Social and technological megatrends do not stop at the insurance sector. As industry specialists, we see it as our task to go beyond our day-to-day business and look into the future. This has resulted in a model that is intended to serve as orientation in the current transformation phase.

The insurance industry is in a state of upheaval. This is reflected in the investments that have been increasingly flowing towards insurtechs for several years. Analogous to the previous wave of fintechs, this is an indication of a technology-related imbalance in the market. The resulting (supply) gaps (keyword: embedded insurance) must now be filled within the industry. The alternative is for disruptors from outside the industry to take over this task.

Digital transformation must then often be held up as both the cause and the solution for these current distortions. It is digitisation that gives customers more direct access, makes new sales models necessary, and is held up as a panacea for today's challenges.

“Technology mustn't be what drives disruption. It really has to be customer obsession or centricity […] driving the disruption.”

- Piero Campopiano, Smile

Current market trends also indicate that there is a need for action in this space. The established players are exposed to pressure to change both on the supply side (through new participants entering the market) and on the demand side (through changing customer needs). This raises questions, as to which ‘digitalisation’ isn’t an adequate answer.

To answer these questions, we need more than profound knowledge of today’s industry structure. What is required is a dynamic model that shows ongoing developments and provides decision-makers with support accordingly. We have set ourselves the goal of developing such a model for the property and casualty (P&C) and life segments, as well as testing and consolidating it with input from the industry.

Theory and model

The pressure on the Swiss insurance industry is increasing. Digitalisation is raising difficult questions in all areas of business and everywhere in value creation. The discrepancy between partly outdated business practices and new realities is creating opportunities. The laws of the market want them to be grabbed, either by established market players, newcomers, or lateral movers. We can already see both situations unfolding.

The customer interface is the key

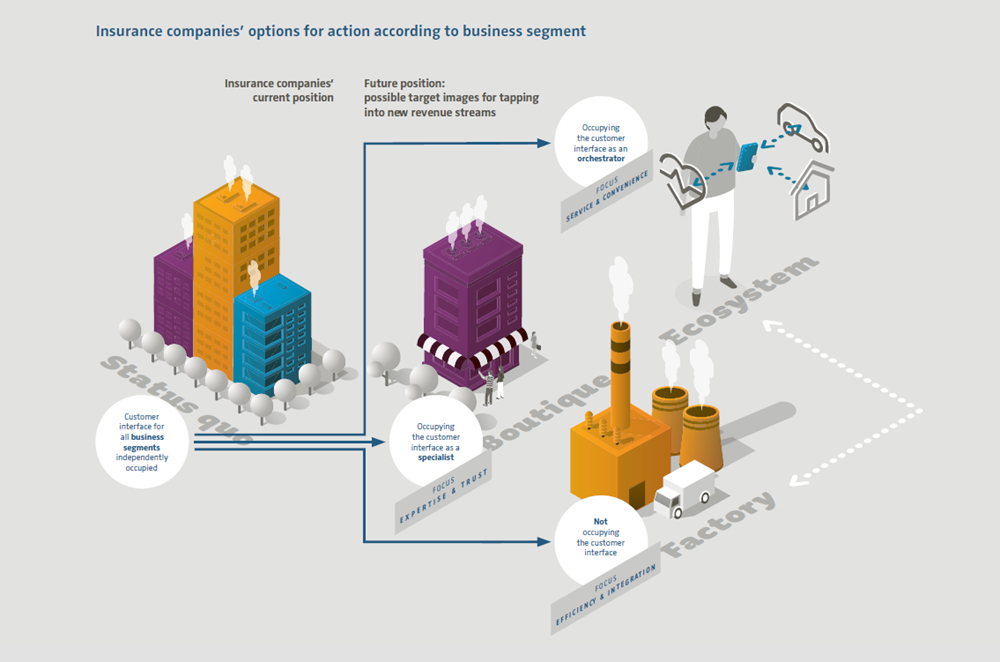

Our model is intended to precisely reflect this conflict and illustrate potential strategic options for action. The customer relationship or customer interface is the pivotal element. Before we go any further, it should be noted that we don’t conduct our analyses and classifications at the level of the entire insurance company, but rather at the level of individual business segments. It is also at this level of the individual business segment that the threat of external disruption must be dealt with.

It is conceivable, for example, that the customer interface in the motor vehicle insurance sector will be occupied by large mobility providers in the future. Insurance would be integrated there, just like the spark plug in the vehicle’s engine.

