This article is the first in a series of five under the main title “How Ready Are Swiss Banks to Become Organisations of the Future?”. In this chapter, we outline the challenge, study, and high-level observations that Synpulse has made.

Organisational agility has been a salient concept in the industry for several years. But have Swiss banks truly moved into this new era or have these trends remained mere buzzwords on strategic agendas?

The challenge

Banks find themselves in a rapidly changing environment. Expectations about how to interact with clients, how to respond to socio-economic challenges, and what services they offer keep shifting. The COVID-19 pandemic has accelerated these developments and deepened the challenges for the sector.

In this context, a bank's organisational agility has become a prerequisite to success. More than ever, it is crucial that a bank's organisation can adapt quickly to new market developments and deliver new banking services and functionalities in a timely and targeted fashion.

At the same time, these kinds of challenges are not unique to the banking sector. As a result, banks are in a broad competition to attract and retain both technical and business talents. Startups, fintech companies, and big techs all offer flexibility and autonomy on the job, a favourable work-life balance, a collaborative atmosphere at work, and a culture that fosters innovation. Such companies have intensified the war for talent, and it has become more challenging for traditional organisations to stay attractive to both prospective and current employees.

At Synpulse, we believe that success and growth for banks will be decided within these two interrelated areas of organisational agility and the attraction and retention of top talent. Therefore, we refer to organisations that take continuous steps to increase their delivery power and make themselves a more attractive employer as future leaders. These companies have managed to overcome these challenges or are at least making significant progress.

Synpulse study

We have conducted a market study to assess the progress of Swiss banks in terms of their organisational development and delivery power. We believe these two metrics are broad enough to allow for a holistic picture of the various companies and also focused in a way that enables us to zero in on the core questions that drive success in the current environment – the agility necessary to stay abreast of a rapidly changing market and the ability build-up the required capabilities.

In order to reach robust conclusions, the study looks at a broad range of organisations and covers a representative swathe of the Swiss banking industry, including mid-sized retail banks, international wealth managers, large private banks, and neobanks.

Delivery power

Delivery power is the level of efficiency and effectiveness with which a bank delivers client value. High delivery power means that the business and the IT departments of a bank can deliver value-adding services, products, features, and functionalities to their end clients in a fast, flexible, innovative, and cost-efficient way.

Organisational development

The organisational development of a bank determines how open it is to new and/or unexpected shifts in the environment, and how quickly it can adapt and change. In order to evaluate and compare the various banks in our study – which differ greatly by size, market penetration, and other crucial factors – we assessed organisational development based on a number of factors.

In the course of our market study, we asked the representatives of the various banks to assess their own organisations on the basis of a number of questions. The answers allow us to make inferences about both the delivery power and the organisational development of the bank in question, as they assessed things like the alignment of the IT department within the bank, the complexity of project planning and implementation, as well as the awareness of the importance of such issues across various hierarchical levels.

As a result, we were able to categorise the banks into the following organisational development stages:

Observations

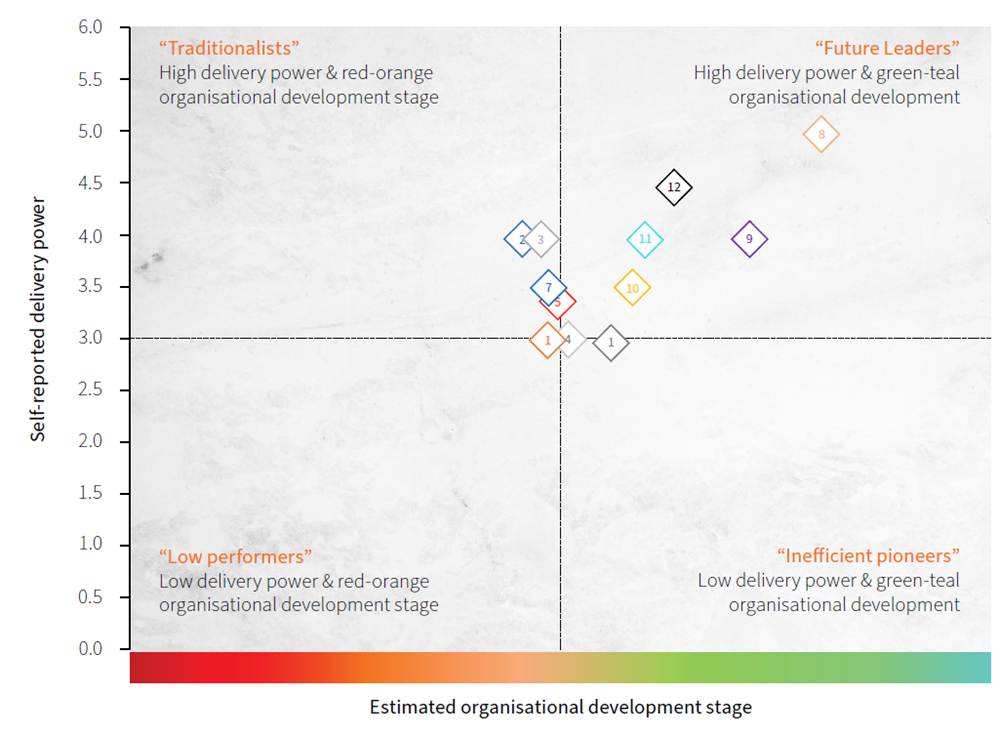

Based on the studied banks’ self-reported scores, we can identify four clusters:

- Banks with high delivery power and advanced organisational development are the future leaders.

- Banks with low delivery power but advanced organisational development are inefficient pioneers with unexploited potential.

- Banks with high delivery power but less advanced organisational development are the traditionalists.

- Banks with low delivery power and less advanced organisational development are the low performers.

Most banks report less advanced organisational development (the orange stage; see Figure 1), and only a few report advanced organisational development (the green or teal stages; see Figure 1). Most banks report medium to medium-high delivery power. Combining these two factors, almost all banks fall into the traditionalist category (see Figure 2). Only a handful have started to move toward being future leaders, with high delivery power and more advanced organisational development.

Overall, there's a positive link between banks’ self-reported delivery power and current organisational development stage. This means that the more advanced the bank’s organisational setup is, the higher its delivery power.

Conclusions

Most banks are currently classified as traditionalists, and their delivery power and organisational development stage still have potential. Whilst they have started to implement initiatives with the ambition to move to the future leaders’ area of the matrix, they still lack the required management buy-in or capabilities to drive sustainable change.

Some of their biggest gaps are in the areas of organisational structures, agile ways of working, and talent management. Another gap is on the technological side.

“We have started to increase our release frequency, but there is still a long way to continuous integration and continuous deployment and end-to-end testing.”

- Head of IT Systems at a Private Bank

With technology becoming more and more crucial in the banking world, the role of the IT department is getting even more important. Investing in technology and tech affine talents is key. Banks that remain traditionalists might miss opportunities in the market. To deliver faster and adapt to meet customers’ needs, a bank’s technology must be up to date and enable continuous integration and deployment. Investing in infrastructure and new technologies – and the capabilities as well as processes to support them – is key.

We will dive deep into each of the following three areas in the next chapters. Leave your contact details here and we will be happy to forward you the full white paper as soon as the study has been released.