Loading Insight...

Insights

Insights

The COVID-19 pandemic has accelerated the shift from physical to digital, with businesses, including the banking industry, considering digital-first solutions to better serve their customers.

In recent years, numerous factors have increased the need for businesses to move from physical to digital. The COVID-19 pandemic has further accelerated this development, with corporations looking to digital-first solutions, as face-to-face interaction became more and more difficult. This trend can also be observed in the banking industry.

Here, the figures indicate the growing use of digital channels and a surge in the use of mobile banking over the past year.

- In 2021, digital banking adoption in Asia-Pacific (APAC) is 88%, up from 65% in 2017.

- 80% of APAC consumers expect to maintain or increase their use of mobile and online channels, post-COVID-19.

- 42% of respondents in a recent survey anticipate visiting their bank branch either less, or not at all, when the pandemic ends.1

The perfect storm

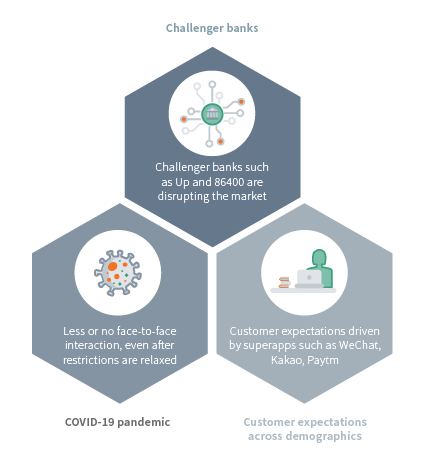

A user-first digital platform has become a hygiene factor as opposed to a pure differentiator. Why? As shown in Figure 1, the market and customer forces have combined to create a perfect storm.

Thanks to innovative solutions offered by tech companies, FinTechs, and challenger banks, digital interactions have already become the default communication method for many people. While some research has shown that the human interaction element is still prevalent in banking – and indeed key in some interactions – due to an aging population and large swaths of rural areas with limited internet access, we see that the younger generations have started to expect "digital only". In fact, 20% of digital banks globally were located in the Asia-Pacific (APAC) region.2

This trend has been accelerated by the lockdown during the pandemic, which forced all banking customers to use digital channels to varying degrees of success. Therefore, the dilemma lies in meeting the varying needs of customers in the present, whilst preparing for a future bank that will primarily consist of digital customer engagements.

The perfect storm created by the three forces – the challenger banks, the COVID-19 pandemic, and the customer expectations across demographics – requires expert navigation. Through our combined extensive experience in the market, Synpulse and Backbase are ideally positioned to provide this expertise and help banks to respond to these three forces and accelerate their digital transformation.

The basis of the solution is an engagement banking platform (EBP). Let us first look at the strategic preconditions you should keep in mind to make your digital transformation a successful one.

Figure 1. The three forces creating a perfect storm in banking today

Why are banks failing to provide satisfying client experiences?

The “perfect storm” is rapidly forcing banks to deliver a compelling digital proposition to remain relevant. For most banks, simply focusing on the client-facing user experience (UX) design will not be enough. It will fail to address the combined threats of challenger banks, changing demographics and customer expectations, and lasting changes resulting from the COVID-19 pandemic and the Royal Commission on Banking before that.

One of the reasons traditional banks struggle to respond is a lack of a unified technology platform that can truly help them engage their customers. Banks traditionally operate in siloed channels: web, mobile, and branches. This leads to duplicated effort and technology, where end-customers experience friction because the information is not shared across channels. In line with this siloed approach, many banks rely on their technology departments to simply make changes to legacy systems in response to market changes.

Finding the right solution

Banks need to think holistically and take ownership of the full customer experience from beginning to end. They need to move away from siloed legacy systems to a single unified platform based on modern architecture. This unified platform approach enables banks to aggregate value from core systems, open banking APIs, and FinTechs, as well as orchestrate the end-customer experience, empowering both the bank’s employees and its clients. We call this an engagement banking platform - or EBP.

An EBP enables a truly engaging customer experience, at any touchpoint. It reconnects customers with their banks by making employees an essential part of the equation. It also creates a unified ecosystem that focuses on unique value creation, not the maintenance of siloed solutions or layered offerings.

Head on to our next article to learn more about engagement banking.

