The future of underwriting is now

Underwriting has long been the heart of insurance, but today it is strained by messy data, tighter regulations, and rising demands for speed and transparency.

At Synpulse, we believe this shift should empower underwriters, not replace them. That is why we built Pulse8AI: a GenAI-powered assistant designed to work with your data, within your environment, and under your control. No data leaves your cloud, ensuring compliance, privacy, and peace of mind. Pulse8AI also acts as a speed multiplier, automating triage, data extraction, and rule application to help you launch faster, serve brokers better, and free up time for innovation.

The underwriting conundrum: navigating modern challenges

Underwriting, the backbone of the insurance industry, is undergoing a seismic shift. Traditional underwriting processes, while foundational, are increasingly strained under the weight of modern demands. Several pressing challenges are at the forefront:

- Data overload: Underwriters face massive volumes of unstructured data from applications, medical records, and financial statements, slowing processes and increasing error risk.

- Evolving risks: Emerging threats like cyberattacks, climate change, and pandemics demand more dynamic, adaptable underwriting tools.

- Rising compliance pressure: Stricter regulations require greater transparency and documentation—manual processes struggle to keep up, heightening compliance risks.

- Talent shortages: With experienced underwriters retiring and fewer new entrants, workloads rise, and institutional knowledge is at risk.

- Demand for speed: Clients expect faster decisions; slow underwriting leads to lost opportunities and weaker customer satisfaction.

These challenges underscore the need for innovative solutions that can enhance efficiency, accuracy, and adaptability in underwriting. In the following sections, we'll explore how Generative AI addresses these issues, transforming underwriting into a more streamlined and effective process.

Introducing Pulse8AI: An assistant to power underwriting solutions

In response to the persistent inefficiencies plaguing underwriting teams, Pulse8AI was built to deliver practical solutions to underwriters. Pulse8AI can be used in different use cases. Here are 4 examples:

