Loading Insight...

Insights

Insights

Summary:

- Private banks embracing AI, cloud, and automation gain a competitive edge, while legacy institutions risk falling behind.

- e-KYC, biometric verification, and automation streamline client onboarding, reducing delays and enhancing satisfaction.

- Advanced analytics refine client profiling, enabling wealth managers to offer hyper-personalised investment recommendations.

- Real-time research tools provide dynamic insights, replacing outdated, manual data collection methods.

- Scalable digital platforms enhance investment simulations, risk management, and portfolio customisation.

Why some private banks are pulling ahead

Digital transformation in private banking continues to accelerate, creating a clear divide between financial institutions (FIs) embracing innovation and those relying on legacy systems. The limitations of core banking systems pose a significant challenge, with 55% identifying it as the top barrier to achieving their business goals. This constraint explains why 93% of decision-makers believe their firms’ future success depends on choosing the right core banking solution.1

For investment advisory, these system limitations result in inconsistent client data, outdated portfolio views, and a slower, less personalised advisory experience. Addressing these gaps is critical for FIs to offer more precise, client-centric advisory services that meet the demands of a digital-first client base.

Consequently, digital-first firms are setting new standards, gaining a competitive edge through client acquisition and assets under management (AUM) growth. Globally, FIs integrating AI, cloud computing, and automation are reshaping wealth management, offering insights into the future of private banking in APAC.

A recent Synpulse8 article highlighted the urgency to modernise technology stacks for the next generation of financial services. Rising complexity, stricter security and compliance, demand for real-time capabilities, and seamless customer experiences are all reshaping investment advisory. Technology-led wealth firms are outpacing their traditional counterparts, particularly in APAC, where digital adoption drives growth. DBS Bank, for instance, has emerged as a tech leader, leveraging digital platforms to enhance customer experience and efficiency.2

With APAC holding 30% of global high-net-worth financial wealth,3 private banks must accelerate digital adoption to remain competitive. According to a London Stock Exchange Group study, 68% of investors expect digital experiences from wealth managers to match those of top technology firms, reinforcing the need for omnichannel capabilities.4 To seize future opportunities, banks must assess their advisory maturity and refine their operating models.

