Loading Insight...

Insights

Insights

Agility is more than just a buzzword for wealth management organizations; it is the key to achieving remarkable growth and success.

Agility empowers organizations to:

- Stay ahead of the curve: identify opportunities and proactively respond to market shifts.

- Enhance client experience: deliver personalized experiences that drive loyalty and satisfaction.

- Drive operational efficiency: streamline processes, reducing waste and optimizing resource allocation.

- Foster a culture of innovation: nurture experimentation, creativity and continuous improvement.

However, there is no one-size-fits-all approach to agile transformation or refresh. Different organizations have different considerations and unique challenges depending on their goals.

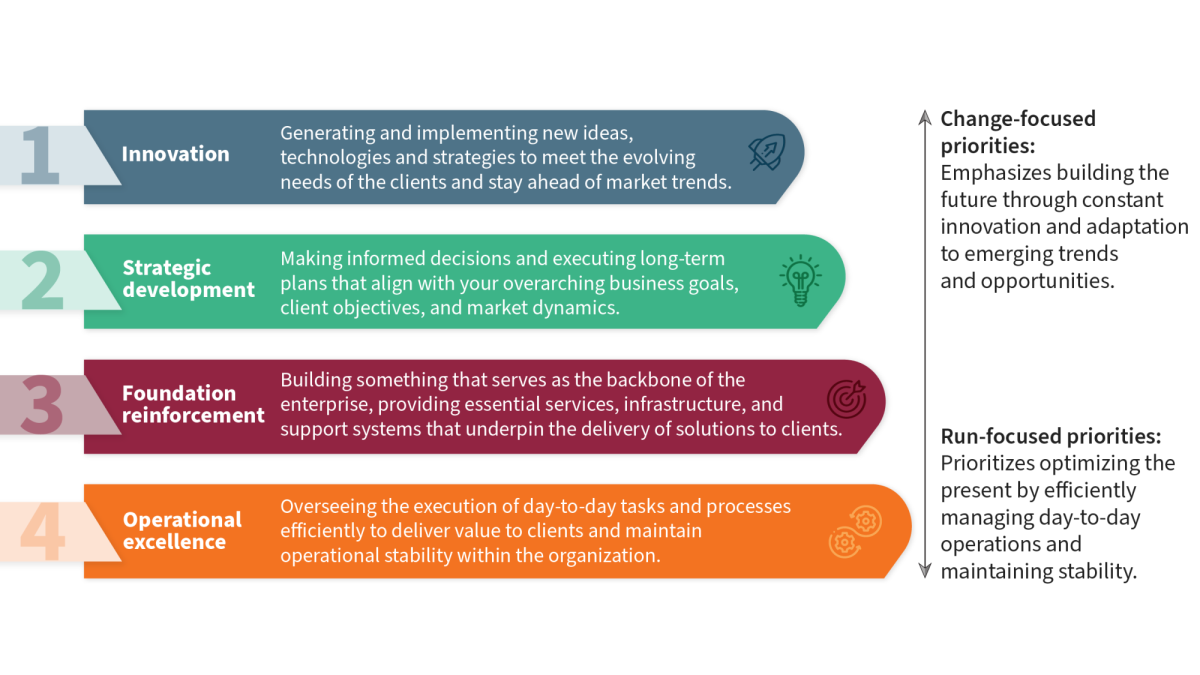

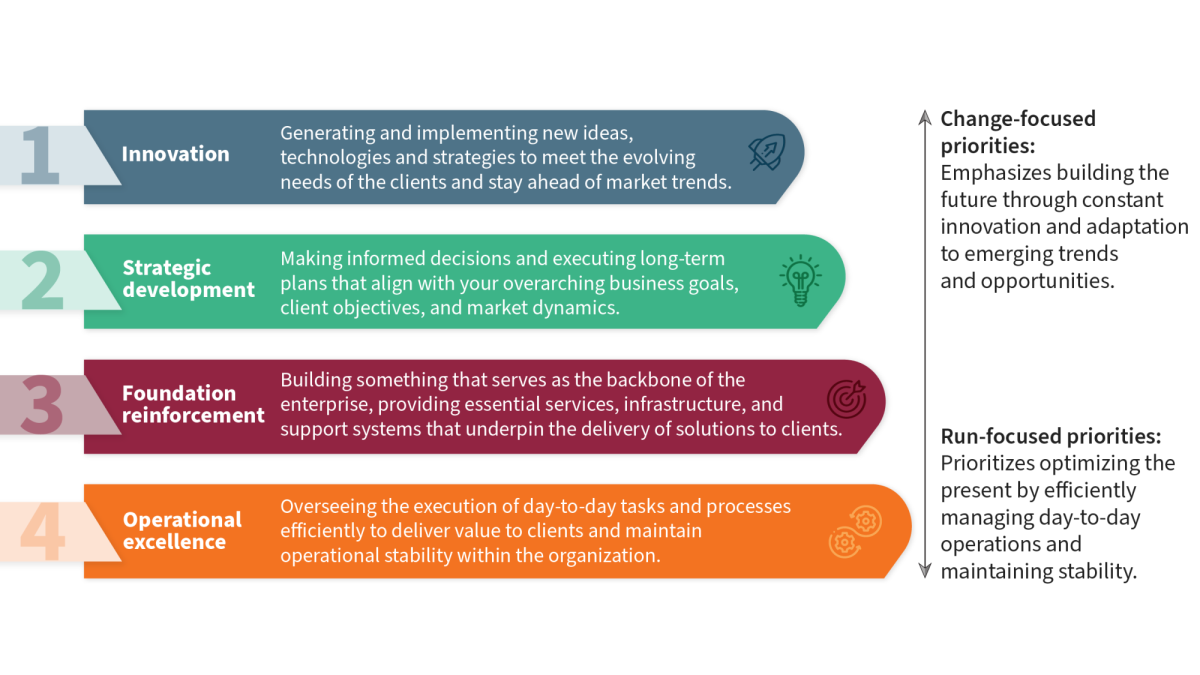

Generally, wealth management organizations have four types of priorities. It is essential to prioritize one main objective at a time, which will vary based on the specific nature of the project at hand.

Figure 1: Wealth management organizational priorities

