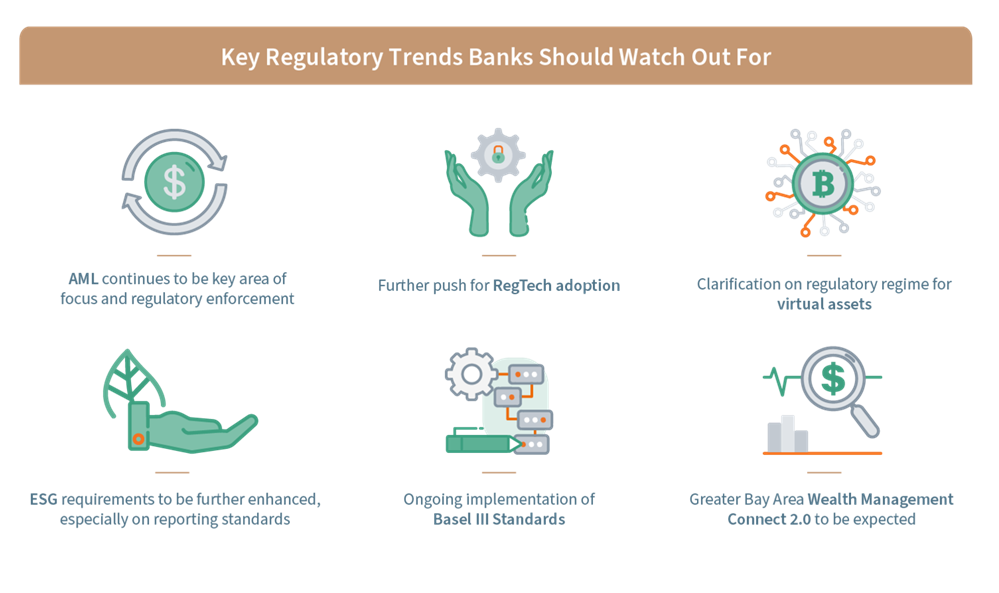

The COVID-19 pandemic has fuelled the rapid digital transformation of the financial services industry and hastened the general interest in virtual assets. As we enter the third year of this pandemic, we identify some key regulatory trends banks should keep an eye on in the next year.

Below, we have identified the key regulatory trends that banks, particularly in Hong Kong and Singapore, should watch out for:

1. AML will continue to be a key area of focus and regulatory enforcement

Anti-money laundering (AML) guidelines are constantly evolving with new AML and combating the financing of terrorism (CFT) requirements. In recent years, regulators have strengthened the AML regime while demanding financial institutions (FIs) to further develop their AML technology capabilities to enable more effective monitoring. In 2022, this remains as a key topic, as regulators increase their scrutiny on AML breaches.

In Hong Kong

Much like the push in Singapore, the Hong Kong Monetary Authority (HKMA) places a strong emphasis on regtech adoption, especially in the areas of AML, KYC, and surveillance. FIs, therefore, need to look at specific use cases that increase the accuracy of their AML processes and controls. Regulators have also increased their focus on ensuring that checks and balances carried out during the client lifecycle are well implemented and followed, including the clients’ sources of wealth.

In Singapore

The Monetary Authority of Singapore (MAS) has been encouraging the adoption of AML regtech solutions. The MAS will also closely monitor FIs for failure to comply with MAS’s AML/CFT requirements. On top of the scrutiny on traditional FIs, we also foresee regulatory enforcement across non-banking financial firms, such as virtual asset service providers.

2. Regtech adoption grows as a key focus

There is an increasing urgency for FIs to further invest in robust technologies to ensure that risks, such as fraud, customer data protection, and cybersecurity, can be mitigated with preventive controls. Technologies like machine learning and artificial intelligence are the way to the future. With a plethora of risks to be managed, regtech solutions are becoming more a necessity than a good to have.

In Hong Kong

The ongoing pandemic and restrictions on physical meetings, coupled with the push from HKMA on regtech adoption, make it imperative for FIs to implement or further adopt the associated technologies to maintain business development and improve efficiency whilst keeping compliant with regulations.

In Singapore

In Singapore

MAS has been promoting regtech solutions across various domains and will continue to encourage the adoption of technology solutions for risk management and regulatory compliance. With the evolving remote working practices, data protection and privacy, and technology risk management continuing to be a key focus of 2022 for the Singapore regulators.

