Companies in the risk transfer market have potential to improve in realizing their ESG aspirations. What still needs to be done to incorporate ESG seamlessly and efficiently into business operations and processes?

Our previous article described how a recent survey we conducted, in collaboration with leading ILS news provider, Artemis, revealed an interest among risk transfer market participants in embedding environmental, social, and governance (ESG) considerations into their operating models. But the survey also found a gap between the perceived importance of ESG factors and actual practice, with only a fraction of respondents indicating that they have taken action reflective of their sentiment. In this article, we identify 3 key challenges that are inhibiting progress toward implementing ESG at the operational level. These challenges only provide a glimpse of our survey findings and interpretations. To find out more, sign up to receive a download of the market study when it appears (around mid-December) or contact us directly.

Challenge no. 1: Not putting your money where your mouth is

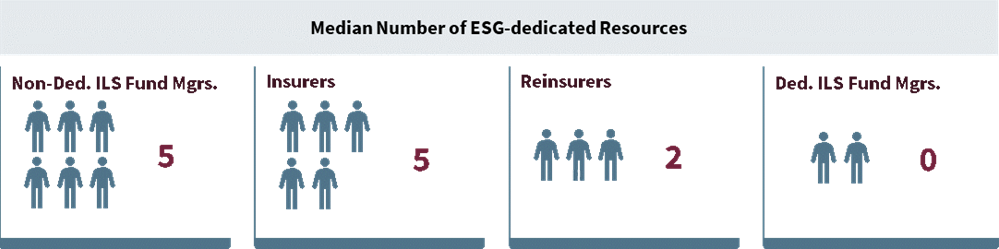

Our survey suggests that the lack of progress in translating ESG into operations and processes starts at a very basic level with a lack of resources dedicated to the purpose. Many companies in the risk transfer market have so far neglected to create dedicated ESG roles as part of their operational set-up. As Figure 1 shows, non-dedicated ILS fund managers and insurers are better organised from a resource perspective than dedicated ILS fund managers. Reinsurers’ efforts are less organised, potentially because most do not have an ESG strategy to serve as a backbone in the first place.

Challenge no. 2: Wishy-washy goals and a lack of clarity on own ESG footprint

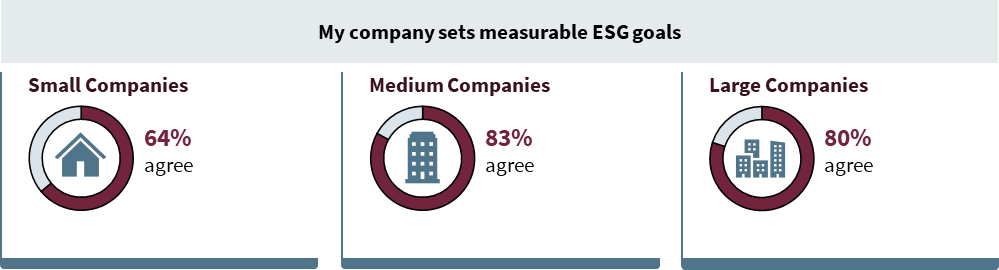

Another fundamental stumbling block to embedding ESG at an operational level appears to be that companies lack well-defined measurable ESG goals and/or a clear idea of their own ESG footprint. Although the majority of those surveyed agree that measurable ESG goals are being set (see Figure 2), many of our survey respondents have voiced that these are currently either not defined clearly enough in ESG strategies or the goals themselves are considered unsatisfactory.

