Loading Insight...

Insights

Insights

Part 4: Remote Video & Customer Self-Inspections

The pandemic is a catalyst for video-calling & self-inspection solutions. Why not get your customers to help? Find out how property underwriters can capitalise on people’s growing comfort with remote video & self-inspection solutions to gather valuable information without being physically present onsite.

Remote Inspection Technologies

Property underwriters are under pressure to generate renewals and new business with limited resources, and the coronavirus isn’t making life any easier. How can technology help?

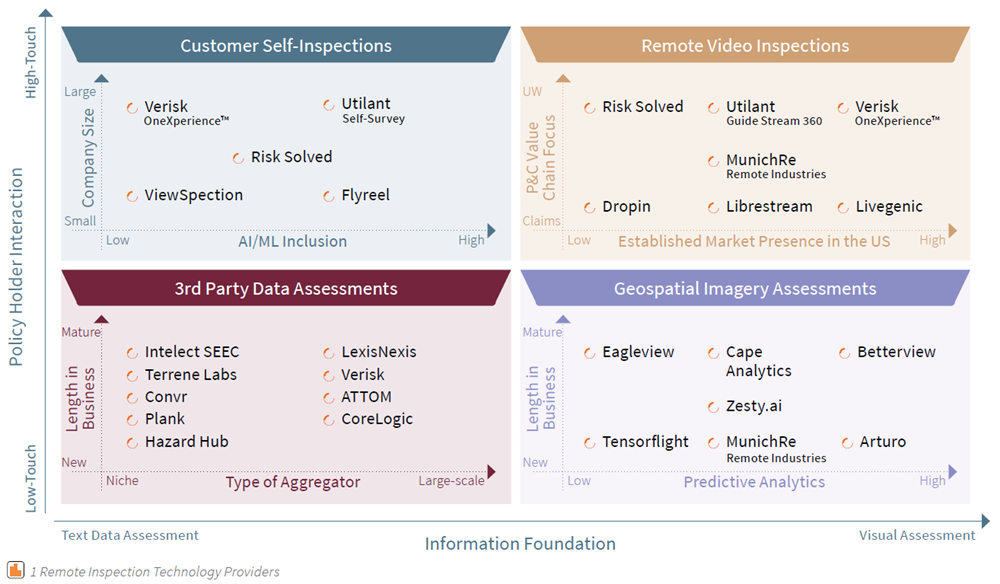

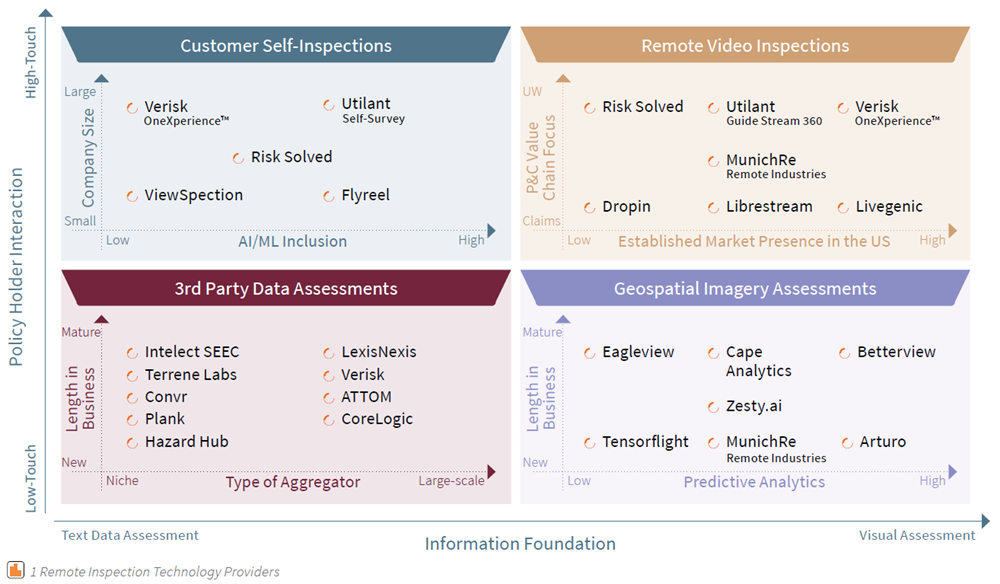

Remote inspection technologies are the way forward. You can read part one of this article series for more insights. Over the past few years, we at Synpulse have performed vendor analysis studies for multiple clients and worked with various technology providers. We’ve seen with overwhelming clarity that adding a remote inspection capability into the underwriting process significantly improves and streamlines the end-to-end underwriting process. We’ve also found that it’s helpful to organise these technologies into four categories (diagram 1):

