Loading Insight...

Insights

Insights

How does an insurer stay relevant as the demands of customers evolve? By becoming a NEOINSURER®.

Insurance evolves as customer demands shift

Traditional insurance, delivered traditionally, faces more and more decreasing customer relevance. Customers these days demand simple, lifestyle-oriented products and lean processes. To cope with this shift in demand, insurers must transform their traditional operations. Success will come to those that manage to couple their core value chain activities to customer journeys, select appropriate ecosystem partners, and leverage the new technological abilities of Open Insurance.

Insurers must embed their tailor-made offerings at the point of risk creation, which is where and when customers are most likely to buy. To help them master the transition from a traditional insurer to a NEOINSURER®, Synpulse has developed the business model NEOINSURANCE®.

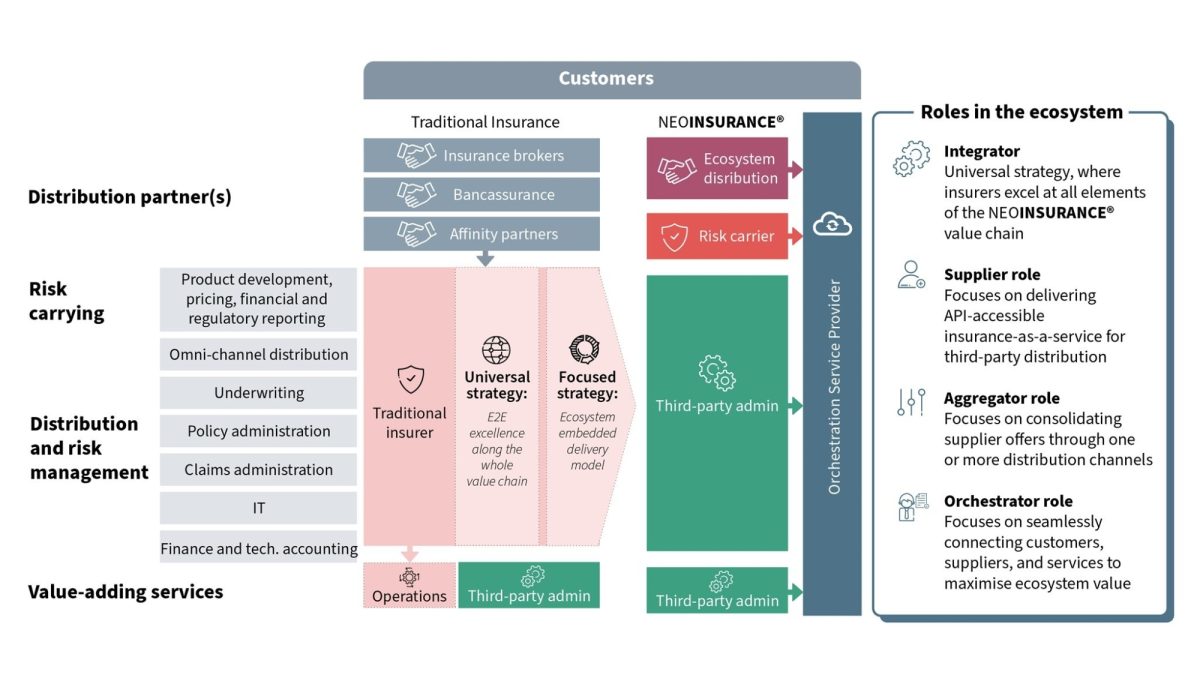