3. Clarification on the regulatory regime for virtual assets

Since the pandemic began, the virtual assets market has been vibrant. The expansion of the virtual assets market calls for focused attention from regulators in the region.

In Hong Kong

The regulators have provided detailed regulatory guidance in response to the public’s growing interest in the activities relating to virtual assets. Virtual asset service providers will be regulated in the coming years as licensed institutions and will be required to operate under a clear regulatory regime based on the circulars issued by regulators.123 Meanwhile, the HKMA welcomes industry feedback as the virtual asset market and regulatory regime evolve.4

In Singapore

Under the Payment Services Act (PSA), virtual asset service providers (VASPs) are subjected to MAS’s regulatory control. MAS continues to monitor and push the VASPs to register for a trading licence and adhere to AML/CFT rules,5 following the standards set out by the Financial Action Task Force (FATF).6 Additionally, MAS expects digital payment token (DPT) service providers not to massively promote DPT services, as a step to protect investors who may not fully comprehend the high risks involved in the trading of DPT.7

4. ESG requirements to be further enhanced, especially on reporting standards

Environmental, social, and corporate governance (ESG) will remain a key agenda for the years to come. With this as a priority, banks are enhancing their processes and policies around ESG (e.g., through enhanced advisory processes and the introduction of sustainable products).

In Hong Kong

HKMA puts sustainable finance as its 2022 priority. It aims to implement supervisory requirements, launch greenness assessments, develop a taxonomy or classification framework, and explore the usage of tools and data. A three-phrase approach is adopted and the commitment to developing Hong Kong as a green finance hub is reaffirmed.

In Singapore

MAS has also made efforts towards ESG by collaborating with the industry to pilot digital platforms initiatives in 2022 to address ESG data quality challenges. This includes establishing partnerships with technology providers and various sustainability data sources by the second half of 2022. ESG will gain more focus on technology development to support banks as they make their processes and systems more robust.

5. Ongoing implementation of Basel III Standards

Following a one-year deferral to increase the operational capacity of banks and supervisors due to the ongoing pandemic, these reforms will take effect from 1 January 2023.

In Hong Kong

The implementation of Basel Standards is placed on HKMA’s 2022 priority list. FIs are expected to apply the Basel Standards, including the Basel III final reforms, and the implementation has taken effect as of 1 January 2022 with a phase-in period of five years.

In Singapore

MAS has issued the consultation response relating to the operational risk capital, credit risk capital, and market risk capital requirements, respectively, in the past years, and expects FIs to complete the implementation from 1 January 2022.

6. Greater Bay Area Wealth Management Connect 2.0 to be expected

Cross-border business continues to be a key offering, enhanced by the growing connectivity between the Hong Kong and Mainland Chinese borders. In the private banking and wealth management space, cross-border rules will continue to be a crucial focus, as they largely represent the main risks from a business point of view.

In Hong Kong

Banks in general will continue to target their attention on the Greater Bay Area Wealth Management Connect (WMC) Scheme, following to the “execution-only” implementation of the Scheme in 2021. Industry players are keen to learn more about how best to prepare and adapt themselves as the Scheme progresses. Operating model, digitisation, and wider product and service scope need to be adapted and will continue to evolve in 2022 in the form of WMC 2.0.

In summary

The regulatory focus will continue evolving alongside the market trends and development of the financial market. To anticipate the challenges of 2022 and the coming years, FIs should remain agile and compliant in the dynamic regulatory environment, whilst managing risks more effectively by leveraging up-to-date technologies and strategically investing in compliance resources.

1 Regulatory approaches to Authorized Institutions interface with Virtual Assets and Virtual Asset Service Providers (HKMA, 28 January 2022).

2 Join circular on intermediaries’ virtual asset-related activities (Hong Kong Securities and Futures Commission, 28 January 2022).

3 Regulatory Approaches of the Insurance Authority in Relation to Virtual Assets and Virtual Asset Service Providers (Insurance Authority, 28 January 2022).

4 Discussion Paper on Crypot-assets and Stablecoins (HKMA, 12 January 2022).

5 Strengthening AML/CFT Controls of Digital Payment Token Service Providers (MAS, 26 March 2021).

6 Updated Guidance for a Risk-Based Approach: Virtual Assets and Virtual Asset Service Providers (FATF, October 2021).

7 Guidelines on Provision of Digital Payment Token Services to the Public [PS-G02] (MAS, 17 January 2022).