1. Innovation as priority

If you are prioritizing innovation, you should actively generate and implement new ideas, technologies, and strategies to meet the evolving needs of clients and stay ahead of market trends.

Your focus areas might include:

- Continuous exploration

- Technical capability acquisition

- User-centricity

Examples of initiatives you might pursue:

- Develop a mobile app with AI-driven investment recommendations

- Pilot a machine learning algorithm for predicting market trends

- Create a robo-advisor platform for automated investment management tailored to Gen Z investors

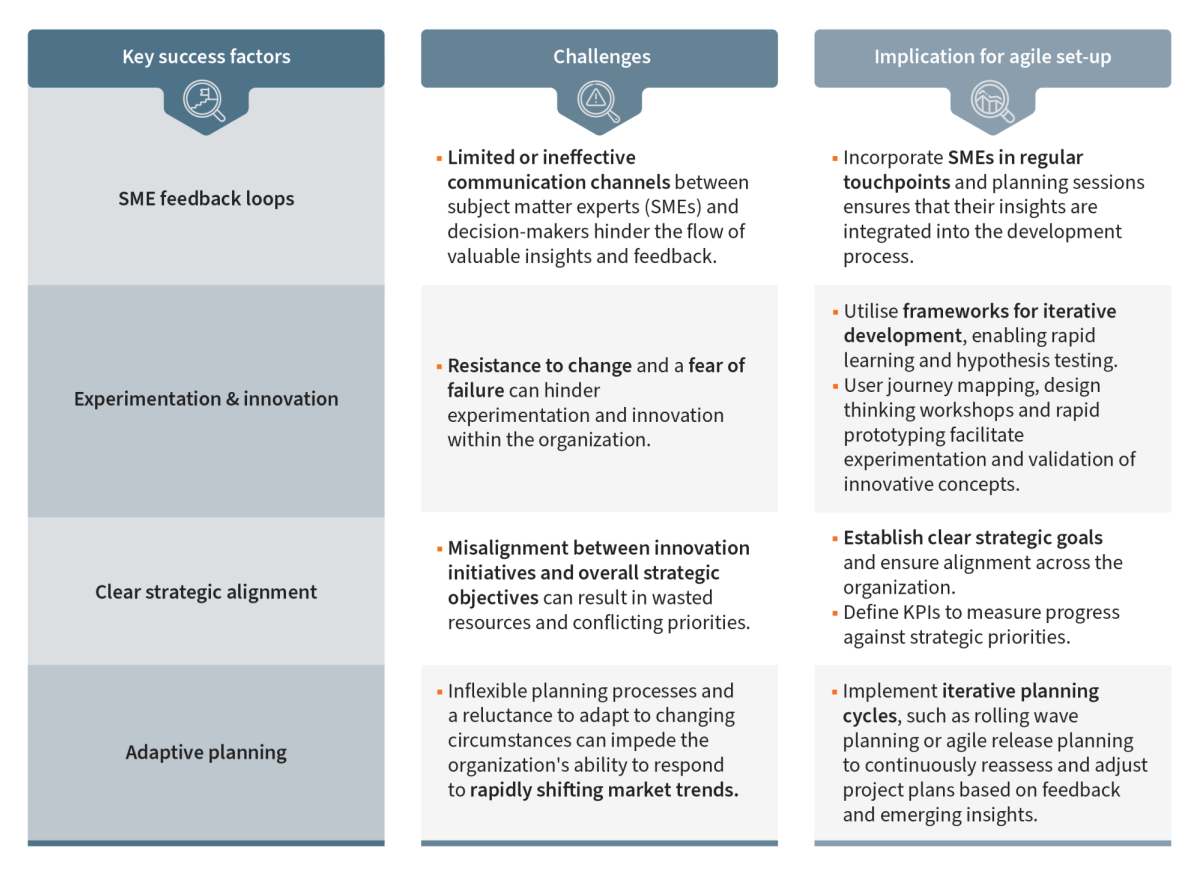

Flexibility in planning is essential to adapt to rapidly changing trends while maintaining a robust strategic direction ensures alignment with overall company goals. Innovative subject matter experts require deep content knowledge and a willingness to embrace experimentation and ambiguity. Establishing robust SME feedback loops is critical as they drive forward-thinking initiatives and help navigate emerging challenges effectively.

