Loading Insight...

Insights

Insights

Summary:

- Combating financial fraud is essential for preserving global financial stability.

- The rise in financial crimes in Hong Kong and Singapore is linked to their advanced digital economies and high GDP per capita, making them attractive targets for scammers.

- Investment scams have caused the most significant financial losses in both Hong Kong and Singapore, highlighting the need for robust regulatory frameworks.

- The experiences of Hong Kong and Singapore provide valuable lessons for other markets in enhancing digital security and public awareness to combat financial fraud.

Combating financial fraud is critical for maintaining the integrity and stability of global financial systems. Recently, we have observed an alarming rise in financial crimes in East Asia, particularly in more developed nations. Our findings suggest that these countries are experiencing the highest number of cases and financial losses.

Financial scams come in many forms. The estimated global financial losses from these crimes range from USD 50 billion to USD 177 billion, with a mid-point of USD 114 billion - comparable to the GDP of a small country.

Hong Kong and Singapore, as major financial hubs, are particularly vulnerable due to their high levels of digitalisation, remote banking services, and e-commerce activities. Both jurisdictions face significant challenges in combating the ever-evolving threat landscape of financial fraud.

This article explores the current trends in Hong Kong and SG, identifying the differences and similarities between them to gain more insight into the broader fight against financial crime.

Current trends in global financial fraud

The COVID-19 pandemic has significantly impacted the financial sector, presenting new challenges for both legitimate institutions and scammers. Advances in AI and machine learning have enhanced scammers' tactics, with AI chatbots mimicking real conversations and algorithms identifying vulnerabilities to target individuals more precisely. Consequently, financial institutions and regulators must stay ahead of these evolving scams.

Here are the most prevalent financial scams in 2024, highlighting their diversity and complexity.

Overview of financial scam in Hong Kong

According to the Hong Kong Police (HKPF), Hong Kong citizens suffered estimated losses totaling HKD 9 billion due to fraud in 2022, marking a 42.6% rise from the previous year.[1] Notably, internet-related fraud accounted for approximately 70% of all reported incidents. A total of 9,239 suspects were arrested and held over scams and money laundering offences in the past year.[2]

