Loading Insight...

Insights

Insights

In the last article, we discussed the external and internal challenges faced by private banks in the realm of client lifecycle management (CLM). The key challenges observed across private banks globally typically revolve around increasing regulatory compliance, evolving client expectations, inefficient processes and systems, and disintegrated data and document management. On the other hand, the emerging trends mark a wealth of opportunities for private banks to create a seamless customer journey through transformation.

In this article, we will discuss the changes that can create the greatest impact on client acquisition and retention.

Unlocking opportunities by optimising the client journey

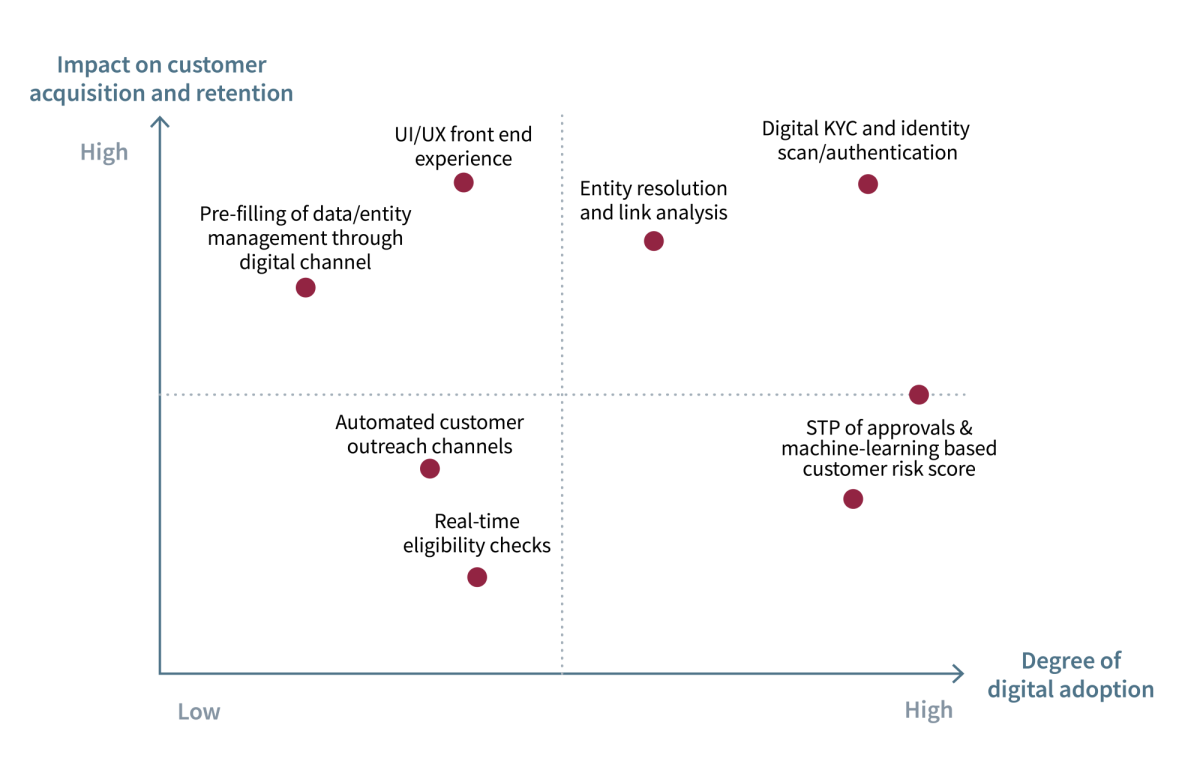

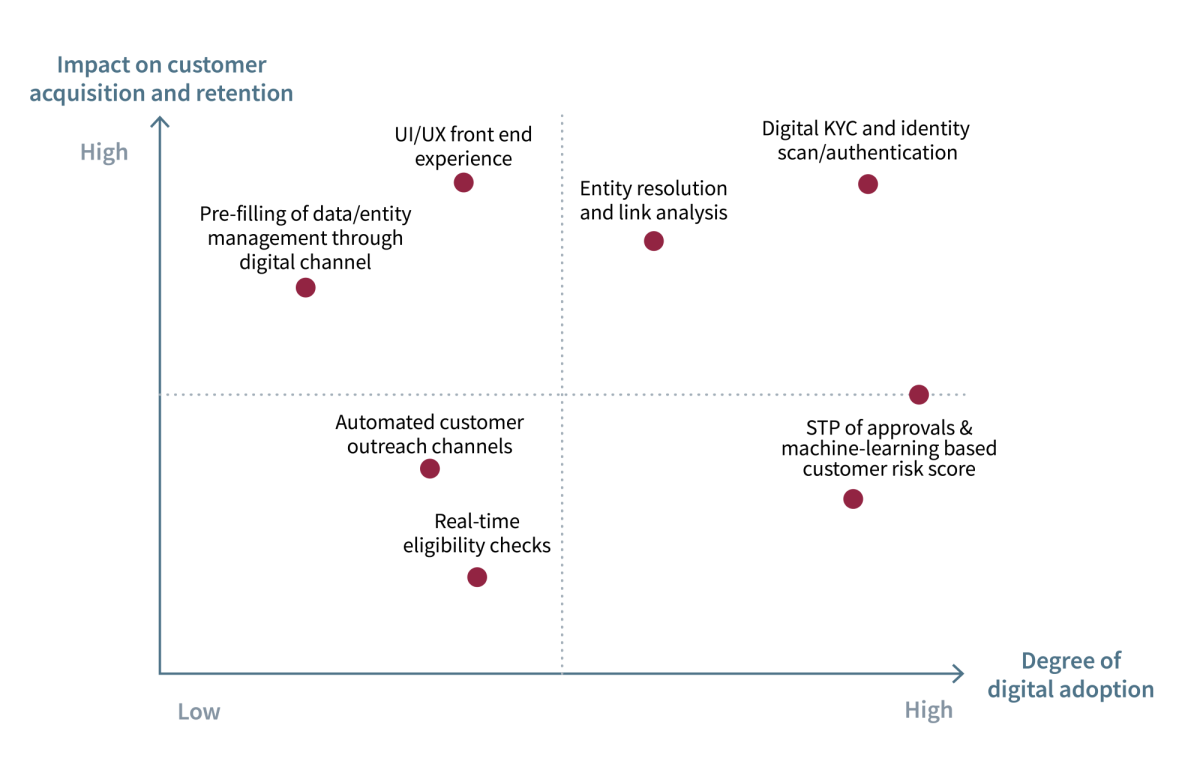

When embarking on the journey towards transformation in today’s digital world, private banks need to first perform a cost-benefit analysis to prioritise changes that create the highest impact in terms of client acquisition and retention, against the expected return on investment from digital adoption.

Client acquisition and retention should be a top priority consideration for private banks because of the high-margin and fee-generation business. Acquiring new clients means more assets under management and retaining clients not only gives longevity but creates cross selling opportunity to expand on the range of products and services.

Similarly, assessing the expected return on investment from digital adoption maturity is paramount for private banks to understand the competitive advantage of being an early adopter of emerging technologies. Private banks need to understand their client profiles well to evaluate whether their desire and acceptance for those digital experiences justify the potential benefits, outweigh the costs and risks involved in implementing new digital technologies.

One of the common challenges associated with onboarding is the dropout midway in the process. Oftentimes, reasons cited for an account being abandoned include a long-drawn-out process, cumbersome paperwork, and the absence of digital options. These abandoned applications translate to missed opportunity cost for the bank, whereas a well-designed client onboarding journey can serve as a powerful tool for client engagement and lead conversion.

Banks can address this issue by implementing a digital onboarding process that remain agile to evolving regulatory changes. Examples of readily available digital tools in the market for banks to capitalise on include:

- Electronic Know Your Customer (eKYC): Digital ID verification including biometric or facial recognition with liveness detection and integration with available national digital IDs (e.g., Singpass)

- Authentication: Tamper-proof digital signatures or digital tokens

- Compliance rules engine: Modular rules template, fully customisable, with traceability and auditability covering KYC/AML policies, data protection laws, tax and suitability classification

- Real-time support and interaction: Chatbots powered by artificial intelligence, portable across all digital channels from messaging app to web browser

Designing a seamless customer journey is critical to a bank’s survival in this digital age. In this article, we explored what strategies banks should employ when embracing digitalisation and how banks should approach opportunities in the digital era.

Our next article will focus on the essential prerequisites and key enablers for a smooth CLM journey. Stay tuned for our final piece in the series.

Previous article in the series:

Developing and Maturing the CLM Journey: Challenges and Insights in PBWM

In the last article, we discussed the external and internal challenges faced by private banks in the realm of client lifecycle management (CLM). The key challenges observed across private banks globally typically revolve around increasing regulatory compliance, evolving client expectations, inefficient processes and systems, and disintegrated data and document management. On the other hand, the emerging trends mark a wealth of opportunities for private banks to create a seamless customer journey through transformation.

In this article, we will discuss the changes that can create the greatest impact on client acquisition and retention.

Unlocking opportunities by optimising the client journey

When embarking on the journey towards transformation in today’s digital world, private banks need to first perform a cost-benefit analysis to prioritise changes that create the highest impact in terms of client acquisition and retention, against the expected return on investment from digital adoption.

Client acquisition and retention should be a top priority consideration for private banks because of the high-margin and fee-generation business. Acquiring new clients means more assets under management and retaining clients not only gives longevity but creates cross selling opportunity to expand on the range of products and services.

Similarly, assessing the expected return on investment from digital adoption maturity is paramount for private banks to understand the competitive advantage of being an early adopter of emerging technologies. Private banks need to understand their client profiles well to evaluate whether their desire and acceptance for those digital experiences justify the potential benefits, outweigh the costs and risks involved in implementing new digital technologies.

One of the common challenges associated with onboarding is the dropout midway in the process. Oftentimes, reasons cited for an account being abandoned include a long-drawn-out process, cumbersome paperwork, and the absence of digital options. These abandoned applications translate to missed opportunity cost for the bank, whereas a well-designed client onboarding journey can serve as a powerful tool for client engagement and lead conversion.

Banks can address this issue by implementing a digital onboarding process that remain agile to evolving regulatory changes. Examples of readily available digital tools in the market for banks to capitalise on include:

- Electronic Know Your Customer (eKYC): Digital ID verification including biometric or facial recognition with liveness detection and integration with available national digital IDs (e.g., Singpass)

- Authentication: Tamper-proof digital signatures or digital tokens

- Compliance rules engine: Modular rules template, fully customisable, with traceability and auditability covering KYC/AML policies, data protection laws, tax and suitability classification

- Real-time support and interaction: Chatbots powered by artificial intelligence, portable across all digital channels from messaging app to web browser

Designing a seamless customer journey is critical to a bank’s survival in this digital age. In this article, we explored what strategies banks should employ when embracing digitalisation and how banks should approach opportunities in the digital era.

Our next article will focus on the essential prerequisites and key enablers for a smooth CLM journey. Stay tuned for our final piece in the series.

Previous article in the series:

Developing and Maturing the CLM Journey: Challenges and Insights in PBWM