Therefore, some considerations for agile efficiency if you have innovative goals are:

Figure 2: Key success factors when implementing agile with innovative priorities

2. Strategic development as priority

If you are prioritizing strategic development, you should spend your time making informed decisions and executing long-term plans that align with your overarching business goals, client objectives, and market dynamics.

Your focus areas might include:

- Strategic agility

- Product development

- Expand user base

Examples of initiatives you might pursue:

- Expand wealth management services into emerging markets with high growth potential

- Enhance or building a mobile application to increase and capture client engagement

- Form strategic partnerships with tech companies to enhance digital capabilities and stay competitive

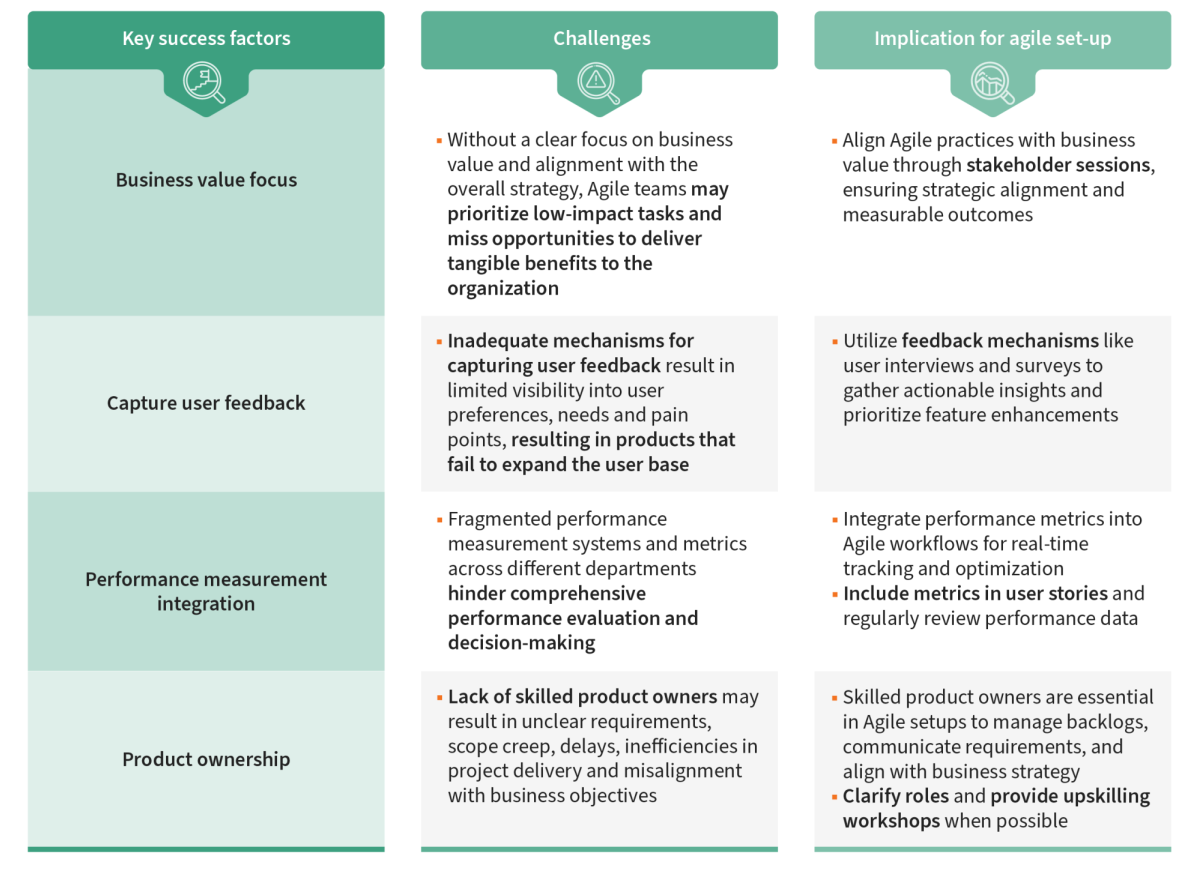

Initiatives contributing to company growth, particularly through customer acquisition, should prioritize capturing user feedback and focusing on business value. Emphasizing product ownership skills enables efficient and iterative product development, while measuring performance defines success. These are some key considerations for agile efficiency:

Figure 3: Key success factors when implementing agile with strategic priorities

3. Foundational reinforcement as priority

If you are prioritizing foundational reinforcement, you should build something that serves as the backbone of the enterprise, providing essential services, infrastructure, and support systems that underpin the delivery of wealth management solutions to clients.