In contrast, insurers might be in a good position that enables them to prominently occupy the ‘pension provision’ area of life and to connect other service providers to their own customer interface as contractors. For industrial customers, on the other hand, insurance could still be offered as a stand-alone product.

“I believe that insurers are tending to lose ‘control’ over the customer interface. And, from that perspective, the ability to integrate into ecosystem landscapes is becoming significantly more important.”

- Marco Kamerling, iptiQ

Current classifications

If we look at the current landscape with our ‘occupying the customer interface’ hat on, it’s split into four positions. Some insurtech firms are clearly positioned as ‘insurance factories’, while the large all-line insurers are split into ‘offensive’, ‘explorative’, and ‘waiting’.

Companies that are on the ‘offensive’ want to take on the role of ecosystem orchestrator for defined business areas. ‘Explorative’ companies, on the other hand, are testing initial partnerships, while ‘waiting’ insurers are monitoring the development.

Interestingly, those taking an offensive approach are characterised by an active attitude towards digital acceleration. They rely on in-house innovations and are hoping to create or build on a comparative advantage using proprietary tools and by constantly optimising core functions. They prioritise strict control of the innovation process and sometimes run the risk of being blind to operational shortcomings.

The ‘waiting’ companies are on the other side. By taking open innovation approaches, they deliberately seek to use innovations from outside the company and outside the sector. Clear objectives, regulated responsibilities, and a controlled budget are all vital if such an approach is to be implemented successfully. Otherwise, there is a risk of spillover. The most common components of an open innovation strategy include partnerships and innovation garages.

We see four positions on the Swiss market in the question surrounding the customer interface:

Potential paths out of the strategic dilemma

We’re starting from the customer interface as the core of the strategic (re)orientation process, as this is where new market players come in. They appear as part of integral ecosystems, and, thus, forcing established players to change course.

Who will occupy the customer interface in the future and how? Who will know how to use the value chain more broadly, and, thus, tap into new revenue streams? We believe these considerations lead to three potential paths:

- As the orchestrator of an ecosystem, do I try to occupy the customer interface with selected partners throughout an entire customer journey?

- Do I single-handedly keep the customer interface as a boutique in a defined segment?

- Or do I give up the customer interface and become a highly efficient product supplier (insurance factory)?

In the second stage, it becomes clear that each of these potential target images presupposes certain capabilities that differ greatly between the approaches and can hardly be implemented in parallel. This also illustrates the identified practical incompatibility of the approaches in theory.

“There’s definitely an opportunity, as an insurer, to position yourself as a trusted advisor at the customer interface. The outcome of this race isn’t yet clear in Switzerland.”

- Sandra Hauser, Zurich

The usual case of a large classic insurer is a mixture of differently positioned business segments. In the medium to longer term, our model arguably calls into question the economic viability of some of these business segments. But there may still be quite a few profitable years ahead, which no company wants to sacrifice before that time comes.

Here, the model only requires that the non-decision (i.e., to carry on as before) is also made consciously. At the same time, it suggests at least planning, if not yet implementing, further development. Because the consequences of setting a course are far-reaching.

The goal of a model must be to make falsifiable statements. This requires robust anchoring and practical design. To achieve this, we made intensive exchanges with the industry at the heart of the project. This took the form of free-form discussions, structured interviews, and standardised surveys, at both top management and operational levels.

For this, we were able to recruit many of the most important exponents of the Swiss insurance industry, who together represent between 70 and 80% of the industry in the country. This gives the results the necessary representativeness to serve as a basis for generalising statements and specific predictions within the framework of the model.

Our conclusion for the insurance industry

Our conclusion for the insurance industry

The question of positioning one’s own company in the customer interface race is strategically the most important. The decisive factor in this respect is not just the company’s own starting situation (brand awareness, technical readiness, personnel skills), but the relevance of insurance in an area of life is also key.

The relevance of insurance within a customer journey should be assessed realistically. One disadvantage of the insurance industry compared to other sectors (retail, mobility providers, telecoms) is that insurance usually isn’t a product of choice for customers, and the interaction density is often very low. The fact that customers generally have a high level of trust in insurers when it comes to maintaining data integrity is advantageous.

Our impression from the expert interviews was that organisations’ awareness of these courses is not yet well-developed. Many are lulled into a potentially false sense of security that their own brand visibility will remain unchanged in the market.

If you, too, would like to rethink your positioning, we are here to guide and support you. We can help you prepare for the challenges and opportunities of digital transformation.