Headwinds in the customer-owned banking industry in 2022

Evolving consumer needs and the COVID-19 pandemic have sparked an ongoing shift towards digital and business transformation in the Australian banking market. This trend does not exclude mutual banks, which, as customer-owned banks, focus on delivering great value to their members and owners. As highlighted by the Customer-Owned Banking Association, the mutuals’ market advantage is seen through attractive rates and fees, socially responsible lending, and personalised customer service.

However, the recent trend in the rapid digitalisation of traditional banks has seen the market strengthen its value proposition for the Australian consumer. Mutual banks’ superiority in rates and customer service has been diminished by increased response times, lack of efficient operational processes, and limited customer-centric solutions—all these combined with rising interest rates, increasingly complex regulatory requirements, and cybersecurity risks. The majority of mutuals are yet to respond to threats from major retail banks who have been equipped with digitalised banking operations since prior to COVID-19.

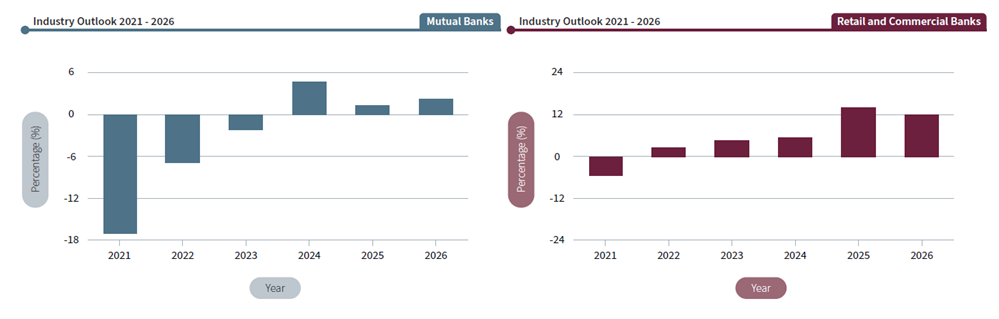

Below is a comparison of the market growth between mutual and traditional banks in the IBIS World Industry Report:

Given a mutual bank’s unique ownership structure, customers expect beneficial reinvestment of profits back into the business to help with their banking needs. In what ways can customers’ experience be improved? Faster transactions, quicker settlement, and better cybersecurity measures — the list goes on, but each of them falls inside an identical spectrum, which is a digitally capable core.

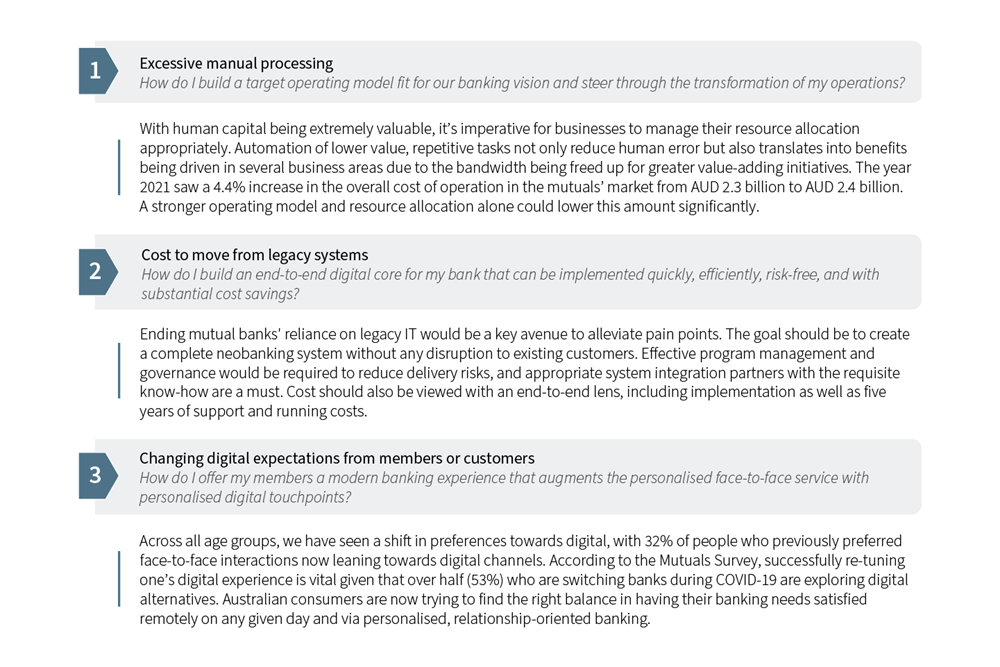

Pain points we observe in mutual banks

We see two approaches to digitally transform

There are two available routes for mutual banks looking to transform their banking system: through a traditional end-to-end solution or via a next-gen cloud-native core. Traditional solutions offer packaged services with coverage over front-to-back-office banking needs. Implementing a next-gen cloud-native core provides greater flexibility where mutuals can easily customise their service and make their banking experience efficient and unique. Either way would help modernise the banking experience for customers and staff alike.

Case study: Next-gen core platform using Thought Machine’s Vault Core

Next-generation solutions tend to focus on a skinny core, with the onus being on integration capabilities. This idea is based on giving banks the flexibility to choose and pay only for the functionality they need. An institution would also be able to select its preferred suppliers per functionality instead of needing to lock itself into an entire suite that may or may not solve for all its needs.