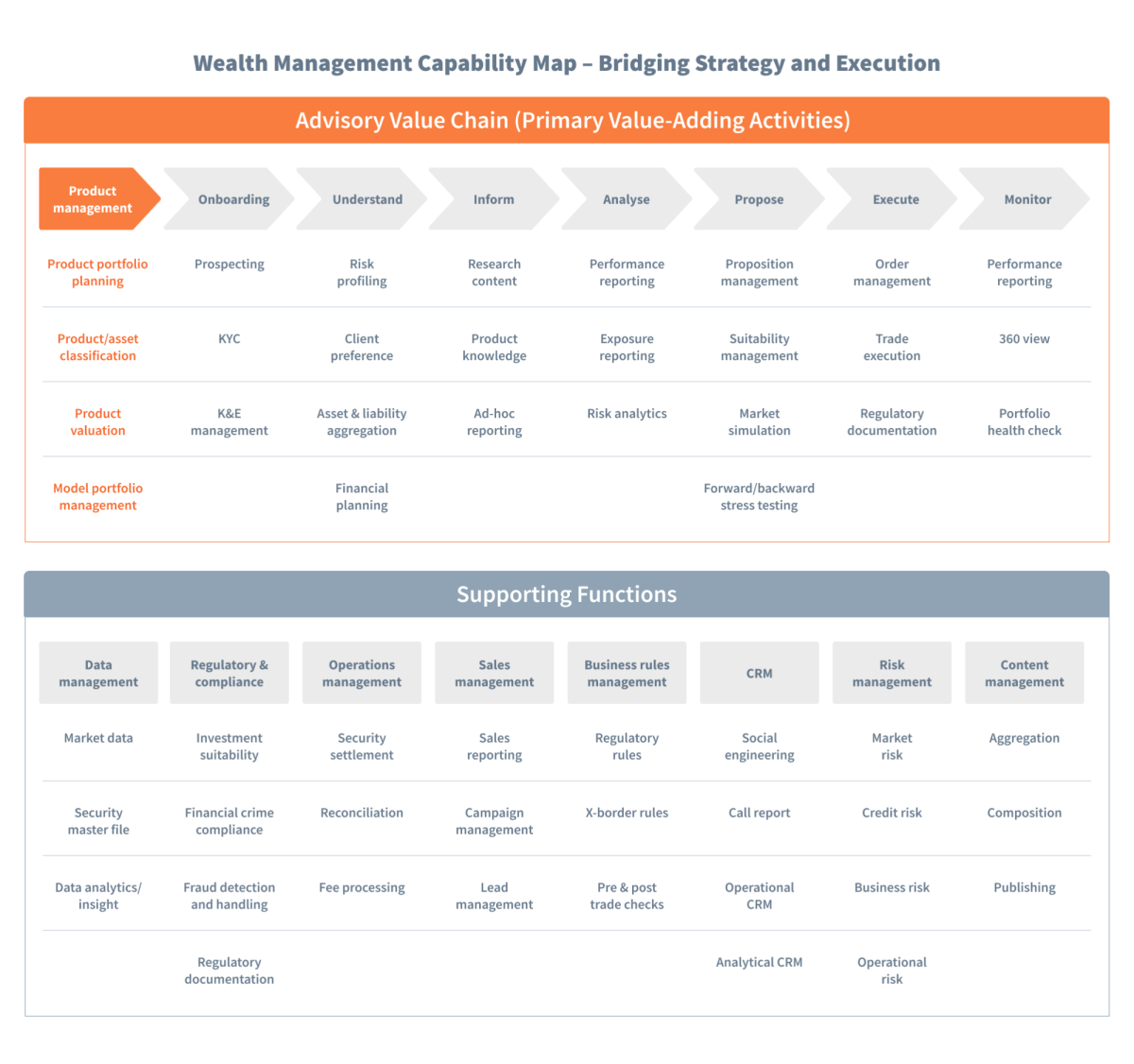

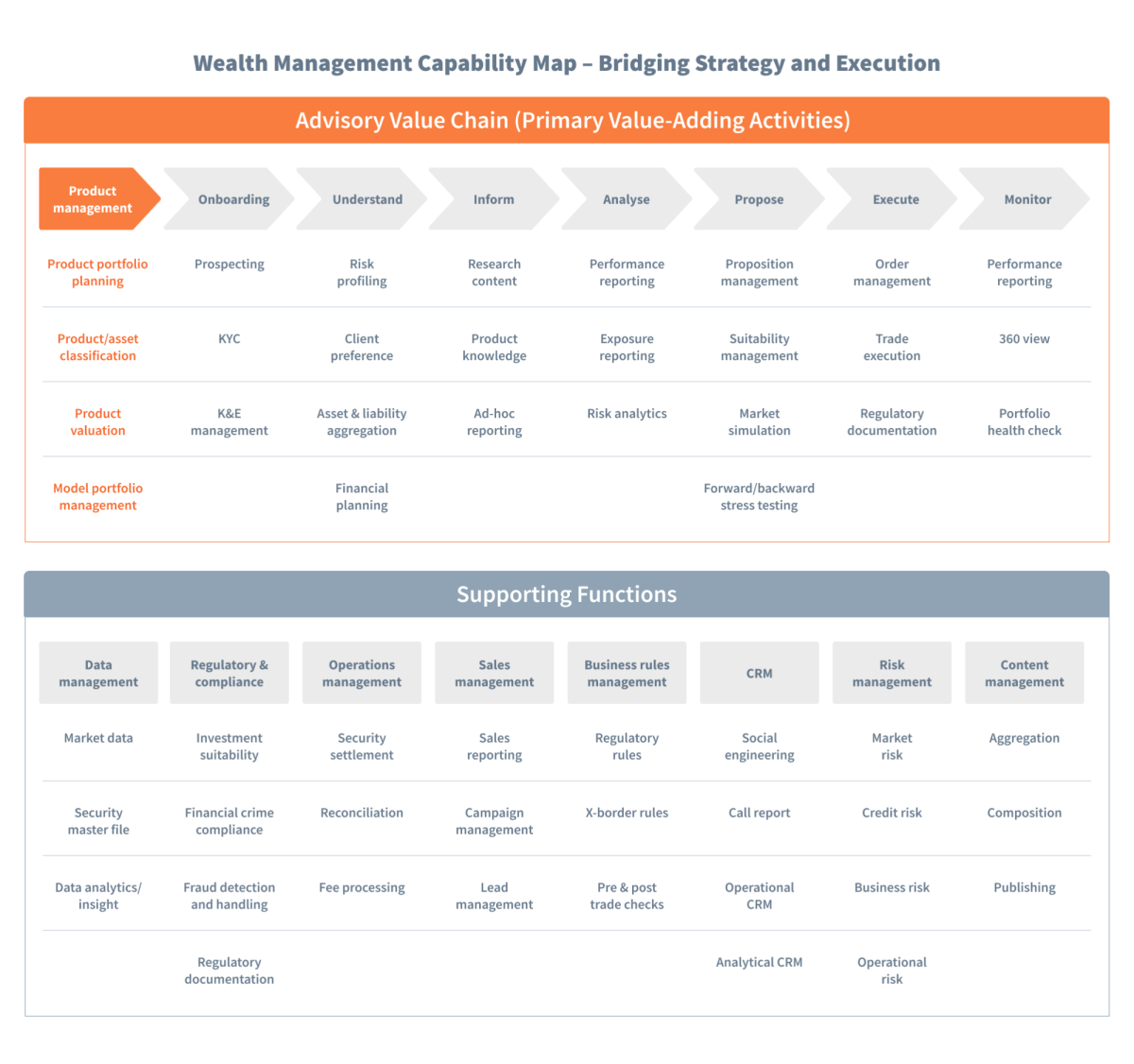

Figure 1. The advisory value chain

Revolutionising client onboarding with AI and automation

Traditional client onboarding processes are slow, manual, and filled with compliance bottlenecks. Clients expect seamless digital experiences, yet many banks still rely on fragmented data collection and labour-intensive documentation. These are just a few areas where we are seeing AI-driven transformation across the value chain. AI is already streamlining onboarding, but its impact extends across the entire advisory value chain, from client profiling to portfolio management.

- e-KYC and biometric verification: Faster identity verification and compliance checks.

- Automated due diligence: AI-driven processes reduce manual workload and errors.

- **Straight-**through processing (STP): Enables near-instant account openings.

Major FIs are already seeing massive efficiency gains. A Swiss private bank reduced onboarding time from seven days to just six hours by integrating AI-powered, no-code process automation.5 APAC banks must follow suit to enhance client satisfaction and scale operations.

Utilising AI-driven insights to better understand clients

Traditional client discovery methods rely on standardised risk assessments that often overlook individual preferences, behaviours, and evolving financial goals. Static questionnaires and manual data entry create inefficiencies, limiting advisors' ability to provide truly tailored recommendations.

AI-driven client profiling is transforming this process by offering wealth managers deeper insights and refining investment recommendations. Studies show that 65% of high-net-worth individuals (HNWIs) acknowledge biases in their decision-making, underscoring the demand for AI-enhanced insights.6 By leveraging advanced analytics, FIs can significantly improve profiling accuracy, streamline advisory, and enhance client satisfaction.

