Considering the lack of a streamlined process across teams in large organisations, we look into a solution that can optimise business processes and can be integrated with the existing landscape.

Large wealth managers often find onboarding a client into their organisation disjointed, complex, and time-consuming. The reason is the lack of a clear and structured process across all the different teams involved.

These cumbersome arrangements not only risk creating a bad first impression with the client but also have a significant impact on both the top and bottom lines. The solution to the problem is an onboarding solution that optimises business processes and integrates with the existing landscape to deliver a seamless experience to the clients.

The challenges of onboarding

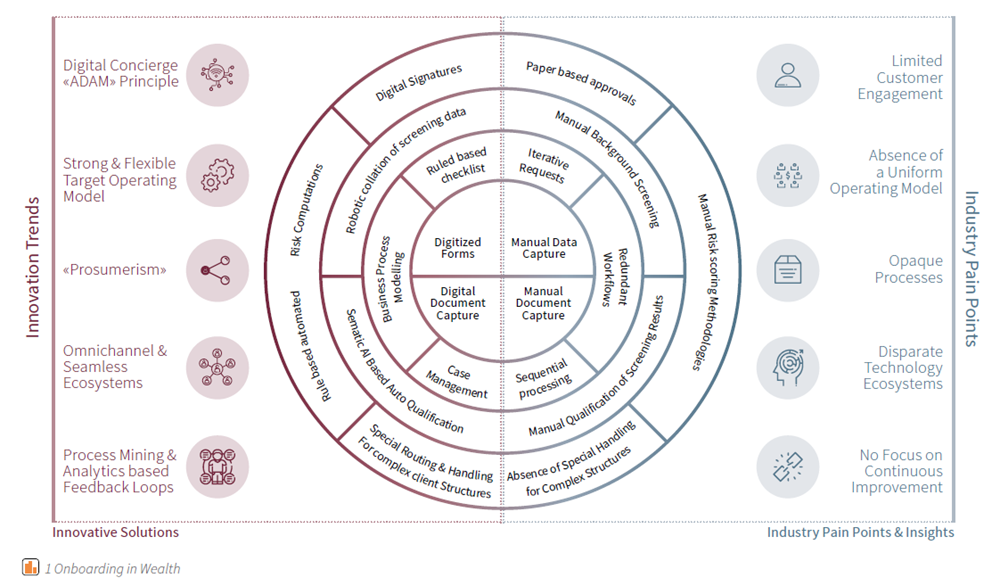

One of the biggest pain points that large organisations face in client onboarding is the lack of a streamlined process that brings together all the relevant front, middle, and back-office teams. In addition to extending prospect-to-client conversion times, such disparate onboarding processes and technologies can also create significant compliance risks.

Based on our project experience, we highlighted three main issues that need to be addressed to improve the overall onboarding experience:

- An unstructured and opaque onboarding process

- Manual data and document capture

- Disconnected infrastructure

The lack of a structured onboarding process can leave business groups working in silos. An effective solution should incorporate all the key elements of onboarding, such as prospecting, KYC, and account opening, into transparent processes.

For example, we commonly see client-facing staff tasked with collecting and documenting all client information during onboarding. Ironically, they are never the experts on the data and documentation required. They often struggle to provide complete and accurate information. This results in an onboarding case that ping-pongs back and forth. Cycle times are also delayed.

A structured onboarding process provides all relevant business rules upfront so that relationship managers can efficiently obtain what is needed without middle or back-office intervention.

Underlying these issues is almost always the fact that the technological infrastructure is disparate and disconnected. The amount of data being shared across all the separate onboarding processes and tools is minimal and the back-office platforms are not integrated with those of the front office.

The onboarding process itself can become incredibly opaque. Most participants will have no way of knowing the progress of an onboarding case or where the bottlenecks are. This makes it very difficult to identify ownership, leading to a lack of downstream accountability.

The lack of connectivity often also creates manual processes to capture the same data and documentation. All these will pose a significant compliance burden on any wealth management organisation. Significant data gaps could be created and identified by regulators. It also leads to two additional inefficiencies:

- Different teams may reach out to the client for the same information

- Data must be rekeyed into the different systems, opening the door for more human error

An effective onboarding solution will not only reduce prospect-to-client conversion times, but will also reduce unnecessary regulatory risks. It can alleviate the frustration caused when clients and staff find themselves having to navigate a complicated and cumbersome process.

Our solution

As a trusted implementation partner to our clients, Synpulse has delivered solutions that harmoniously combine all onboarding processes, fully integrating them with upstream and downstream solutions.

Download the full article in pdf and keep reading to learn more about our approach.