Virtual asset (VA) markets have been burgeoning in the last two years in Asia. Zooming in on cryptocurrencies, the region contributed to 43% of global activity, the equivalent of USD 296 billion in transactions in 2021 alone.1 With the increasing adoption and use of virtual assets in financial systems and markets, regulatory clarity and certainty will be key to maintaining market stability through the course of the coming years.

In response to the growing interest on the part of financial institutions in providing VA-related products and services, regulatory bodies in Hong Kong issued three circulars in January 2022. This came about after an initial consultation on stablecoins earlier in the same month to lay out a regulatory framework for VAs.

The Hong Kong circulars include:

- The “Regulatory approaches to Authorised Institutions’ Interface with Virtual Assets and Virtual Asset Service Providers”,2 first circular from the Hong Kong Monetary Authority (HKMA)

- The “Intermediaries’ Virtual Asset-related Activities”,3 second circular from the HKMA and the Securities and Futures Commission (SFC)

- The “Regulatory Approaches of the Insurance Authority in Relation to Virtual Assets and Virtual Asset Service Providers”,4 third circular from the Insurance Authority (IA)

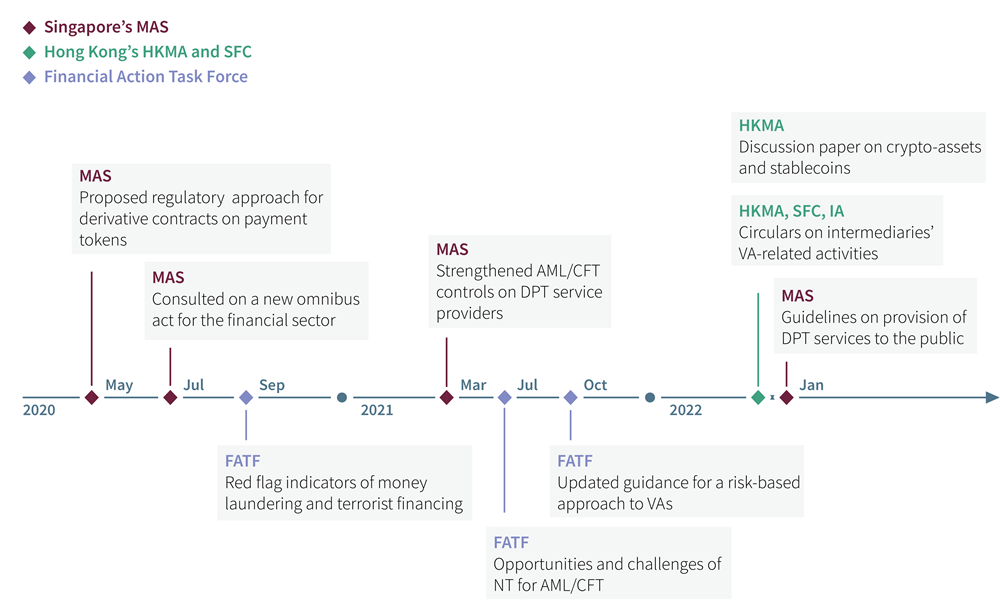

The Hong Kong circulars are the latest milestones in a high-paced series of publications, also embraced by the Monetary Authority of Singapore (MAS), patterned on output from the Financial Action Task Force (FATF) working groups.

These circulars mainly target virtual exchanges, financial intermediaries, and insurers, providing comprehensive guidance on VA-related activities, with a focus on risks, regimes, and frameworks to comply with.

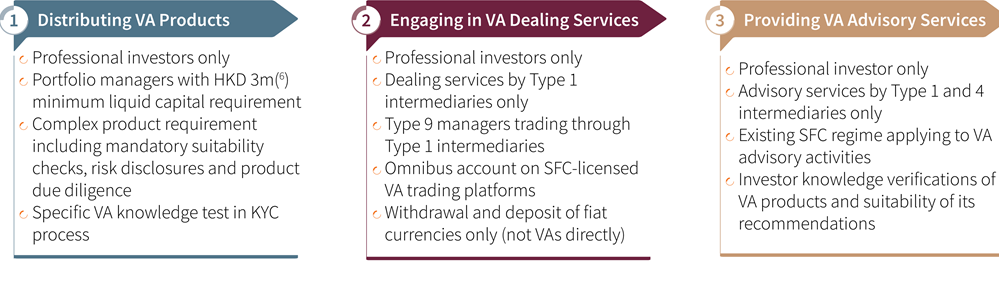

Here are some of the key considerations for market participants who wish to engage in VA-related proprietary investments and client services:

Key requirements for VA-related activities

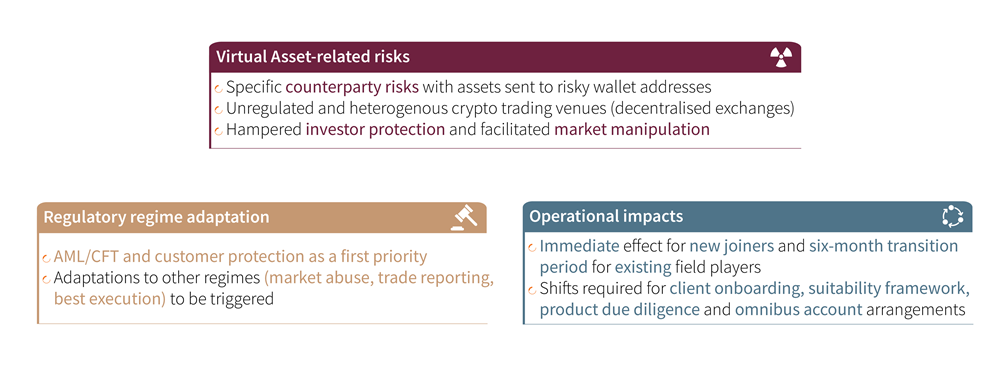

The circulars have tightened scrutiny over those undertaking VA-related activities by introducing controls and restrictions in the following main areas:

Impacts on existing regulatory regimes

While they retain a strong focus on the protection of professional investors, the circulars also target aspects, such as market surveillance and licensing.

Target timeline and next steps

Authorised institutions must adapt to their operating model either:

- Immediately (for those who have already embarked on a VA journey)

- Or within six months (e.g., early July) – for those who have not yet started advising on, dealing or selling virtual asset services or products to clients

In order to embrace those adaptations, the following staggered workstreams shall be engaged by financial institutions:

Why work with us?

“Synpulse helped shape the entire value chain, from identifying gaps and formulating controls and implementing solutions to ensuring regulatory compliance.”

– Client testimonial

Subject matter expertise

Synpulse has been proposing multi-dimensional operating model to enable trading, booking, settling, monitoring, and reporting of virtual assets in a safe and efficient way. Our expertise in regulatory compliance and risk topic has a proven track for technology-driven business processes re-engineering and target operating model implementation.

Extensive industry experience in the Asian market

Having worked with eight of the 10 largest financial institutions in Asia over the past 10 years on an array of successful projects, we understand the most pressing regulatory and compliance challenges this region faces and aim to support and help our clients face the challenges with our proven methodologies.

We would be delighted to share industry best practices and provide you with further information on how this risk topic may impact your organisation.

Reach out to Gregory Achache (Associate Partner) at gregory.achache@synpulse.com and Adrien Barquissau (Director) at adrien.barquissau@synpulse.com.

1 The Chainalysis 2021 Geography of Cryptocurrency Report (Chainalysis, 5 April 2022).

3 Joint circular on intermediaries’ virtual asset-related activities (SFC, 28 January 2022).