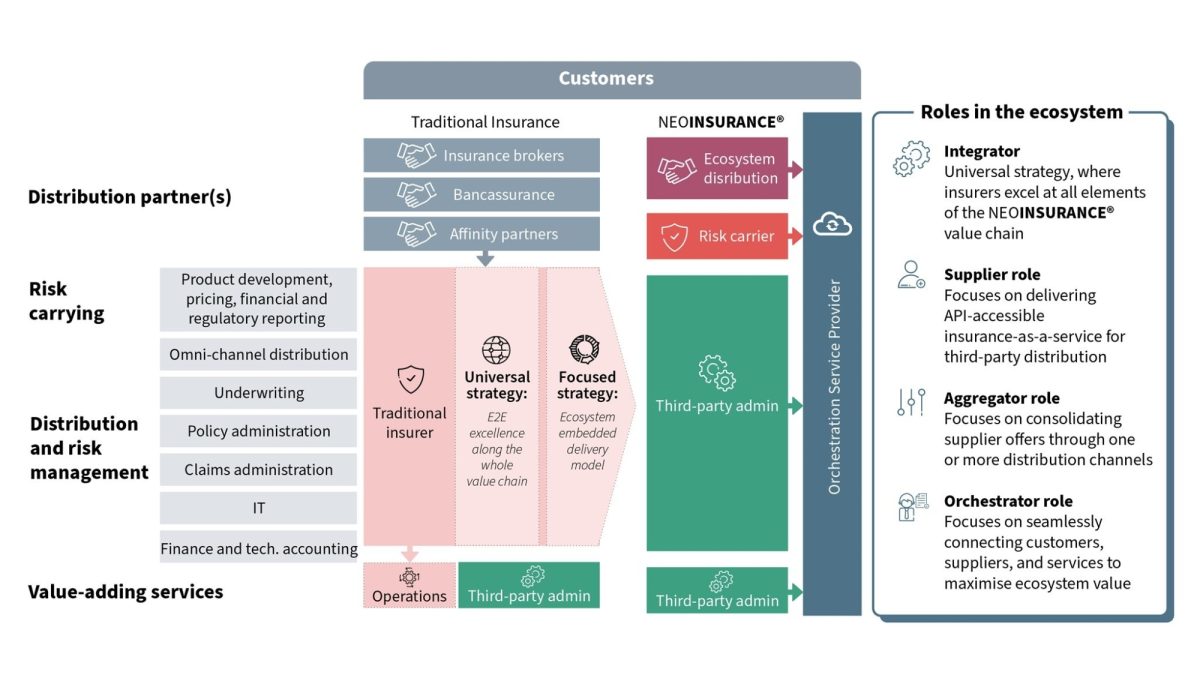

Traditional insurance vs. NEOINSURANCE®

Figure 1: The NEOINSURANCE® business model

Making the transformation from a traditional insurer to a NEOINSURER® prerequisites the development of a feasible operating model which is dependent on the selection of the strategic target role an NEOINSURER® aims to play in a specific ecosystem and line of business. When planning an NEOINSURER’s**®** future, it’s therefore crucial to be clear about its current and target position, and then work out the right transformation path to bridge the gap.

NEOINSURANCEINABOX® as an accelerator

Synpulse’s NEOINSURANCEINABOX® model brings together our suite of best-practice assets, tools, and methods enabling us to provide a structured approach to managing and accelerating digital transformations. It consists of modular components that can be flexibly tailored and deployed to each insurer’s individual transformation needs.

