Embedded life insurance can significantly expand retail protection footprints, opening new channels and tapping previously inaccessible customers by seamlessly integrating coverage into primary products and services. Digital ecosystems, APIs, and automation remove barriers to access, making life insurance both more intuitive and more relevant to consumers. Fully realising its potential, however, requires insurers to adapt to new distribution models, rethink the value chain and embrace technology-driven solutions, which Synpulse can help you overcome.

Why embedded life insurance?

Though embedded insurance (EI) has revolutionised protection product distribution, it has primarily been in property and casualty (P&C) insurance. Embedded solutions in other product segments have lagged P&C in terms of market growth, but unique use cases are now emerging, showing the potential for embedded life to address critical protection gaps when adapted to specific consumer needs.

One key driver of this shift is the high global mortality protection gap. Studies forecast the aggregated mortality protection gap to reach USD 119 trillion by 2030 in Asia-Pacific (APAC) alone¹, with similar gaps projected in North America and Europe. Many remain un(der)insured, leaving families financially vulnerable in the event of unexpected death while stressing overburdened public sectors. Traditional life distribution struggles to close this gap due to several factors, such as complex sales processes, lengthy underwriting, restrictive payment structures and limited access to certain customer segments. These challenges can be addressed through embedded life products.

Another key driver of this shift is growing demand for integrated insurance solutions. The rapid expansion of non-traditional employment models, such as freelancing and gig work, means many workers have no access to employer-sponsored life insurance. Embedded life insurance seamlessly provides financial protection through platforms they already use, such as payroll services, digital banking, gig worker or ride-hailing apps

Next, shifts in consumer expectations are feeding demand for embedded life insurance. Digital-native consumers expect convenience, speed, and personalisation in their financial products which truly embedded life can offer, leveraging real-time data, automation, and contextual offerings to deliver instant-issue policies, often within digital ecosystems and platforms that can also support policy management and claims handling use cases.

Finally, regulatory and technological advancements such as open finance, digital identity verification, and API-driven ecosystems are enabling insurers to offer embedded life insurance at scale, integrated into financial services, retail, and employer benefit platforms.

Embedded life represents such a significant opportunity precisely because it can address all of these shifts, helping insurers and ecosystem partners close real protection gaps for their customers while simultaneously expanding their customer base and creating new revenue streams.

Relevant embedded life use cases

Embedded life’s greatest relevance is when coverage is brought directly into appropriate consumer-facing platforms and services, bringing financial protection into consumers' daily lives. Instead of relying on traditional sales channels, such as agents or standalone policy purchases, life insurance is embedded into familiar ecosystems like banking apps, payroll services, or e-commerce platforms, or gig worker platforms solving a felt customer need.

One example of this is the SNACK by Income financial lifestyle app in Singapore. SNACK has aggressively pursued a number of channels for product distribution, directly selling digital coverage in its own channel, partnering with fast-moving consumer goods (FMCG) businesses to offer embedded and point-of-sale coverages and targeting gig economy workers with bite-sized or right-sized coverage through ecosystem providers like the super-app Grab. These use cases highlight the flexibility embedded life insurance provides, targeting buyers with variable income, such as gig economy workers.

The product’s success derives from evolved consumer expectations, addressing their growing demands for convenience, relevance, and accessibility. They require simple, on-demand financial solutions with premium structures tailored to their income patterns that fit seamlessly into their routines. Embedded life insurance meets this brief by reducing complexity, enabling instant coverage with minimal effort, and integrating protection naturally into everyday digital experiences.

Impacts and opportunities for life insurers

Embedded life insurance also represents a shift in the distribution models for life insurance products. Consumers perception is that traditional life insurance sales are complex and time-consuming, generating consumer friction. By providing life insurance with transparent, relevant offerings within consumer-trusted channels and platforms this friction is reduced, presenting an opportunity for risk carriers to meet this demand with instant-issue policies built into everyday digital interactions.

This shift is not only a new distribution model for life insurance products; it represents an opportunity to open fresh revenue streams from previously inaccessible consumers, gather new insights from new partners and their data sources, and take a leading role in increasingly API-driven financial ecosystems. If they choose to, insurers can position themselves at the forefront of digital transformation by embracing embedded life insurance while offering customers a more intuitive way to access life protection.