Your focus areas might include:

- Enhance functionality

- Manage risk

- IT integration

Examples of initiatives you might pursue:

- Implement a comprehensive client data management platform

- Upgrade legacy systems to improve data security and compliance

- Enhance reporting and analytics capabilities for better client insights

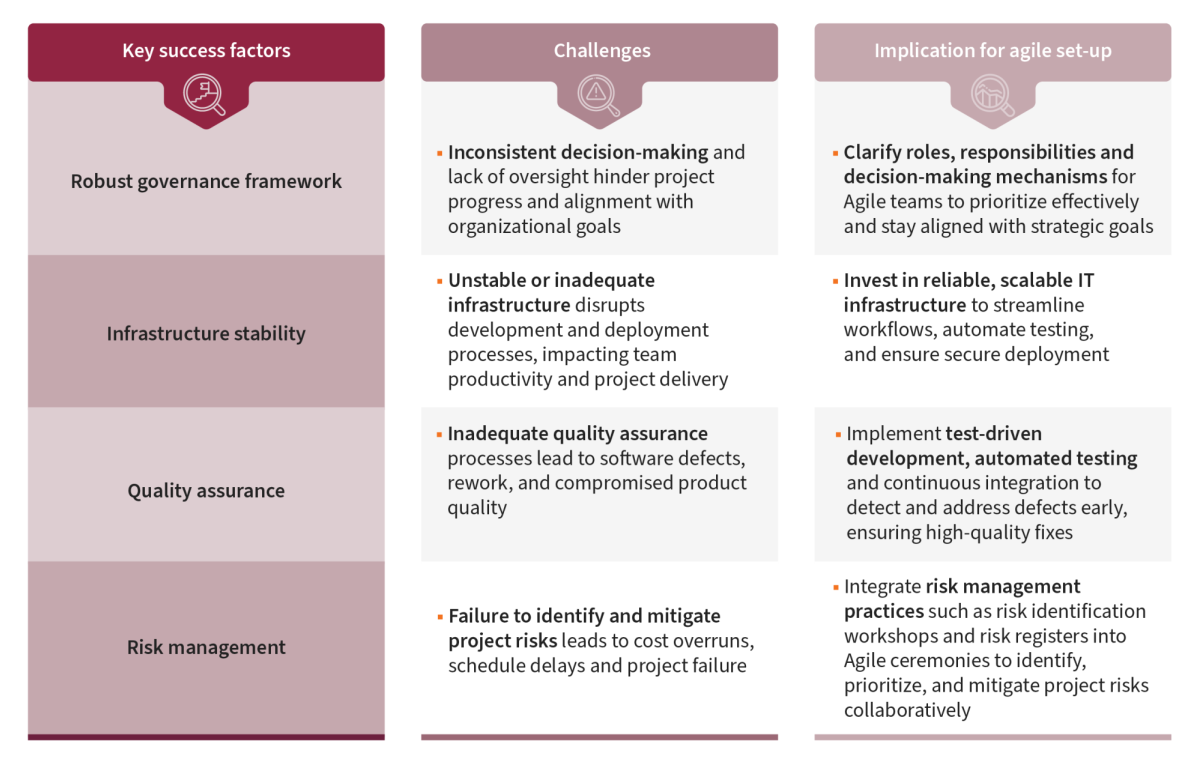

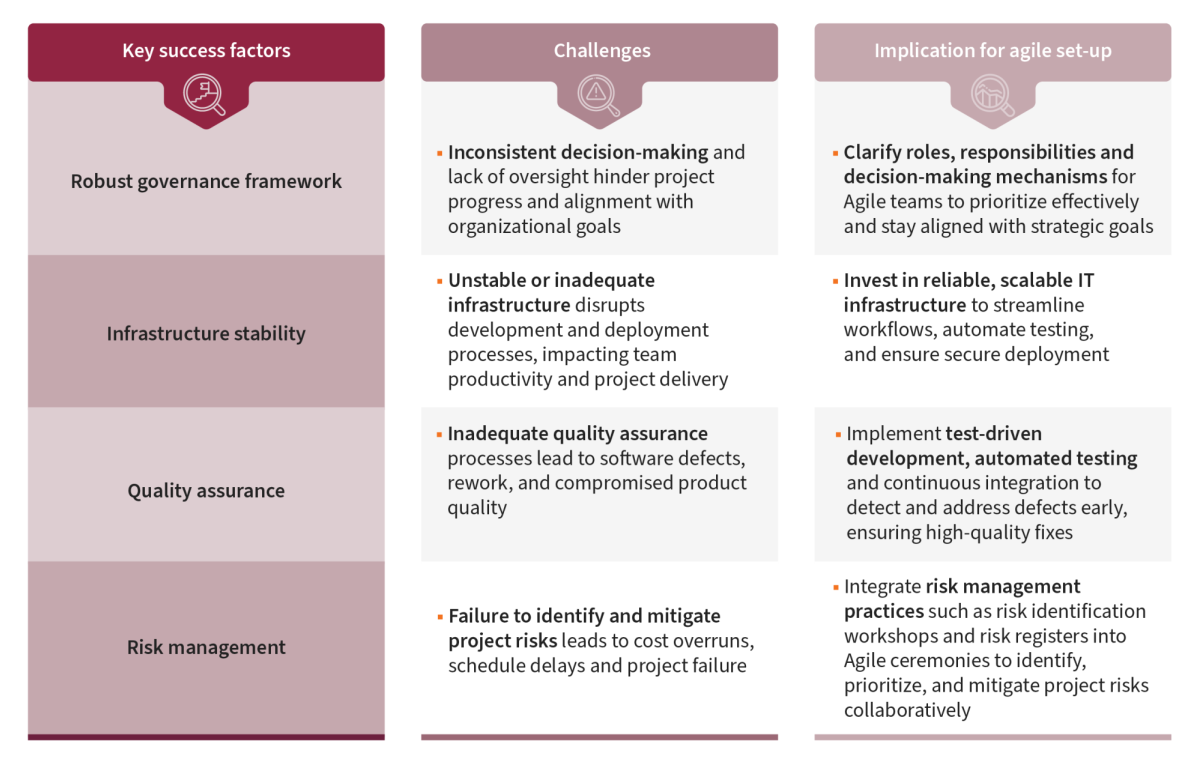

Implementing a robust governance framework streamlines decision-making, with quality assurance at every step ensuring optimal organizational value. Scalability considerations allow for seamless operational expansion, supporting growth and evolving requirements, alongside effective risk management.

These are some key considerations for agile efficiency:

Figure 4: Key success factors when implementing agile with foundational priorities

4. Operational excellence as a priority

