Since 2014, the Hong Kong and mainland China financial markets have started integrating significantly, as exemplified by the launch and growth of the Stock Connect and the Bond Connect. By end of June 2020, regulators newly announced a Wealth Management Connect Scheme “WMC”1. The new scheme is expected to create a new channel for Chinese and Hong Kong financial institutions to seek growth with the expansions of cross-border trading and broader capital markets.

Challenges

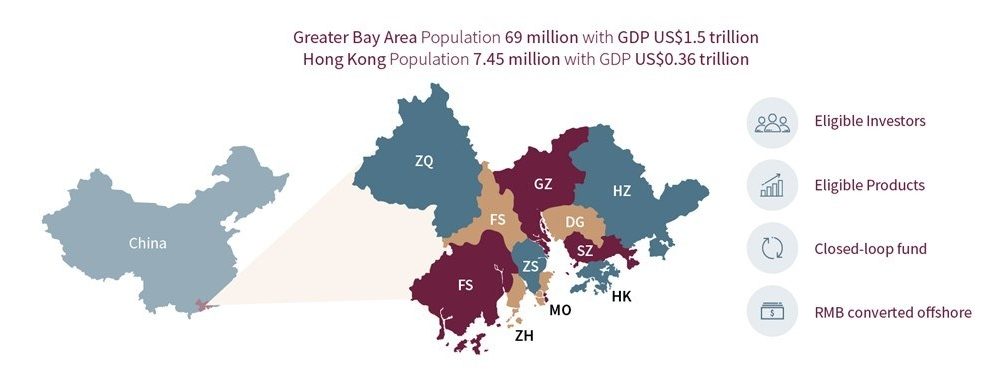

New Business Model for WMC has four key components (Figure 1):

- Currency and Exchange: Cross-border remittance will be carried out in RMB (or CNY) and currency will be converted in offshore market to comply with exchange control in mainland China.

- Closed-loop Fund Management: The remittance will be bundled up under a closed-loop to ensure the fund is used only for investment purpose, as to manage the cross-border capital flows in mainland China.

- Eligible Products: The retail wealth management products available will be governed by respective laws and regulation, the scrutiny of products should comply with the strictest scrutiny in the region.

- Eligible Investors: The WMC will open to residents in Hong Kong, Macao and Greater Bay Area, investors will be admitted via a series of checking on KYC for AML purpose and eligibility of investment products for suitability.

Figure 1: Wealth Management Connect Key Factors2

Risk Management and Regulatory Focus

WMC will be governed by respective laws and regulations on selling and trading Retail Wealth Management products applicable in the three places. Key aspects of regulatory requirements are listed below:

- Eligible Investor Definition: Know-your-customer including source of wealth check; investor profiling including risk tolerance, risk preference, knowledge, and experience.

- Eligible Investment Product Definition: Product Due Diligence including risk level, nature of the product, disclosure of pricing and monetary benefit.

- Money Flow Management: Source of fund tracing and checking, Cross-boundary remittance , Foreign exchange management, post-trade monitoring.

- Sales Governance: Voice/video recording, Risk disclosure, Trade surveillance, and complaint and dispute handling.

Product and Service Value Chain and Offerings

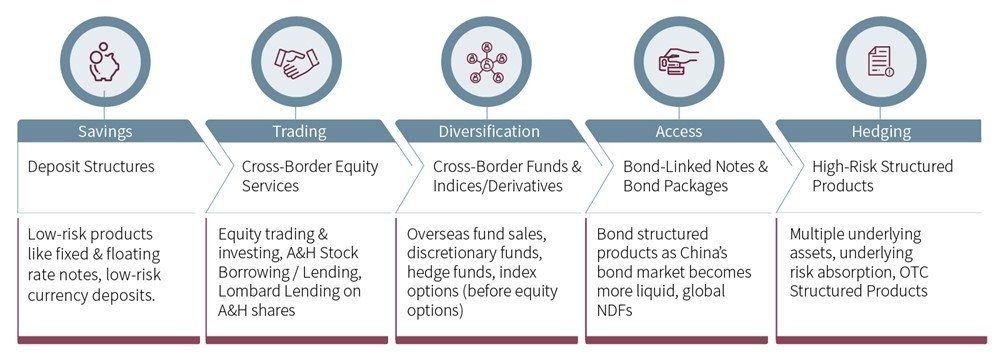

We anticipate that less complex products with lower risks are likely to be available in the WMC earlier, with the overall estimated trajectory outlined in Figure 2.

How can Synpulse Help

Synpulse is committed to the financial services industry and private banks. Many of our clients are major retail and wealth management banks in the Asia-Pacific region, and we focus particularly on Regulatory Compliance and Risk expertise across the Mainland and Hong Kong. Our expertise includes defining and implementing Target Operating Model, which ensures financial services processes control and risk management is compliant. We look forward to speaking with you about the cross-border framework that can support Wealth Management Connect's expansion into the strategic market.

Kindly reach out to Mike Choi (Associate Partner, Operational Excellence and Technology Greater China Competence Centre Lead) at mike.choi@synpulse.com, and Gregory Achache (Associate Partner, Regulatory Compliance and Risk Greater China Competence Centre Lead) at gregory.achache@ synpulse.com.

1 Launch of the Cross-boundary Wealth Management Connect Pilot Scheme ― June 2020

2 Hong Kong vs. mainland China: A series of framework comparison