As investment and retail banking trends continue to evolve, building societies are starting to feel the ripple effects. It's crucial for building societies to consider going digital, especially with the advancements in AI technologies such as ChatGPT and Google's Bard. The rise of environmental, social, and governance (ESG) reporting and the increasing focus on social responsibility in the financial industry can also be aided by technological development. The economic crisis caused by the pandemic affected many UK homeowners who are struggling with steep interest rates and potential job losses. Today, building societies face unprecedented macro-economic challenges, increased regulatory scrutiny and low customer loyalty, creating the perfect catalyst to enact change, we must discuss what lies ahead.

Landscape

Building societies are financial institutions that have been a part of the UK's financial landscape for more than two centuries. As mutual organisations, they are owned by their members and operate to benefit their members rather than to maximise shareholder profits. This unique structure has enabled building societies to prioritise customer service, foster strong relationships with their members, and uphold a commitment to corporate social responsibility (CSR). Building societies often engage in philanthropic activities, sponsorships, and charitable partnerships to support the communities in which they operate. This commitment to CSR aligns with the values of its members and reinforces the sense of community ownership and social responsibility.

Building societies primarily offer mortgage loans and savings accounts to their members. Some of the 43 UK societies also provide other services, such as current accounts, credit cards, investment products, and insurance policies. Although building societies have traditionally been able to provide attractive rates for members through their focused approach, retail banks can offer similar rates through economies of scale. In addition, younger customers are increasingly seeking digital channels, including mobile banking and AI chatbots, which building societies may not be able to provide.

Despite 86% of building societies offering online banking services, only 23% of them have mobile banking applications, and a mere 7% have implemented AI chatbots to provide 24/7 support. Due to their lower revenue streams compared to retail banks, 12 building societies have average turnovers of less than GBP 10 million per year, making it challenging for them to invest in digital services.

Challenges

Building societies in the UK face a number of challenges, which are impacting organisations in different ways.

Internal Factors

One of the main challenges that UK building societies face is their regional focus. Unlike larger banks, building societies tend to operate within a specific geographic area, which can limit their growth potential. While this local focus can be an advantage in terms of community engagement and brand recognition, it can also be a hindrance when it comes to attracting new members and expanding services beyond their core markets.

Another challenge for building societies is their heavy reliance on mortgage brokers. While brokers play an important role in helping customers find the right mortgage product, the reliance limits access to new a demographic of consumers. Building societies should turn their focus to attracting and retaining customers directly. One way to do this, is by investing in digital channels and marketing strategies for an extended reach.

Low budgets for projects are also a common challenge for building societies. With limited financial resources, it can be difficult for these institutions to invest in new technology, improve customer service, or expand their product offerings. This can put them at a disadvantage compared to larger banks, which have more resources to allocate to these areas. However, the lack of investment into digitised systems also presents the challenge of increased operating costs as legacy systems require greater resources to maintain. The implementation of modern solutions to existing issues, such as cloud-based banking technology, regulatory reporting tools and mortgage origination platforms, can provide long-term cost-savings for building societies.

Finally, while these institutions have traditionally been known for their customer service and personalised approach, there is growing competition in the market from online banks and fintech's. Building societies need to find ways to differentiate themselves and offer a compelling value proposition to their members to retain their loyalty. To stay ahead in member satisfaction and loyalty, building societies may need to focus on creating a more personalised experience for their customers. This could involve offering tailored advice and financial planning services, or developing loyalty programs that reward members for their continued business.

External Factors

Building societies are also facing several external challenges that are impacting their ability to serve their customers effectively. These challenges include regulations, serving vulnerable customers, IT security and cyber-attacks, and difficulty in attracting younger customers.

One of the main challenges facing building societies in the UK is the increasing level of regulation. The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) are both regulatory bodies that oversee the financial sector in the UK. In recent years, they have introduced a number of new regulations that building societies have had to comply with. This has placed an additional burden on building societies, particularly smaller ones that may not have the resources to devote to compliance. Building societies have had to invest heavily in compliance systems and personnel to meet the regulatory requirements, which has reduced their profitability. This is essential, due to the growing risk of heavy fines from regulators, which is a possibility that building societies must work to avoid.

Another challenge faced by building societies is the need to serve vulnerable customers and an ageing population. With an ageing population, building societies need to adapt their products and services to cater to the needs of older customers. This can include offering more flexible mortgages that allow for later life lending or offering savings accounts with higher interest rates for those on fixed (pension) incomes. Additionally, building societies have had to ensure that their staff are trained to deal with vulnerable customers, such as those with dementia or other cognitive impairments.

The building society industry is also facing an increasing threat from cyber attacks. With more and more customers using online banking and mobile apps, building societies have had to invest in robust IT security systems to protect their customers' data. However, despite these efforts, cyber attacks continue to be a significant threat. Building societies need to ensure that their IT systems are constantly updated and that their staff are trained to identify and respond to cyber threats.

Finally, building societies are finding it increasingly difficult to attract younger customers. With the rise of challenger banks and fintech firms, younger customers are more likely to use digital banking services and may not see the value in using a traditional building society.

To address these challenges, building societies need to take a proactive approach to innovation and customer service. This may involve investing in new technology, such as digital platforms and mobile apps, to enhance the customer experience and make it easier for members to access services. It may also involve developing new products and services that can help building societies expand their offerings beyond traditional savings and mortgage products.

Scenarios

The challenges discussed above could have serious implications for the success and longevity of building societies in the near future. Each scenario will have a different impact to the organisation.

