To address the current gaps and challenges in the market, we look at the solutions that can ramp up your market surveillance framework.

Market surveillance, including trade and communication surveillance, has always been a focal point for regulations, such as Markets in Financial Instruments Directive II (MiFID II) and Market Abuse Regulation (MAR) [1]. It continues to be a growing concern in Asia, with greater scrutiny exercised by Asian regulators, as seen in recent enforcements, such as the Securities and Futures Commission (SFC) suspension of 13 brokers for market manipulation on 18 February 2021[2].

In the past three years, the Monetary Authority of Singapore (MAS) in Singapore has steered stringent audits regarding the current practices of financial institutions (FIs) by recommending best practices on market surveillance. These regulatory audits highlighted two critical gaps regarding insider trading awareness amongst risk and compliance teams and the lack of gap-closing across the different investigation areas for Financial Crime Compliance (FCC), such as:

- Lack of risk management and risk scenario awareness in the first line of defense (i.e., insider trading).

- Lack of connectivity within the FCC department where transaction and communication data were analysed separately.

This highlights a pressing need for a holistic surveillance framework to address the current gaps and market challenges. The Hong Kong Monetary Authority (HKMA) has also encouraged FIs to adopt RegTech solutions. For example, incorporating enablers, including advanced analytics, machine learning, and specific artificial intelligence (AI), such as natural language processing (NLP) and sentiment analysis, in surveillance systems.

The remote working arrangement, increasingly prevalent with the COVID-19 pandemic, has also driven FIs to focus on communication surveillance, as relationship managers and traders use online messaging services (e.g., WeChat and WhatsApp) to communicate with their clients.

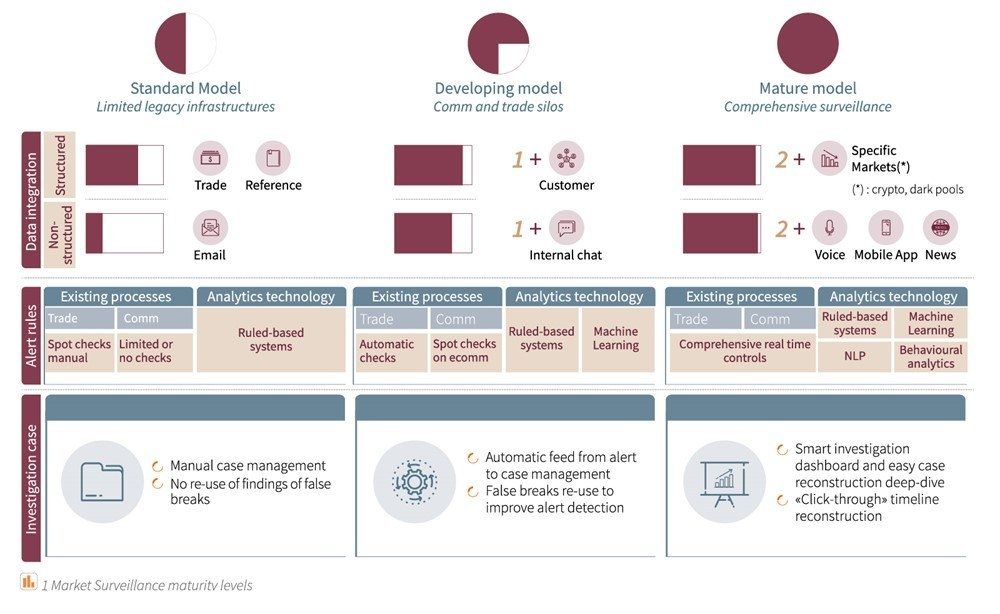

Financial institutions grappling with siloed surveillance architecture are advised to look at potential third-party solutions and assess the maturity level of their market surveillance model. They can trigger their journey towards the next surveillance maturity model by looking at three vantage points:

- How to ingest broader internal and external unstructured data, including communication information

- How to unveil more accurate surveillance signals via innovative solutions and potentially external vendors

- How to smartly connect the investigation towers across the first and second lines of defence (LOD)

[1] ESMA publishes outcomes of MAR review (European Securities and Markets Authority, 24 September 2020).

