In a recent Synpulse white paper discussing the financial advisory process for insurance in Hong Kong and Singapore, the inconsistency in advisory experience due to diversity in competency, experience and diligence of the advisors was highlighted. One of the reasons attributed to the observation was the high attrition rate amongst the advisors and recruitment overdrive to cope.

Following the release of the white paper, Synpulse encountered several discussions surrounding the recruitment and retention of financial advisor representatives (FA reps). The key question put forth was, how can the industry and/or insurer attract promising FA reps and retain them?

The question assumes that FA reps remain relevant, even in the world of digital distribution. In a focus group survey Four Lessons from Customers on Advisory, Synpulse found that half the participants preferred to have an advisor to guide them even if self-education tools are available. Women, in fact, expressed a stronger inclination for advisory than males. Nonetheless the fact that half the group didn’t think an advisor would be necessary means that the role of an advisor must somehow change with the times.

The solution to this question is essential. Generally, the industry experiences difficulties to recruit suitable FA reps. Organic growth requires years and a sound grooming structure, with a good dosage of luck to attract the right saplings and retain them after they have been trained. To beat the odds, recruitment intensifies but it isn’t aligned well enough with scalable and systematic training to produce consistent quality among the FA reps. Considering the uncertainty of the returns from organic growth, some principals turned to industry hires instead. Such a strategy doesn’t usually end well as incumbents wage public wars over the poaching of FA reps and potential churning, affecting customers adversely. Acquirers also tend to underestimate the cost of buyout packages.

Why is it difficult to recruit promising FA reps and retain them?

To come up with a sustainable solution, Synpulse sought to uncover the root cause(s) of the recruitment and retention difficulties.

The insurance industry is poorly understood, hasn't been known for being innovative, and suffers a poor reputation: Public awareness of the industry is frequently linked to its front-line distributors, perceived as low-entry careers, associated with pushy sales culture and occasional but sensational news of rogue sales. Insurance as a discipline is barely represented in universities at the undergraduate level in Singapore and Hong Kong. Actuarial science is not well marketed and drop-out rates are high. Well-educated individuals from the millennial generation look for exciting and innovative companies to join. It is indeed rare for graduating students to aspire to work in the insurance industry and many stumble into it. Those who embark on the career of an FA rep frequently find themselves having to cope with social stigma and even opposition from their families.

The profession is subject to increasingly stringent regulations. The job also comes with personal liability, a risk which many may be unwilling to bear: To raise the quality of FA reps, MAS has significantly raised the bar for their licensing requirements. In terms of education, tertiary graduates would find it easier to clear the licensing hurdle, which is ironic given the unpopularity and stigma as described earlier. Regulations have also gone as far as to protect the end consumers by making FA reps personally liable for damages. New FA reps do not understand the repercussions completely until they start to be active in sales.