If you are prioritizing operational excellence, you should aim to oversee the execution of day-to-day tasks and processes to deliver value to clients and maintain operational stability within the organization.

Your focus areas might include:

- Day-to-day delivery

- Compliance

- User satisfaction

Examples of initiatives you might pursue:

- Enhance compliance monitoring processes to meet regulatory requirements

- Launch employee training and development programs to improve service delivery

- Implement a client feedback system to identify areas for service improvement

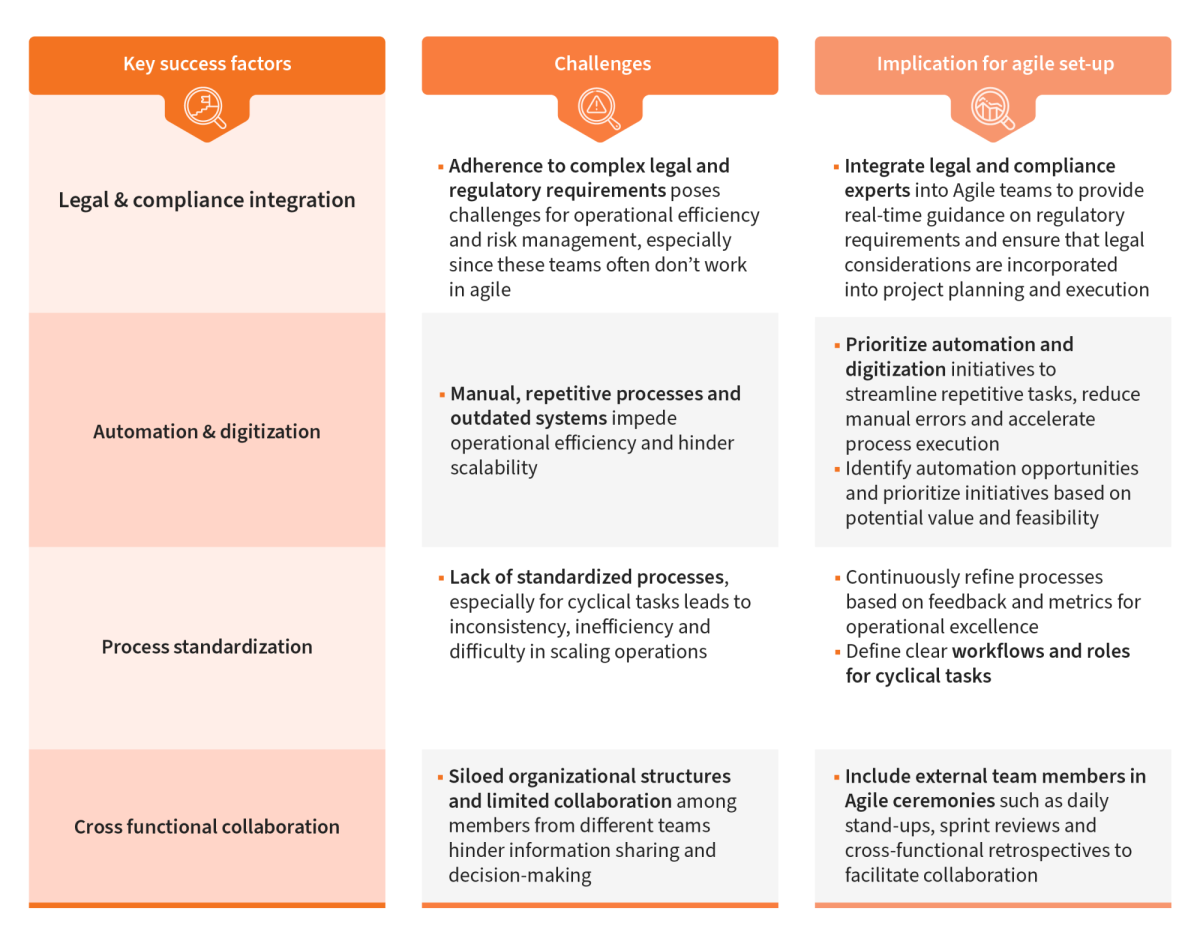

Engaging stakeholders like legal and compliance teams goes beyond agile methodologies. Open communication and cross-functional collaboration optimize workflows, mitigate risks, and drive continuous improvement. Standardizing processes and automating tasks enhance efficiency, especially for cyclical operations.

