Loading Insight...

Insights

Insights

The culture of a financial institution (FI) shapes how the FI conducts its business and deals with customers. In today’s world, good culture and conduct have evolved from a “nice to have” into a crystal-clear business and compliance requirement.

On 10 September 2020, the Monetary Authority of Singapore (MAS) published their Guidelines on Individual Accountability and Conduct (the Guidelines), which focused on the measures that FIs should implement “to promote the individual accountability of senior managers, strengthen oversight over material risk personnel, and reinforce standards of proper conduct among all employees”.

The Guidelines succeed the Consultation on Proposed Guidelines on Individual Accountability and Conduct of April 2018, which aimed to increase the level of accountability of senior managers and advocated policies and processes at FIs to embed risk ownership at all levels of the organisation.

All FIs regulated by MAS are required to achieve the following five outcomes regarding senior managers1, material risk personnel (MRPs)2 and all employees, from 10 September 2021 .

The five outcomes

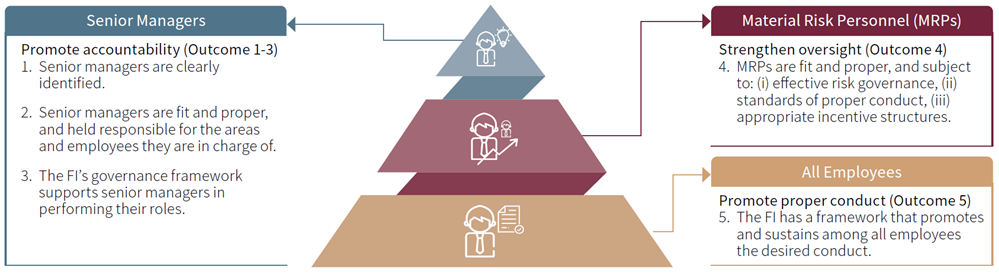

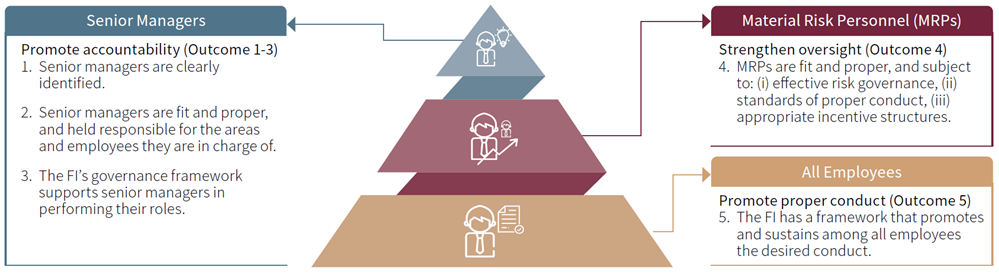

Embedding a strong culture of responsibility and ethical behaviour in FIs requires individual accountability on the part of senior managers and a supportive governance framework (Figure 1). The guidelines focus on the measures FIs should put in place to achieve and promote clear accountability and proper conduct.

Figure 1: Expected outcomes framework as stipulated in the MAS Guidelines

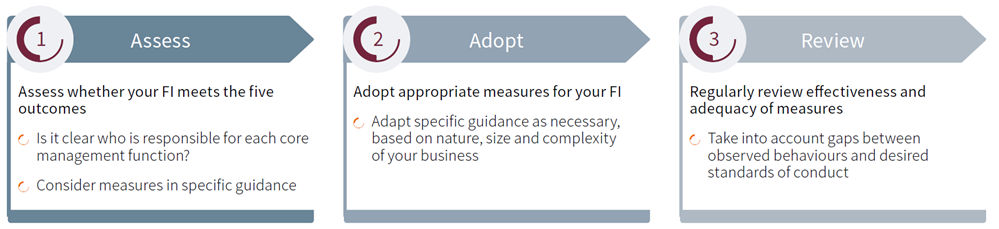

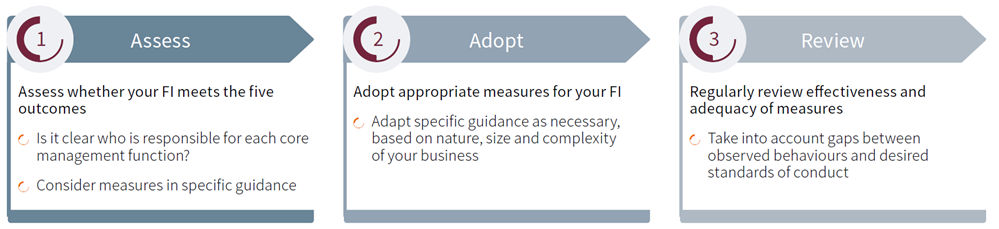

MAS's three-step approach to achieve the five outcomes

MAS recommended the below three-step approach to achieve the afore-mentioned five outcomes:

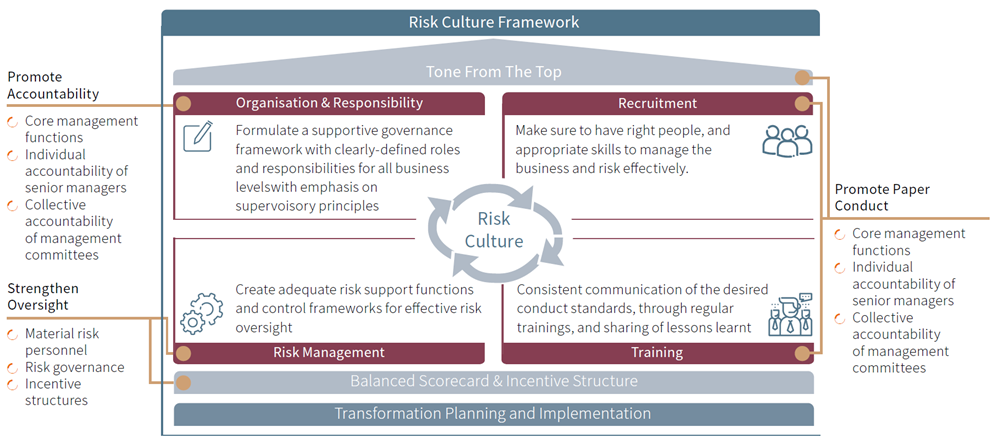

Our risk culture framework

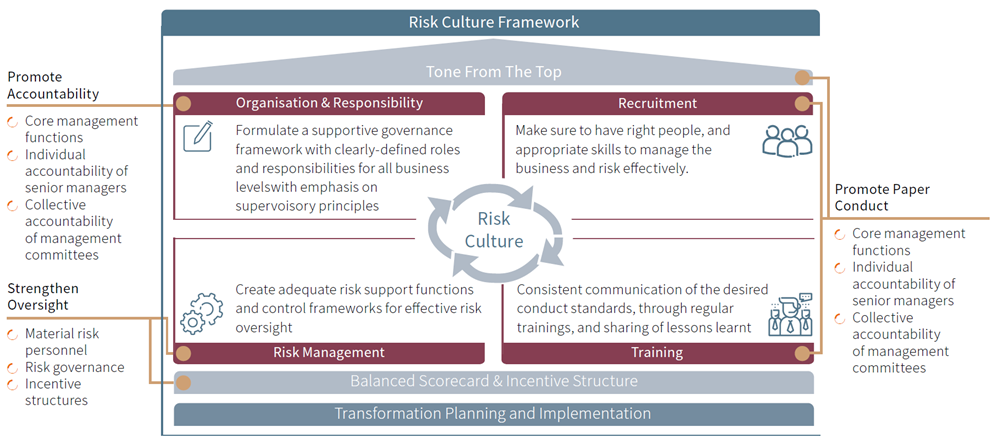

The measurement of conduct can be easily mistaken as a box-ticking exercise, but that’s not what MAS advocates. To achieve the five outcomes, Synpulse supports banks with gap assessment of their risk culture framework (Figure 2) and roll out an effective framework to address the identified gaps.

Figure 2: Our Risk Culture Framework

Common challenges

Culture and conduct have been under increased scrutiny from the regulators across jurisdictions, with leading financial centres introducing their own sets of accountability regimes. Some common challenges observed include:

- The 12-month timeline is often seen as too optimistic as similar regimes in other jurisdictions have generally taken longer than expected to implement. Time also needs to be set aside to work on any issues with roadblocks along the way.

- Cross-team collaboration is paramount to the success of the implementation. Getting buy-in from relevant functions such as business lines, legal, compliance, risk, and human resource and agreeing on the level of involvement might not be straightforward. The attainment of their own revenue targets in the short term.

- A balanced incentive framework isn’t easy to come by and needs time to implement alongside the yearly appraisal process in the FIs. It remains a challenge to strike the balance between risk and reward so that bankers don’t obstruct the profitability of their banks in the long term, nor compromise the attainment of their own revenue targets in the short term.

- Given the global and regional presence of many banks, it isn’t uncommon that they might have to comply with different sets of requirements across jurisdictions. Banks should not reinvent the wheel. However, the alignment with other accountability regimes presents another hurdle.

- Rome wasn’t built in a day. Cultural change is a journey. Banks need to be prepared for the sustained effort required to embed the risk culture and drive the desired behavioural changes.

Why work with us

Synpulse helped shape the entire value chain, from identifying gaps to formulating controls and implementing solutions to ensure regulatory compliance.

Subject matter expertise

Synpulse has been at the forefront of culture and conduct, from assessing the culture and conduct of top private banks and developing a fair risk and reward framework to strengthening accountability and oversights in regulatory requirements. Our knowledge of key regulatory and compliance topics has helped drive solution implementation, business processes re-engineering and target operating model definition.

