Loading Insight...

Insights

Insights

Ensuring compliance with Know Your Customer (KYC) regulations is a top priority for financial institutions. However, traditional KYC processes are plagued by inefficiencies, high costs, poor customer experience, and error-prone as manual and complex. Enter automated KYC, by leveraging advanced technologies to streamline and automate the KYC process. In this article, we'll define automated KYC and explore how it can transform your KYC compliance, improve efficiency, and effectiveness, and enhance customer satisfaction.

Overview of KYC

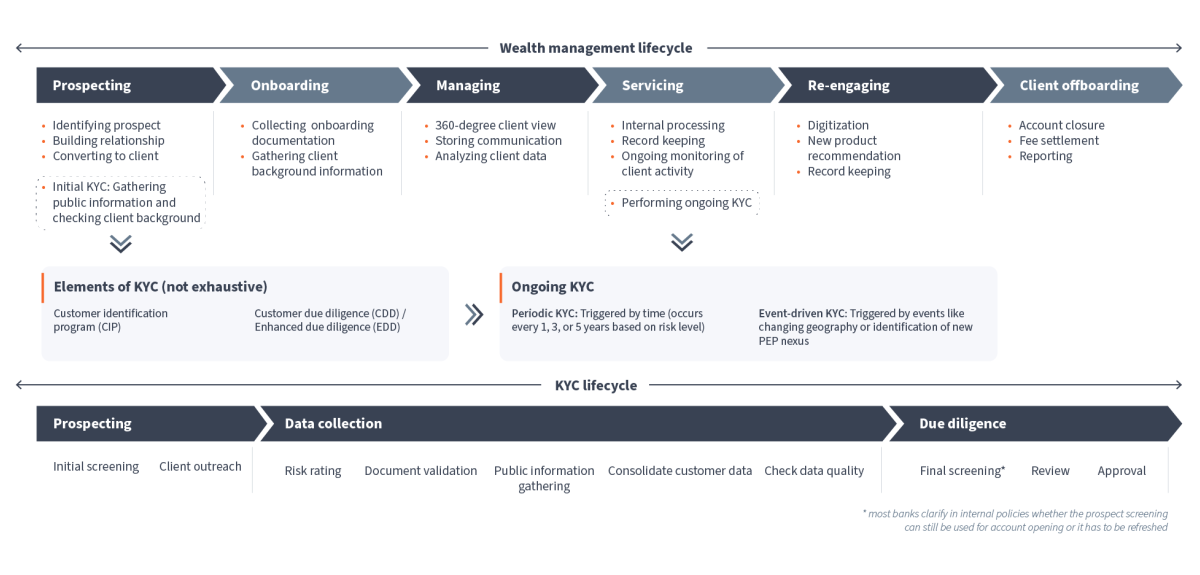

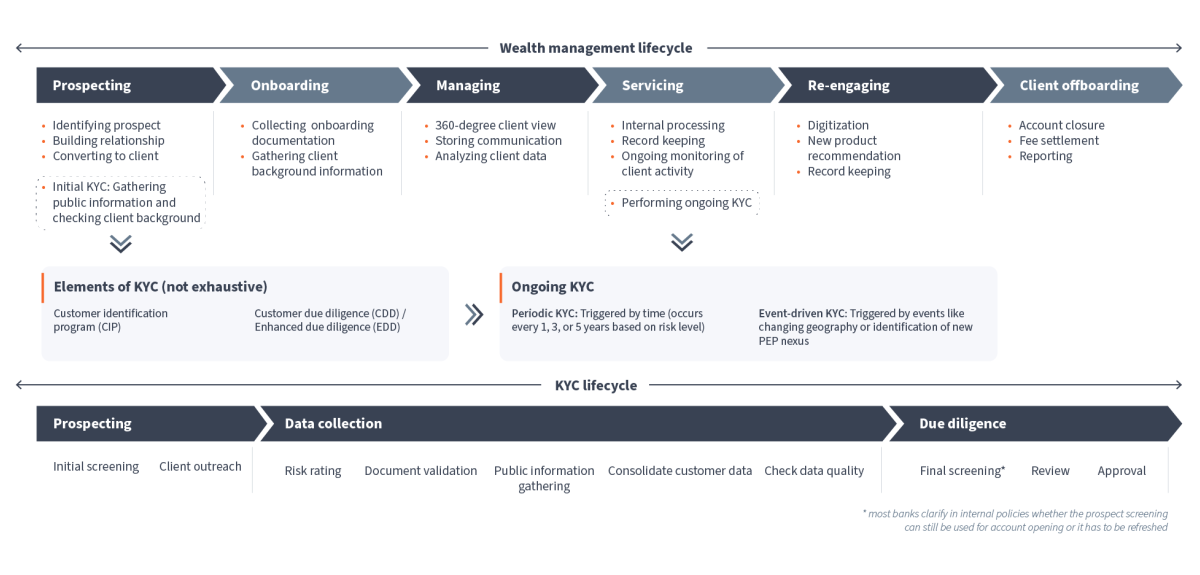

KYC is a critical pillar during the client life-cycle, encompassing three vital types:

- Initial KYC

- Periodic KYC

- Event-driven KYC

KYC is a key regulatory requirement, that ensures the integrity and security of financial institutions while building trust with clients. KYC processes are essential for financial institutions to verify the identity of their clients, understand the purpose and background of the client relationship to support effective monitoring for illicit activity, prevent fraud, and comply with regulatory requirements. However, the traditional KYC process is manual and comes with several pain points.