Leading firms are already implementing these innovations. J.P. Morgan utilises AI to optimise model development and compliance while Deutsche Bank employs algorithms to personalise investment recommendations.7 Meanwhile, cloud-based CRM systems further enable seamless data synchronisation across advisory teams, ensuring more cohesive and personalised client experiences.

As predictive analytics and real-time behavioural analysis redefine client segmentation, APAC institutions must embrace these trends to remain competitive.

Delivering personalised investment insights in real time

Legacy banks rely on periodic market reports and manual data collection, often leading to outdated insights and slow responses to market shifts. In contrast, progressive institutions are adopting AI-driven research tools and cloud-based analytics to deliver real-time, personalised market intelligence.

The ability to rapidly analyse and distribute tailored investment insights is becoming a key differentiator in wealth management. AI-powered research tools enable private banks to curate and share market intelligence more efficiently, ensuring timely and targeted client engagement.

Top firms are already leveraging AI for research distribution. Morgan Stanley, for example, has integrated OpenAI’s technology to process vast internal intellectual capital, providing advisors with deep insights across asset classes and global markets.8 Meanwhile, cloud-based platforms are enhancing real-time data aggregation, allowing wealth managers to incorporate alternative data sources, such as satellite imagery, consumer transaction data, and social sentiment analysis, to refine investment strategies.

As APAC FIs enhance their digital strategies, integrating AI into research functions will be critical for maintaining competitiveness and meeting evolving client expectations.