To use a personal example, on a recent holiday with my in-laws, we went quad biking in Bali. Being over 70, they both had concerns and insisted that whomever we booked insurance be included in the activity as it was not covered by their travel insurance. As we booked the activity, the organising company asked our age, and then indicated that death and disability protection was provided for the activity’s risks. With only a single data point, we gained coverage without additional paperwork or lengthy decision-making. This real, recent example showed insurance being the differentiator of a primary service, illustrating how embedded life insurance can effortlessly integrate into customer journeys through third-party platforms.

Furthermore, the insurance industry is becoming more modular and API-driven, allowing insurers to embed appropriately constructed life products directly into third-party platforms without requiring full-stack integration. This lowers entry barriers and accelerates adoption and is relatively common, with many life insurers incentivising healthy lifestyle activities through premium discounts based on wearable or wellness app integrations, fitness membership usage, and other wellbeing initiatives.

How to develop embedded life insurance products

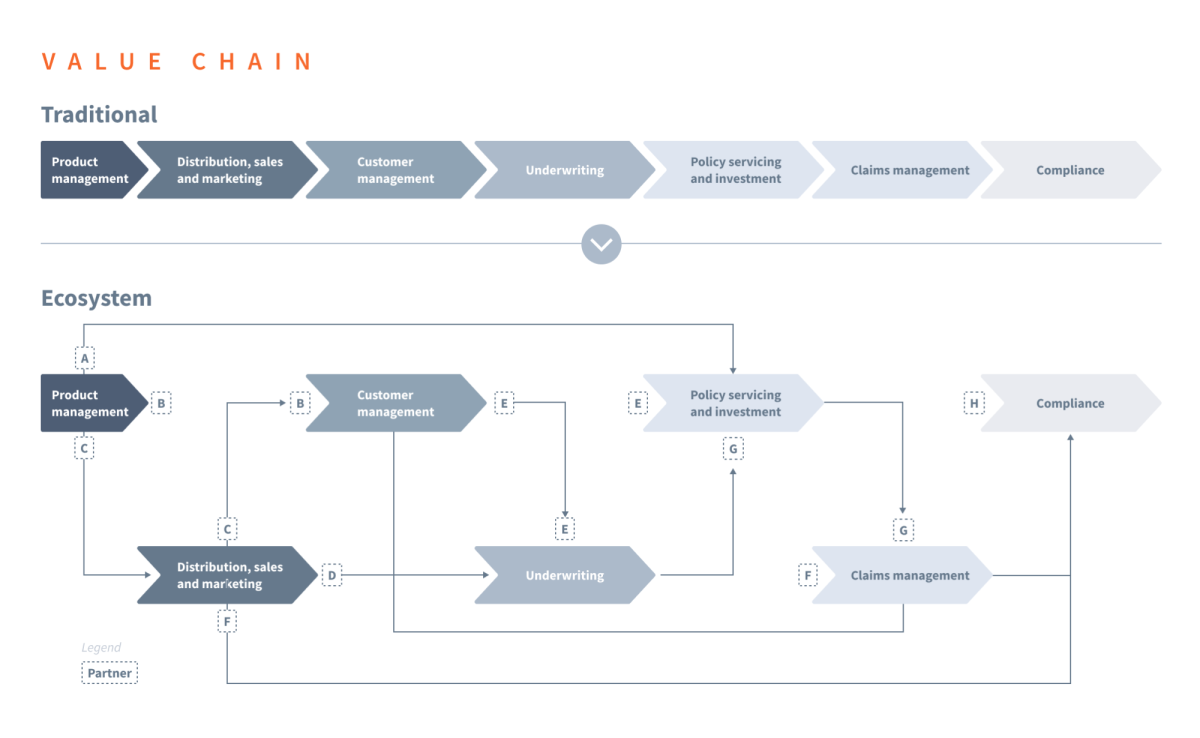

Developing embedded life insurance products requires a fundamental shift from the traditional policy value chain to digitally native, customer-centric solutions. Unlike conventional life insurance, which often involves lengthy applications, underwriting processes, and agent-driven sales, embedded life insurance must be simple, flexible, and instantly accessible. Products must be designed to enable automated underwriting, instant issuance, and frictionless integration into partner platforms.