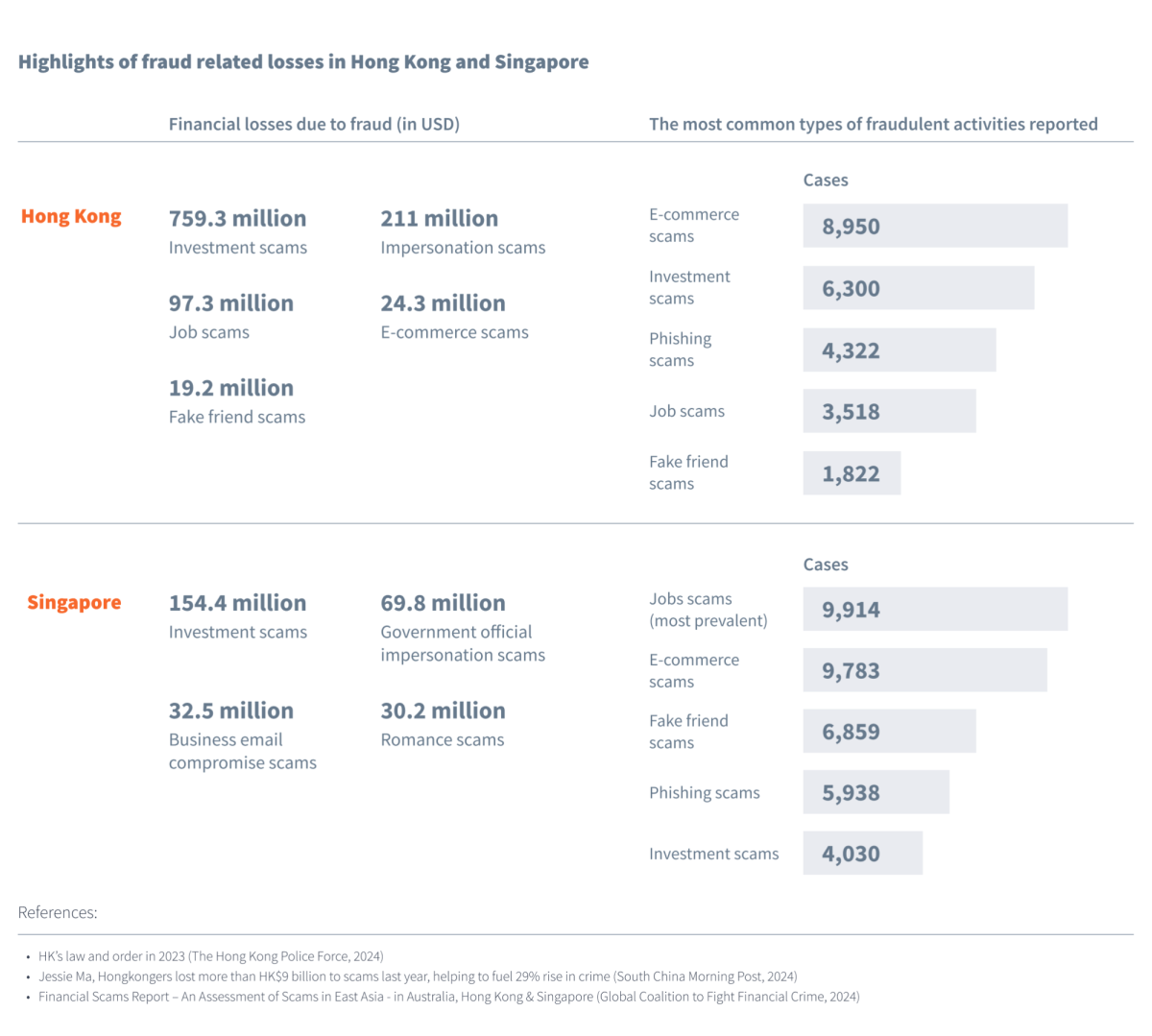

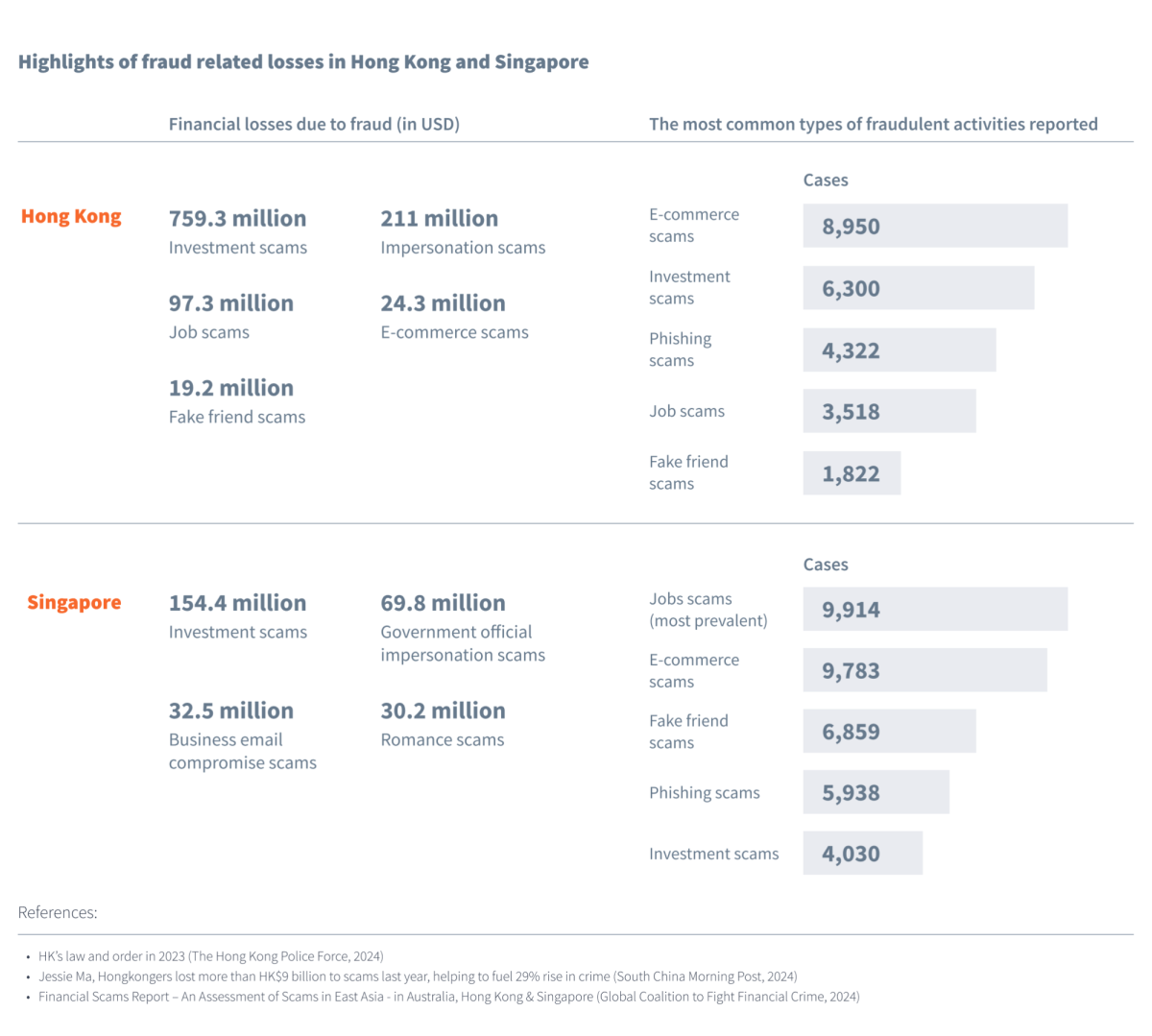

Our findings show that investment scams were the leading cause of financial loss, resulting in combined damages of HKD 5.9 billion (USD 759.3 million).

Other notable fraud types and their corresponding financial losses include:

- Impersonation scams: HKD 1.65 billion (USD 211 MM)

- Job scams: HKD 760 million (USD 97.3 MM)

- E-commerce scams: HKD 190 million (USD 24.3 MM)

- Fake friend scams: HKD 150 million (USD 19.2 MM)