Building societies that don’t react

For a building society that decides not react to the macroeconomic factors impacting their business, we can predict continued resistance to change, resulting in stagnant IT security and core banking platform upgrades. The firms would see a rise in costs from potential fines by the regulator and associated with the maintenance and upkeep of legacy systems. Furthermore, cyber attacks would likely come into fruition as this category of building societies become easy targets. Payments could be made in the form of ransom demand and could in turn once again lead to more fines. Lastly, consumer confidence would further be damaged post attacks, resulting in lower customer loyalty and existing members deciding to bank elsewhere, thus reducing the pool of funds the building society has access to. In turn we expect to see decreased overall profitability with an inability to provide competitive rates on core products.

Building societies that make some changes

For some building societies, the environment could push them to adopt some very necessary changes to stay relevant. We’d expect to see a vital upgrade into IT and core banking systems as the first step towards digitisation. This should suffice to keep the regulator at bay and deter future cyber attacks. However, such internal facing upgrades would not result in customer growth due to no perceived added benefits to existing or potential customers, thus member satisfaction may remain motionless or continue to decline.

Building societies that embrace digitisation

The building societies that recognise the need to go digital will see the current environment as an opportunity to enact substantial change. Though most building societies offer some form of online banking, the number offering mobile applications is significantly lower, and online chat services, even more so. We'd expect investment into these technologies to create differentiation in the market. By going digital, the building societies transcend their regional borders and tap into a national market of consumers, looking to get the best rates. This would see significant growth in customers and henceforth long-term revenue. Internally, automation of manual processes can be pursued to improve efficiencies and lower costs, further becoming a truly digital organisation. Previously on hold data migrations would now sit at the top of a CEO’s agenda, as migrations can take over a decade to complete.

Solution

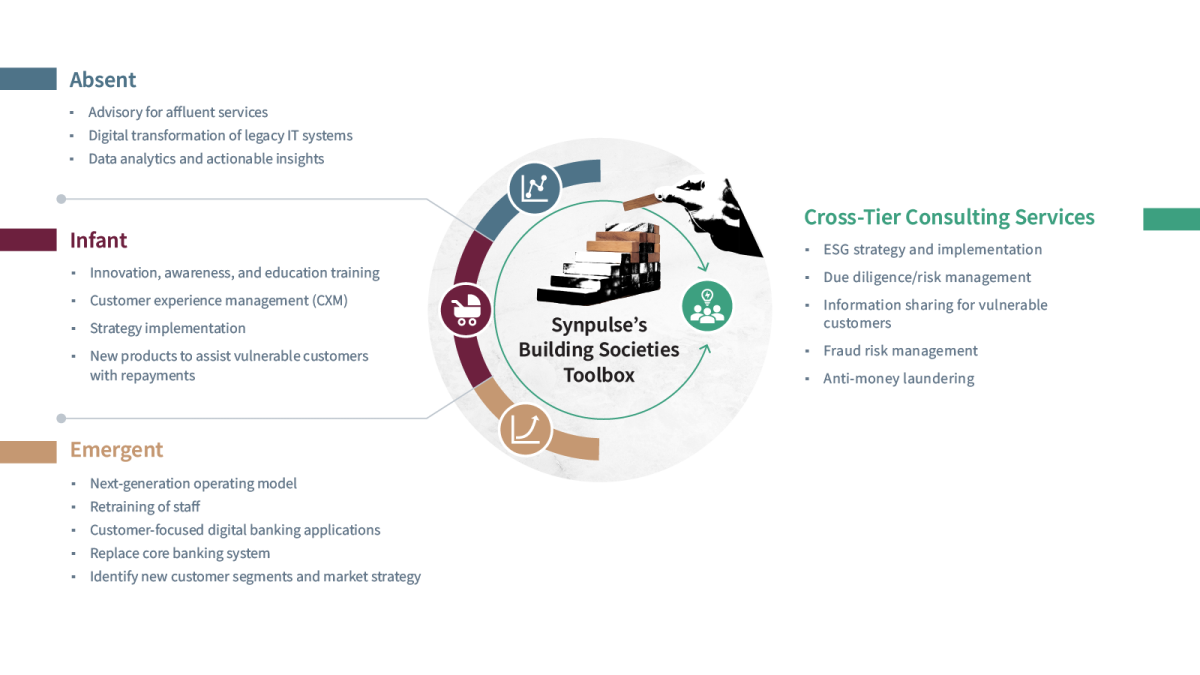

These scenarios can be illustrated with Synpulse’s Building Society Maturity Curve. Through analysing technological and product maturity of building societies against their peers, we have created a robust framework that can assess a building society as a benchmark. The maturity curve is vital as we recognise that there is no one-size-fits-all when it comes to the journey of digitisation. Our individual analysis of building societies uniquely places us in the market as a preferred partner for consulting and technology projects.

Following an in-depth analysis of a building society’s maturity, Synpulse can offer curated specialist advice and consulting services tailored to your individual needs. Our ToolBox blends traditional management consulting services with our digital transformation expertise.

Synpulse is well-positioned to drive technological advancements through its subsidiary company, Synpulse8, which specialises in providing tailored, cutting-edge solutions from inception to implementation. The team consists of seasoned professionals in experience design, technical architecture, data science, software development, and hosting, who collaborate to deliver innovative and highly customized products to clients.

In addition to the above, Synpulse and Thought Machine have partnered to marry product and process excellence around the next-generation core banking engine to deliver Vault Core. Better known as Synpulse x Thought Machine Operating Requirements Model (STORM), we can accelerate your digital banking journey from value proposition to operationalisation.