While the global markets experience a slowdown, wealth managers should capitalise on this window to better prepare for future challenges and seize emerging market opportunities. In line with this proactive approach, we explore the regulatory developments in China’s digital advisory landscape, shedding light on how the nation is adapting to accommodate its growing wealth market.

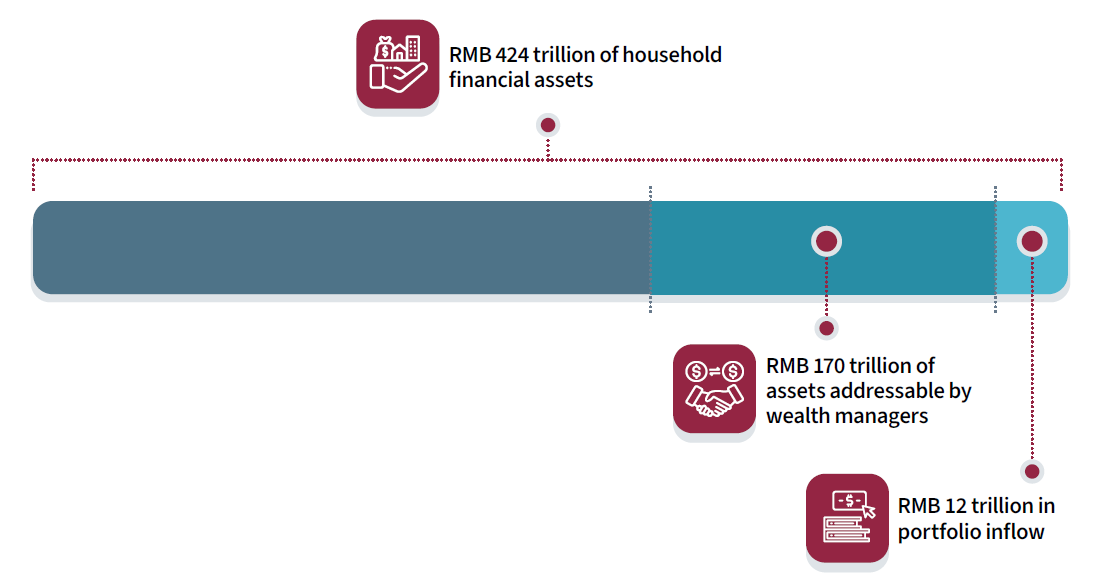

As China continues to make its mark on the global economic stage, its wealth management sector stands out prominently. With a steadily increasing population of high-net-worth individuals (HNWIs), China is experiencing remarkable growth in household wealth, which is expected to rise by approximately 8.5% annually, with household investable assets projected to surpass RMB 300 trillion (USD 41.7 trillion) by 2025.1

The surge in HNWIs and mass affluent individuals has been instrumental in driving this growth, with over 2.06 million families boasting a net worth exceeding RMB 10 million (USD 1.4 million) by the end of 2022. 2

The substantial growth in the number of affluent households translates to significant opportunities in the wealth management advisory market, allowing advisory businesses to establish a more robust presence and extend their influence across the country.