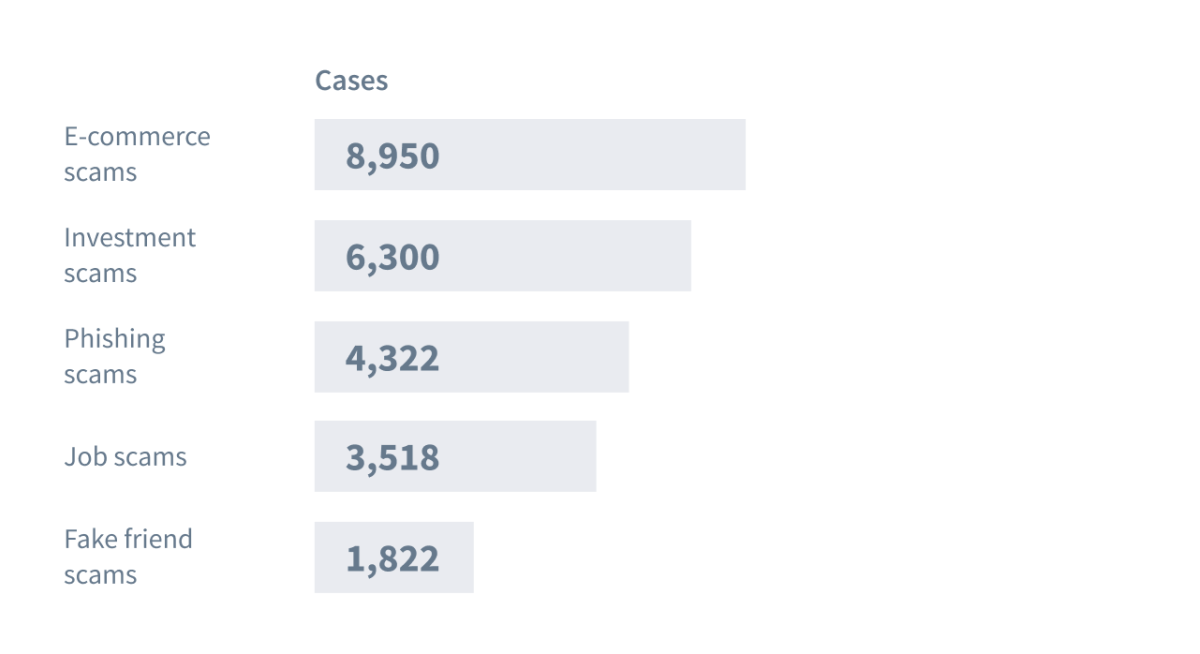

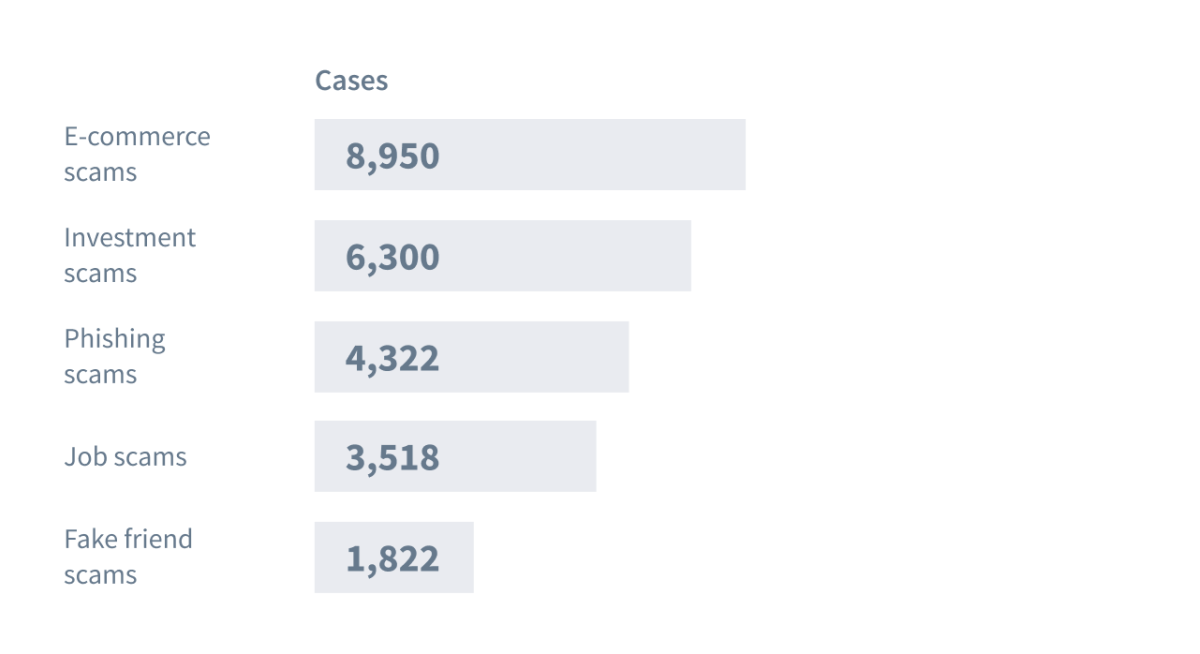

The data also reveals the most common types of fraudulent activities reported in Hong Kong in 2023:

The rise of financial crime in Hong Kong Special Administrative Region (SAR) could be attributed to several factors.

As one of the world's largest international financial centres, Hong Kong SAR has established itself as a magnet for capital and investment from mainland China. This poses a risk of attracting criminal organisations seeking to exploit vulnerabilities in the financial system. Hong Kong SAR is an attractive target for fraudsters due to its high average GDP per capita of USD 69,072, which significantly exceeds the global average of USD 12,647.