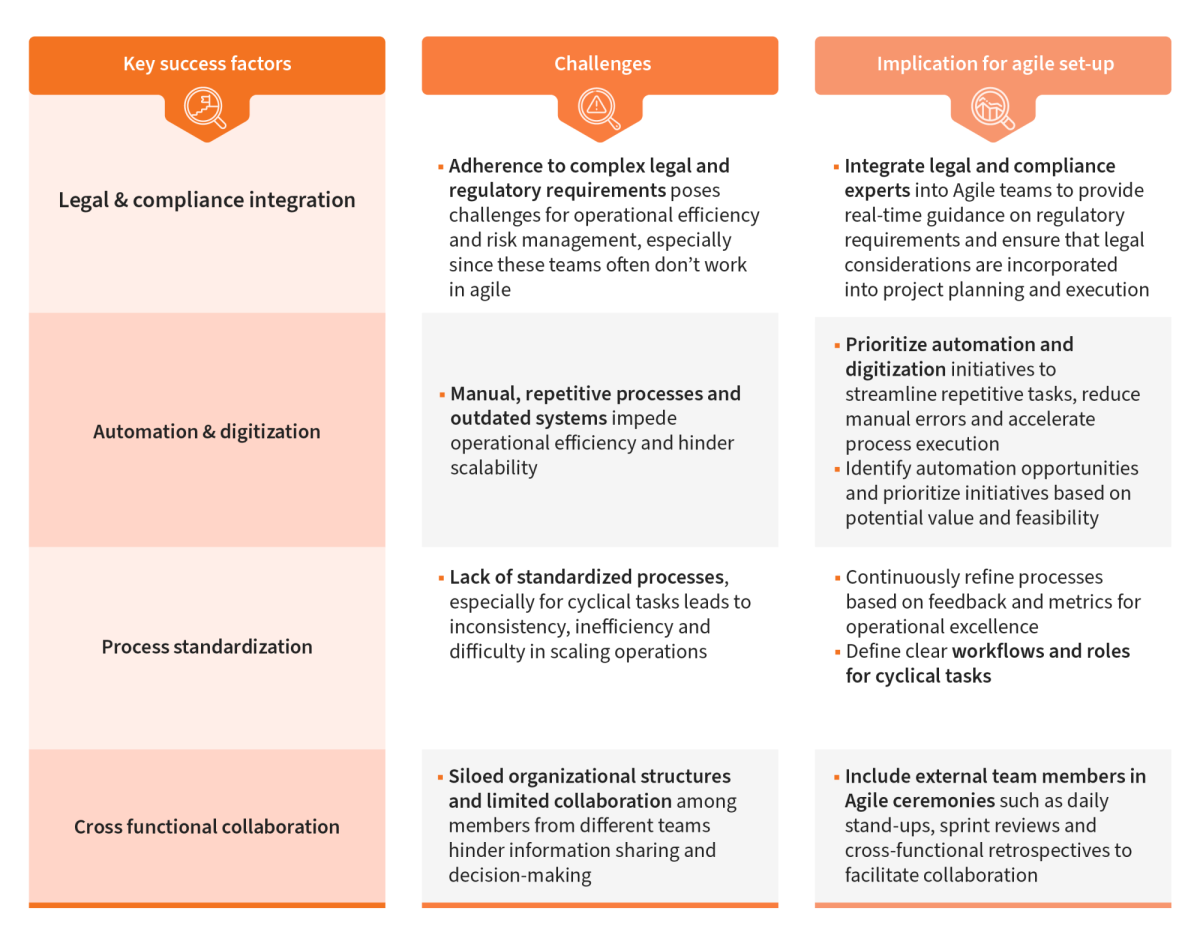

These are some considerations for agile efficiency:

Figure 5: Key success factors when implementing agile with operational priorities

Synpulse understands that each organization is unique, with distinct goals and aspirations. That is why agility is not a one-size-fits-all solution. It is a customized roadmap tailored to your specific needs.

Whether you are starting from scratch or optimizing your current agile setup, our expertise in the financial services industry uniquely positions us to guide you through the complexities of agile transformation.

Ready to transform? Schedule a call with one of our experts today!

Agility is more than just a buzzword for wealth management organizations; it is the key to achieving remarkable growth and success.

Agility empowers organizations to:

- Stay ahead of the curve: identify opportunities and proactively respond to market shifts.

- Enhance client experience: deliver personalized experiences that drive loyalty and satisfaction.

- Drive operational efficiency: streamline processes, reducing waste and optimizing resource allocation.

- Foster a culture of innovation: nurture experimentation, creativity and continuous improvement.

However, there is no one-size-fits-all approach to agile transformation or refresh. Different organizations have different considerations and unique challenges depending on their goals.

Generally, wealth management organizations have four types of priorities. It is essential to prioritize one main objective at a time, which will vary based on the specific nature of the project at hand.

Figure 1: Wealth management organizational priorities

1. Innovation as priority

If you are prioritizing innovation, you should actively generate and implement new ideas, technologies, and strategies to meet the evolving needs of clients and stay ahead of market trends.

