Insights from the Backbase and Synpulse partnership.

This is the third article in a series of five, where we look at the first of the three valuable lessons learned from our real-life experience with helping a client set up an engagement banking platform.

Takeaway 1: Plan for more than software delivery

The first of our three key takeaways on how to set up an EBP as part of your bank's digital transformation programme lies in planning for more than just software delivery.

Delivering a new digital banking and client engagement platform isn’t only about the technical delivery of software. It also involves a transformation of the client proposition. For instance, new client channels and engagement processes, as well as additional digital sales processes, are not only required but often among the reasons for the change in the first place.

Other changes beyond software delivery that are part of our programmes include:

- Changing the ways of working within the bank

- Changing the front-to-back process and operating model

- Redesigning the architectural landscape

- Modularising the application landscape

- Failing fast or building in flexibility through agile adoption

Our key takeaway

When you’re introducing a new digital banking platform with a deep impact on both the front and the back of the bank, you need to extend the classic software delivery plan. This includes scoping, delivering, testing with (in this case) migration, cutover, increments in sprints, and changes in the business operating model.

Backbase and Synpulse support the intake, inception, foundation, training, and delivery project phases to meet the specific needs of the bank’s delivery requirements.

Added to that, Synpulse contributes through its expertise in:

- Implementation of project management

- Delivery stream leadership

- Business analysis

- Banking end-to-end architecture

- Collaboration model or ways of working (see takeaway 2)

- Testing, training, and migration

- Bank operating model

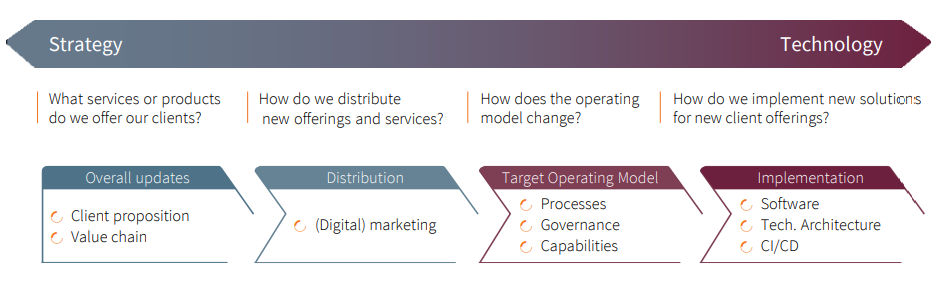

The diagram in Figure 1 shows the guiding questions and high-level areas when setting up an engagement banking platform.

In our next post, we will look at the second key takeaway, which is about structuring your EBP delivery teams.

Digital banking will be the dominant channel for your clients going forward

Banks, which have launched on the Backbase engagement banking platform, have improved their KPIs significantly, with 90% lower channel maintenance costs, 33% lower IT costs for new app builds, and 60% faster time to market.

The digital bank is the bank of the future. When planning or running such a programme, our recommendation is to focus on a plan beyond delivery, establish clear ways of working between all the teams involved, and attract and build up specific platform skills early.

If you’re interested in finding out more and learning how this approach can benefit the digital transformation of your bank, feel free to contact us.