Managing client portfolios with cloud-based technologies

Outdated portfolio management systems rely on rigid, one-size-fits-all templates that limit personalisation and client engagement. In contrast, forward-thinking banks are adopting dynamic portfolio-building tools that enable real-time investment simulations, fostering greater collaboration between advisors and clients.

Customisable digital platforms are now the norm, allowing advisors to construct, test, and optimise model portfolios instantly. Global institutions are setting new standards by integrating risk-adjusted return optimisation and scenario analysis. For instance, Siam Commercial Bank has embraced cloud and data-driven strategies to enhance portfolio management and advisory services.9

However, challenges remain. A 2024 study on AI-driven risk management highlights the benefits of AI in improving risk assessments and decision-making while acknowledging hurdles such as data quality, model interpretability, and regulatory constraints.10

Cloud-based portfolio management systems offer scalability, ensuring consistent service across markets. To stay competitive, APAC private banks must invest in digital solutions that integrate AI and cloud efficiencies, enhancing both personalisation and operational agility.

Future-proofing investment advisory with the right partner

The private banking sector in APAC is at a turning point; digital transformation is no longer optional but essential for sustained growth. Institutions adopting AI for advisory, execution, and real-time monitoring are already seeing gains in client engagement and investment performance. Meanwhile, the gap between traditional and technology-driven private banks continues to widen, increasing pressure on those slow to modernise.

To remain competitive, APAC financial institutions must:

- Conduct a comprehensive assessment of current digital advisory capabilities.

- Strategically integrate AI-powered investment solutions across the value chain.

- Redefine the target operating model to support greater agility and personalisation.

While the path to transformation may seem complex, partnering with experienced advisors can help navigate the challenges. Synpulse specialises in guiding private banks through this journey with customised solutions that enhance client experiences while optimising operational efficiency.

Summary:

- Private banks embracing AI, cloud, and automation gain a competitive edge, while legacy institutions risk falling behind.

- e-KYC, biometric verification, and automation streamline client onboarding, reducing delays and enhancing satisfaction.

- Advanced analytics refine client profiling, enabling wealth managers to offer hyper-personalised investment recommendations.

- Real-time research tools provide dynamic insights, replacing outdated, manual data collection methods.

- Scalable digital platforms enhance investment simulations, risk management, and portfolio customisation.

Why some private banks are pulling ahead

Digital transformation in private banking continues to accelerate, creating a clear divide between financial institutions (FIs) embracing innovation and those relying on legacy systems. The limitations of core banking systems pose a significant challenge, with 55% identifying it as the top barrier to achieving their business goals. This constraint explains why 93% of decision-makers believe their firms’ future success depends on choosing the right core banking solution.1

For investment advisory, these system limitations result in inconsistent client data, outdated portfolio views, and a slower, less personalised advisory experience. Addressing these gaps is critical for FIs to offer more precise, client-centric advisory services that meet the demands of a digital-first client base.

Consequently, digital-first firms are setting new standards, gaining a competitive edge through client acquisition and assets under management (AUM) growth. Globally, FIs integrating AI, cloud computing, and automation are reshaping wealth management, offering insights into the future of private banking in APAC.

A recent Synpulse8 article highlighted the urgency to modernise technology stacks for the next generation of financial services. Rising complexity, stricter security and compliance, demand for real-time capabilities, and seamless customer experiences are all reshaping investment advisory. Technology-led wealth firms are outpacing their traditional counterparts, particularly in APAC, where digital adoption drives growth. DBS Bank, for instance, has emerged as a tech leader, leveraging digital platforms to enhance customer experience and efficiency.2

With APAC holding 30% of global high-net-worth financial wealth,3 private banks must accelerate digital adoption to remain competitive. According to a London Stock Exchange Group study, 68% of investors expect digital experiences from wealth managers to match those of top technology firms, reinforcing the need for omnichannel capabilities.4 To seize future opportunities, banks must assess their advisory maturity and refine their operating models.

Figure 1. The advisory value chain

Revolutionising client onboarding with AI and automation

Traditional client onboarding processes are slow, manual, and filled with compliance bottlenecks. Clients expect seamless digital experiences, yet many banks still rely on fragmented data collection and labour-intensive documentation. These are just a few areas where we are seeing AI-driven transformation across the value chain. AI is already streamlining onboarding, but its impact extends across the entire advisory value chain, from client profiling to portfolio management.