[2] SFC issues restriction notices to 13 brokers to freeze client accounts linked to suspected social media ramp-and-dump scam (Securities and Futures Commission, 18 Feb 2021).

The three maturity models

Based on the above criteria, financial institutions can understand the level of maturity they are at and develop the path to a mature model if they are not there yet (see Figure 1).

Key observations

FIs face three vital recurring challenges to building a holistic market surveillance framework:

- Ability to efficiently link trade and communicate surveillance

- Ability to efficiently reconstruct timelines for investigation along with strong case management

- Understand the wider context of the client network instead of only focusing singularly on a specific client

RPA as a tactical enabler for more efficient market surveillance

Robotic process automation (RPA) is a key ingredient to ramping up your surveillance framework. Our article “Robotic Process Automation: An efficient solution to better trade surveillance” highlights the benefits of RPA for market surveillance, such as enabling automation and streamlining human-intensive processes (e.g., data extraction and consolidation).

However, as seen in Figure 1, any technological enhancement cannot be implemented alone and must be part of a comprehensive and robust real-time surveillance framework. By leveraging RPA, financial institutions can enjoy several benefits, such as:

- Broader scope of coverage (e.g., breadth of transaction and communication sample size)

- Lower operational cost because of the 24-hour work model

- Higher accuracy, thanks to an improvement in quality and consistency in the process

RegTech enablers for a holistic market surveillance system

For financial institutions aspiring to attain full holistic market surveillance capabilities, the adoption of RegTech will provide:

A holistic view

RegTech solutions can connect siloed systems to consolidate information from various sources, including trade and communication data, enabling FIs to monitor e-communications that match suspicious trading alerts effectively.

Meaningful insights

Artificial intelligence and network and contextual analytics can identify non-obvious connections across individuals, entities, and events based on historical trade and communication patterns, allowing FIs to detect suspicious activity proactively.

High-quality alerts

Technology, such as AI, NLP, and machine learning, can generate more accurate analytics than the current rule-based algorithm. The quality of the generated trading alerts can be significantly improved with a notable drop in false positives.

Continuous improvements to accuracy

RegTech solutions that incorporate supervised machine learning allow FIs to continuously use investigation results to improve the system’s algorithms to validate the generated alerts better and reduce the time needed to re-evaluate alert parameters manually.

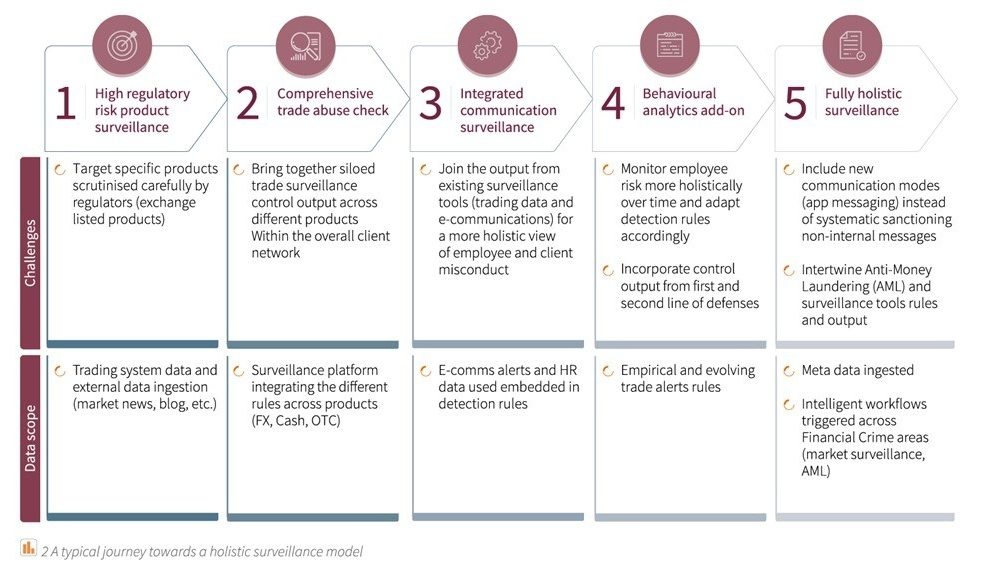

Your journey towards a holistic surveillance

To shape a robust holistic surveillance model, FIs can usually monitor two axes of progress in parallel (see Figure 2):