Evolution of advisory regulations in China

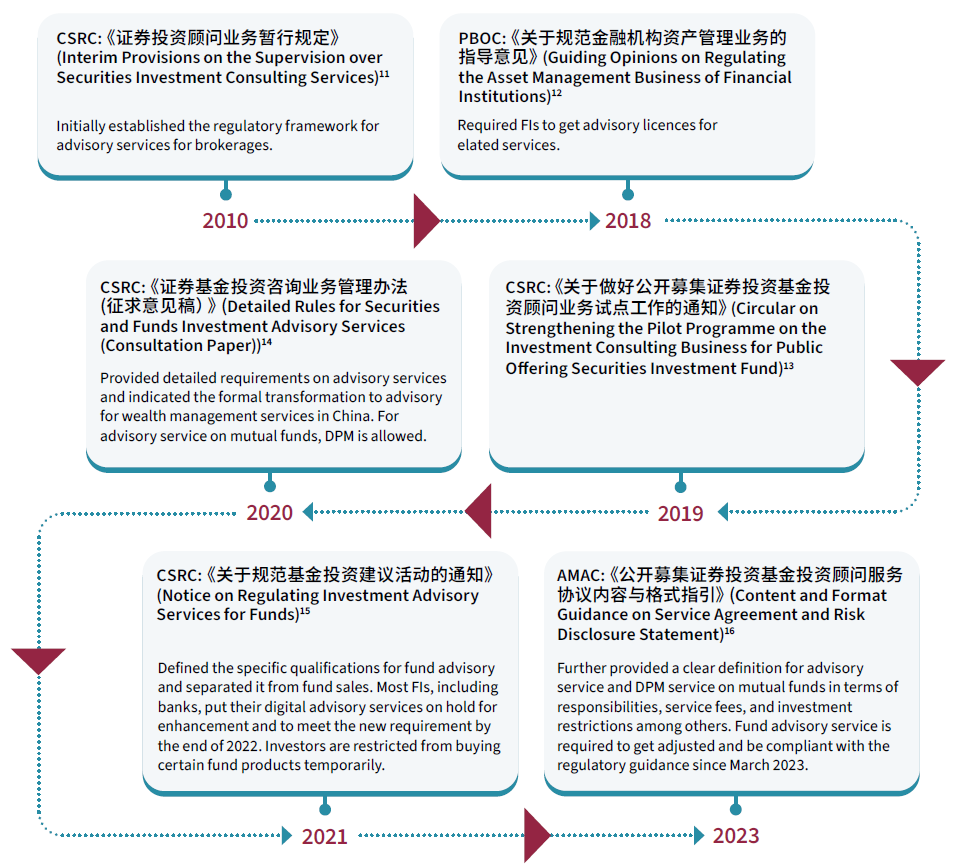

Despite the constant growth of China’s wealth market since the 2000s, the regulatory framework governing advisory services remains at its initial stage. While regulations for investment advisory were established in 2010, comprehensive advisory services only initiated a pilot launch in 2019.

For quite a while, the investment advisory business in China had lax regulations, but this has changed with new guidelines being drafted. Official regulations on the administration of foreign-invested banks have been released in 2019, opening to a larger range of Chinese investors. The key regulatory updates include lower asset thresholds for principal foreign investors, elimination of the single presence restriction, broader scope of business, and greater flexibility for branches to use capital.3

Specifically, for foreign banks seeking to enter the Chinese market, the existing regulations set different requirements for different investment products. As a prerequisite, banks should also apply and receive relevant qualifications for advisory services for different investment products.

In 2020, the China Securities Regulatory Commission (CSRC) proposed the draft Management Measures on Securities and Fund Investment Advisory Business, introducing a new licensing regime. While advisory entities are subject to a relatively low entrance barrier under the current regulatory framework, the draft measures, however, have outlined stricter and higher standards for the advisory entities and their investors.4

As for public offering securities investment fund, the pilot launch in 2019 allowed the qualified institutions to provide more comprehensive advisory services,5 and the most recent guidance issued in March 2023 provided a clearer definition of advisory service and discretionary portfolio management (DPM) service. 6

For other investment products, such as equities, fixed income, and forwards, only advisory service is allowed, and the institutions should not make investment decisions on behalf of the customers.

Navigating new guidelines and opportunities

Going forward, China’s advisory services are set to shift from product-centric approaches to client-centric wealth management. The National Institution for Finance and Development (NIFD) report in 2023 highlights the successes seen during the three-year pilot launch of funds advisory services.7 This accomplishment encourages more institutions to join in the advisory pilot launch, signalling a promising era of expansion in both investment product offerings and regions.

How we can support you

At Synpulse, we collaborate with leading financial institutions to deliver valuable advisory services and platform implementations to our clients. Backed by our technological powerhouse, Synpulse8, we offer holistic solutions that bridge any gaps, ensuring we meet your business needs.

Our extensive expertise in wealth management, digital advisory, and regulatory compliance is at your disposal. Reach out to us to learn more!

References

[1] Impact of Chinese wealth will transcend slowing economy (Nikkei Asia, 2022).

[2] Top 10 regions with high net worth families in China (China Daily, 2022).

[3] China banking law: Revised regulations on foreign invested banks (Norton Rose Fullbright, 2019).

[4] China update: Relaxation of legislation and policies (Norton Rose Fulbright, 2020).

[5] Circular on Strengthening the Pilot Program on the Investment Consulting Business for Public Offering Securities Investment Fund (CSRC, October 2019).

[6] Content and Format Guidance on Service Agreement and Risk Disclosure Statement on the Investment Consulting Business for Public Offering Securities Investment Fund (AMAC, March 2023).

[7] Advisory Global Practice and the China Outlook (NIFD, March 2023).