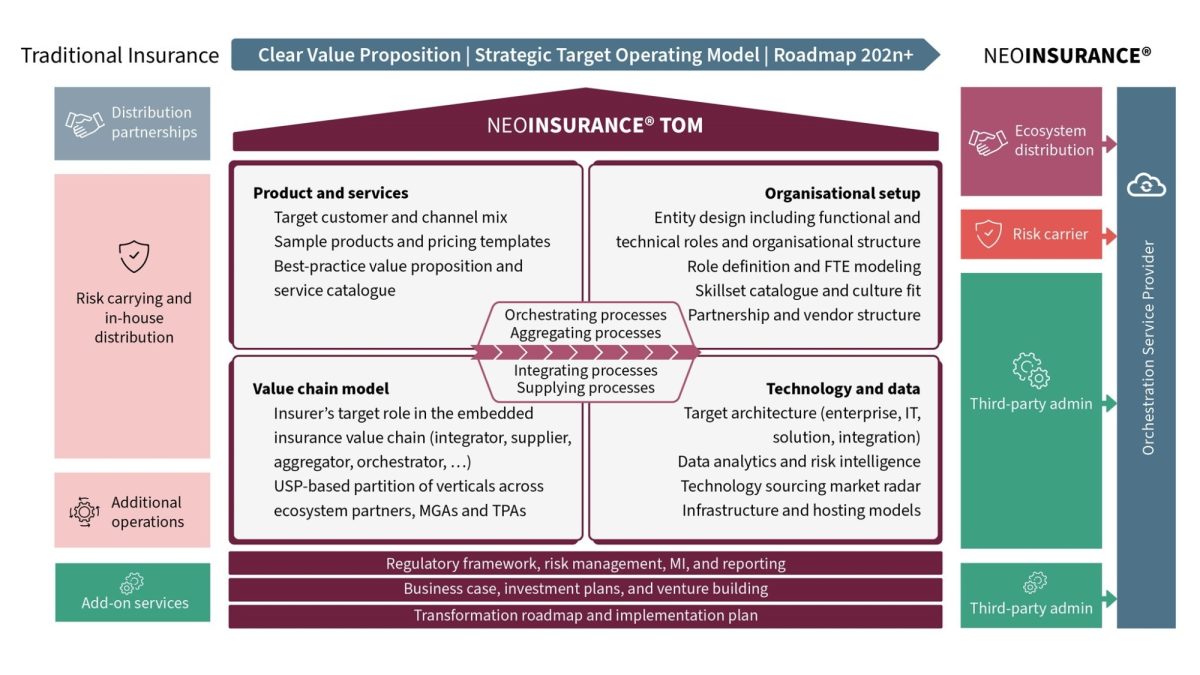

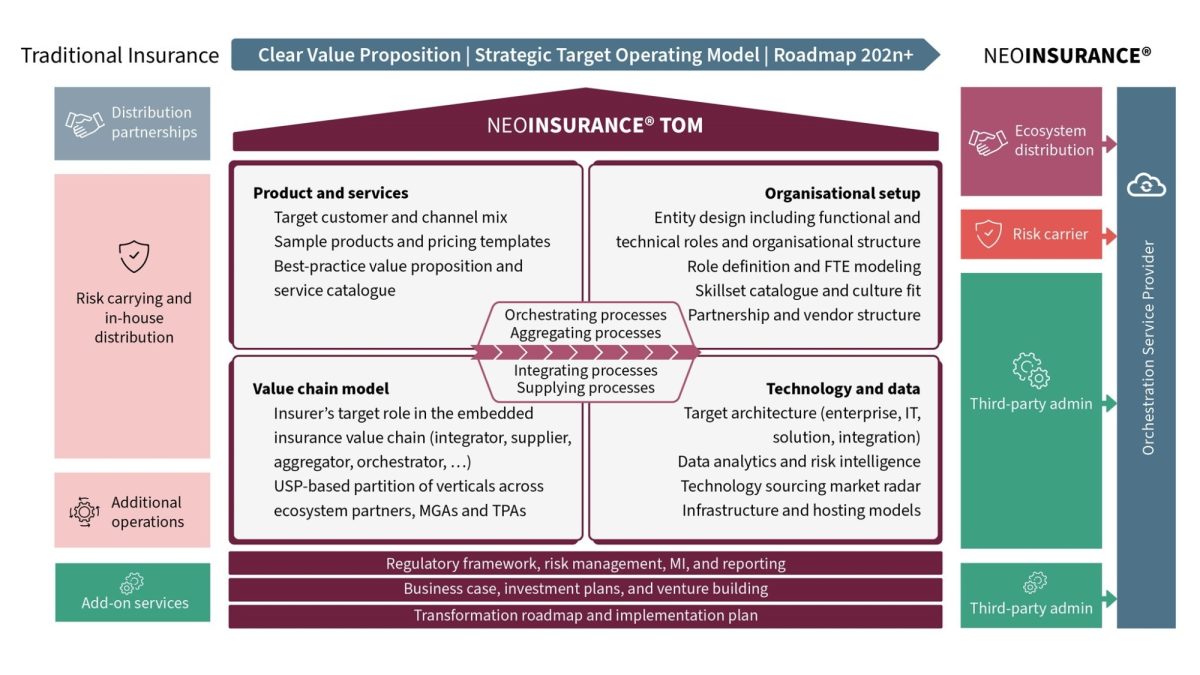

The NEOINSURANCEINABOX® suite

Figure 2: The NEOINSURANCEINABOX® suite

NEOINSURANCEINABOX® is comprehensive toolset, covering all aspects of the transition into a NEOINSURER®, including:

- Target Operating Model (TOM): Defines the strategic direction and organizational pillars for the successful operation of a NEOINSURER® comprehending an actionable change management approach to navigate towards target state.