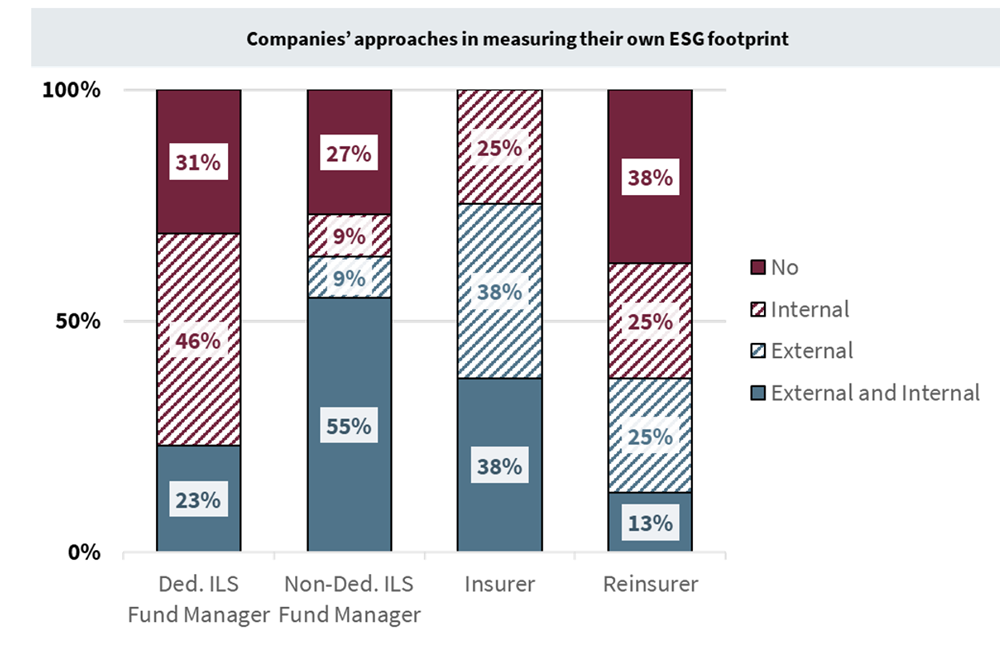

The survey also asked companies whether they were measuring their ESG footprint. Here North America has clear catch-up potential, with only 54% of companies measuring their ESG footprint versus 84% in EMEA and 100% in the Asia Pacific. The more revealing question, however, turned out to be how companies are measuring their own impact – internally, using external service providers, or a combination of both.

The strategy used by insurers and non-dedicated ILS fund managers demonstrates that these two peer groups evaluate their ESG performance more thoroughly than dedicated ILS fund managers, who primarily focus on measuring their ESG footprint internally, and reinsurers, nearly 40% of whom haven’t yet evaluated it at all. There is a positive sign that most dedicated ILS fund managers and reinsurers will be stepping up their efforts in this area by increasingly involving external parties. We infer this because 70% of these two peer groups surveyed state that measuring ESG performance through external rating or scoring is important for their business.

Challenge No. 3: Inadequate screening of parties and elements in the risk transfer value chain

90% of respondents agree that screening external parties or elements in the risk transfer value chain (e.g., covered risks or investment of collateral) for ESG criteria is important. Are they backing this sentiment up with actions?

The survey indicates that overall efforts to assess external elements haven’t covered the risk transfer value chain comprehensively. Companies primarily focus on downstream parties such as covered risks and clients when analysing external parties for ESG adherence. This downstream focus might result from the fact that investors pay more attention to where incoming business is sourced from, and what type. This is another area that companies serious about ESG can improve in to get an accurate picture of the impact related to their interactions with external parties.

This raises two sets of challenges related to measuring ESG adherence of external parties or elements: a lack of data and disclosure and a lack of consistency and standards. Again, the implication is that while companies in the risk transfer market have good intentions, the practical means for implementing ESG strategy are lacking.

Conclusion: Major obstacles to practical implementation still to be overcome

The survey findings on progress in implementing ESG at the operational and process level are sobering. More dedicated resources, clearer defined goals, more accurate and comprehensive measurements, better standards, and data disclosure are required if companies in the risk transfer market are to achieve their stated aspirations.

Stay tuned to find out about progress in another key practical area: translating ESG factors into products in the marketplace.