The COVID-19 pandemic has accelerated the shift from physical to digital, with businesses, including the banking industry, considering digital-first solutions to better serve their customers.

In recent years, numerous factors have increased the need for businesses to move from physical to digital. The COVID-19 pandemic has further accelerated this development, with corporations looking to digital-first solutions, as face-to-face interaction became more and more difficult. This trend can also be observed in the banking industry.

Here, the figures indicate the growing use of digital channels and a surge in the use of mobile banking over the past year.

- In 2021, digital banking adoption in Asia-Pacific (APAC) is 88%, up from 65% in 2017.

- 80% of APAC consumers expect to maintain or increase their use of mobile and online channels, post-COVID-19.

- 42% of respondents in a recent survey anticipate visiting their bank branch either less, or not at all, when the pandemic ends.1

The perfect storm

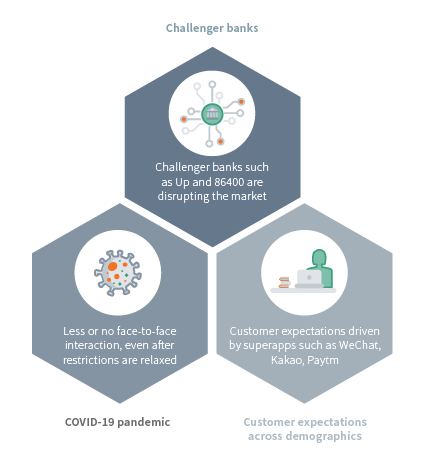

A user-first digital platform has become a hygiene factor as opposed to a pure differentiator. Why? As shown in Figure 1, the market and customer forces have combined to create a perfect storm.

Thanks to innovative solutions offered by tech companies, FinTechs, and challenger banks, digital interactions have already become the default communication method for many people. While some research has shown that the human interaction element is still prevalent in banking – and indeed key in some interactions – due to an aging population and large swaths of rural areas with limited internet access, we see that the younger generations have started to expect "digital only". In fact, 20% of digital banks globally were located in the Asia-Pacific (APAC) region.2

This trend has been accelerated by the lockdown during the pandemic, which forced all banking customers to use digital channels to varying degrees of success. Therefore, the dilemma lies in meeting the varying needs of customers in the present, whilst preparing for a future bank that will primarily consist of digital customer engagements.

The perfect storm created by the three forces – the challenger banks, the COVID-19 pandemic, and the customer expectations across demographics – requires expert navigation. Through our combined extensive experience in the market, Synpulse and Backbase are ideally positioned to provide this expertise and help banks to respond to these three forces and accelerate their digital transformation.

The basis of the solution is an engagement banking platform (EBP). Let us first look at the strategic preconditions you should keep in mind to make your digital transformation a successful one.

Figure 1. The three forces creating a perfect storm in banking today

Why are banks failing to provide satisfying client experiences?

The “perfect storm” is rapidly forcing banks to deliver a compelling digital proposition to remain relevant. For most banks, simply focusing on the client-facing user experience (UX) design will not be enough. It will fail to address the combined threats of challenger banks, changing demographics and customer expectations, and lasting changes resulting from the COVID-19 pandemic and the Royal Commission on Banking before that.

One of the reasons traditional banks struggle to respond is a lack of a unified technology platform that can truly help them engage their customers. Banks traditionally operate in siloed channels: web, mobile, and branches. This leads to duplicated effort and technology, where end-customers experience friction because the information is not shared across channels. In line with this siloed approach, many banks rely on their technology departments to simply make changes to legacy systems in response to market changes.

Finding the right solution

Banks need to think holistically and take ownership of the full customer experience from beginning to end. They need to move away from siloed legacy systems to a single unified platform based on modern architecture. This unified platform approach enables banks to aggregate value from core systems, open banking APIs, and FinTechs, as well as orchestrate the end-customer experience, empowering both the bank’s employees and its clients. We call this an engagement banking platform - or EBP.

An EBP enables a truly engaging customer experience, at any touchpoint. It reconnects customers with their banks by making employees an essential part of the equation. It also creates a unified ecosystem that focuses on unique value creation, not the maintenance of siloed solutions or layered offerings.

Head on to our next article to learn more about engagement banking.