Loading Insight...

Insights

Insights

Cyber insurance is one of the fastest growing insurance segments globally. It is designed to protect individuals and businesses from the repercussions that come with attacks on their information technology and associated assets. The market is in its early stages and has significant potential for insurers worldwide.

yber insurance, once a niche offering, has become one of the fastest-growing subsectors of the global insurance market. It holds significant growth potential as it addresses large and persistent unmet protection gaps.

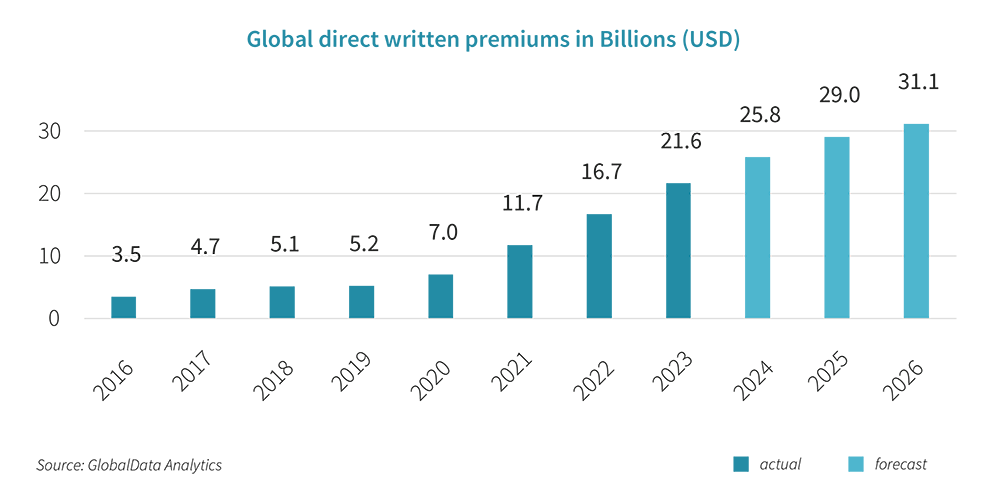

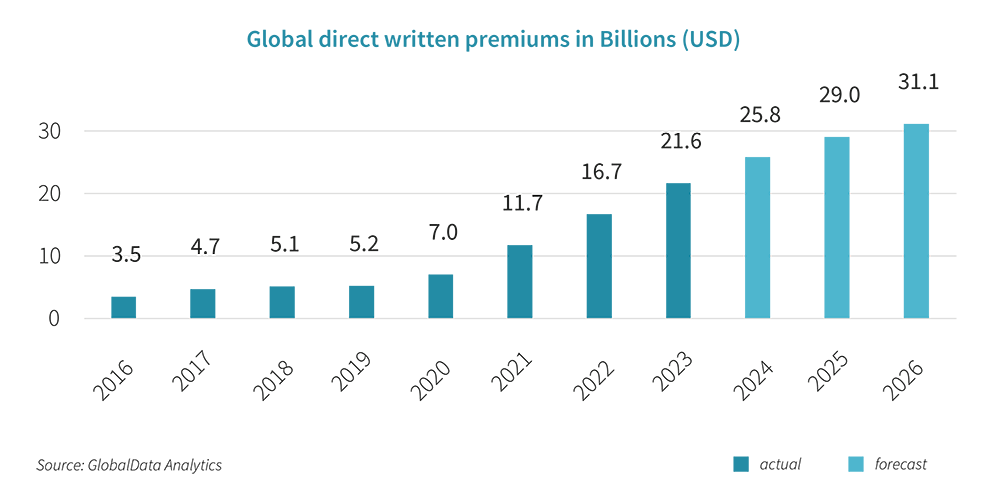

Market projections suggest a substantial rise in cyber insurance, with estimated direct written premiums set to reach USD 31.1 billion by 2026 globally (see Figure 1). This growth emphasises the growing importance of cyber insurance as a critical aspect of risk management.

Figure 1: Key market statistics

The lack of long-term statistics and actuarial information as well as the increasing number and scale of cyber-attacks make it very difficult for insurers to adequately assess, model, price cyber risks, and manage their underwritten cyber risk portfolio. Insurers are therefore often reluctant to play a central role in this growing sub-sector or to enter it at all.

