank accounts or completing transactions. NLP and natural language generation are also used for chatbots in digital banking applications.

- Machine learning. ML enables banks to predict future outcomes by processing and analysing historical data. It has a wide range of use cases across the banking value chain, including recommendation systems, customer segmentation, and fraud detection.

- Entity resolution and network link analysis (NLA). NLA uses entity resolution and network generation to connect disparate data points and identify hidden relationships. This helps detect fraud and criminal activity by analysing large datasets in real time, flagging suspicious activity, and allowing investigators to focus their efforts on high-risk cases.

Challenges of implementing AI/ML technologies

Although AI and ML hold the potential to improve the effectiveness and efficiency of an organisation's business functions, there are various factors that can significantly impact the success or failure of an AI transformation programme.

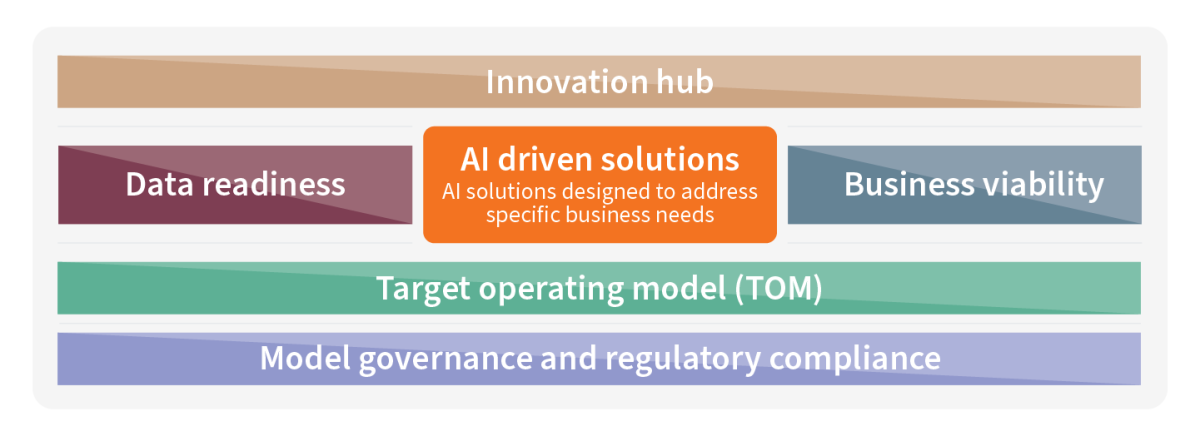

Figure 2: Enterprise-wide AI transformation framework

- Data readiness. Data is crucial for any AI model and must be considered before starting development. Factors, including data availability, maturity, quality, and lineage, should be evaluated to ensure the models are fit for purpose.

- Business viability. Organisations must drive and maintain usage of technological solutions through socialisation, training, data visualisation, and comprehension of the product. Failure to deliver on any of these areas can result in a lack of adoption or failure of a solution.

- Target operating model (TOM). Continuous assessment and redesign of the TOM is essential throughout the AI implementation roadmap to ensure that the teams and processes affected by the solution are aligned and optimised for success.

- Model governance and regulatory compliance. Robust governance is essential to monitor the creation, testing, and usage of AI-based solutions, and compliance with regulatory guidelines is crucial throughout the implementation roadmap in APAC countries.

- Centralised innovation. Cross-functional teams with the relevant techno-functional expertise are necessary to support various aspects of AI implementation roadmaps, including technology decisions, vendor evaluation, development of business use cases, and more.

How can we help?

With 25 years of experience in the financial services industry, Synpulse offers consulting and technology services across the entire value chain. Our expertise in AI/ML technologies, regulatory compliance, and risk management allows us to identify and address business problems while ensuring compliance.

Our capabilities include:

- Data management. We can assist clients with their data management needs through our data management in a box (DMINABOX®) methodology and framework, which helps clients understand their current data state and establish robust data governance and management capabilities.

- TOM design. We help clients design and set up a TOM for their business using our BANKINABOX® framework, incorporating accepted and contextual best practices across banking functions for a robust and expedited implementation.

- ML in banking. Our team has extensive experience in supporting banks select AI/ML-based solutions, design and develop the solutions with the banks, and validate the developed solutions in line with regulatory guidance. These are done while ensuring the business objectives are achieved.

- RPA. We have expertise in assisting banks to select, design, develop, and validate AI/ML-based solutions while ensuring regulatory compliance and achieving business objectives.

- NLA. We have experience and expertise in designing, implementing, and deploying NLA-based solutions for various use cases, such as master data modelling, financial crime and compliance, credit risk, ESG, and revenue and lead generation.

- Facilitating innovation. We can facilitate design thinking workshops to help teams collaborate and develop innovative solutions for new product ideas and problem areas.