Your focus areas might include:

- Continuous exploration

- Technical capability acquisition

- User-centricity

Examples of initiatives you might pursue:

- Develop a mobile app with AI-driven investment recommendations

- Pilot a machine learning algorithm for predicting market trends

- Create a robo-advisor platform for automated investment management tailored to Gen Z investors

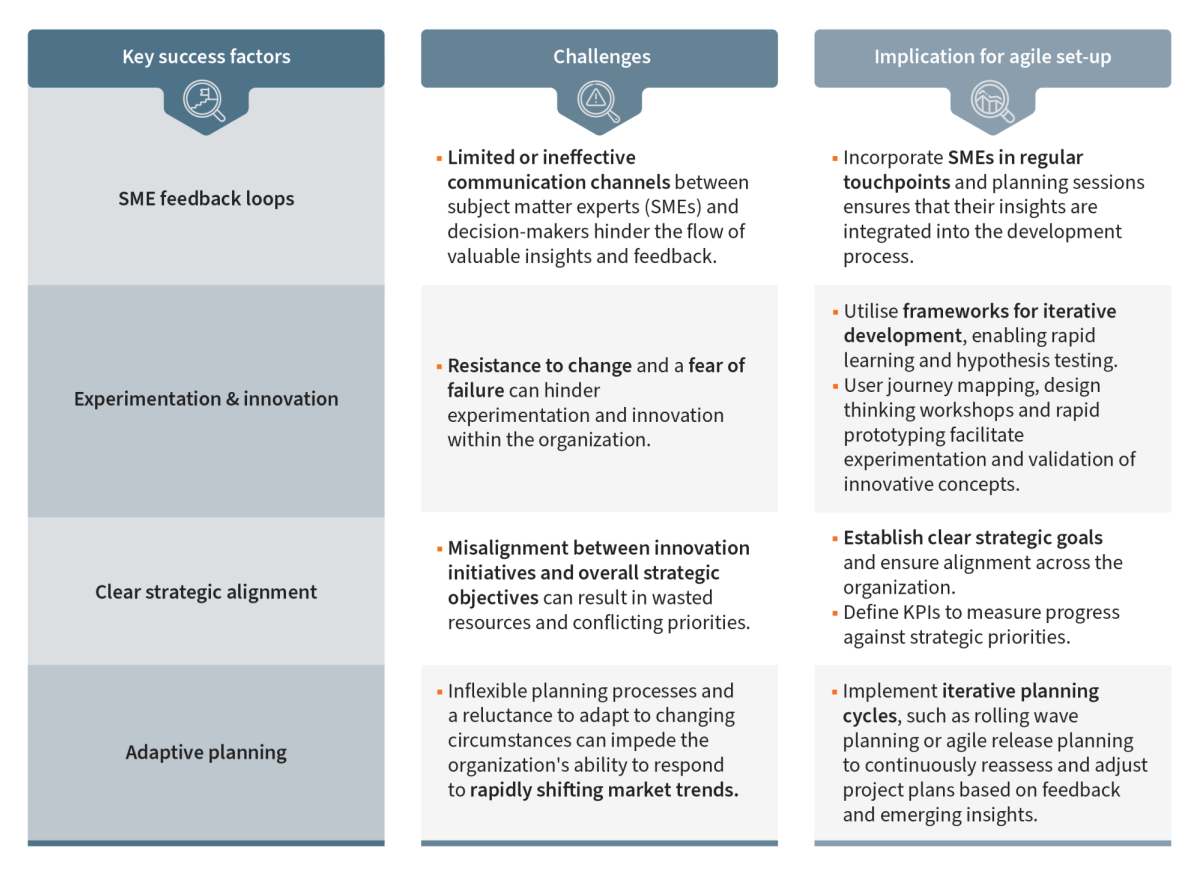

Flexibility in planning is essential to adapt to rapidly changing trends while maintaining a robust strategic direction ensures alignment with overall company goals. Innovative subject matter experts require deep content knowledge and a willingness to embrace experimentation and ambiguity. Establishing robust SME feedback loops is critical as they drive forward-thinking initiatives and help navigate emerging challenges effectively.

Therefore, some considerations for agile efficiency if you have innovative goals are:

Figure 2: Key success factors when implementing agile with innovative priorities

2. Strategic development as priority

If you are prioritizing strategic development, you should spend your time making informed decisions and executing long-term plans that align with your overarching business goals, client objectives, and market dynamics.

Your focus areas might include:

- Strategic agility

- Product development

- Expand user base

Examples of initiatives you might pursue:

- Expand wealth management services into emerging markets with high growth potential

- Enhance or building a mobile application to increase and capture client engagement

- Form strategic partnerships with tech companies to enhance digital capabilities and stay competitive