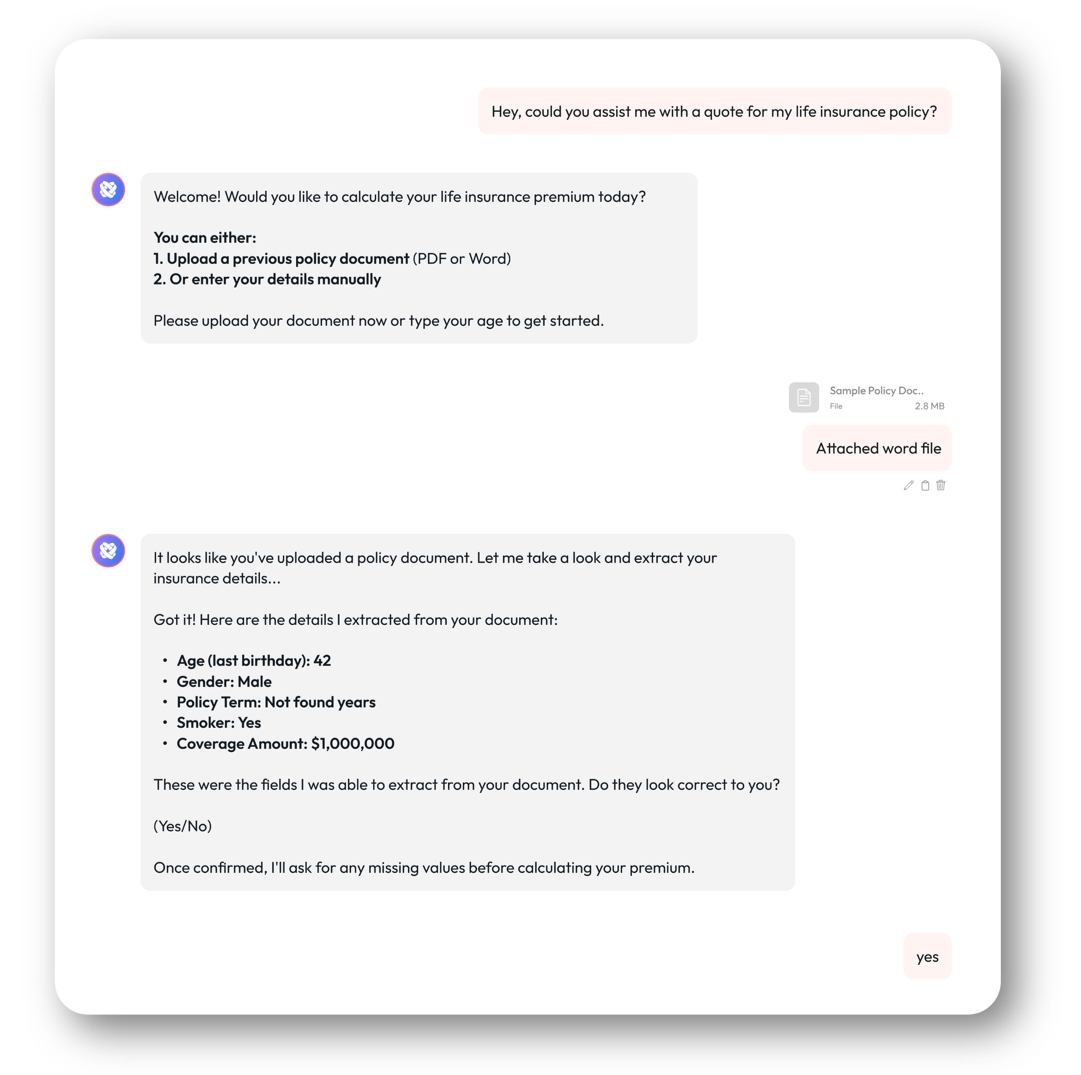

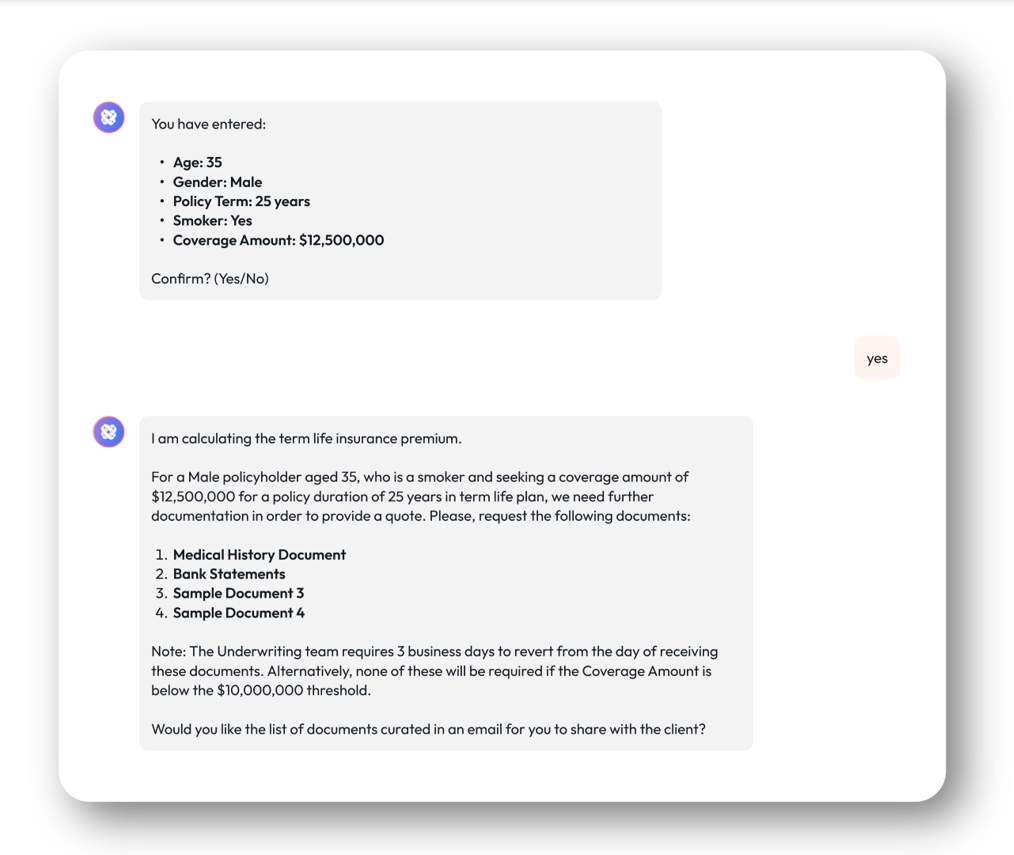

Automated risk triage with embedded business rules

Pulse8AI automates eligibility checks by connecting directly to your underwriting rules. The assistant returns instant outcomes like “Accept,” “Refer,” or “Decline” based on structured criteria.