1 Financial Sector Technology and Innovation Scheme (MAS, March 2023). 2 Artificial Intelligence and Data Analytics (AIDA) Grant (MAS, October 2021). 3 Financial Information Service Co., Ltd – Index (March 2023). 4 The Next Phase of the Banking Open API Journey (HKMA, 2021). 5 HKMA-ASTRI Fintech Innovation Hub (ASTRI, November 2016). 6 Hong Kong Monetary Authority Strengthens Cybersecurity Controls on Banks (Norton Rose Fulbright, May 2016). 7 Malaysia Digital Economy Blueprint (Economic Planning Unit, Prime Minister’s Department, February 2021). 8 Capital Market Masterplan 3 (Securities Commission Malaysia, November 2021). 9 Licensing Framework for Digital Banks (BNM, December 2020). 10 The RegTech Association (2017). The RegTech Association - Home / 2022 11 Payments and Settlements - National Retail Payment System (BSP, April 2020).

In this article, we look at the adoption of artificial intelligence and machine learning (AI/ML) across the Asia-Pacific (APAC) region and the steps regulators are taking to ensure its safe and ethical use.

s the financial industry undergoes rapid transformation, staying ahead of the rising competition requires financial institutions (FIs) to leverage cutting-edge technologies, such as AI/ML. However, the increasing adoption of AI/ML raises concerns about potential risks, including the lack of transparency and privacy. To ensure compliance with the existing requirements, FIs must be aware of the relevant guidelines when designing and using AI/ML applications.

Regulatory landscape and sentiment on the use of AI/ML

Strict regulatory oversight plays a significant role in shaping the strategies of FIs in the APAC region. Recognising the potential of AI/ML as key drivers of innovation in financial services, regulators actively promote their development and adoption.

Although no specific regulation exists for AI/ML use, regulators have issued extensive guidance and principles, launched schemes and initiatives, and offered financial incentives to support FIs in adopting advanced technology, promoting innovation and upskilling, and preparing for growth.

1. Singapore

The Monetary Authority of Singapore (MAS) promotes AI/ML and advanced technology to digitise banking operations. To support this effort, MAS launched the Financial Sector Technology and Innovation (FSTI) scheme in 2015, which sanctioned SGD 225 million for FIs to adopt AI for risk management, customer service, and efficiency.1

Additionally, the Artificial Intelligence and Data Analytics (AIDA) Grant programme was launched in 2017, providing up to 50% funding support for AI and data analytics adoption.2 The following year in 2018, Veritas developed a framework for its ethical and responsible use. MAS also partnered with industry players to develop AI solutions in banking, including AI-powered virtual bank assistants and digital advisory tools.

2. Taiwan

Taiwan's government and the Financial Supervisory Commission launched the FinTech Regulatory Sandbox in 2018 to test innovative fintech solutions, including AI/ML. They collaborate with industry players to develop AI solutions, such as an AI-powered chatbot for customer service. Open banking is promoted, and guidelines for implementation have been issued, with several banks launching open banking platforms. The Financial Information Service Platform offers financial institutions access to a centralised data repository for developing AI/ML solutions.3

3. Hong Kong

The Hong Kong Monetary Authority (HKMA) launched the Banking Made Easy Task Force in 2018 to promote AI/ML and Regtech usage across multiple digital journeys for banks in Hong Kong. Measures include the introduction of an open API standard.4

In 2016, the Fintech Innovation Hub was established to provide a platform for Fintechs to collaborate with banks.5 The government actively promotes Regtech solutions, with programmes like the Cybersecurity Fortification Initiative launched in the same year.6 The HKMA also collaborates with industry players to develop AI/ML solutions, such as an AI-powered anti-fraud system with the largest bank in Hong Kong.

4. Malaysia

Artificial Intelligence Roadmap 2021-2025 (AI-Rmap), and the Malaysian Digital Economy Blueprint in 2021 to support the adoption of advanced technologies in the financial industry.7

The Securities Commission's Capital Market Masterplan 3 promotes Regtech adoption, while the Malaysia Digital Economy Corporation collaborates with the banking sector for fintech solutions.8 Efforts to encourage the usage of AI/ML technologies are also reflected when Bank Negara Malaysia (BNM), the central bank of Malaysia, issued guidelines for open banking, resulting in the launch of several banks' platforms.9

5. Australia

Australia has launched the Consumer Data Right in 2019, which allows consumers to access and share their personal data with third-party service providers, including banking data with other banks. This promotes competition and innovation in the banking sector by enabling fintech companies to access bank data and develop innovative solutions using AI/ML.

The Australian government also promotes Regtech solutions to enhance regulatory compliance. They established the Regtech Advisory Group to facilitate collaboration between fintech companies and public-private partnerships and develop an AI-powered financial assistant for customers.10 Additionally, the Organisation for Economic Cooperation and Development published AI ethics principles to address risks to human safety, data protection, privacy, and fairness.

6. The Philippines

The Philippine government has launched several initiatives to promote the growth of the fintech industry, including AI/ML solutions in banking. The Fintech Alliance.Ph and Digital Transformation Strategy aim to drive this growth, while the National Retail Payment System promotes electronic payments and digital financial services.11 Moreover, the Regtech Steering Committee supports Regtech companies and the Fintech Innovation Lab offers funding and support to fintech companies developing innovative solutions.