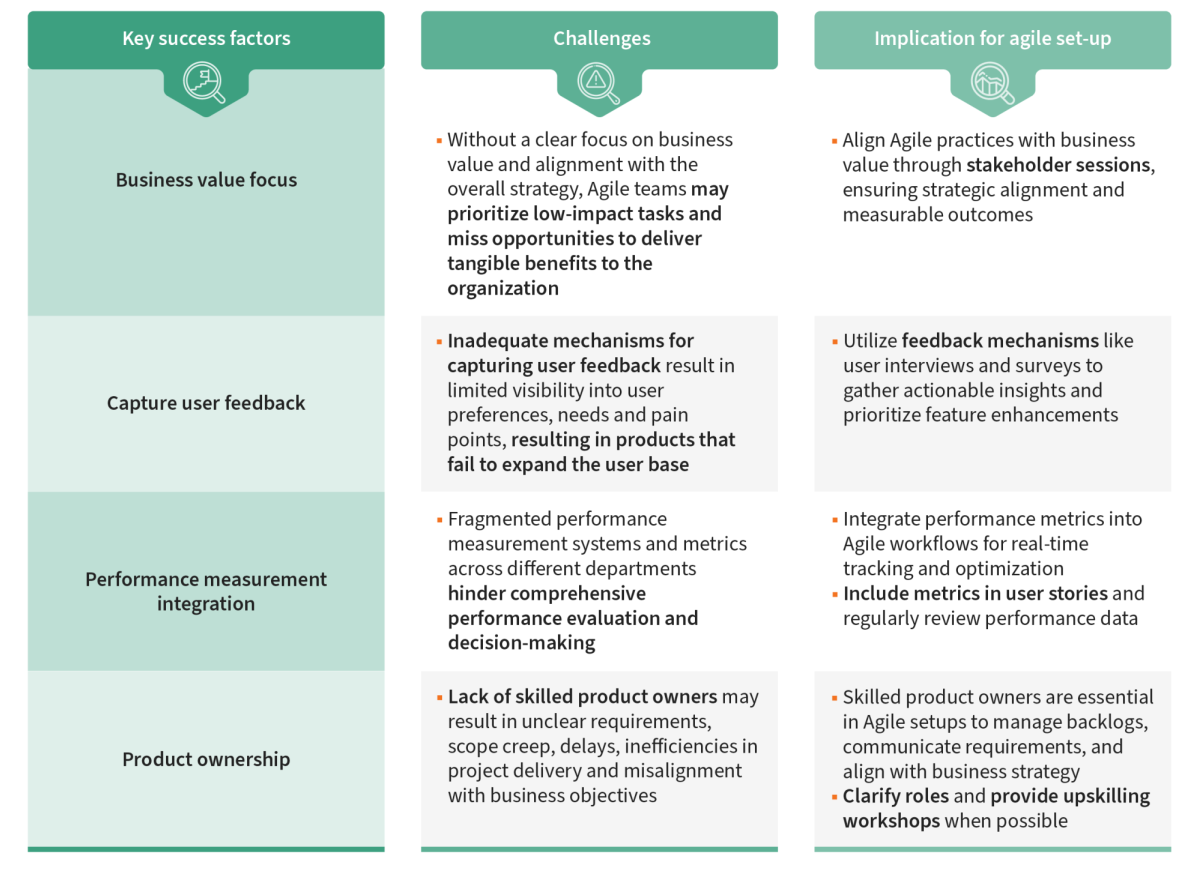

Initiatives contributing to company growth, particularly through customer acquisition, should prioritize capturing user feedback and focusing on business value. Emphasizing product ownership skills enables efficient and iterative product development, while measuring performance defines success. These are some key considerations for agile efficiency:

Figure 3: Key success factors when implementing agile with strategic priorities

3. Foundational reinforcement as priority

If you are prioritizing foundational reinforcement, you should build something that serves as the backbone of the enterprise, providing essential services, infrastructure, and support systems that underpin the delivery of wealth management solutions to clients.

Your focus areas might include:

- Enhance functionality

- Manage risk

- IT integration

Examples of initiatives you might pursue:

- Implement a comprehensive client data management platform

- Upgrade legacy systems to improve data security and compliance

- Enhance reporting and analytics capabilities for better client insights

Implementing a robust governance framework streamlines decision-making, with quality assurance at every step ensuring optimal organizational value. Scalability considerations allow for seamless operational expansion, supporting growth and evolving requirements, alongside effective risk management.

These are some key considerations for agile efficiency:

Figure 4: Key success factors when implementing agile with foundational priorities

4. Operational excellence as a priority

If you are prioritizing operational excellence, you should aim to oversee the execution of day-to-day tasks and processes to deliver value to clients and maintain operational stability within the organization.

Your focus areas might include:

- Day-to-day delivery

- Compliance

- User satisfaction

Examples of initiatives you might pursue:

- Enhance compliance monitoring processes to meet regulatory requirements

- Launch employee training and development programs to improve service delivery

- Implement a client feedback system to identify areas for service improvement

Engaging stakeholders like legal and compliance teams goes beyond agile methodologies. Open communication and cross-functional collaboration optimize workflows, mitigate risks, and drive continuous improvement. Standardizing processes and automating tasks enhance efficiency, especially for cyclical operations.

These are some considerations for agile efficiency:

Figure 5: Key success factors when implementing agile with operational priorities

Synpulse understands that each organization is unique, with distinct goals and aspirations. That is why agility is not a one-size-fits-all solution. It is a customized roadmap tailored to your specific needs.

Whether you are starting from scratch or optimizing your current agile setup, our expertise in the financial services industry uniquely positions us to guide you through the complexities of agile transformation.

Ready to transform? Schedule a call with one of our experts today!