Despite being quite widely implemented across the Asia-Pacific (APAC) jurisdictions for derivatives products, over-the-counter (OTC) trade reporting obligations remain at the top of the agenda of both regulators and financial institutions (FIs).

On the one hand, regulators aim to harmonise the reporting constraints across jurisdictions for global and systemic risk supervision. On the other hand, FIs seek to fulfil their reporting obligations and bring value back to the business through reporting data and finding effective and operational ways of cost-saving.

Last phase of implementation

In the last phase of implementation, OTC reporting has been broadly implemented across the APAC jurisdictions for derivative products.

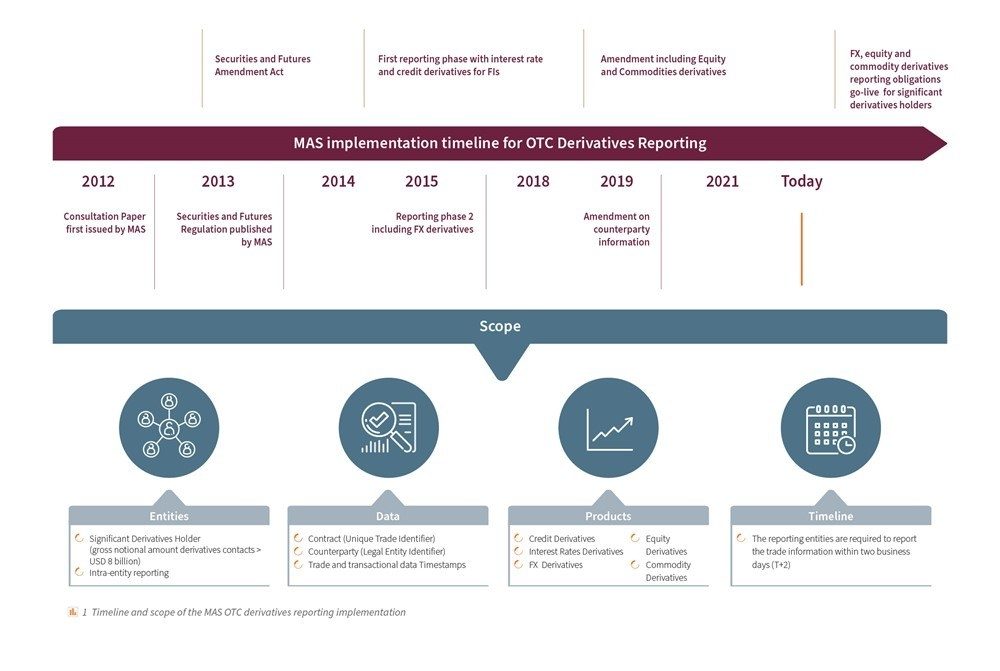

Since 2012, the reporting obligations for OTC derivatives contracts for most major APAC markets have followed the European Market Infrastructures Regulation (EMIR) model. However, the COVID-19 pandemic of 2020 has caused some delays in the adoption of late-stage phases by some regulators, such as the Monetary Authority of Singapore (MAS) (see Figure 1).[1]

The following are the derivatives reporting objectives in both the European Union (EU) and APAC:

- To shed light on “shadow banking” and operations that were out of the regulators’ scope, while pinpointing the potential counterparty risks

- To streamline and harmonise practices and data to report across counterparties via the compulsory reporting via trade repository (TR)

[1] Securities and Futures Act (Chapter 289) (Singapore Statues Online, 27 April 2020).

The constraints of multi-regime reporting for APAC FIs

I. APAC market participants are grappling with a plethora of OTC reporting constraints

A focus on APAC OTC derivatives reporting obligations across the jurisdictions shows how fragmented the markets are (see Figure 2):

Consequently, where a European bank would have to deal with only two sets of regulations in Western Europe (i.e., EU and Swiss regulations), an Asian bank with a presence in multiple APAC countries must comply with as many local regulations as places of operations, typically in Australia, Singapore, Hong Kong, Japan, and South Korea, which significantly increases their compliance costs.

As such, financial institutions with broad APAC market coverage need to produce multiple daily trade reports with various central trade repositories (TRs), depending on the jurisdictions they book or originate their trades.

Transactions reporting obligations in APAC have mainly focused on OTC derivatives since 2012. However, the scope is still evolving. For instance, last December, the Securities and Futures Commission (SFC) issued its consultation to introduce an OTC securities transactions reporting regime for shares listed on the Stock Exchange of Hong Kong (SEHK).[1]

APAC firms operating with European branches have also been impacted by the Securities Financing Transaction Regulation (SFTR), with the phased implementation that started in Q1 2020 for investment firms and credit institutions.[2] It is inevitable that reporting obligations are increasingly cumbersome for FIs in APAC, potentially holding them back from investing in other business areas.

