In the insurance industry, particularly in Asia, ESG concerns push insurers to manage their underwriting and investment activities in lieu of environmental risks.

In the last five years, environmental, social, and corporate governance (ESG) issues have garnered significant attention across the financial services industry and financial institutions (FIs) around the world. In the Asian insurance landscape, ESG concerns, such as biodiversity loss, carbon emissions, and climate change have received regulators’ attention, leading to a strong focus on encouraging insurers to manage their underwriting and investment activities in lieu of environmental risks.

Both the Monetary Authority of Singapore (MAS) and the Hong Kong Monetary Authority (HKMA) have actively increased their emphasis in this area. Particularly in Singapore, MAS issued on 25 June 2020 a consultation paper that highlights the proposed guidelines on environmental risk management for insurers.1 These guidelines spell out the ESG governance, risk management, and disclosure sound practices that can be enhanced to build a resilient financial ecosystem.

Regulatory expectation, building an ESG framework

A robust organisation-wide ESG framework is paramount to ensure that ESG practices comply with client and regulatory expectations. Synpulse, with our in-depth ESG experience, can support you in building and implementing the ESG framework that is tailored to your insurance’s specific operational circumstance and nature of business.

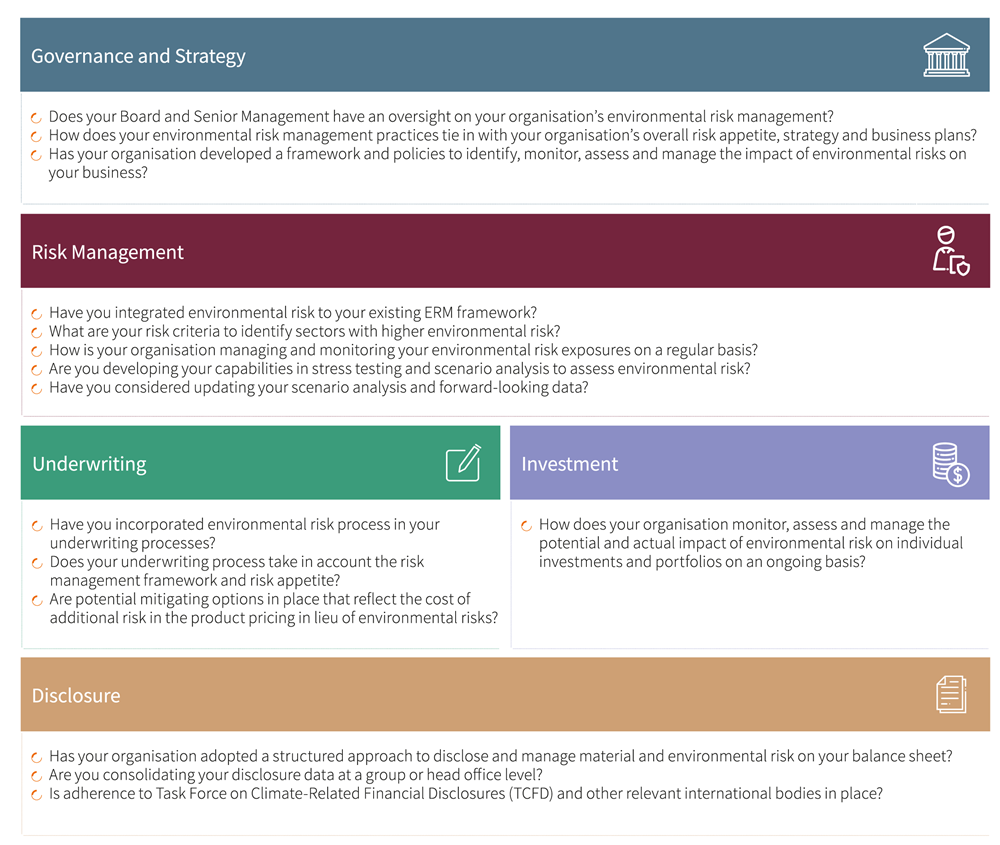

Below is an illustration of the ESG framework that is expected by regulators in Singapore:

ESG integration

Incorporating ESG factors into the underwriting and investment decision-making process can be challenging for many insurers. Consistency of data, risk framework, and regulatory components are some of the factors that insurers must consider during their ESG integration. It is, thus, important for insurers to review their business strategy, underwriting process, and investment portfolio early to effectively mitigate ESG risk and leverage on current opportunities.

Referencing MAS’s recent Guidelines on Environmental Risk Management, we have identified a list of key questions for the board of directors, C-suite personnel, and managers of insurers in Singapore to consider.

Implementation approach

Phase I: Gap assessment

In Phase I, we will perform a maturity assessment of the environmental risk framework’s adoption based on the insurer’s overall ESG strategy and mission, with regulatory expectations serving as a baseline. Focused group workshops and reviewing of underwriting processes and investment portfolios will be used for the diagnosis to understand the current status in comparison to the target position, in terms of governance, policies, and methodology.

This assessment will identify any existing gaps in regulatory expectations on governance and strategy, risk management, underwriting, investment, and disclosure. Analysis and recommended environmental risk framework for Phase II is delivered at the end of Phase I.

Phase II: Development of environmental risk framework

In Phase II, an environmental risk framework that manages and governs the environmental risk will be designed and customised for the insurer. According to the insurer’s specific size, nature of business, complexity of operations, and international ESG circumstances, a customised framework will be designed, in line with regulatory expectations and industry best practices. Standards for appropriate ESG risk exposure, mitigation, frequency, and the extent of ESG disclosure will also be clearly defined.

Phase III: Implementation

Phase III will help to formalise the Transformation Plan and Implementation Roadmap, together with all the relevant stakeholders from senior management, products, distribution compliance, underwriting, and investment to identify resources for the work streams.

Different work streams, covering governance, policy, and methodology, will be carried out in parallel to implement relevant charters, procedural documents, risk measurement and mitigation tools, disclosure requirements, and system controls.

To effectively implement an environmental risk framework, the entire implementation should be overseen by the Board and senior management, so that it brings across a clear direction for employees to align with.

Why work with us

“Synpulse helped shape the entire value chain, from identifying gaps to formulating controls and implementing solutions to ensure regulatory compliance.”

Subject matter expertise

Synpulse has been at the forefront of business transformation topics, engaging leading insurance companies to deliver both distribution compliance and commercially viable strategy frameworks in response to regulatory changes. Our knowledge of key regulatory and compliance topics within financial services has helped drive solution implementation, business processes re-engineering, and target operating model definition.

Extensive industry experience in the Asian market

Having worked with eight of the ten largest financial institutions in Asia over the past 10 years on an array of successful projects in Hong Kong and Singapore, we understand the most pressing regulatory and compliance challenges facing this region based on our proven methodologies.

Access to global ecosystem partners

Synpulse works closely with its innovative ecosystem partners across different topics. With deep insights and knowledge in the fintech and regtech landscape, Synpulse is in a strong position to identify the most suitable technological solution to meet its client’s needs.

We would be most pleased to share the industry best practices and provide you with further information on how these risk topics may impact your organisation.