Insurance underwriters with superpowers make quicker, better-informed decisions. There’s nothing supernatural about it: automation technologies already exist to make the magic happen.

An introduction to underwriting automation

Automated underwriting can broadly be defined as using technology-driven solutions in the underwriting process to reduce manual work, enable underwriters to make quicker, well-informed decisions, lower expense ratios for the insurer, and enhance the customer experience. The scope and sophistication of solutions and how they are utilised can vary greatly – and there are many ways an insurer can approach the topic.

In this article we’d like to first give you three examples of available solutions, secondly show how their potential can be maximised for underwriting (UW), and thirdly explore how insurers can prepare their organisation to embark on underwriting automation projects. To make our examples more concrete, we’ll be describing them from the perspective of a B2B commercial underwriting process.

What’s available?

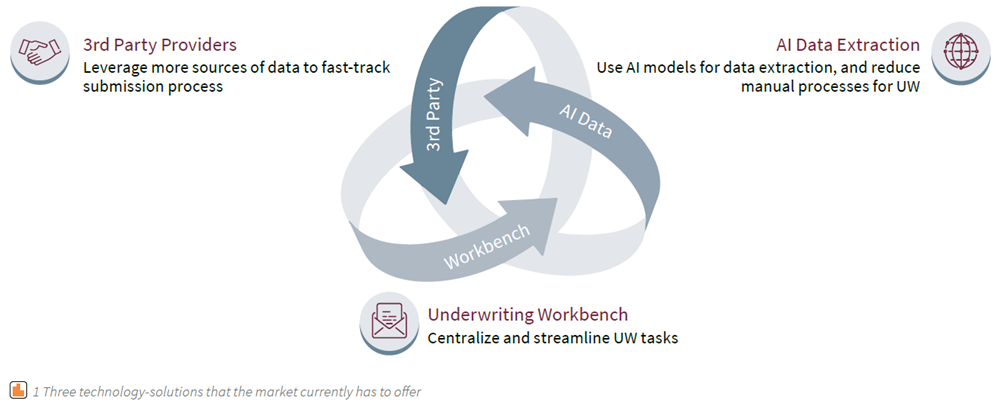

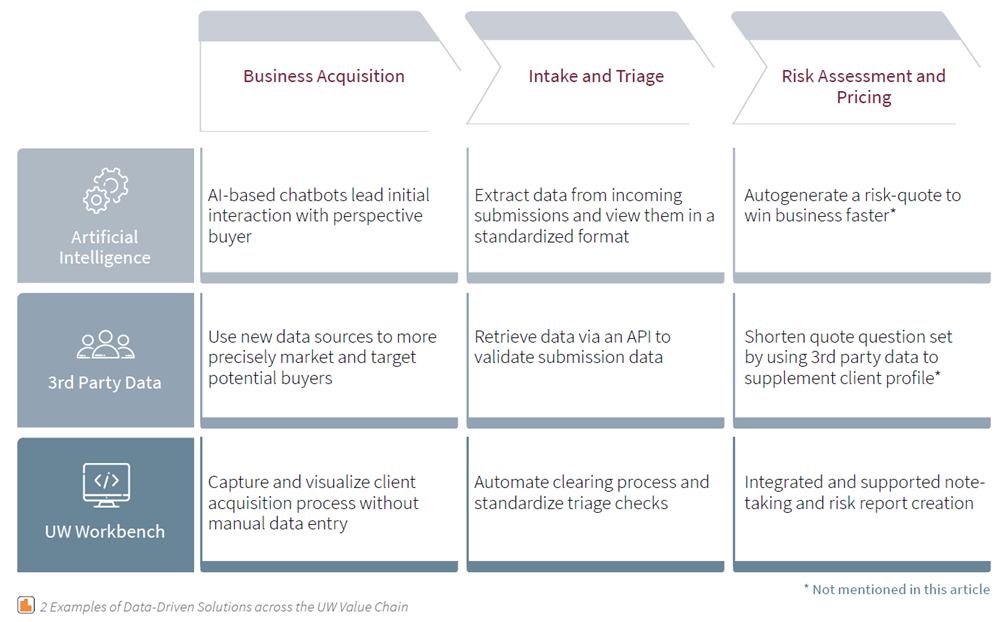

First we’d like to give you a quick introduction to three technology solutions that the market currently has to offer: third-party data providers, AI-assisted data extraction, and underwriting workbenches (Figures 1&2).