Figure 1: KYC in wealth management lifecycle

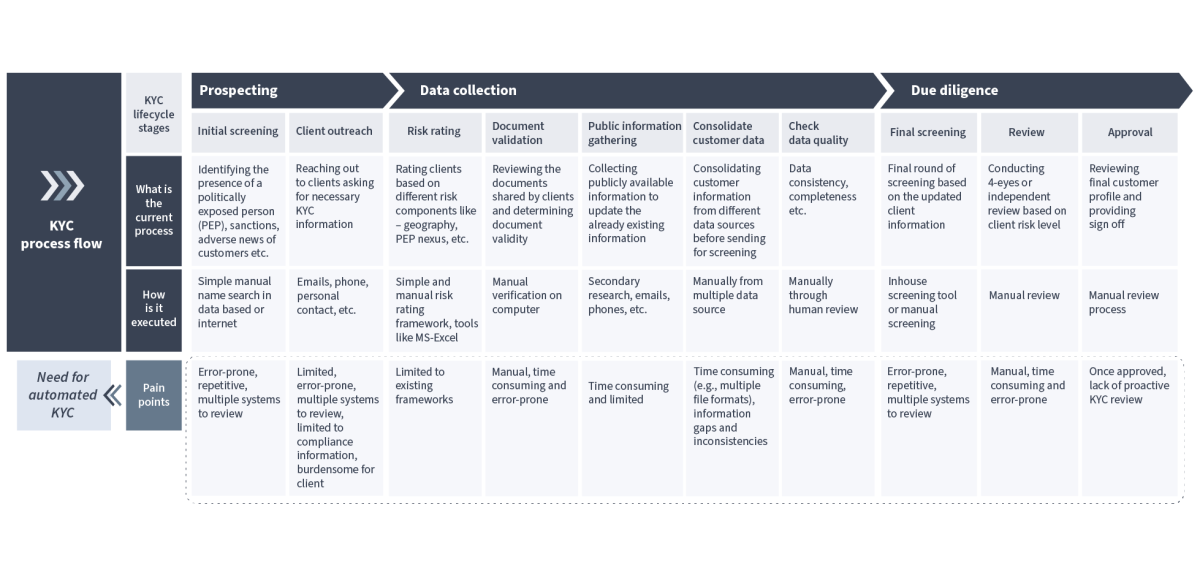

Pain points of traditional KYC

- Time-consuming: Traditional KYC involves manual verification of documents and background checks, which can take days or even weeks to complete. This delays customer onboarding and can frustrate clients.

- Manual and costly: The manual nature of traditional KYC requires significant human resources and infrastructure, leading to high operational costs for financial institutions.

- Inconsistent and error-prone: Manual verification processes are prone to human error, leading to inconsistencies and inaccuracies in data collection and verification.

- Poor customer experience: The lengthy and cumbersome process can lead to a poor customer experience, potentially driving customers to seek faster and more efficient alternatives.

- Regulatory compliance: Keeping up with ever-changing regulatory requirements is challenging. Traditional KYC processes may struggle to adapt quickly, increasing the risk of non-compliance and potential fines.