Governing bodies across APAC are investing heavily to promote the use of AI/ML in their financial sectors through public-private partnerships, subsidies, and initiatives. The implementation of these technologies is encouraged as long as it is done ethically, responsibly, and securely.

AI/ML innovations in the banking sector

AI/ML encompasses diverse technologies that can optimise different banking processes, improve customer experiences, and strengthen financial crime and operational risk management.

Figure 1: Five pillars of artificial intelligence

Here are the examples:

- Expert systems. Systems that provide decisioning support and automate complex processes that require human expertise. They can be used in loan underwriting where the system analyses credit scores, income, and other financial data to determine the risk associated with a loan application and make a recommendation for approval or denial.

- Robotic process automation (RPA). RPA automates repetitive and routine tasks, increasing efficiency by automating manual processes, such as client lifecycle management in banks. RPA with optical character recognition helps extracts data from customer documents and records it in the bank's systems, reducing the need for manual review during processes like client onboarding and know your customer.

- Biometric matching and natural language processing (NLP). Biometric matching uses unique biological attributes like faces, iris, and fingerprints for identification, while NLP interprets human language. These technologies are used in facial and voice recognition, as well as fingerprint recognition, to identify customers accessing their bank accounts or completing transactions. NLP and natural language generation are also used for chatbots in digital banking applications.

- Machine learning. ML enables banks to predict future outcomes by processing and analysing historical data. It has a wide range of use cases across the banking value chain, including recommendation systems, customer segmentation, and fraud detection.

- Entity resolution and network link analysis (NLA). NLA uses entity resolution and network generation to connect disparate data points and identify hidden relationships. This helps detect fraud and criminal activity by analysing large datasets in real time, flagging suspicious activity, and allowing investigators to focus their efforts on high-risk cases.

Challenges of implementing AI/ML technologies

Although AI and ML hold the potential to improve the effectiveness and efficiency of an organisation's business functions, there are various factors that can significantly impact the success or failure of an AI transformation programme.

Figure 2: Enterprise-wide AI transformation framework

- Data readiness. Data is crucial for any AI model and must be considered before starting development. Factors, including data availability, maturity, quality, and lineage, should be evaluated to ensure the models are fit for purpose.

- Business viability. Organisations must drive and maintain usage of technological solutions through socialisation, training, data visualisation, and comprehension of the product. Failure to deliver on any of these areas can result in a lack of adoption or failure of a solution.

- Target operating model (TOM). Continuous assessment and redesign of the TOM is essential throughout the AI implementation roadmap to ensure that the teams and processes affected by the solution are aligned and optimised for success.

- Model governance and regulatory compliance. Robust governance is essential to monitor the creation, testing, and usage of AI-based solutions, and compliance with regulatory guidelines is crucial throughout the implementation roadmap in APAC countries.

- Centralised innovation. Cross-functional teams with the relevant techno-functional expertise are necessary to support various aspects of AI implementation roadmaps, including technology decisions, vendor evaluation, development of business use cases, and more.

How can we help?

With 25 years of experience in the financial services industry, Synpulse offers consulting and technology services across the entire value chain. Our expertise in AI/ML technologies, regulatory compliance, and risk management allows us to identify and address business problems while ensuring compliance.

Our capabilities include:

- Data management. We can assist clients with their data management needs through our data management in a box (DMINABOX®) methodology and framework, which helps clients understand their current data state and establish robust data governance and management capabilities.

- TOM design. We help clients design and set up a TOM for their business using our BANKINABOX® framework, incorporating accepted and contextual best practices across banking functions for a robust and expedited implementation.

- ML in banking. Our team has extensive experience in supporting banks select AI/ML-based solutions, design and develop the solutions with the banks, and validate the developed solutions in line with regulatory guidance. These are done while ensuring the business objectives are achieved.

- RPA. We have expertise in assisting banks to select, design, develop, and validate AI/ML-based solutions while ensuring regulatory compliance and achieving business objectives.

- NLA. We have experience and expertise in designing, implementing, and deploying NLA-based solutions for various use cases, such as master data modelling, financial crime and compliance, credit risk, ESG, and revenue and lead generation.

- Facilitating innovation. We can facilitate design thinking workshops to help teams collaborate and develop innovative solutions for new product ideas and problem areas.

1 Financial Sector Technology and Innovation Scheme (MAS, March 2023). 2 Artificial Intelligence and Data Analytics (AIDA) Grant (MAS, October 2021). 3 Financial Information Service Co., Ltd – Index (March 2023). 4 The Next Phase of the Banking Open API Journey (HKMA, 2021). 5 HKMA-ASTRI Fintech Innovation Hub (ASTRI, November 2016). 6 Hong Kong Monetary Authority Strengthens Cybersecurity Controls on Banks (Norton Rose Fulbright, May 2016). 7 Malaysia Digital Economy Blueprint (Economic Planning Unit, Prime Minister’s Department, February 2021). 8 Capital Market Masterplan 3 (Securities Commission Malaysia, November 2021). 9 Licensing Framework for Digital Banks (BNM, December 2020). 10 The RegTech Association (2017). The RegTech Association - Home / 2022 11 Payments and Settlements - National Retail Payment System (BSP, April 2020).