However, at Synpulse, we believe that with the right strategic approach and a holistic target operating model (TOM) for cyber insurance equipped with the appropriate capabilities, insurers have the right to play and win in this space, which is currently still more of a blue ocean than a red one.

That is why we have developed our Synpulse Cyber Insurance Factsheet to shed light on this rapidly evolving field. It provides insights and analyses to help insurers and other industry players navigate the complexities of cyber risk. It provides a comprehensive overview of the various cyber threats and outlines potential risks, losses and damages that insurers and policyholders could face in the event of a cyber-attack to promote a better understanding of these pervasive risks.

The Synpulse Cyber Insurance Factsheet addresses these key challenges by defining different strategic approaches from exploratory to conglomerate, which insurers can adopt in the cyber insurance space. It outlines a holistic solution framework with specific capabilities along the E2E insurance value chain. It also addresses transversal business functions that insurers need to navigate the complex landscape of cyber risks and develop a resilient and forward-looking insurance offering.

Our factsheet provides industry players, whether experienced professionals or new entrants, with valuable and actionable insights from successfully implemented cyber insurance strategies and solutions.

What is covered in the factsheet:

- Potential cyber threats & their impact

- Trends shaping the market

- Challenges faced by insurers

- Strategic approaches for market entry

- Synpulse Cyber Insurance Framework®

This factsheet is your gateway to understanding the lucrative yet intricate world of cyber insurance. Leverage our actionable insights derived from extensive industry knowledge to fortify your cyber insurance strategy. Download the factsheet now.

We understand the intricacies and challenges posed by cyber risks in today's interconnected world. If you are seeking guidance or further insights into cyber insurance strategies, our team at Synpulse is here to assist. Contact us to start the conversation.

Cyber insurance is one of the fastest growing insurance segments globally. It is designed to protect individuals and businesses from the repercussions that come with attacks on their information technology and associated assets. The market is in its early stages and has significant potential for insurers worldwide.

yber insurance, once a niche offering, has become one of the fastest-growing subsectors of the global insurance market. It holds significant growth potential as it addresses large and persistent unmet protection gaps.

Market projections suggest a substantial rise in cyber insurance, with estimated direct written premiums set to reach USD 31.1 billion by 2026 globally (see Figure 1). This growth emphasises the growing importance of cyber insurance as a critical aspect of risk management.

Figure 1: Key market statistics

The lack of long-term statistics and actuarial information as well as the increasing number and scale of cyber-attacks make it very difficult for insurers to adequately assess, model, price cyber risks, and manage their underwritten cyber risk portfolio. Insurers are therefore often reluctant to play a central role in this growing sub-sector or to enter it at all.

However, at Synpulse, we believe that with the right strategic approach and a holistic target operating model (TOM) for cyber insurance equipped with the appropriate capabilities, insurers have the right to play and win in this space, which is currently still more of a blue ocean than a red one.

That is why we have developed our Synpulse Cyber Insurance Factsheet to shed light on this rapidly evolving field. It provides insights and analyses to help insurers and other industry players navigate the complexities of cyber risk. It provides a comprehensive overview of the various cyber threats and outlines potential risks, losses and damages that insurers and policyholders could face in the event of a cyber-attack to promote a better understanding of these pervasive risks.

The Synpulse Cyber Insurance Factsheet addresses these key challenges by defining different strategic approaches from exploratory to conglomerate, which insurers can adopt in the cyber insurance space. It outlines a holistic solution framework with specific capabilities along the E2E insurance value chain. It also addresses transversal business functions that insurers need to navigate the complex landscape of cyber risks and develop a resilient and forward-looking insurance offering.

Our factsheet provides industry players, whether experienced professionals or new entrants, with valuable and actionable insights from successfully implemented cyber insurance strategies and solutions.

What is covered in the factsheet:

- Potential cyber threats & their impact

- Trends shaping the market

- Challenges faced by insurers

- Strategic approaches for market entry

- Synpulse Cyber Insurance Framework®

This factsheet is your gateway to understanding the lucrative yet intricate world of cyber insurance. Leverage our actionable insights derived from extensive industry knowledge to fortify your cyber insurance strategy. Download the factsheet now.

We understand the intricacies and challenges posed by cyber risks in today's interconnected world. If you are seeking guidance or further insights into cyber insurance strategies, our team at Synpulse is here to assist. Contact us to start the conversation.