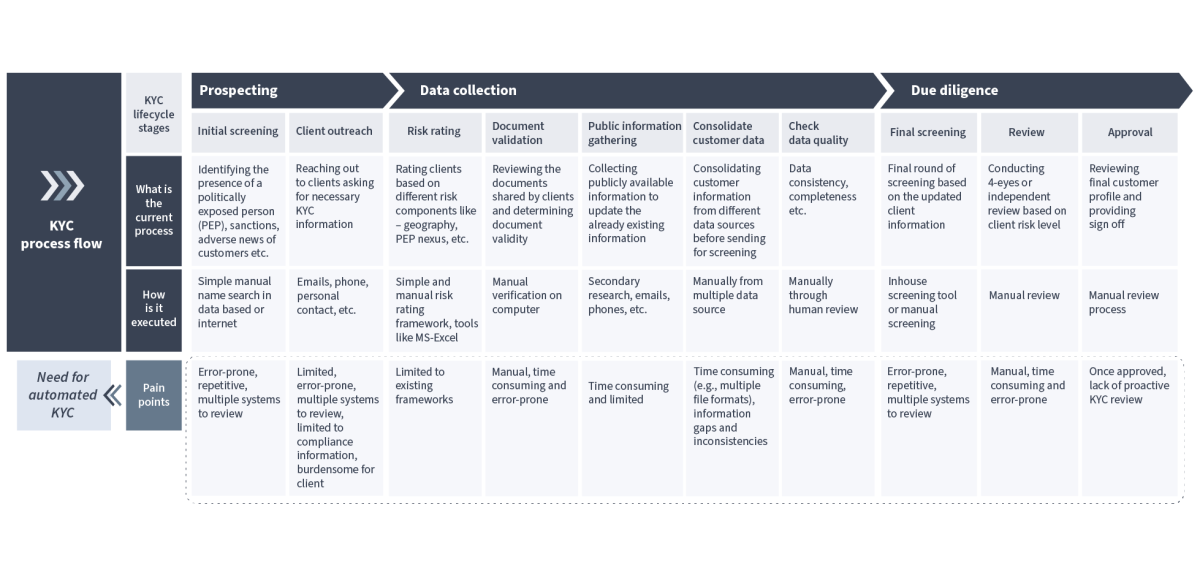

Figure 2: Traditional KYC process and selection of pain points

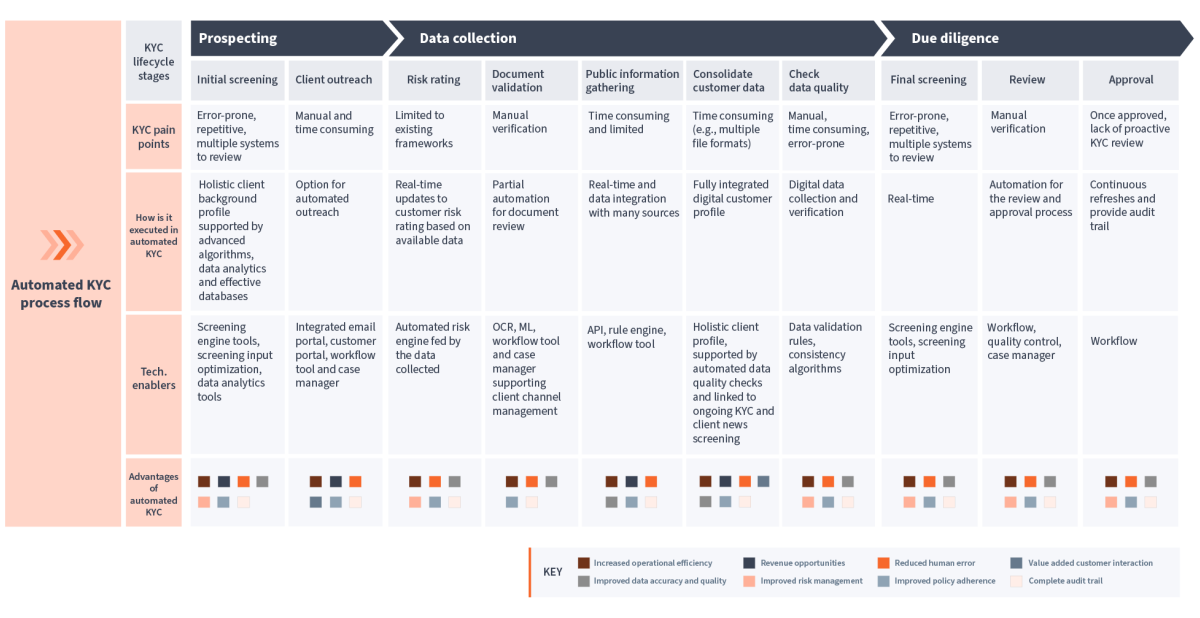

Advantages of automated KYC solution

Automated KYC offers a solution to these pain points by leveraging advanced technologies to streamline and automate the KYC process. Automated KYC seamlessly integrates external data and leverages automation to verify and update customer records dynamically throughout the entire relationship to proactively comply with regulations, manage risk, and improve customer service.