II. Multiple reporting regimes increase the processes and data challenges of OTC reporting journeys

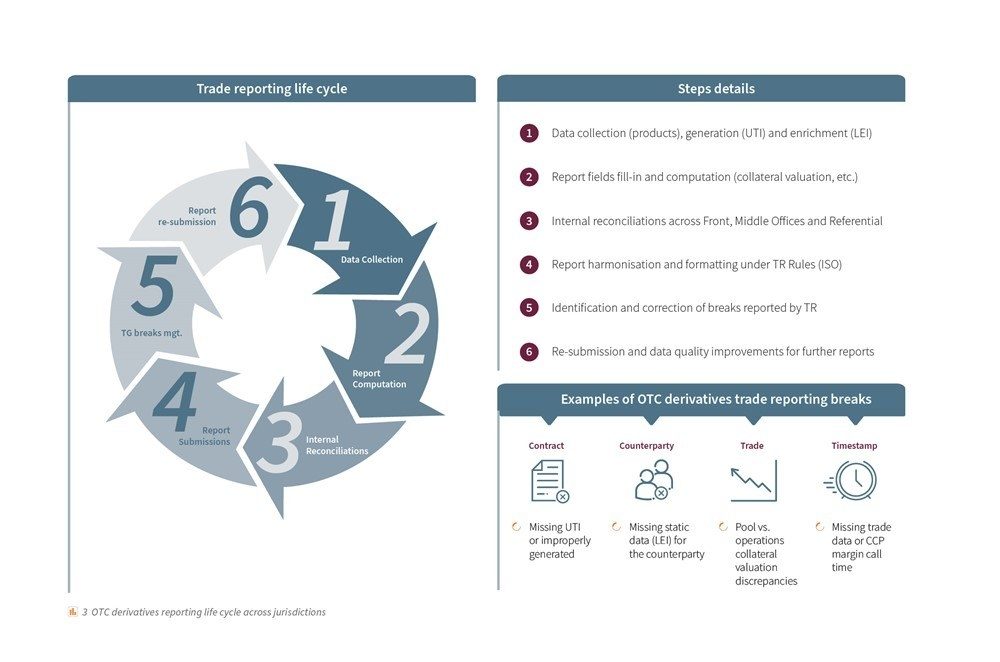

Faced with multiple OTC regulations across APAC, global banks must send multiple variations of reports to the different TRs. For each report, they must go through a demanding end-to-end report generation (see Figure 3) and face specific data challenges, such as:

- Data collection. Multiple static data must be sourced or generated ex nihilo (legal entity identifier, unique trade identifier)

- Data processing. Find synergies across the different reports to send regarding business rules, fields to report, and TRs to interact with

- Data cleansing. Data fields in error must be corrected timely and pro-actively both before (intraday checks) and after having been sent to the TR (trades in error are reverted usually on Trade Day +3)

[1] Consultation on proposals to (1) implement an investor identification regime at trading level for the securities market in Hong Kong and (2) introduce an over- the-counter securities transactions reporting regime for shares listed on the Stock Exchange of Hong Kong (SFC, 4 December 2020).

[2] ICMA Recommendations for Reporting under SFTR (ICMA, February 2021).

Solutions to tackle the multi-reporting challenges

The solutions to tackle the multi-reporting challenges stem from the data management initiatives of both regulators and financial institutions.

I. APAC regulators’ initiatives: fostering common data standards to alleviate the operational burdens

In the aftermath of the OTC derivatives domestic reporting roll-out, supra-national advisor entities started to call for global harmonisation. The objectives of common dataset elements are:

- To enable cross-jurisdictions analysis via the same sourcing rules and lessen the systemic market risks

- To facilitate reporting for FIs that can breakdown the data into different sets based on criticality and use leaner architecture for their reporting

This road to harmonisation was first initiated under the guidance of the Financial Stability Board (FSB) in 2014. Since the initiation of FSB, the Committee on Payments and Market Infrastructures (CPMI) and the International Organisation of Securities Commissions (IOSCO) have worked closely with market participants and regulators across the United States, Europe and Asia (Hong Kong, Japan, and Singapore) to propose a set of guidelines.

It was materialised in 2017[1] , with common data standards proposed for over-the-counter trade reporting, including:

- Unique trade identifier (UTI) common rules. As of today, in Australia, Australian Securities and Investments Commission (ASIC)-registered FIs can report their transactions via a universal trade identifier, a single identifier, an identifier used by the trading venue, or – if none of those are available – an internal identifier.

- Unique product identifier (UPI) code that is assigned to each distinct OTC derivative product to map reference data elements with specific values that describe the product.

- Legal entity identifier (LEI) reporting party obligations to map all OTC participants, especially in the case of delegated reporting.

- Other OTC critical data elements (CDE) for trading reporting, such as beneficiary, collateral valuation, clearing, etc.