- Geospatial Imagery Assessments – read all about it in part two of this article series

- 3rd Party Data Assessments - read all about it in part three of this article series

- Customer Self-Inspections

- Remote Video Inspections

In this article, we focus on the last two of the four main categories of remote inspection technology: Customer Self-Inspections & Remote Video Inspections.

Customer Self-Inspections

One of the main trends we’ve seen is that customers are more comfortable using technology to “self-serve.” This means they can do much of the work on their own, which limits the need for physical contact or a phone call. This can work quite well for customers who are busy and have trouble setting up a risk assessment due to their schedule. Especially during Covid-19, where rules of social distancing and even self-isolation have been enforced, having access to such technology helps gather first-hand property information without exposing clients, employees, or third-party inspectors to the virus.

Here’s a short survey of the market for customer self-inspection solutions:

- Utilant offers a product called Self-Survey through its Loss Control 360 platform. It enables underwriters to gather vital information about the risks they cover. A step-by-step workflow guides the insured or agent through their own survey and enables them to fill out form data and upload photos, videos, or documents. Behind the scenes, the self-survey app uses metadata such as latitude, longitude, or time stamps to validate the geocoordinates of the assessed location and prove the accuracy of uploaded photographs.

- Verisk’s OneXperience**™** Self Evaluation provides a self-inspection option that enables policyholders or their agents to upload documents, images, and videos directly to OneXperience at their convenience and with no need for an inspector to visit. Recently, Verisk has extended its virtual inspection platform to digitally engage with policyholders through real-time surveys, allowing them to obtain critical insights for both commercial and home inspections.

- Risk Solved’s self-assessment solution provides a customisable questionnaire for policyholders to capture survey data, photos, and videos. The tool allows autogenerated recommendations for risk improvements and guides policyholders to implement risk improvements themselves. Clients have achieved up to 20% improvements in loss ratio using Risk Solved’s self-assessment solution.

- ViewSpection also offers a self-service inspection and helps reduce the number of days to bind a policy. The policyholder completes a series of steps that walks them through the building with conditional questions. A summary report will show all the interior and exterior data points that were assessed and reported.

- Flyreel takes a different approach by allowing artificial intelligence to play the risk assessor. It uses proprietary computer vision to document the contents and condition of the property. As the user is guided through the inspections, the software takes notes on things such as hazards, risks, features, and materials, and fills out a detailed property and contents report that is immediately available to the underwriter. The solution allows you to configure workflows for self-service inspections and claims that will help streamline your operations.

Remote Video Inspections

With the prevalence of video and live-stream communication, several companies have integrated such tools to guide the insured or potential customer through a typical risk assessment at the actual property. While many of these companies have initially targeted the claims assessment and adjustment process, there’s a pattern of using the same products for live-stream inspections during the underwriting process.

Here’s a brief overview of the market:

- Utilant’s newest product, Guide Stream 360, helps the risk engineer walk the policyholder through a structured risk assessment, and records the video for archiving purposes. A huge benefit is that the individual doesn’t need to install a mobile app but can access the service using a browser. When the video is up and running, additional features allow the guide to take and highlight pictures and inject recommendations.

- Risk Solved has extended its global risk management platform with secure and live video streaming for remote surveys and inspections. Debbie Baker explains: “At the press of a button, a remote survey request is generated with a calendar invite to initiate a live video call.” Using the native mobile phone capabilities, snapshots of specific areas of interest can be taken and annotated.

- Verisk’s OneXperience™ Virtual Inspection solution empowers insurers to conduct live-feed video surveys of commercial and residential properties. The browser and app-based solution allow you to digitally engage with clients and capture, annotate, and highlight granular details on potential risks throughout the recording. In combination with ClaimXperience®, the platform facilitates a full value chain integration along the policy life cycle from quote to claim.