Third-Party data: Drawing on more sources for quicker and better UW decisions

Third-party data is information collected from several sources without any direct connection to the (potential) customer. Sources can include public databases (e.g. housing authorities), social media, websites, and data collected in other ways. Underwriters can use this additional data – retrieved via an API – to validate submission data and enhance or complement it to make a more informed and potentially quicker decision.

Providers of such solutions include FRISS, intellect SEEC, Planck and Convr. The main focus of these services is to curate the required additional data from multiple data sources and Betterview whose machine-learning-powered solution analyses aerial shots (taken from low-flying airplanes) to provide in-depth information on rooftops and surrounding areas.

AI data extraction: Reducing manual UW processes

Natural language processing (NLP) and machine learning (ML), both subsets of artificial intelligence (AI), are data extraction methods that can be used to analyse incoming submissions and the accompanying documents, such as emails with an attached statement of value (SoV) or loss run, and deliver them in standardised form to make them easier for the system to ingest or simply easier for underwriters to review. More often than not with these solutions, low-confidence results have to be reviewed manually to ensure high-quality output.

An example of this type of solution is the AI platform from Ityx that can capture and extract information from incoming communication and send this data to employees and downstream systems.

Digital UW workbenches: Centralising and streamlining UW tasks

UW workbenches are applications that enable underwriters to conduct their work on one platform. This is done by integrating with the insurer’s (legacy) systems and external companies such as the providers of third-party data and data extraction services mentioned above. UW workbenches also feature built-in rules and workflows that can automate previously manual processes (e.g. clearing) to enable underwriters to work more efficiently.

While it’s possible to build a UW workbench in-house from scratch, there are also companies such as AdvantageGo that provide their own platforms to centralise and streamline the underwriter’s tasks, as well as supporting various activities such as data collection and analysis.

These are just a few examples of solutions that allow insurers to embark on the journey to increased underwriting automation.

Download our complete guide and continue reading

We gathered even more insights for you and put them in our guide on how automation technologies can give your underwriters superpowers. Click to continue reading and download the whole guide for free.

We will cover this and much more:

- How to maximise the benefits: We’ll be showing concrete examples of how the technology-driven solutions we’ve described can empower insurance underwriters, enable quicker and better-informed underwriting decisions, lower costs, and increase customer satisfaction. These types of solutions can potentially enhance your underwriting activities in many other ways as well.

- Preparing the ground for a successful underwriting automation project: To show you how these automation ideas can be turned into value-creating reality, we’ll be exploring how insurers can prepare their organisation to embark on successful underwriting automation projects.

How Synpulse can support you

At Synpulse we’ve helped dozens of major insurers in the vendor research phase and implementation delivery to bring new tools to their enterprise. Often this takes the form of initial conversations to understand the real problem areas of the underwriting and risk engineering teams and use workshops and interviews to find a target solution and the accompanying approach. We’ve had extensive experience with insurers of every size, and we often see that a new perspective is very helpful in transforming teams and organisations. Now is a crucial time for every insurer to strategically position themselves with the right risk assessment technology to remain competitive in 2021 and beyond.

If you’re interested in learning more about the opportunities available in terms of underwriting automation, get in touch with us now to discuss:

- How you can identify the best automation solution or solutions to match your current situation and pain points

- How you can maximise the impact of these tools on your underwriting operations

- How much you have to spend and which tool will give you the most value for your investment

- How you could incorporate these tools into your existing system landscape to create an automated E2E journey