- Product & Pricing: Defines simplistic, lifestyle-oriented, and customer-centric product templates for embedded insurance, with advanced pricing mechanisms – such as dynamic pricing – to influence customers’ willingness to buy.

- Organizational Setup: Entity design, including definitions of functional & technical roles, skill catalogue and FTE plan required to successfully run a NEOINSURANCE® business model. Includes sourcing and partnership models to define the best fitting ecosystem partner & vendor mix complementing the insurer’s own USP.

- Value Chain Model: Outlines capabilities by target role and USP to optimally partition the value chain and verticals across complementing ecosystem partners, MGAs, and TPAs. Innovative end-to-end value chain models to depict customers’ life-time journey across ecosystem partners and beyond mere core insurance needs.

- Capability Model (Processes): Multi-layered process repository to fulfill scalable NEOINSURANCE® processes and services, including NEOINSURANCE®-specific performance metrics & SLAs. Serves as a structured, target role-based fit-gap analysis and maturity assessment against industry-leading best-practices.

- Technology & Data: Target Architecture blueprints emphasizing modularity, scalability, extensibility and agility that suit the NEOINSURANCE® TOM from an IT and data governance perspective. Insurtech platform capability assessment framework to facilitate make-or-buy decision.

- Regulatory Framework, Risk Management, MI & Reporting: Forward-looking regulatory framework, due diligence, and risk management checklists to enable full conformity with country-specific and regional infrastructure, hosting, and data protection requirements.

- Business Case, Investment Plans & Venture Building: Short-, mid- and long-term business projections based on NEOINSURANCE® market-relevant opportunity score cards and stage-gated investment proposal for stakeholder decision making and venture capital negotiations.

- Transformation Roadmap & Implementation Plan: Staggered transformation roadmap and implementation plan with entry/exit criteria to incrementally increase NEOINSURANCE® readiness and level of maturity.

Benefits of the NEOINSURANCEINABOX® model

NEOINSURANCEINABOX® jump-starts the next steps on an insurer’ digital transformation and innovation agenda. It measurably improves an insurer’s operational excellence by aligning any digital transformation initiative to market dynamics and shifts in customer demand, and by seizing new opportunities and innovation potential by reacting to the needs of the open, ecosystem-driven world in shorter reaction cycles than ever before.

The NEOINSURANCEINABOX® suite continually evolves with the latest insights and thought leadership from our NEOINSURANCE® Innovation Center and worldwide expert network, offering holistic, multi-dimensional digital transformation support across all domains and lines of business.

Synpulse’s NEOINSURANCE® suite is empowered by Synpulse8, our tech powerhouse for technology advisory and delivery excellence, providing connectivity, integration, NextGen Insurtech partnerships, software products, managed platforms, and services supporting ecosystem-driven insurance value chains. Synpulse8 enables a seamless transition from concept and design to delivery and managed services leveraging the latest technologies and trends from the Open Insurance practice.

Embark your next digital transformation step with us

NEOINSURANCEINABOX® facilitates the successful delivery of any digital transformation initiative, ensuring that you get quality, target-oriented, and cost-efficient outcomes. Our experts will help you accelerate your readiness with the practice-proven assets, methods, and deliverables outlined earlier in this article.

Contact us now to benefit from Synpulse’s NEOINSURANCE® expertise embodied in the NEOINSURANCEINABOX® suite.

How does an insurer stay relevant as the demands of customers evolve? By becoming a NEOINSURER®.

Insurance evolves as customer demands shift

Traditional insurance, delivered traditionally, faces more and more decreasing customer relevance. Customers these days demand simple, lifestyle-oriented products and lean processes. To cope with this shift in demand, insurers must transform their traditional operations. Success will come to those that manage to couple their core value chain activities to customer journeys, select appropriate ecosystem partners, and leverage the new technological abilities of Open Insurance.

Insurers must embed their tailor-made offerings at the point of risk creation, which is where and when customers are most likely to buy. To help them master the transition from a traditional insurer to a NEOINSURER®, Synpulse has developed the business model NEOINSURANCE®.

Traditional insurance vs. NEOINSURANCE®

Figure 1: The NEOINSURANCE® business model

Making the transformation from a traditional insurer to a NEOINSURER® prerequisites the development of a feasible operating model which is dependent on the selection of the strategic target role an NEOINSURER® aims to play in a specific ecosystem and line of business. When planning an NEOINSURER’s**®** future, it’s therefore crucial to be clear about its current and target position, and then work out the right transformation path to bridge the gap.