- MunichRe’s Remote Industries have developed a Remote Inspection video tool. Initially designed to provide loss adjustment capabilities through remote video assessments, it now also leverages this technology to support the underwriting submission process. Flashlight, zoom, or picture highlighting features reveal and capture hazardous areas to better document and evaluate the actual conditions at the property.

- Livegenic, another solution provider helping carriers do virtual inspections and process claims, can easily be repurposed to support the customer onboarding process. It’s the same technology and set of features that makes it easy for risk engineers to perform a risk assessment.

- DropIn is another company primarily designed for claims review which many underwriters are now successfully using in the risk assessment phase.

- Even platforms like Librestream are growing in popularity for risk assessments. A robust technology originally designed for technicians to walk factory floors or do inspections at field sites can now also be used by risk engineers and underwriters.

Conclusion

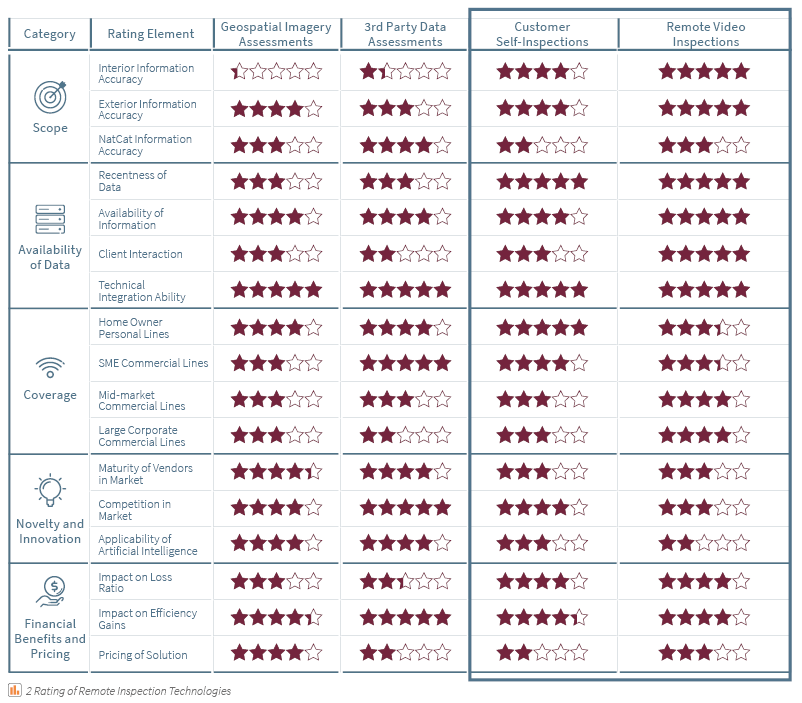

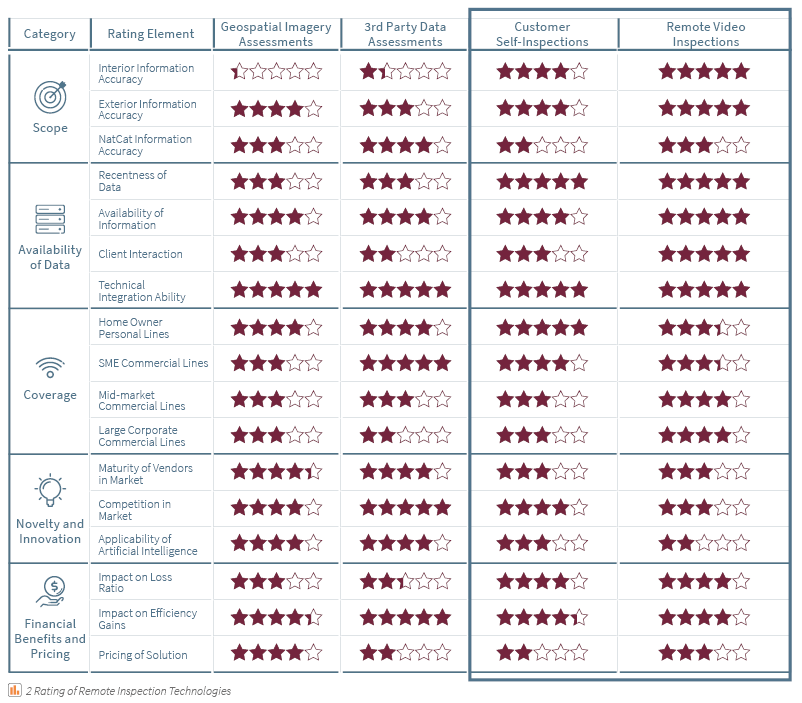

We put together an overview comparing the pros and cons of the various remote inspections solutions (diagram 2):