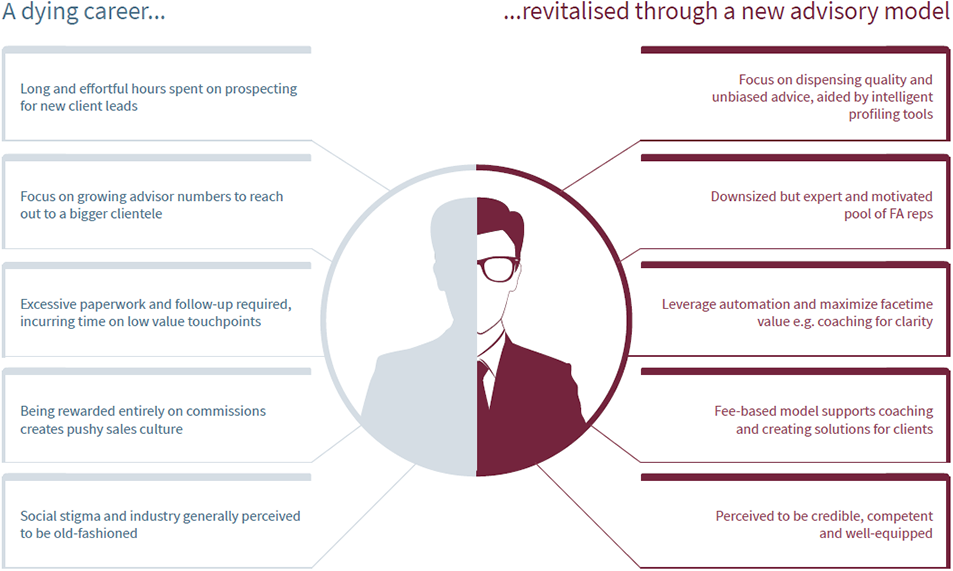

FA reps don’t necessarily start on the right footing, affecting income and job satisfaction: While it can be argued that any job would have its fair share of downsides, the job of an FA rep can be exceptionally draining. Most FA reps operate fully on commissions. In the absence of mentorship, new recruits would grapple with self-employment. Most would be in a hurry to break the first egg, neglecting the foundations in terms of habits and routines to sustain the career. Agency culture contributes to the neglect too. Some agencies believe in getting their new recruits without an established clientele to get leads from traditional methods of prospecting such as street canvassing, road shows, and cold calls. These methods demand long hours and emotional resilience from the FA reps. Poorly designed advisory journeys also compel FA reps to spend significant time on paperwork. The meaningfulness of the job isn’t apparent until a claim happens. The career of an FA rep is typically positioned as an entrepreneur, but considering the sheer layers of compliance requirements, it’s difficult to imagine how much creativity is permitted. Being unable to earn an adequate income and gain job satisfaction are among the key attrition factors.

What can be done to attract promising FA reps and retain them?

Looking beyond tactical methods such as introducing incentives and improvising recruitment pitch, Synpulse pins down strategic ideas aligned with market and technology revolution.

Reshape the role of FA reps and support them with a well-designed advisory journey: Many FA reps deliver value in the acquisition and renewal stages. The work done during these stages contributes to a poor reputation (pushy sales culture) and job dissatisfaction (paperwork). While many fret that digital and direct distribution can render the FA reps redundant, it pays off to see things from a different perspective, the trends can be leveraged to help reshape the role of the FA rep for the better.

Reshaping the role of advisors paves the way to making the career more attractive. Customers want to be profiled and understood. They cannot be expected to articulate the exact form of solution they want. Rather than pushing for product sales without discernment, an FA rep takes on the role of a coach and steers the conversation meaningfully to learn about the customer. While designing the advisory journey, financial advisory providers need to consider how to support the FA reps to maximise value during the facetime. Integrating external technology such as document capture and recognition software to allow data auto-population would help the advisor to reduce low-value touchpoints and the risk of non-compliance. Simulating life scenarios to test customer reactions can support the advisor’s role as a coach to steer the conversation meaningfully.

The advisory business model needs to align with the change in the role of the FA reps: Well educated individuals from the millennia generation enjoy work challenges. They are comfortable with technical analysis and welcome steep learning curves. The business model must be compatible with their needs. Financial advisory firms, even including the hybrid types, offer a wide product portfolio across product brands and types to allow the reps to design value-adding solutions for their customers. These firms attract the better educated reps who tend to have a network of friends and acquaintances similar to themselves. As such, they have little need to go through the traditional prospecting methods which tend to have a higher risk of crossing into non-compliance.

Training also has to go beyond sales motivation seminars. Aligned with the proposed role of the rep as a coach and access to the multi-label & product portfolio, principals need to consider more sophisticated and professional financial and non-financial training. Career progression likewise needs to reflect experience and expertise, rather than just sales.

Finally, the compensation model needs to be compatible with the change in the FA rep’s role and business model: The industry is presently in conflict within itself. While regulators try to rein in the sales culture, the FA reps’ incomes are entirely commission-based. However, if an FA rep is being paid commissions for his/her role in acquiring and renewing customers, focusing the role on coaching and creating solutions should then entail a change in the compensation model.

Earning a fixed fee for advisory takes away the pressure to find leads, close sales quickly a,nd ultimately, the social stigma. The industry has explored charging customers advisory fees, and substituting commissions but it hasn’t worked in Asia. In fact, the advisory is often marketed as a freebie to open doors. The fee-based model is however still worth a re-look, using a concerted approach involving raising public awareness and involving major players in the industry to reprice products sold without incurring commissions.

An alternative exploratory and brief idea would be to break apart the compensation according to roles and responsibilities. A third party is paid a referral fee for a cold lead. The FA rep is paid advisory fees for educating, reviewing, and raising the readiness of the leads to go into a transaction. The product provider would handle the sales transactions directly and is responsible for paying the third-party referral and FA rep’s advisory fees.

An Advisory Model Overhaul

Taken together, the entire advisory model needs to transform to complement the new regulatory landscape, customer expectations and the new generation’s career aspirations. Roles of FA reps needs to be reshaped to deliver value at the advisory stage rather than in the acquisition or renewal stages. To do so, FA reps must be technically competent and equipped with intelligent tools such as robo-advisory and profiling applications to assist in dispensing quality and unbiased financial advice to their clients. A positive side effect is an improved industry reputation as frontline advisors are perceived by customers to be credible, competent and well-equipped. This makes recruitment efforts more fruitful as insurers can focus on attracting and retaining a downsized but expert and motivated pool of FA reps.

However, as highlighted in our advisory whitepaper The Financial Advisory Process in Insurance: Flux and Transformation, many of such FA reps are handicapped by tools offered by their principals. In the next article, we elaborate on some of the advisory tools principals should consider offering to complement the next-gen FA reps.