Summary

- The reliance on manual processes in managing credit applications reduces efficiency, data integrity, and scalability.

- Newgen and Synpulse collaborated to revolutionise the credit application process for their wealth management client.

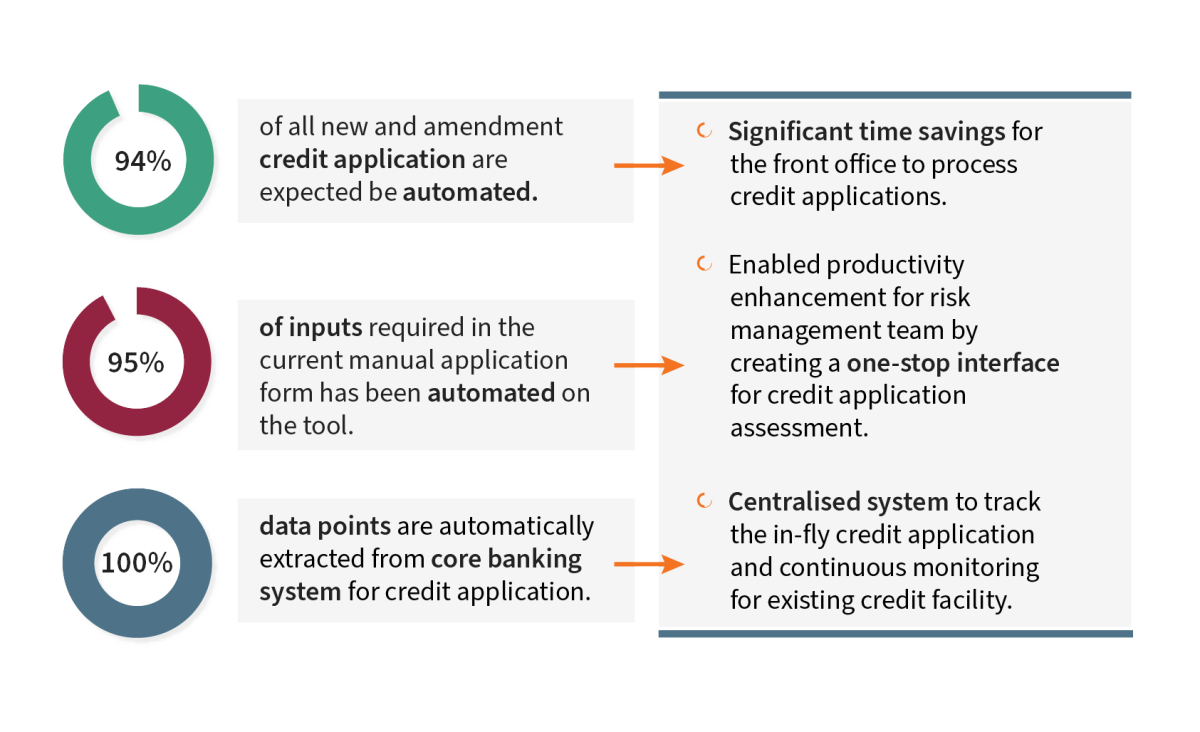

- The partnership yielded significant gains for the client in the areas of automation, productivity, and monitoring.

In today's fast-paced business environment, banks must constantly evolve by streamlining and automating their processes. Relying solely on conventional methods is no longer sufficient in a rapidly changing landscape.

This article explores the recent collaboration between Synpulse and Newgen, which resulted in the successful implementation of Newgen’s low-code credit origination system in an Asian private bank. The implementation brought about a significant transformation in how the bank's wealth management division assesses and approves credit applications.

The need for change within the wealth management sector

The bank’s wealth management division relied on a heavily manual approach in managing credit applications, which resulted in significant challenges. Here are some notable examples:

- Application processing time: manual processing steps are inherently slower and often cumbersome, demanding excessive time and resources, consequently causing delays in credit approvals.

- Data integrity issue: manual verification of client information from multiple systems results in inaccuracies, posing risks, and compliance issues.

- Credit documents preparation: manual document generation and storage processes require time and effort to create, organise, manage and archive credit documents.

- Limited scalability: lack of automation restricted the bank’s capacity to cope with higher credit application volumes and new market expansion to service multi-booking centre, therefore impeding its growth potential and adaptability.

Recognising the need for change, the bank made a strategic decision to digitise the entire credit approval process by selecting Newgen's low-code credit origination system led by Synpulse’s management consultants.

The implementation journey with Newgen and Synpulse

The collaborative effort between Newgen and Synpulse commenced in January 2023. Within a span of one year and three months, the entire credit process was implemented in a phased approach for multiple products, including:

- Lombard loan (comprises about 75% of the bank’s book)

- Mortgage loan

- Premium financing

- Security borrowing and lending

- Standby letter of credit (SBLC) loan

The implementation marked a significant milestone in revolutionising the credit application process within the bank with positive user feedback on the quick go-live of tangible results, coupled with easy product configuration, usage, and maintainability.

Holistic collaboration and clearly defined roles

The successful collaboration between Newgen and Synpulse was built on the foundation of effective teamwork and shared responsibilities.

Newgen acted as the leading solution provider with emerging technologies and product capabilities, giving invaluable inputs and product expertise during solution design workshops. Meanwhile, Synpulse played assumed key delivery roles, ensuring a holistic approach to the transformation initiative:

- Project management: Managed project activities, resources, and timelines all throughout various milestones and phases.

- Business analysis: Analysed and interpreted complex business procedures, requirements planning and design, and implement optimised workflows to achieve organisational goals.

- Test lead: Carefully planned, executed, and coordinated system integration testing, and user acceptance testing efforts to produce high-quality software solutions that meet strict standards and surpass customer expectations.

- Integration lead: Analysed, extracted, transformed, and transferred data between the core banking system and the credit origination system to improve decision-making and workflows.

Enhanced efficiency and user experience

The implementation of the system resulted in substantial time savings for all users involved, from front office, risk management to credit operation functions. The system now serves as a one-stop interface, simplifying the creation, assessment, and management of credit applications. It facilitates periodic reviews and continuous monitoring with well-designed workflow orchestration and rule-based review.

The transformative power of a low-code credit origination system

The successful collaboration between Newgen and Synpulse showcases the transformative power of low-code workflow management system. This partnership sets a precedent for banking peers seeking to enhance their operational processes. As this is a working model that can be easily replicated, we hope to deepen our collaboration to change traditional thinking and ways of operating.