The rapid adoption of digital technology has provided scammers with new opportunities to commit crimes online. According to the HKPF, scammers in Hong Kong SAR posed as sellers and posted fake advertisements on various platforms, including Facebook (60%), Carousell (23%), WhatsApp (5%), and Instagram (4%). This has given way to data and security concerns among users.

In 2023, the Office of the Privacy Commissioner for Personal Data (PCPD) received over 150 notifications of data breaches, representing a nearly 50% year-on-year increase from the previous year's total of 105 notifications. The reported incidents included hacking attacks, document loss or misplacement, unintentional disclosures of personal data, and other types of breaches, underscoring the need for heightened vigilance in protecting personal data.

Demographics also play a role in financial fraud in Hong Kong SAR, as scammers often target older people who might be more vulnerable to scams due to their advanced age and life experience. Some victims are reluctant to come forward due to shame or fear of repercussions.

Overview of financial scam in Singapore

A report from the Singapore Police Force (SPF) reveals a slight decrease of 1.3% in fraud-related losses despite an uptick in the number of scam cases.[3] This marks the first decline in scam-related losses in the past five years, although the amount lost remains substantial.

Similarly, Singapore was also impacted by investment scams, which emerged as the most prevalent fraudulent activity, resulting in significant financial losses of SGD 204.5 million.

Other notable fraud types and their respective financial losses include:

- Government official impersonation scams: SGD 92.5 million (USD 69.8 MM)

- Business email compromise scams: SGD 43 million (USD 32.5 MM)

- Romance scams: SGD 40 million (USD 30.2 MM)

