Loading Insight...

Insights

Insights

(Re)insurance data is driving transformation like never before. We delve into the topic of data-led (re)insurance, exploring how cutting-edge technologies and advanced analytics are reshaping the landscape for (re)insurers. Join us as we uncover the benefits, challenges, and strategies of harnessing data to stay ahead in today's dynamic insurance market.

Before you continue with this part of our exploration into becoming a data-led (re)insurer, we highly recommend you read the first part of this series. In Part 1, we covered:

- The transformative power of data and advanced analytics in the (re)insurance industry.

- How new technologies like intelligent document processing and generative AI are reshaping risk assessment, underwriting, and operational efficiencies.

- The regulatory landscape and strategic benefits, including improved decision-making, enhanced accuracy, operational excellence, and superior customer experiences.

By understanding these foundational concepts, you'll be better equipped to appreciate the insights we will share here, where we delve into the maturity levels of data adoption in the (re)insurance sector.

Becoming a data-led (re)insurer

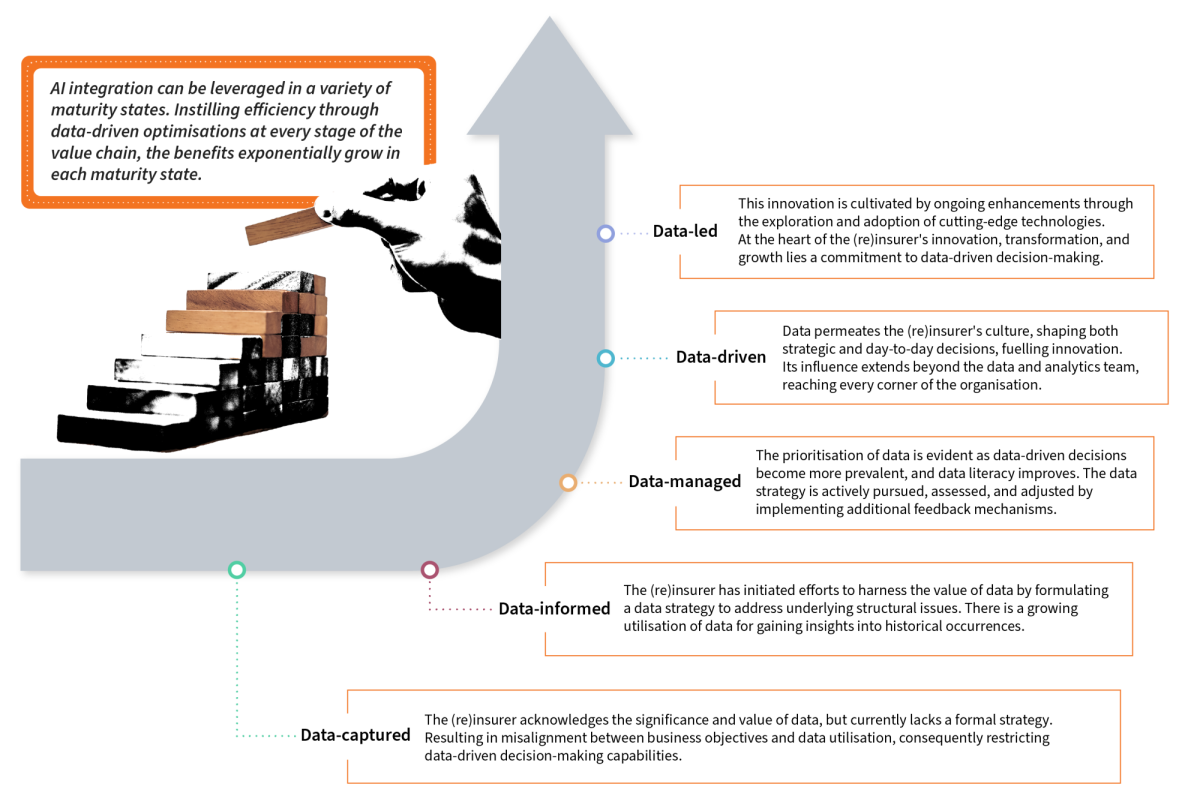

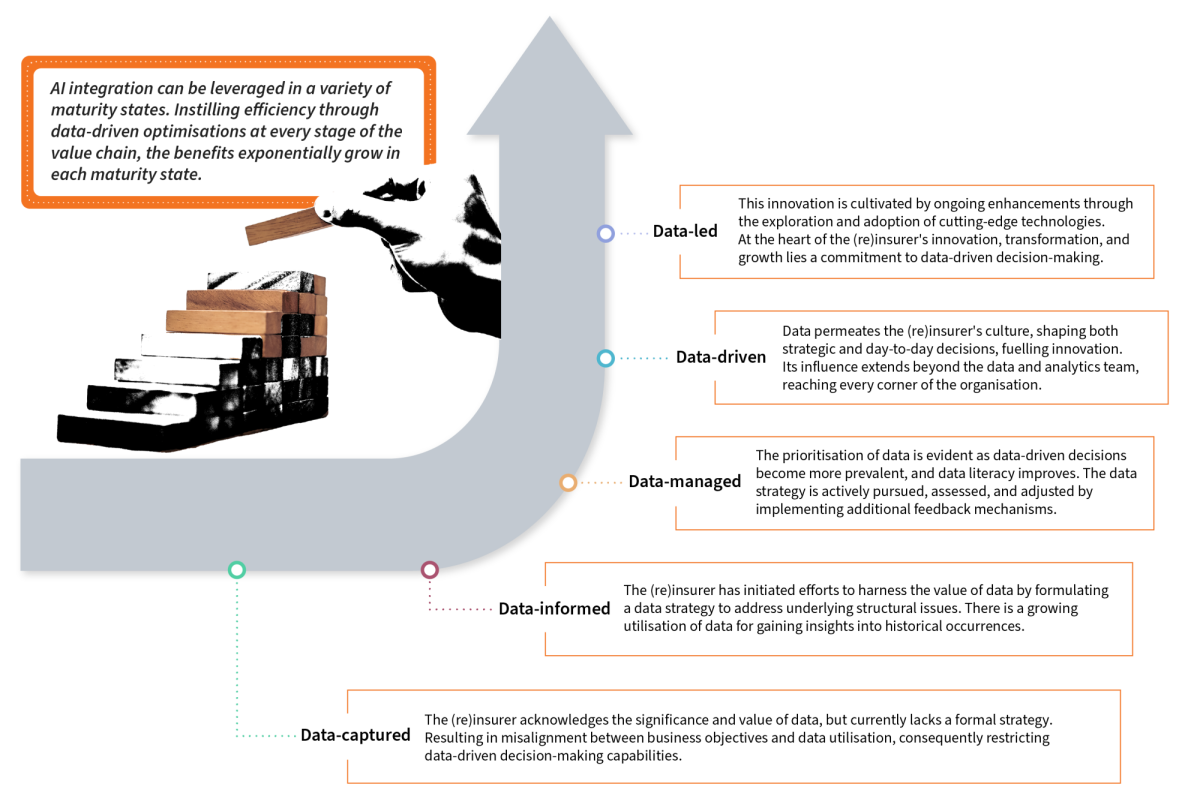

Balancing AI innovation with a flexible and secure IT/data architecture is challenging for many organisations, including (re)insurers. Challenges such as strict regulation to ensure security of the data slows down innovation, and often there is a disconnect between business goals and IT/data strategies, leading to unsuccessful AI projects or overly complex architectures without a defined purpose. The extent to which these roadblocks are successfully resolved decides on which of the different maturity levels an organisation operates (see figure).

Figure 1: Data competency

Achieving the highest level of maturity usually means that the data-led (re)insurer has unlocked their data’s full potential. Data-driven decision-making sits at the cornerstone of the (re)insurer’s innovation, transformation, and growth. Additionally, continuous improvement is fostered by experimenting with new emerging technologies.

