A high degree of transparency is key to successfully optimising material costs. A view from the outside can help in that effort.

If this trend continues, then a higher cost-to-income ratio (CIR) is inevitable.

The current cost situation at banks and savings institutions can be described as pretty tight. The current environment is getting increasingly tougher for decision-makers at lending institutions. One always comes to the same conclusion: «If this trend continues, then a higher cost-to-income ratio (CIR) is inevitable.»

Lending institutions have recognised this dilemma and are attempting to optimise their cost structures. But dependencies of many kinds often impede the effort. Indeed, only part of the entire cost-saving potential, and not the maximum, is being realised. With active material cost management», a structural approach is guaranteed.

Realistic cost optimisation for lending institutions

It is not realistic to expect that material costs expressed in euros can be brought significantly in the short term without the corresponding effort. This is true even if one has already begun dealing with the issue in advance. Naturally, this doesn’t mean that one cannot recognise the further potential to put the institution in a better cost position. Indeed, several savings banks have pledged to get costs – above all material costs – under control and succeeded.

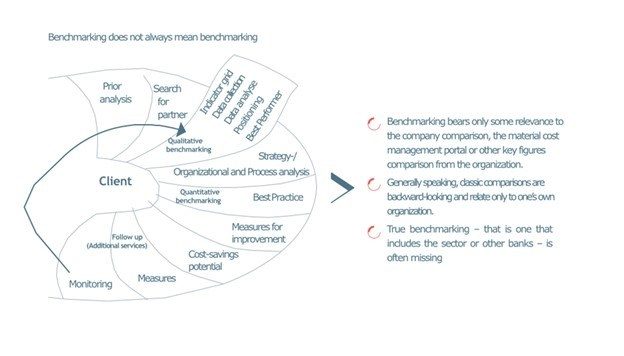

If, however, these efforts are not tied to a «control goal», one will never know what additional cost-savings could have been made. A control goal is derived from a classic benchmarking process, where best performers – even outside of one’s peer group – are used as an example of what is possible internally.

In this process, the lending institution can compare its own position with a corresponding goal. This is usually only possible when each action can be measured monetarily. For this reason, qualitative benchmarking regarding issues of cost optimisation isn’t expedient. Quantitative benchmarking is necessary to achieve relief on the profit and loss account.

Calculated costs per action can be defined as unit costs so that the entire operation is divided into units, which can and must explain the entire operating expense position by means of quantities with associated prices as a balance. A high degree of transparency is required to compile realistic results. It must be clear what precisely is behind the material costs in each of the corresponding units.

However, such transparency doesn’t exist at many banks. As a result, those responsible at these institutions must deal with the fact that the entire scope of the issue cannot be determined due to missing control goals. Material costs aren’t only to be regarded separately but often in conjunction with internal processes. How the costs and processes are related and what can be optimised can only be clarified through transparency. Only in this way is it possible to estimate the effect of taboo themes like the closing of branches ex-ante and ex-post. With respect to branch closings, the lethargy of the process and the significant dependency on personnel costs are often underestimated. This can lead to the anticipated economies of scale not being realised on the material cost side.

This also increases the need for the management of unit costs, volumes, and the underlying processes or the need for efficient and sustainable material cost management. Such management should be part of a continual improvement process or better yet in conjunction with the introduction of lean management at the financial institution. In this way, an efficient tool can arise from a paper tiger.

A high degree of transparency is crucial for sustainable and efficient material cost management. A side benefit is that compliance rules are more easily upheld. So what should a bank do specifically?

The first step involves making fixed costs variable. Fixed costs remain constant whether revenues increase or decline. When those revenues decline, they have a toxic effect on the entire cost situation. By varying these costs, the costs that can be controlled increase, and the entire cost situation that’s made up of fixed and variable cost changes. Unit or process-oriented costs must be presented separately. In each institution, there will be areas where the costs cannot be broken down to a possible price per unit. There are many reasons for this. They frequently stem from the fact that the person in charge of the operation is not the same person who oversees the costs. In this case, cost optimisation is not handled by one person.