NEOINSURANCEINABOX® as an accelerator

Synpulse’s NEOINSURANCEINABOX® model brings together our suite of best-practice assets, tools, and methods enabling us to provide a structured approach to managing and accelerating digital transformations. It consists of modular components that can be flexibly tailored and deployed to each insurer’s individual transformation needs.

The NEOINSURANCEINABOX® suite

Figure 2: The NEOINSURANCEINABOX® suite

NEOINSURANCEINABOX® is comprehensive toolset, covering all aspects of the transition into a NEOINSURER®, including:

- Target Operating Model (TOM): Defines the strategic direction and organizational pillars for the successful operation of a NEOINSURER® comprehending an actionable change management approach to navigate towards target state.

- Product & Pricing: Defines simplistic, lifestyle-oriented, and customer-centric product templates for embedded insurance, with advanced pricing mechanisms – such as dynamic pricing – to influence customers’ willingness to buy.

- Organizational Setup: Entity design, including definitions of functional & technical roles, skill catalogue and FTE plan required to successfully run a NEOINSURANCE® business model. Includes sourcing and partnership models to define the best fitting ecosystem partner & vendor mix complementing the insurer’s own USP.

- Value Chain Model: Outlines capabilities by target role and USP to optimally partition the value chain and verticals across complementing ecosystem partners, MGAs, and TPAs. Innovative end-to-end value chain models to depict customers’ life-time journey across ecosystem partners and beyond mere core insurance needs.

- Capability Model (Processes): Multi-layered process repository to fulfill scalable NEOINSURANCE® processes and services, including NEOINSURANCE®-specific performance metrics & SLAs. Serves as a structured, target role-based fit-gap analysis and maturity assessment against industry-leading best-practices.

- Technology & Data: Target Architecture blueprints emphasizing modularity, scalability, extensibility and agility that suit the NEOINSURANCE® TOM from an IT and data governance perspective. Insurtech platform capability assessment framework to facilitate make-or-buy decision.

- Regulatory Framework, Risk Management, MI & Reporting: Forward-looking regulatory framework, due diligence, and risk management checklists to enable full conformity with country-specific and regional infrastructure, hosting, and data protection requirements.

- Business Case, Investment Plans & Venture Building: Short-, mid- and long-term business projections based on NEOINSURANCE® market-relevant opportunity score cards and stage-gated investment proposal for stakeholder decision making and venture capital negotiations.

- Transformation Roadmap & Implementation Plan: Staggered transformation roadmap and implementation plan with entry/exit criteria to incrementally increase NEOINSURANCE® readiness and level of maturity.

Benefits of the NEOINSURANCEINABOX® model

NEOINSURANCEINABOX® jump-starts the next steps on an insurer’ digital transformation and innovation agenda. It measurably improves an insurer’s operational excellence by aligning any digital transformation initiative to market dynamics and shifts in customer demand, and by seizing new opportunities and innovation potential by reacting to the needs of the open, ecosystem-driven world in shorter reaction cycles than ever before.

The NEOINSURANCEINABOX® suite continually evolves with the latest insights and thought leadership from our NEOINSURANCE® Innovation Center and worldwide expert network, offering holistic, multi-dimensional digital transformation support across all domains and lines of business.

Synpulse’s NEOINSURANCE® suite is empowered by Synpulse8, our tech powerhouse for technology advisory and delivery excellence, providing connectivity, integration, NextGen Insurtech partnerships, software products, managed platforms, and services supporting ecosystem-driven insurance value chains. Synpulse8 enables a seamless transition from concept and design to delivery and managed services leveraging the latest technologies and trends from the Open Insurance practice.

Embark your next digital transformation step with us

NEOINSURANCEINABOX® facilitates the successful delivery of any digital transformation initiative, ensuring that you get quality, target-oriented, and cost-efficient outcomes. Our experts will help you accelerate your readiness with the practice-proven assets, methods, and deliverables outlined earlier in this article.

Contact us now to benefit from Synpulse’s NEOINSURANCE® expertise embodied in the NEOINSURANCEINABOX® suite.