There are numerous opportunities for private banks to improve their client lifecycle management (CLM). However, they need the right guidance to navigate the complexities of the CLM journey. In this article, we discuss the various pre-requisites and key enablers to set banks up for success.

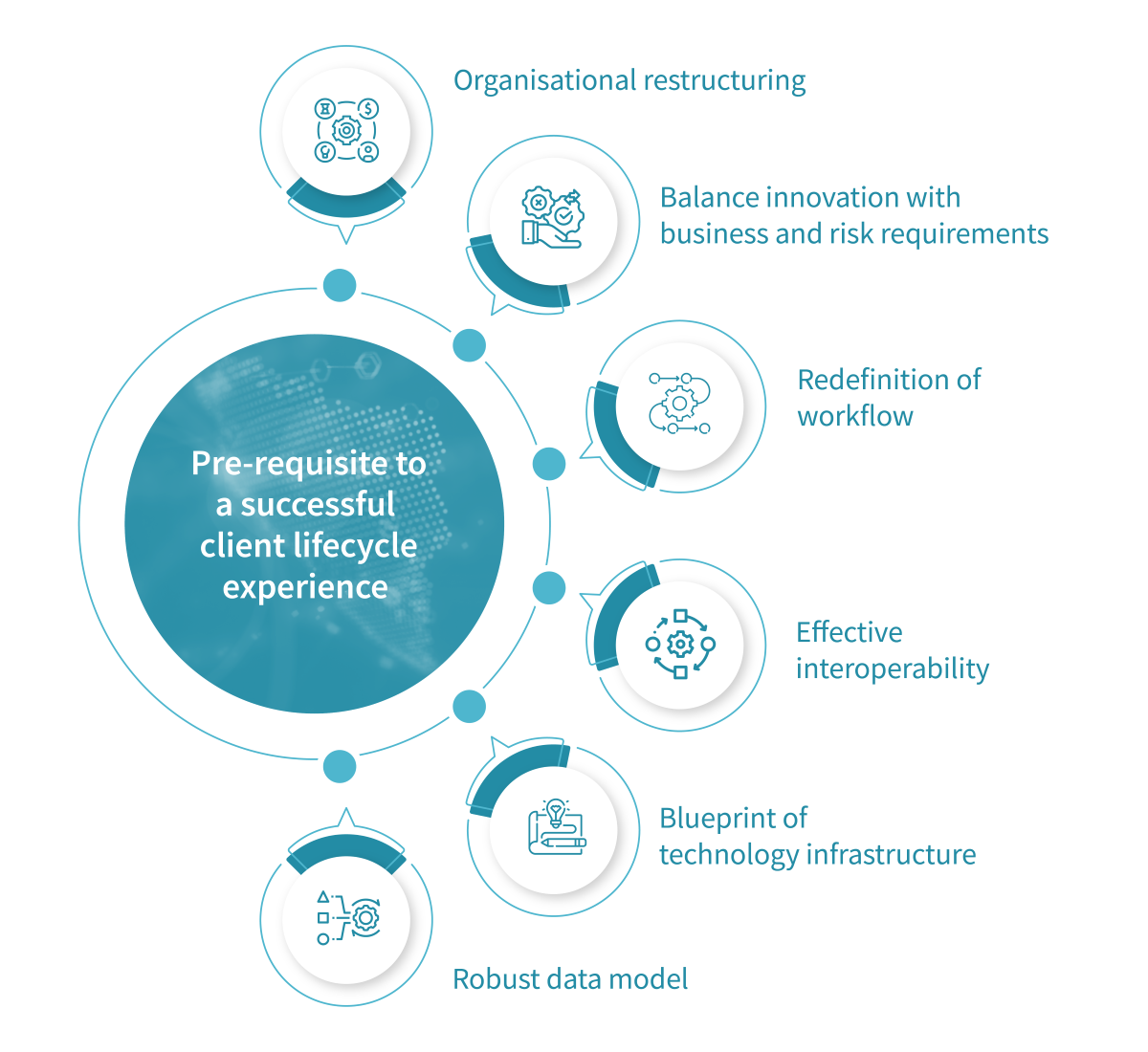

Pre-requisites to a successful client lifecycle experience

It is critical for banks to formulate the right strategy to strengthen their foundation and create value for client in their relationship lifecycle with the bank.

Organisational restructuring

Banks must transform their organisational structure, redefining the division of activities amongst teams, along with suitable technology and tools to improve turnaround time of onboarding and maintenance requests.

Reimagine CLM journeys

Banks must redesign their processes and orchestrate client journeys by removing unnecessary tasks through smart conditional triggers, de-linearize workflows to enable parallel journeys, and accurately map each process to policy for full traceability and accountability.

Balance innovation with business and risk requirements

To reduce manual effort and eliminate duplication for meeting legal, compliance, and operational requirements across jurisdictions, banks must venture towards a centralised rule-based approach that enables continuous updates in line with fast-changing regulations.