- e-KYC and biometric verification: Faster identity verification and compliance checks.

- Automated due diligence: AI-driven processes reduce manual workload and errors.

- **Straight-**through processing (STP): Enables near-instant account openings.

Major FIs are already seeing massive efficiency gains. A Swiss private bank reduced onboarding time from seven days to just six hours by integrating AI-powered, no-code process automation.5 APAC banks must follow suit to enhance client satisfaction and scale operations.

Utilising AI-driven insights to better understand clients

Traditional client discovery methods rely on standardised risk assessments that often overlook individual preferences, behaviours, and evolving financial goals. Static questionnaires and manual data entry create inefficiencies, limiting advisors' ability to provide truly tailored recommendations.

AI-driven client profiling is transforming this process by offering wealth managers deeper insights and refining investment recommendations. Studies show that 65% of high-net-worth individuals (HNWIs) acknowledge biases in their decision-making, underscoring the demand for AI-enhanced insights.6 By leveraging advanced analytics, FIs can significantly improve profiling accuracy, streamline advisory, and enhance client satisfaction.

Leading firms are already implementing these innovations. J.P. Morgan utilises AI to optimise model development and compliance while Deutsche Bank employs algorithms to personalise investment recommendations.7 Meanwhile, cloud-based CRM systems further enable seamless data synchronisation across advisory teams, ensuring more cohesive and personalised client experiences.

As predictive analytics and real-time behavioural analysis redefine client segmentation, APAC institutions must embrace these trends to remain competitive.

Delivering personalised investment insights in real time

Legacy banks rely on periodic market reports and manual data collection, often leading to outdated insights and slow responses to market shifts. In contrast, progressive institutions are adopting AI-driven research tools and cloud-based analytics to deliver real-time, personalised market intelligence.

The ability to rapidly analyse and distribute tailored investment insights is becoming a key differentiator in wealth management. AI-powered research tools enable private banks to curate and share market intelligence more efficiently, ensuring timely and targeted client engagement.

Top firms are already leveraging AI for research distribution. Morgan Stanley, for example, has integrated OpenAI’s technology to process vast internal intellectual capital, providing advisors with deep insights across asset classes and global markets.8 Meanwhile, cloud-based platforms are enhancing real-time data aggregation, allowing wealth managers to incorporate alternative data sources, such as satellite imagery, consumer transaction data, and social sentiment analysis, to refine investment strategies.

As APAC FIs enhance their digital strategies, integrating AI into research functions will be critical for maintaining competitiveness and meeting evolving client expectations.

Managing client portfolios with cloud-based technologies

Outdated portfolio management systems rely on rigid, one-size-fits-all templates that limit personalisation and client engagement. In contrast, forward-thinking banks are adopting dynamic portfolio-building tools that enable real-time investment simulations, fostering greater collaboration between advisors and clients.

Customisable digital platforms are now the norm, allowing advisors to construct, test, and optimise model portfolios instantly. Global institutions are setting new standards by integrating risk-adjusted return optimisation and scenario analysis. For instance, Siam Commercial Bank has embraced cloud and data-driven strategies to enhance portfolio management and advisory services.9

However, challenges remain. A 2024 study on AI-driven risk management highlights the benefits of AI in improving risk assessments and decision-making while acknowledging hurdles such as data quality, model interpretability, and regulatory constraints.10

Cloud-based portfolio management systems offer scalability, ensuring consistent service across markets. To stay competitive, APAC private banks must invest in digital solutions that integrate AI and cloud efficiencies, enhancing both personalisation and operational agility.

Future-proofing investment advisory with the right partner

The private banking sector in APAC is at a turning point; digital transformation is no longer optional but essential for sustained growth. Institutions adopting AI for advisory, execution, and real-time monitoring are already seeing gains in client engagement and investment performance. Meanwhile, the gap between traditional and technology-driven private banks continues to widen, increasing pressure on those slow to modernise.

To remain competitive, APAC financial institutions must:

- Conduct a comprehensive assessment of current digital advisory capabilities.

- Strategically integrate AI-powered investment solutions across the value chain.

- Redefine the target operating model to support greater agility and personalisation.

While the path to transformation may seem complex, partnering with experienced advisors can help navigate the challenges. Synpulse specialises in guiding private banks through this journey with customised solutions that enhance client experiences while optimising operational efficiency.