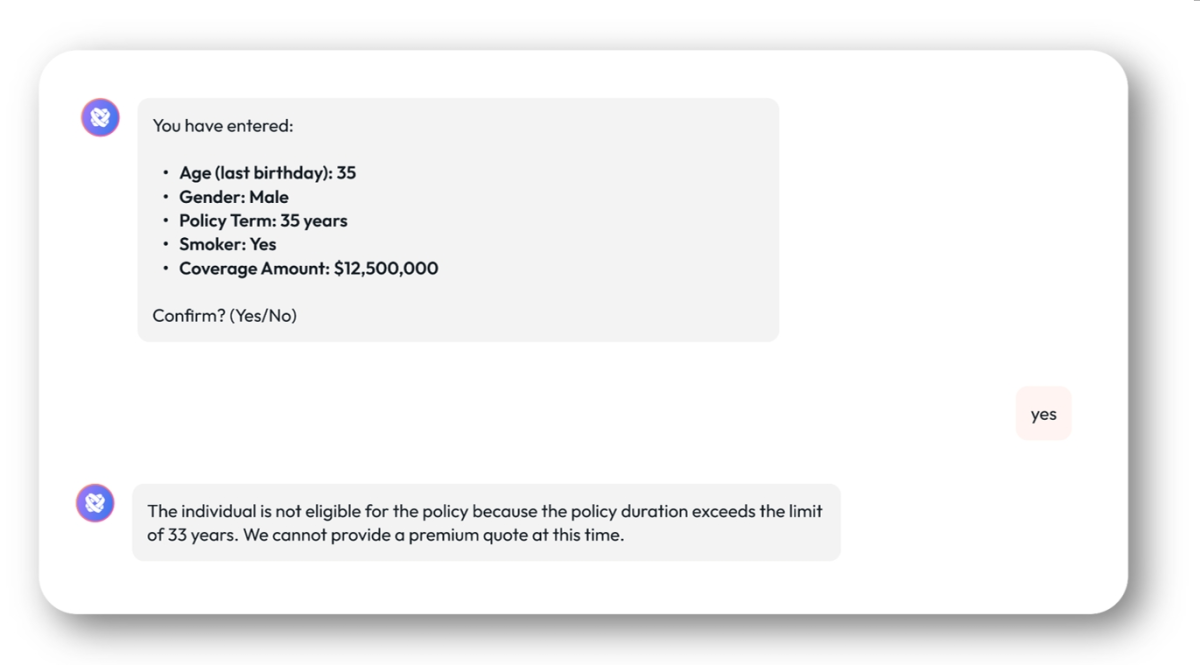

Intelligent pre-fill from unstructured documents

Whether it is a broker-submitted PDF, an application form, or an email thread, Pulse8AI extracts the required data and populates your systems-no templates, no data entry.

AI-Guided decision support

When a risk gets referred, underwriters don’t need to dig through guidelines. Pulse8AI explains why the referral occurred, cites the relevant rule, and surfaces similar precedents for reference.

Seamless rule integration via APIs-excel or core systems

Pulse8AI connects to your rules wherever they live:

- If in core policy systems, it plugs into existing APIs.

- If in spreadsheets, it wraps them in callable services-optionally leveraging partners like Coherent Spark to expose them as scalable APIs.

PULSE8AI’s core is powered by your data, hosted on your cloud

Pulse8AI is deployed on-premise or within your private cloud, ensuring complete control.

No customer data leaves your organisation. No reliance on third-party LLMs. Full auditability, full privacy, zero compromise.

Real-world applications: empowering underwriters, building trust

The value of GenAI in underwriting is clear, but a valid question remains: should AI interact directly with clients? Underwriting is not just about applying rules; it is a relationship-driven discipline built on nuance, judgment, and trust.

At Synpulse, we don’t believe in one-size-fits-all answers; instead, we advocate starting by using GenAI to empower your people internally, building confidence before extending its reach externally.

Empowering the people behind the decisions

Pulse8AI was designed as an underwriting co-pilot, not a client-facing chatbot. It extracts, interprets, and triages information, freeing your teams from manual tasks so they can focus on what matters most: underwriting judgment, client engagement, and strategic decision-making.

Tangible use cases

- Faster quote turnaround: Pulse8AI automates data extraction and rule checks, speeding up response times.

- Accelerated learning curve: Junior staff contribute faster, guided by real-time AI support.

- Improved portfolio consistency: Uniform rule application across systems ensures better risk management.

- Faster time-to-market: AI-enabled tooling helps configure and deploy products more efficiently.

As your models mature and trust builds, external applications may follow. But the journey starts inside:

Train your AI on your data, empower your teams—and expand when the time is right.

Strategic advantages: faster, safer, smarter

Pulse8AI is not just about automation; it is about unlocking capacity, maintaining control, and gaining a competitive edge.

- Speed to market, without the bloat: Leverage existing rules and APIs to launch products faster—no massive integrations needed. Attain quicker cycles, better customer experiences.

- Full ownership, zero data risk: Stay compliant and in control—your data never leaves your environment.

- First-mover advantage, done right: Start internally, build trust, and scale outward. Early adopters train stronger models and take the lead as the market evolves.

- More time for innovation: With GenAI handling the manual work, your teams can focus on the innovation often sidelined by operational pressures.

Underwriting for the future

Underwriting will always rely on people, but the future belongs to those amplified by technology. Pulse8AI reduces grunt work, accelerates decisions, and unlocks strategic thinking, integrating seamlessly with your systems, securing your data, and delivering value from day one.

In a market where speed, compliance, and innovation are often at odds, Pulse8AI brings them together without compromise. Please don't hesitate to contact us for a demo or a conversation about underwriting transformation with our underwriting co-pilot.