In this article series, we discuss how technology can be used to augment traditional risk controls to reduce costs, gain deeper business insights, and ensure the right risks are being assessed through predictive analytics. Join us on this transformative journey as we explore the future of risk control.

Current hard market conditions have seen many insurers return to profitability through increased rates and the ability to be selective over the risks they cover. However, there is still an opportunity to drive this further through risk control. Rather than passively collecting premiums and reacting to claims as they arise, insurers can take a proactive approach to managing risks within their portfolio.

Unlocking hidden potential: The role of risk control

By collaborating closely with risk engineers or risk control professionals, insurers can unearth the untapped potential within their current pool of policyholders. Imagine a scenario where the risks already assumed are not stagnant liabilities, but malleable entities which can be sculpted into safer, more resilient shapes.

While the benefits of mitigating claims through loss control are obvious, there are also wider profound benefits:

Expanding the customer base for risk control

Traditionally, the customers who benefit most from risk control services are typically those with substantial operational risks or high-value assets, such as manufacturing firms, construction companies, healthcare institutions, logistics and transportation companies, and energy firms. The costs and resources required for performing in-depth risk assessments, site visits, and ongoing consultation often made it uneconomical for smaller risks/organisations. However, with technological advances and changing business models, the accessibility of risk control is expanding to benefit a wider range of customers and risks.

By harnessing technological innovations, risk control services can be made more affordable, efficient, and scalable, breaking down the barriers of accessibility.

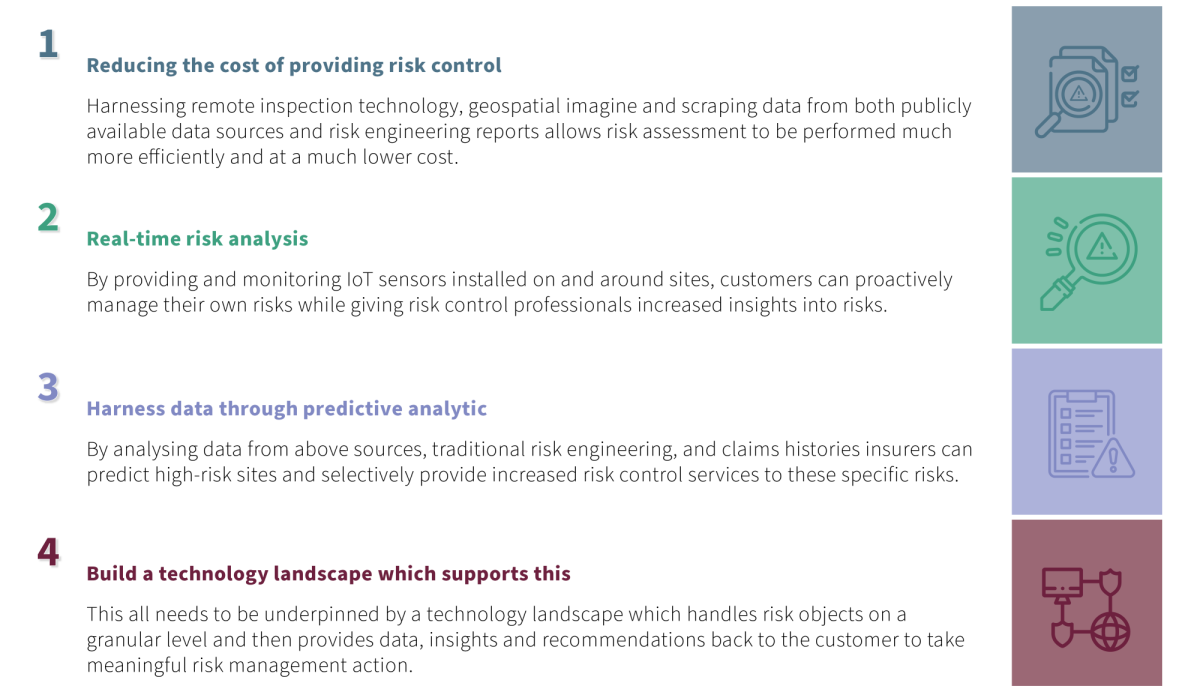

In this short series, we explore four ways in which risk control can be expanded across the portfolio and the technology solutions that underpin this:

When the hard market starts to "soften," insurers that can best identify and retain high-quality risks in their portfolio will thrive. Risk control services are an important tool to achieve this and technology must be leveraged to provide these services across their book of business.

To learn more about risk control check out our upcoming articles in this series! Get in touch with us if you are interested in our customised solutions.