For (re)insurers that are only starting with their data journey, their organisation looks very different. The (re)insurer is aware of the importance of data and its potential value, yet no formal strategy is in place. There is often limited alignment between business and data, leading to limited data-driven decision making.

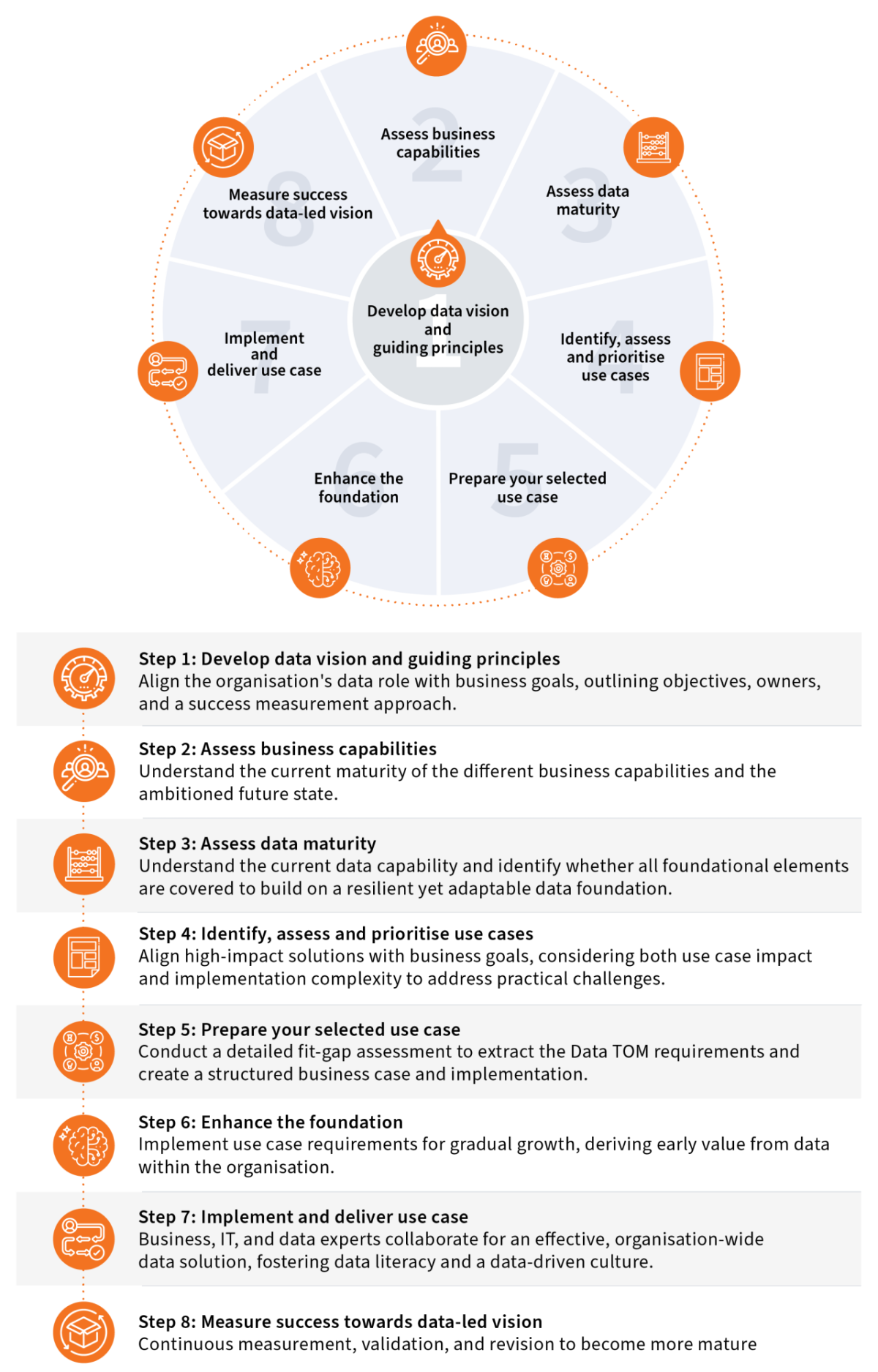

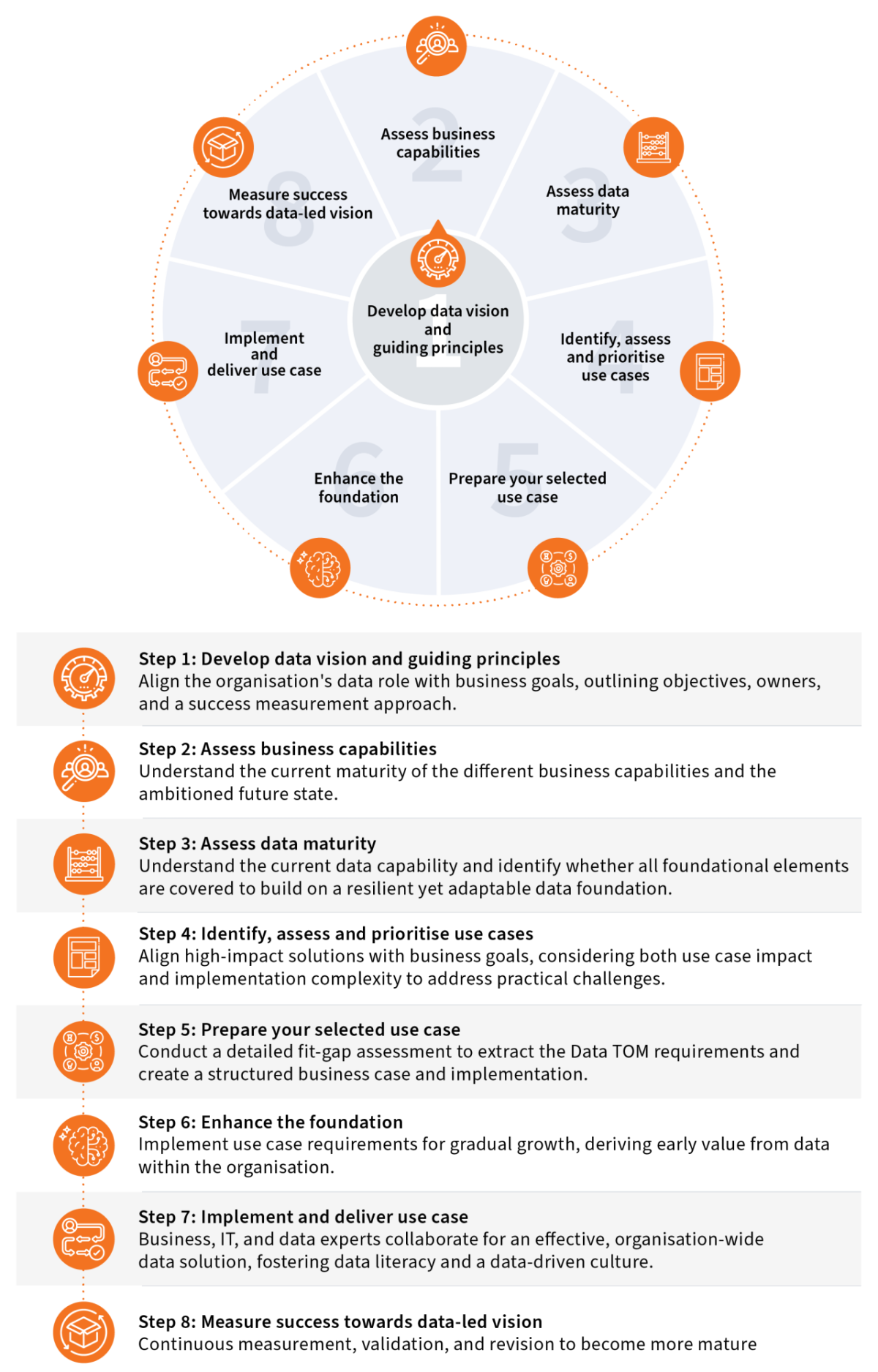

At Synpulse, we put data at the center of all our services, assets, and products. We enable (re)insurers to grow through our value case driven approach by deriving immediate value from data and establishing a foundation for a strong, scalable, and adaptable future. Our proven value case driven approach ensures alignment between business, IT, and data teams, enabling the adoption of any current and future innovations.