Modular coverage options can open new customer segments, having specific benefits tailored to gig workers, young professionals, or busy families. Products can be designed with dynamic pricing, utilising real-time data inputs to leverage financial, behavioural, or health insights, from wearables or fitness activity, to further personalise coverage.

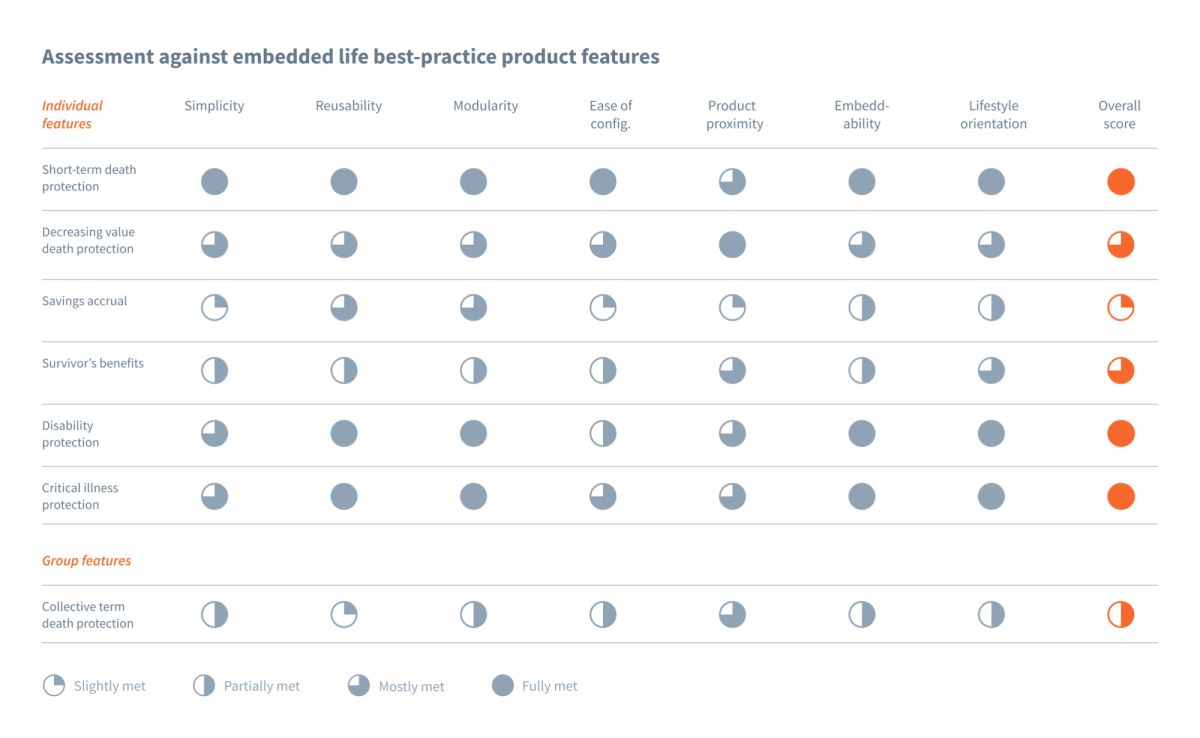

Synpulse’s proprietary product assessment and coverage selection framework help insurers evaluate these factors strategically, ensuring embedded offerings are relevant, scalable, and profitable.

Conclusion and outlook

To fully capitalise on the embedded life opportunity, insurers need a partner with experience adapting products to digital-first distribution models. The insurance value chain must be reconsidered to effectively benefit from embedded life offerings, as value shifts from traditional agent-led distribution towards integrated, partnership-driven ecosystems. Proactively investing in embedded capabilities and forging strategic partnerships will best position you to capture market share and drive innovation.

At Synpulse, we bring the expertise you need to thrive in the evolving embedded insurance landscape. Our worldwide consulting and technology services provide proprietary frameworks such as the Embedded Insurance Target Operating Model (TOM)®, Embedded Insurance Product and Pricing Model®, Embedded Insurance Capability Model®, and Embedded Insurance Architecture Blueprints® to support seamless embedded life implementations.

If you want to further explore how embracing embedded life insurance can help you reach new customers, future-proof your business model, and close protection gaps, please contact us.

References:

1. APAC mortality protection gap forecast at $119tn by 2030: Swiss Re (Reinsurance News, 11 August 2020).