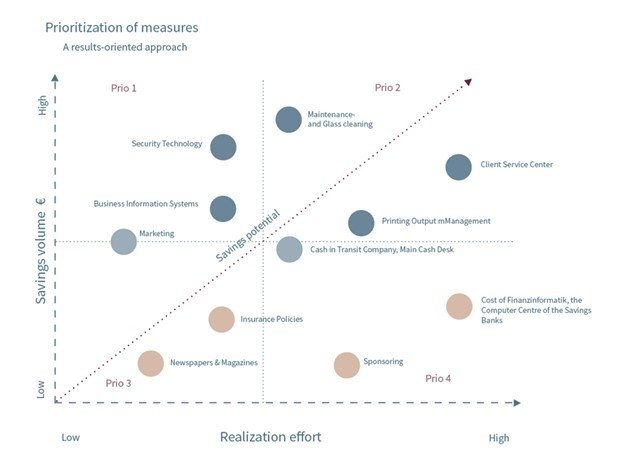

Only when a high degree of transparency exists regarding one’s material cost position can the potential for success be determined. Only then can cost positions be identified that can be influenced either indirectly or over a long period of time. In any event, those quantifiable cost positions that can be optimised over the short or medium term should be identified.

On the basis of the results, a concrete plan can be worked out for the prioritisation and implementation of specific issues. Commitments then must be made within a certain timeline. Only in this way is there an opportunity to include the results in future cost estimates and budgets.

Implementation is the most difficult and time-consuming part. Cost optimisation projects often collide with cultural challenges, protection of the status quo, comfort and the lack of time or resources that exist on the personal or technical level. These challenges must, however, be overcome in today’s time. That such an effort can succeed has been proven in numerous projects in past years. For example, a new position for a structural and well-functioning material cost management can be created within the organisation.

Material cost management in practice

Along with the entire banking sector, persistently low interest rates have left their mark on German retail banks. In order to avoid a further increase in the CIR, many of these institutions have implemented a strategy of increasing revenues while lowering costs. It is recommended that active material cost management be made part of this effort.

As a first step, the likely cost-savings in the respective units can be identified through benchmarking. Apart from company comparisons, German savings banks have other instruments at their disposal, including a material cost management portal or financial planning tools.

Regarding the determination of cost savings, it is advisable to be as specific as possible. For example, the cost savings in relation to balance sheet assets must be standardised and expressed in absolute terms. One useful standard is the existing client business volume, as it isn't affected by fluctuations in the proprietary business.

With active material cost management, the material costs should be brought down quickly, significantly and sustainably. Another goal is leverage the results from the project to gain future insights into the individual budgets. This is useful both to those with budget responsibility and those charged with steering the firm. When choosing an external partner, the following criteria should be considered:

- Experience with all kinds of costs – that is no specialists for specific themes. One important factor in the success of the project is the standardised and ongoing evaluation of all costs.

- Experience in advising banks with their special cost structures.

- Specific cost-saving targets are necessary instead of stereotypes.

- Enabling bank employees to better control costs in the future.

Such a project should also include a payment scheme that either partly or fully depends on the results delivered by the consultant. When initialising the project, the following factors should be considered:

- Complete support of the project by the management board.

- No exclusion of blind spots during the examination.

- Clear role definition for those responsible.

- Holding persons responsible for budgets to account.

- Clear lines of communication, as not only material costs are affected but the processes and personnel capacities that are related (staff representatives must be included at an early stage, if necessary).

- Clear decision-making regarding the cost-saving suggestions and their implementation.

As a first step, all material cost budgets are scrutinised to identify their cost-saving potential on an individual basis. It’s here that one determines how well the bank is positioned regarding specific issues. Once the results of the determination are available, the bank can decide which measures to take – whether by itself or with external support.

Specialists and budget personnel are crucial to project success

A previously defined cost manager should coordinate the entire process and prepare the material to be decided on by the steering committee or a cost committee. The responsibility for the success of the project can also be transferred to those in charge of budgets. In this case, they have a number of tasks to master, including:

- Agreeing with the advisors about the content-related and timing aspects of the task.

- Working out and assessing the alternatives and their advantages with the advisors.

- Assessing the action and the challenges related to it, including changes to contracts, processes and personnel.

- Participating in contract negotiations where appropriate.

- Agreeing business decisions with senior management (e.g. relations with long-time customers, personnel changes, etc.);

- Drafting templates for decision-making by senior management (recommendations from the advisors are included).

The success of this project organisation depends particularly on the specialists in the bank as well as those in charge of budgets. Given that many issues are to be dealt with, timely and direct communication is essential. Specialists in the bank with project responsibility act as coordinators and moderators for all project participants and advisors. Controlling meetings, ensuring the quality of decision-making templates as well as central communication of results is crucial to the project’s success.

Conclusion

Cost savings will continue to be a pressing them for banks. For this reason, the implementation of ongoing material cost management is crucial. But it will only work if there is a high degree of transparency. Also, in order to make the underlying processes highly efficient, a project involving the implementation of both material cost management and lean management is recommended.

Material cost management cannot, however, prevent the natural tendency to cling to familiar structures. As a result, the procurement of outside expertise will be necessary. Active material cost management will also be intrinsic to the process of using such experts for project work.