Here is how automated KYC can help:

- Real-time verification: Automated KYC systems use digital tools to verify customer information in real-time. This significantly reduces the time required for verification, enabling faster customer onboarding.

- Cost efficiency through automation: Process automation reduces the need for extensive human intervention, lowering operational costs associated with traditional KYC processes.

- Enhanced accuracy: Advanced algorithms and machine learning, effectively integrated in the bank's model control framework ensure higher accuracy and consistency in data verification, minimizing errors and discrepancies.

- Improved customer experience: With faster and more efficient verification, customers enjoy a smoother and more positive onboarding experience, enhancing overall satisfaction.

- Regulatory compliance: Automated KYC solutions can be easily updated to comply with new regulations, ensuring that financial institutions remain compliant with minimal effort.

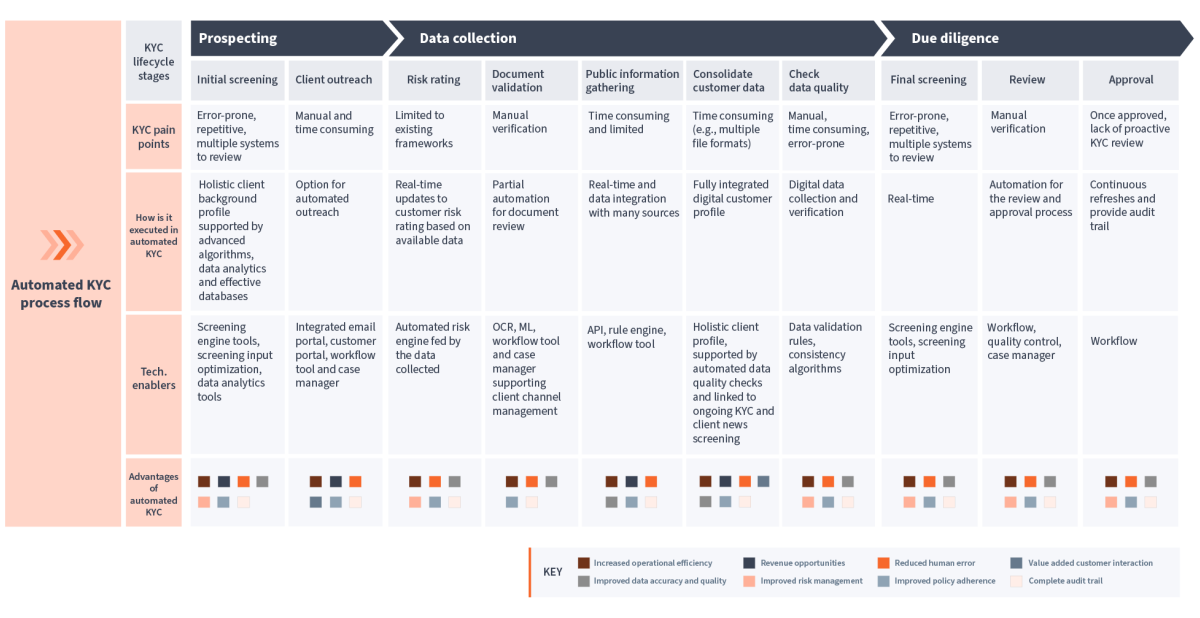

Figure 3: Automated KYC alleviates traditional KYC pain points

Synpulse expertise

Synpulse can help organizations in different aspects of an automated KYC process –

- Data aggregation

- Defining workflows and customizing rule engines that integrate primary and premium data sources to automate data aggregation and reduce error

- Partner with vendors to create custom solutions that visualize entities of interest and how they relate

- Digital KYC profile

- Conducting workshops with stakeholders to understand data availability as well as the prioritization of features for KYC profiles that would ultimately drive the biggest impact on compliance

- Helping integrate data sources from multiple systems and build KYC profiles. Designs of digital KYC profiles are adapted with the client’s branding and most importantly, fully tested and integrated into the client’s system

- Technology and vendor evaluation

- Conducting vendor evaluation by leveraging Synpulse vendor evaluation framework

Why work with us?