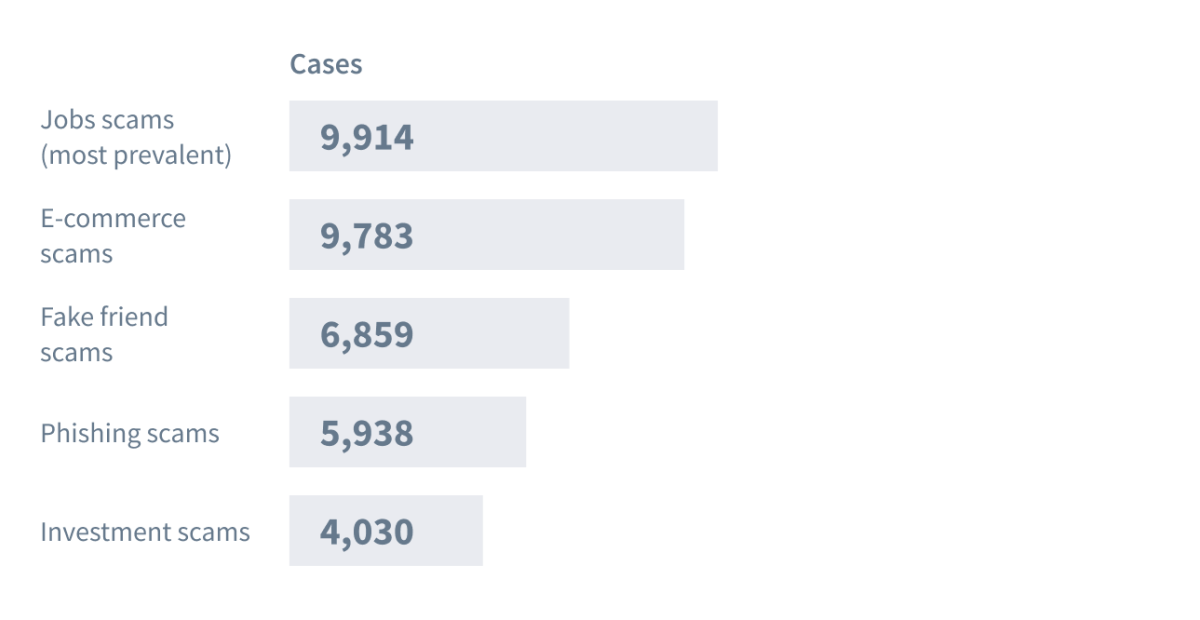

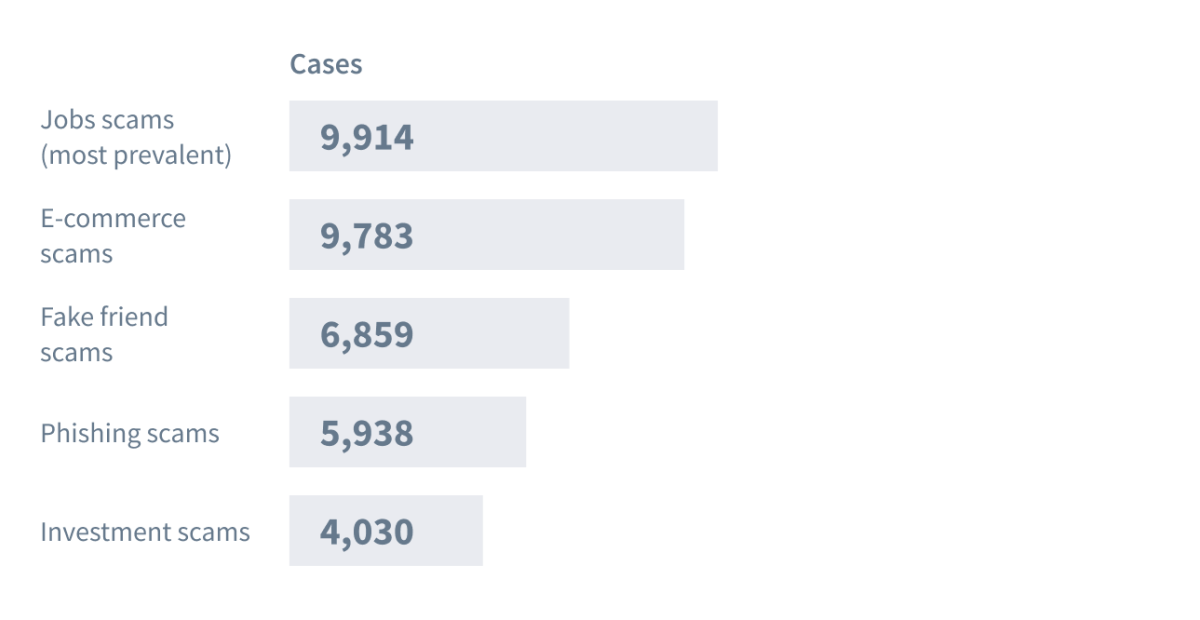

The data also reveals the most common types of fraudulent activities reported in Singapore in 2023:

Despite being one of the safest countries globally with strong financial oversight, Singapore’s wealth and advanced digital infrastructure make it particularly attractive to scammers. With a GDP per capita of SGD 113,779 (about USD 84,500) in 2023, this financial centre is a lucrative target for fraudsters aiming for higher-value victims.

Like Hong Kong, Singapore has witnessed an unprecedented surge in online fraud cases, highlighting the need for effective measures to combat this growing threat According to the SPF Annual Scams Report for 2023, scammers frequently exploited digital enablers and businesses that provide services such as mail, telephone, SMS, online and social media messaging, and e-commerce. Out of a total of 9,783 e-commerce scam cases, the top five digital platforms used were Facebook (46.5%), Carousell (25.3%), Telegram (8%), X/Twitter (3.1%), and WhatsApp (2.5%).

The rising cost of living and the potential for economic downturns have further fueled financial insecurity, creating more opportunities for scammers to exploit fears through job, investment, and e-commerce fraud. Singapore’s diverse cultural and linguistic landscape also adds complexity, allowing fraudsters to tailor their tactics to different communities.

Unlike Hong Kong, which faces the challenge of an aging population, Singapore has a broader demographic profile that includes a range of age groups, including tech-savvy individuals who might fall victim to scams and fraudulent activities.