Extensive industry experience in the Asian market

Having worked with eight of the ten largest financial institutions in Asia over the past ten years on an array of successful projects in Hong Kong and Singapore, we understand the most pressing regulatory and compliance challenges in this region.

We would be pleased to share industry best practices and provide you with further information on how Synpulse can support you in building a comprehensive risk culture framework and addressing regulatory guidelines.

1 “Senior managers” refers to individuals who are employed by, or acting for or by arrangement with, the FI and are principally responsible for the day-to-day management of the FI. 2 “Material risk personnel” refers to individuals who have the authority to make decisions or conduct activities that can significantly affect the FI’s safety and soundness or cause harm to a significant segment of the FI’s customers or other stakeholders.

The culture of a financial institution (FI) shapes how the FI conducts its business and deals with customers. In today’s world, good culture and conduct have evolved from a “nice to have” into a crystal-clear business and compliance requirement.

On 10 September 2020, the Monetary Authority of Singapore (MAS) published their Guidelines on Individual Accountability and Conduct (the Guidelines), which focused on the measures that FIs should implement “to promote the individual accountability of senior managers, strengthen oversight over material risk personnel, and reinforce standards of proper conduct among all employees”.

The Guidelines succeed the Consultation on Proposed Guidelines on Individual Accountability and Conduct of April 2018, which aimed to increase the level of accountability of senior managers and advocated policies and processes at FIs to embed risk ownership at all levels of the organisation.

All FIs regulated by MAS are required to achieve the following five outcomes regarding senior managers1, material risk personnel (MRPs)2 and all employees, from 10 September 2021 .

The five outcomes

Embedding a strong culture of responsibility and ethical behaviour in FIs requires individual accountability on the part of senior managers and a supportive governance framework (Figure 1). The guidelines focus on the measures FIs should put in place to achieve and promote clear accountability and proper conduct.

Figure 1: Expected outcomes framework as stipulated in the MAS Guidelines

MAS's three-step approach to achieve the five outcomes

MAS recommended the below three-step approach to achieve the afore-mentioned five outcomes:

Our risk culture framework

The measurement of conduct can be easily mistaken as a box-ticking exercise, but that’s not what MAS advocates. To achieve the five outcomes, Synpulse supports banks with gap assessment of their risk culture framework (Figure 2) and roll out an effective framework to address the identified gaps.

Figure 2: Our Risk Culture Framework

Common challenges

Culture and conduct have been under increased scrutiny from the regulators across jurisdictions, with leading financial centres introducing their own sets of accountability regimes. Some common challenges observed include:

- The 12-month timeline is often seen as too optimistic as similar regimes in other jurisdictions have generally taken longer than expected to implement. Time also needs to be set aside to work on any issues with roadblocks along the way.

- Cross-team collaboration is paramount to the success of the implementation. Getting buy-in from relevant functions such as business lines, legal, compliance, risk, and human resource and agreeing on the level of involvement might not be straightforward. The attainment of their own revenue targets in the short term.

- A balanced incentive framework isn’t easy to come by and needs time to implement alongside the yearly appraisal process in the FIs. It remains a challenge to strike the balance between risk and reward so that bankers don’t obstruct the profitability of their banks in the long term, nor compromise the attainment of their own revenue targets in the short term.

- Given the global and regional presence of many banks, it isn’t uncommon that they might have to comply with different sets of requirements across jurisdictions. Banks should not reinvent the wheel. However, the alignment with other accountability regimes presents another hurdle.

- Rome wasn’t built in a day. Cultural change is a journey. Banks need to be prepared for the sustained effort required to embed the risk culture and drive the desired behavioural changes.

Why work with us

Synpulse helped shape the entire value chain, from identifying gaps to formulating controls and implementing solutions to ensure regulatory compliance.

Subject matter expertise

Synpulse has been at the forefront of culture and conduct, from assessing the culture and conduct of top private banks and developing a fair risk and reward framework to strengthening accountability and oversights in regulatory requirements. Our knowledge of key regulatory and compliance topics has helped drive solution implementation, business processes re-engineering and target operating model definition.

Extensive industry experience in the Asian market

Having worked with eight of the ten largest financial institutions in Asia over the past ten years on an array of successful projects in Hong Kong and Singapore, we understand the most pressing regulatory and compliance challenges in this region.

We would be pleased to share industry best practices and provide you with further information on how Synpulse can support you in building a comprehensive risk culture framework and addressing regulatory guidelines.

1 “Senior managers” refers to individuals who are employed by, or acting for or by arrangement with, the FI and are principally responsible for the day-to-day management of the FI. 2 “Material risk personnel” refers to individuals who have the authority to make decisions or conduct activities that can significantly affect the FI’s safety and soundness or cause harm to a significant segment of the FI’s customers or other stakeholders.