Leverage our deep expertise in data aggregation, workflow design, and custom solutions to transform your KYC processes. With our subject matter expertise, global ecosystem partnerships, and extensive experience in the North American market, Synpulse is your partner in creating efficient, compliant, and fully integrated digital KYC profiles.

Partner with us to streamline your KYC journey and ensure your organization stays ahead of the compliance curve.

Ensuring compliance with Know Your Customer (KYC) regulations is a top priority for financial institutions. However, traditional KYC processes are plagued by inefficiencies, high costs, poor customer experience, and error-prone as manual and complex. Enter automated KYC, by leveraging advanced technologies to streamline and automate the KYC process. In this article, we'll define automated KYC and explore how it can transform your KYC compliance, improve efficiency, and effectiveness, and enhance customer satisfaction.

Overview of KYC

KYC is a critical pillar during the client life-cycle, encompassing three vital types:

- Initial KYC

- Periodic KYC

- Event-driven KYC

KYC is a key regulatory requirement, that ensures the integrity and security of financial institutions while building trust with clients. KYC processes are essential for financial institutions to verify the identity of their clients, understand the purpose and background of the client relationship to support effective monitoring for illicit activity, prevent fraud, and comply with regulatory requirements. However, the traditional KYC process is manual and comes with several pain points.

Figure 1: KYC in wealth management lifecycle

Pain points of traditional KYC

- Time-consuming: Traditional KYC involves manual verification of documents and background checks, which can take days or even weeks to complete. This delays customer onboarding and can frustrate clients.

- Manual and costly: The manual nature of traditional KYC requires significant human resources and infrastructure, leading to high operational costs for financial institutions.

- Inconsistent and error-prone: Manual verification processes are prone to human error, leading to inconsistencies and inaccuracies in data collection and verification.

- Poor customer experience: The lengthy and cumbersome process can lead to a poor customer experience, potentially driving customers to seek faster and more efficient alternatives.

- Regulatory compliance: Keeping up with ever-changing regulatory requirements is challenging. Traditional KYC processes may struggle to adapt quickly, increasing the risk of non-compliance and potential fines.

Figure 2: Traditional KYC process and selection of pain points

Advantages of automated KYC solution

Automated KYC offers a solution to these pain points by leveraging advanced technologies to streamline and automate the KYC process. Automated KYC seamlessly integrates external data and leverages automation to verify and update customer records dynamically throughout the entire relationship to proactively comply with regulations, manage risk, and improve customer service.

Here is how automated KYC can help:

- Real-time verification: Automated KYC systems use digital tools to verify customer information in real-time. This significantly reduces the time required for verification, enabling faster customer onboarding.

- Cost efficiency through automation: Process automation reduces the need for extensive human intervention, lowering operational costs associated with traditional KYC processes.

- Enhanced accuracy: Advanced algorithms and machine learning, effectively integrated in the bank's model control framework ensure higher accuracy and consistency in data verification, minimizing errors and discrepancies.

- Improved customer experience: With faster and more efficient verification, customers enjoy a smoother and more positive onboarding experience, enhancing overall satisfaction.

- Regulatory compliance: Automated KYC solutions can be easily updated to comply with new regulations, ensuring that financial institutions remain compliant with minimal effort.

Figure 3: Automated KYC alleviates traditional KYC pain points

Synpulse expertise

Synpulse can help organizations in different aspects of an automated KYC process –

- Data aggregation

- Defining workflows and customizing rule engines that integrate primary and premium data sources to automate data aggregation and reduce error

- Partner with vendors to create custom solutions that visualize entities of interest and how they relate

- Digital KYC profile

- Conducting workshops with stakeholders to understand data availability as well as the prioritization of features for KYC profiles that would ultimately drive the biggest impact on compliance

- Helping integrate data sources from multiple systems and build KYC profiles. Designs of digital KYC profiles are adapted with the client’s branding and most importantly, fully tested and integrated into the client’s system

- Technology and vendor evaluation

- Conducting vendor evaluation by leveraging Synpulse vendor evaluation framework

Why work with us?

Leverage our deep expertise in data aggregation, workflow design, and custom solutions to transform your KYC processes. With our subject matter expertise, global ecosystem partnerships, and extensive experience in the North American market, Synpulse is your partner in creating efficient, compliant, and fully integrated digital KYC profiles.

Partner with us to streamline your KYC journey and ensure your organization stays ahead of the compliance curve.