Hong Kong and Singapore in review

Financial institutions and authorities in both Hong Kong and Singapore have been quick to respond to the growing threat of financial fraud. However, the fight remains a relentless cat-and-mouse game as scammers continuously evolve and refine their tactics. Hong Kong saw a staggering 42.6% increase in fraud-related losses in 2022, amounting to HKD 9 billion, with investment scams leading the way. Meanwhile, Singapore faces similar challenges, with investment scams again being the most prevalent, causing SGD 204.5 million in damages. The rapid adoption of digital technology in both regions has opened new avenues for fraudsters, who frequently exploit online platforms like Facebook, Carousell, and WhatsApp to perpetrate their schemes.

These trends highlight the importance of constant vigilance and innovation in anti-fraud measures. Both developed and emerging markets can learn from Hong Kong and Singapore's experiences by enhancing digital security, educating the public, and adapting swiftly to new threats.

For a deeper discussion on effective strategies to combat financial fraud, please continue reading: Combatting Financial Fraud: Crime Mitigation in Hong Kong and Singapore, and don't hesitate to speak with our experts.

Summary:

- Combating financial fraud is essential for preserving global financial stability.

- The rise in financial crimes in Hong Kong and Singapore is linked to their advanced digital economies and high GDP per capita, making them attractive targets for scammers.

- Investment scams have caused the most significant financial losses in both Hong Kong and Singapore, highlighting the need for robust regulatory frameworks.

- The experiences of Hong Kong and Singapore provide valuable lessons for other markets in enhancing digital security and public awareness to combat financial fraud.

Combating financial fraud is critical for maintaining the integrity and stability of global financial systems. Recently, we have observed an alarming rise in financial crimes in East Asia, particularly in more developed nations. Our findings suggest that these countries are experiencing the highest number of cases and financial losses.

Financial scams come in many forms. The estimated global financial losses from these crimes range from USD 50 billion to USD 177 billion, with a mid-point of USD 114 billion - comparable to the GDP of a small country.

Hong Kong and Singapore, as major financial hubs, are particularly vulnerable due to their high levels of digitalisation, remote banking services, and e-commerce activities. Both jurisdictions face significant challenges in combating the ever-evolving threat landscape of financial fraud.

This article explores the current trends in Hong Kong and SG, identifying the differences and similarities between them to gain more insight into the broader fight against financial crime.

Current trends in global financial fraud

The COVID-19 pandemic has significantly impacted the financial sector, presenting new challenges for both legitimate institutions and scammers. Advances in AI and machine learning have enhanced scammers' tactics, with AI chatbots mimicking real conversations and algorithms identifying vulnerabilities to target individuals more precisely. Consequently, financial institutions and regulators must stay ahead of these evolving scams.

Here are the most prevalent financial scams in 2024, highlighting their diversity and complexity.

Overview of financial scam in Hong Kong

According to the Hong Kong Police (HKPF), Hong Kong citizens suffered estimated losses totaling HKD 9 billion due to fraud in 2022, marking a 42.6% rise from the previous year.[1] Notably, internet-related fraud accounted for approximately 70% of all reported incidents. A total of 9,239 suspects were arrested and held over scams and money laundering offences in the past year.[2]

Our findings show that investment scams were the leading cause of financial loss, resulting in combined damages of HKD 5.9 billion (USD 759.3 million).

Other notable fraud types and their corresponding financial losses include:

- Impersonation scams: HKD 1.65 billion (USD 211 MM)

- Job scams: HKD 760 million (USD 97.3 MM)

- E-commerce scams: HKD 190 million (USD 24.3 MM)

- Fake friend scams: HKD 150 million (USD 19.2 MM)

The data also reveals the most common types of fraudulent activities reported in Hong Kong in 2023:

The rise of financial crime in Hong Kong Special Administrative Region (SAR) could be attributed to several factors.

As one of the world's largest international financial centres, Hong Kong SAR has established itself as a magnet for capital and investment from mainland China. This poses a risk of attracting criminal organisations seeking to exploit vulnerabilities in the financial system. Hong Kong SAR is an attractive target for fraudsters due to its high average GDP per capita of USD 69,072, which significantly exceeds the global average of USD 12,647.