- Progressive collection of a wider scope of data, including communication information

- Intensification of behaviour–based rules, enabling a transformation of standard to bespoke alert rules scenarios data scope challenges

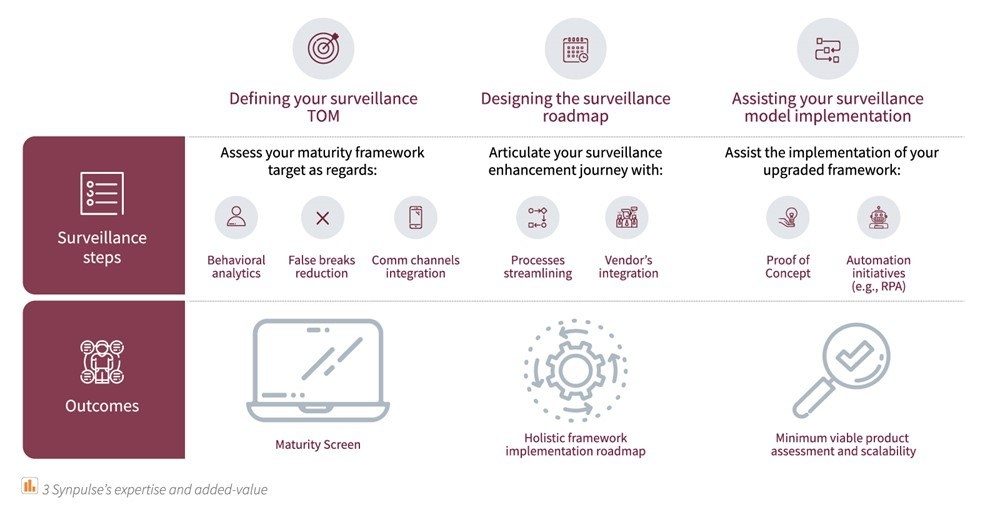

The Synpulse market surveillance value proposition

Synpulse can assist you along your holistic surveillance model implementation journey (see Figure 3):

Why work with us

“Synpulse helped shape the entire value chain, from identifying gaps to formulating controls and implementing solutions to ensure regulatory compliance.”

Subject matter expertise

Synpulse supports banks and insurers across their entire value chain, from developing strategies and realising them operatively to technical implementation and hand-over. Within the banking sector, Synpulse works closely with private, retail, and investment banks, as well as assets and wealth managers.

Our expertise in regulatory compliance and risk topics has a proven track record for technology-driven business processes re-engineering and target operating model review, design, and implementation, including maturity level assessment.

In parallel with supporting our clients in addressing their immediate challenges, we are committed to bringing transformational solutions to the industry, some developed in-house and others in collaboration with our RegTech partners.

Extensive industry experience in the Asian market

Having worked with eight of the 10 largest financial institutions in Asia over the past 10 years on an array of successful projects in Hong Kong and Singapore, we understand the most pressing regulatory and compliance challenges facing this region based on our proven methodologies.

We would be most pleased to share the industry’s best practices and provide you with further information on how these risk topics may impact your organisation.

Reach out to Prasanna Venkatesan (Partner) at prasanna.venkatesan@synpulse.com, Gregory Achache (Associate Partner, Regulatory Compliance and Risk Greater China Competence Centre Lead) at gregory.achache@ synpulse.com and Adrien Barquissau (Director) at adrien.barquissau@synpulse.com.