Figure 2: Value case driven approach

In the coming months, we will detail our approach by examining each step in the value chain, demonstrating the implementation of data-led (re)insurance. We will explain how a data-led (re)insurer operates, identify associated use cases, and describe how to achieve these objectives using our value case approach and solutions. This will highlight the importance of integrating technology and business strategies, ensuring (re)insurers are prepared to meet industry challenges.

Sign up to stay tuned for our first deep dive into data-led product development, where we will explore how data-led strategies can innovate product offerings, emphasising the need for tailored solutions, long-term relationships, and collaborative risk management in the commercial and (re)insurance industry.

To learn more about data-led (re)insurance and how it can transform your business, get in touch with us.

(Re)insurance data is driving transformation like never before. We delve into the topic of data-led (re)insurance, exploring how cutting-edge technologies and advanced analytics are reshaping the landscape for (re)insurers. Join us as we uncover the benefits, challenges, and strategies of harnessing data to stay ahead in today's dynamic insurance market.

Before you continue with this part of our exploration into becoming a data-led (re)insurer, we highly recommend you read the first part of this series. In Part 1, we covered:

- The transformative power of data and advanced analytics in the (re)insurance industry.

- How new technologies like intelligent document processing and generative AI are reshaping risk assessment, underwriting, and operational efficiencies.

- The regulatory landscape and strategic benefits, including improved decision-making, enhanced accuracy, operational excellence, and superior customer experiences.

By understanding these foundational concepts, you'll be better equipped to appreciate the insights we will share here, where we delve into the maturity levels of data adoption in the (re)insurance sector.

Becoming a data-led (re)insurer

Balancing AI innovation with a flexible and secure IT/data architecture is challenging for many organisations, including (re)insurers. Challenges such as strict regulation to ensure security of the data slows down innovation, and often there is a disconnect between business goals and IT/data strategies, leading to unsuccessful AI projects or overly complex architectures without a defined purpose. The extent to which these roadblocks are successfully resolved decides on which of the different maturity levels an organisation operates (see figure).

Figure 1: Data competency

Achieving the highest level of maturity usually means that the data-led (re)insurer has unlocked their data’s full potential. Data-driven decision-making sits at the cornerstone of the (re)insurer’s innovation, transformation, and growth. Additionally, continuous improvement is fostered by experimenting with new emerging technologies.

For (re)insurers that are only starting with their data journey, their organisation looks very different. The (re)insurer is aware of the importance of data and its potential value, yet no formal strategy is in place. There is often limited alignment between business and data, leading to limited data-driven decision making.

At Synpulse, we put data at the center of all our services, assets, and products. We enable (re)insurers to grow through our value case driven approach by deriving immediate value from data and establishing a foundation for a strong, scalable, and adaptable future. Our proven value case driven approach ensures alignment between business, IT, and data teams, enabling the adoption of any current and future innovations.

Figure 2: Value case driven approach

In the coming months, we will detail our approach by examining each step in the value chain, demonstrating the implementation of data-led (re)insurance. We will explain how a data-led (re)insurer operates, identify associated use cases, and describe how to achieve these objectives using our value case approach and solutions. This will highlight the importance of integrating technology and business strategies, ensuring (re)insurers are prepared to meet industry challenges.

Sign up to stay tuned for our first deep dive into data-led product development, where we will explore how data-led strategies can innovate product offerings, emphasising the need for tailored solutions, long-term relationships, and collaborative risk management in the commercial and (re)insurance industry.

To learn more about data-led (re)insurance and how it can transform your business, get in touch with us.