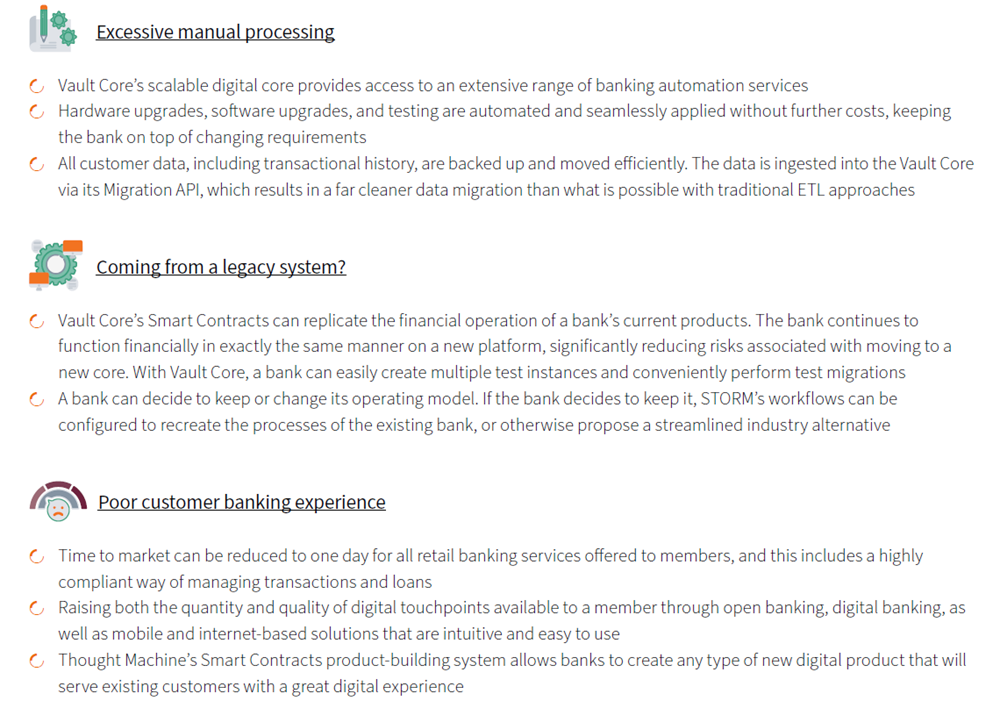

To enhance the implementation of Thought Machine’s cloud-native core banking platform, Vault Core, we have collaborated with Thought Machine to develop our newly designed operating model, STORM (Synpulse x Thought Machine Operating Requirements Model). STORM combines Synpulse’s in-depth expertise in target operating models and strategies for mutuals with the powerful core banking capabilities of the Vault Core platform. This allows a bank to seamlessly upgrade to an industry best practice operating model and have the right amount of flexibility built into their solution suite for future scalability.

Implementing STORM for more efficient processes

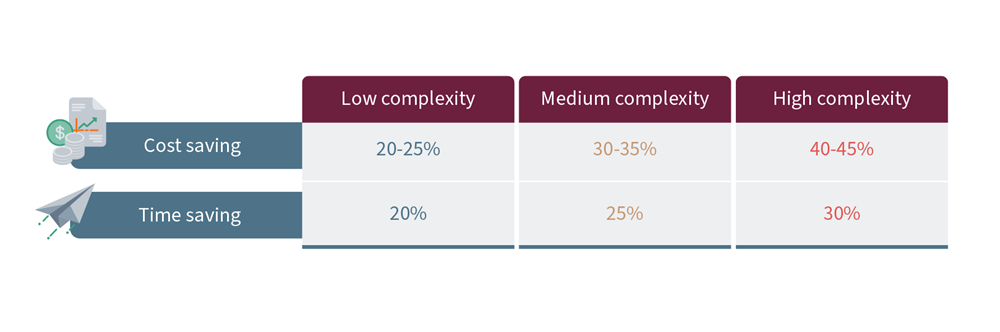

Mutual banks can achieve a 35% reduction in resourcing and time spent modernising banking when implementing STORM compared to a traditional modelling and planning approach, resulting in substantial cost savings. For instance, the implementation of STORM reduces time to market for a medium to complex structured bank from 10 to 12 months to 8 to 10 months. The quicker a core banking implementation can be completed, the earlier a bank can start to realise a return on its investment.

The model outlines 100 baseline processes essential to digital banks and maps them to integrate seamlessly with Thought Machine’s Vault Core systems. These processes are designed such that stakeholders across the bank can analyse, adopt, and build on top of them effortlessly.

Removing obstacles in effective business transformation

To keep up with the evolving regulatory and banking requirements, mutual banks have been forced to rely on workarounds to stay afloat. This has resulted in a way of working that often does not align with the industry’s best practice and with the key product and process experience missing. With STORM, we understand that the speed of the digital transformation journey depends on a full range of factors, from value proposition to operationalisation. Therefore, we provide:

Benefits from our Synpulse x Thought Machine collaboration

Synpulse’s digital transformation expertise has fostered a lasting, integrated partnership alongside Thought Machine. We have combined a target operating model and strategy uniquely curated for mutual banks, which has, in the past, proved to be successful in saving cost and time to market for banks.