The rapid adoption of digital technology has provided scammers with new opportunities to commit crimes online. According to the HKPF, scammers in Hong Kong SAR posed as sellers and posted fake advertisements on various platforms, including Facebook (60%), Carousell (23%), WhatsApp (5%), and Instagram (4%). This has given way to data and security concerns among users.

In 2023, the Office of the Privacy Commissioner for Personal Data (PCPD) received over 150 notifications of data breaches, representing a nearly 50% year-on-year increase from the previous year's total of 105 notifications. The reported incidents included hacking attacks, document loss or misplacement, unintentional disclosures of personal data, and other types of breaches, underscoring the need for heightened vigilance in protecting personal data.

Demographics also play a role in financial fraud in Hong Kong SAR, as scammers often target older people who might be more vulnerable to scams due to their advanced age and life experience. Some victims are reluctant to come forward due to shame or fear of repercussions.

Overview of financial scam in Singapore

A report from the Singapore Police Force (SPF) reveals a slight decrease of 1.3% in fraud-related losses despite an uptick in the number of scam cases.[3] This marks the first decline in scam-related losses in the past five years, although the amount lost remains substantial.

Similarly, Singapore was also impacted by investment scams, which emerged as the most prevalent fraudulent activity, resulting in significant financial losses of SGD 204.5 million.

Other notable fraud types and their respective financial losses include:

- Government official impersonation scams: SGD 92.5 million (USD 69.8 MM)

- Business email compromise scams: SGD 43 million (USD 32.5 MM)

- Romance scams: SGD 40 million (USD 30.2 MM)

The data also reveals the most common types of fraudulent activities reported in Singapore in 2023:

Despite being one of the safest countries globally with strong financial oversight, Singapore’s wealth and advanced digital infrastructure make it particularly attractive to scammers. With a GDP per capita of SGD 113,779 (about USD 84,500) in 2023, this financial centre is a lucrative target for fraudsters aiming for higher-value victims.

Like Hong Kong, Singapore has witnessed an unprecedented surge in online fraud cases, highlighting the need for effective measures to combat this growing threat According to the SPF Annual Scams Report for 2023, scammers frequently exploited digital enablers and businesses that provide services such as mail, telephone, SMS, online and social media messaging, and e-commerce. Out of a total of 9,783 e-commerce scam cases, the top five digital platforms used were Facebook (46.5%), Carousell (25.3%), Telegram (8%), X/Twitter (3.1%), and WhatsApp (2.5%).

The rising cost of living and the potential for economic downturns have further fueled financial insecurity, creating more opportunities for scammers to exploit fears through job, investment, and e-commerce fraud. Singapore’s diverse cultural and linguistic landscape also adds complexity, allowing fraudsters to tailor their tactics to different communities.

Unlike Hong Kong, which faces the challenge of an aging population, Singapore has a broader demographic profile that includes a range of age groups, including tech-savvy individuals who might fall victim to scams and fraudulent activities.

Hong Kong and Singapore in review

Financial institutions and authorities in both Hong Kong and Singapore have been quick to respond to the growing threat of financial fraud. However, the fight remains a relentless cat-and-mouse game as scammers continuously evolve and refine their tactics. Hong Kong saw a staggering 42.6% increase in fraud-related losses in 2022, amounting to HKD 9 billion, with investment scams leading the way. Meanwhile, Singapore faces similar challenges, with investment scams again being the most prevalent, causing SGD 204.5 million in damages. The rapid adoption of digital technology in both regions has opened new avenues for fraudsters, who frequently exploit online platforms like Facebook, Carousell, and WhatsApp to perpetrate their schemes.

These trends highlight the importance of constant vigilance and innovation in anti-fraud measures. Both developed and emerging markets can learn from Hong Kong and Singapore's experiences by enhancing digital security, educating the public, and adapting swiftly to new threats.

For a deeper discussion on effective strategies to combat financial fraud, please continue reading: Combatting Financial Fraud: Crime Mitigation in Hong Kong and Singapore, and don't hesitate to speak with our experts.