Blueprint of technology infrastructure

Leverage technologies to achieve a simplified and open architecture that supports flexible and modularised features, eliminating potential integration challenges with legacy platforms and providing agility for future configuration to meet changing business needs.

Effective interoperability

By establishing a customised framework, banks can achieve data visualisation and interoperability, allowing diverse datasets to be merged and aggregated in meaningful ways to turn data into actionable insights.

Robust data model

Banks need to pivot towards a singular model with clear data inputs, flows, attributes, logical models and relational structures with governance around data mastering.Key enablers to efficient CLM journeys

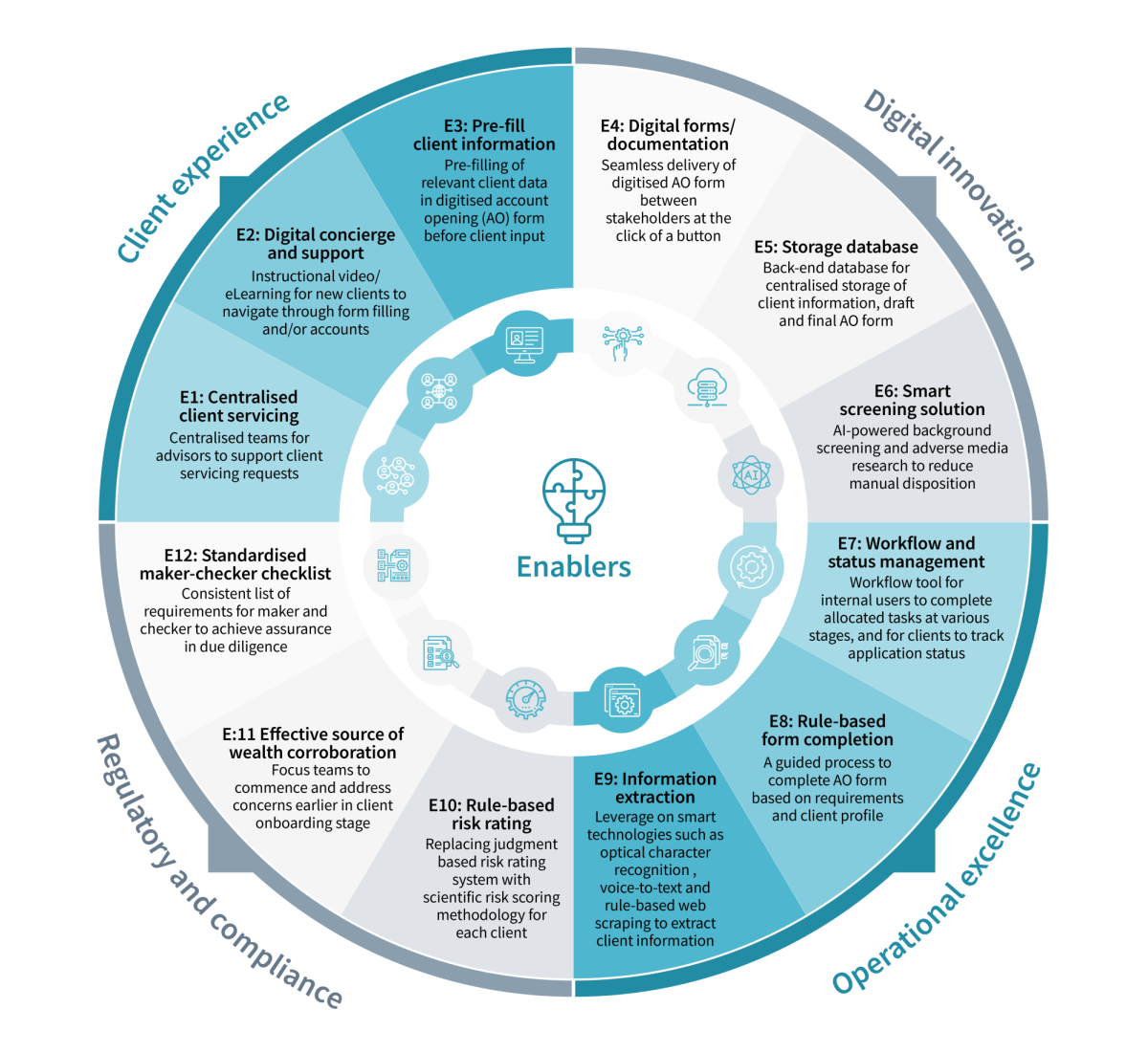

To build a sustainable CLM journey, it is key that banks identify and utilise the key enablers. Synpulse has outlined 12 key enablers that support an effective CLM journey, addressing client experience, digital innovation, operational excellence, and regulatory compliance respectively.

This concludes our article series to introduce CLM journey. For a more detailed discussion on your needs in CLM, please feel free to contact us at Synpulse.

With extensive collaboration with leading product partners in the fintech sector and profound industry knowledge in the banking domain. Synpulse offers a client-centric approach to change management initiatives. Our services include advisory and delivery, assisting clients in developing CLM propositions and strategies, defining target state operating models, and engaging with the appropriate vendors for implementation and future product upgrades.