These principles are afterwards translated into a technical implementation guide by local APAC regulators, such as the Interface Development Guide (AIDG) issued by the SFC for UTI standards.[2]

However, there is still a long way to go before a global and harmonised regulatory framework for OTC reporting can be achieved. Currently, the US Commodity Futures Trading Commission (CFTC) and European Securities and Markets Authority (ESMA) have only agreed on less than 50% of common data practice.[3] Yet, this leaves room for much higher discrepancies with Asian regulations, unless the parties agree on a simple alignment.

II. In-house FIs’ initiatives: striking a balance between cost-saving and regulatory obligation abidance with data management improvements

As the regulators chose a staggered approach towards the implementation of OTC trade reporting, the practice maturity across the different FIs does not stand on an equal footing. They largely depend on:

- The volume of the OTC derivatives operations dealt by, or delegated, to the FI

- A firm legal structure (e.g., asset manager, security firm, non-financial company, etc.), with incumbent obligations

As such, some financial institutions that have been reporting for a few years may focus more on challenges that come after the reporting, such as report automation, data quality, and business value. Conversely, there are FIs new to reporting that will grapple with the more fundamental requirements, such as identifying what needs to be reported and how data is extracted.

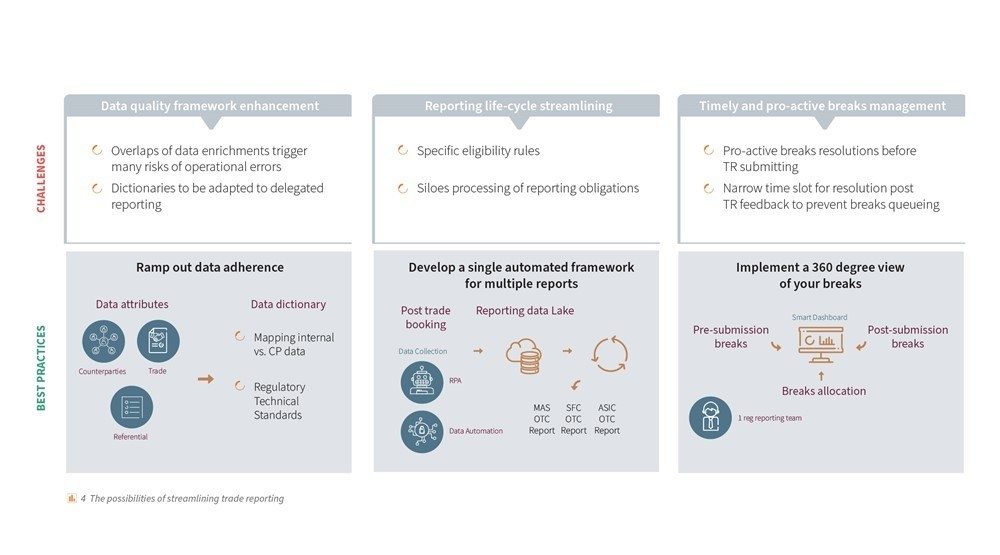

Different solutions can be explored by the more advanced FIs to articulate data quality with operational efficiency improvements (see Figure 4):

- Data quality framework enhancement. Develop common data dictionaries and pro-actively address data corrections before TR feedback

- Reporting life-cycle streamlining. Explore automation paths for the different reporting generation steps.

- End-to-end error supervision. Develop a central smart dashboard for investigation and automated task allocation for correction.

[1] CPMI and Board of IOSCO Consultative report: Harmonisation of critical OTC derivatives data elements (other than UTI and UPI) – third batch (Bank for International Settlements, June 2017).

[2] Updated Technical Specifications for Reporting (2021-03-23) (HKMA, 23 March 2021).

[3] The Devil Will Be in The Detail When It Comes to the Harmonisation of OTC Derivatives Reporting (DerivSource, 10 March 2021).

These best practices can be supported by regtech integration, with one-stop solutions covering submission to numerous trade repositories, data management, or reconciliation. Regulators are currently pushing for firms to invest to keep the maximum level of counterparty oversight in-house. The HKMA, for instance, recently issued a two-year roadmap to “harness the power of regtech for compliance departments”.[1]

[1] The HKMA developed a two-year roadmap to promote Regtech adoption (HKMA, 3 November 2020).

What’s next for OTC trade reporting in APAC

From a regulatory perspective, over-the-counter reporting obligations are expected to embed more and more activities, such as securities financing transactions (SFTs) in Europe.

From a technology standpoint, the adoption of blockchain networks is also an option to tackle the rising expectations towards regulatory authorities and the high costs of regulatory compliance. Distributed ledger technology (DLT) offers the possibility to significantly improve regulatory reporting by providing high data granularity, high data quality, and a transparent view of live transactions.

With DLT fully implemented, we can expect a major disruption in the reporting life cycle with counterparties connected in real-time and the regulators informed accordingly, breaking the legacy cycle of reporting data collection that is followed by computation and submission.