How Synpulse Can Help

At Synpulse we’ve helped dozens of major insurers in the vendor research phase and implementation delivery to bring new tools to their enterprise. Often this takes the form of initial conversations to understand the real problem areas of the underwriting and risk engineering teams and use workshops and interviews to find a target solution and the accompanying approach. We’ve had extensive experience with insurers of every size, and we often see that a new perspective is very helpful in transforming teams and organisations. Now is a crucial time for every insurer to strategically position themselves with the right risk assessment technology to remain competitive in 2020.

If you’re interested in learning more about the opportunities available in terms of remote inspection, get in touch with us now to discuss:

- How you can identify the best solution to match your current situation and pain points

- How these tools can better equip you to respond to Covid-19

- How these tools fit into your operating model to enable or replace site visits

- How much you have to spend and which tool will give you the most value for your investment

- How you could incorporate these tools into your existing system landscape to create an automated E2E journey

Part 4: Remote Video & Customer Self-Inspections

The pandemic is a catalyst for video-calling & self-inspection solutions. Why not get your customers to help? Find out how property underwriters can capitalise on people’s growing comfort with remote video & self-inspection solutions to gather valuable information without being physically present onsite.

Remote Inspection Technologies

Property underwriters are under pressure to generate renewals and new business with limited resources, and the coronavirus isn’t making life any easier. How can technology help?

Remote inspection technologies are the way forward. You can read part one of this article series for more insights. Over the past few years, we at Synpulse have performed vendor analysis studies for multiple clients and worked with various technology providers. We’ve seen with overwhelming clarity that adding a remote inspection capability into the underwriting process significantly improves and streamlines the end-to-end underwriting process. We’ve also found that it’s helpful to organise these technologies into four categories (diagram 1):

- Geospatial Imagery Assessments – read all about it in part two of this article series

- 3rd Party Data Assessments - read all about it in part three of this article series

- Customer Self-Inspections

- Remote Video Inspections

In this article, we focus on the last two of the four main categories of remote inspection technology: Customer Self-Inspections & Remote Video Inspections.

Customer Self-Inspections

One of the main trends we’ve seen is that customers are more comfortable using technology to “self-serve.” This means they can do much of the work on their own, which limits the need for physical contact or a phone call. This can work quite well for customers who are busy and have trouble setting up a risk assessment due to their schedule. Especially during Covid-19, where rules of social distancing and even self-isolation have been enforced, having access to such technology helps gather first-hand property information without exposing clients, employees, or third-party inspectors to the virus.

Here’s a short survey of the market for customer self-inspection solutions:

- Utilant offers a product called Self-Survey through its Loss Control 360 platform. It enables underwriters to gather vital information about the risks they cover. A step-by-step workflow guides the insured or agent through their own survey and enables them to fill out form data and upload photos, videos, or documents. Behind the scenes, the self-survey app uses metadata such as latitude, longitude, or time stamps to validate the geocoordinates of the assessed location and prove the accuracy of uploaded photographs.

- Verisk’s OneXperience**™** Self Evaluation provides a self-inspection option that enables policyholders or their agents to upload documents, images, and videos directly to OneXperience at their convenience and with no need for an inspector to visit. Recently, Verisk has extended its virtual inspection platform to digitally engage with policyholders through real-time surveys, allowing them to obtain critical insights for both commercial and home inspections.

- Risk Solved’s self-assessment solution provides a customisable questionnaire for policyholders to capture survey data, photos, and videos. The tool allows autogenerated recommendations for risk improvements and guides policyholders to implement risk improvements themselves. Clients have achieved up to 20% improvements in loss ratio using Risk Solved’s self-assessment solution.

- ViewSpection also offers a self-service inspection and helps reduce the number of days to bind a policy. The policyholder completes a series of steps that walks them through the building with conditional questions. A summary report will show all the interior and exterior data points that were assessed and reported.

- Flyreel takes a different approach by allowing artificial intelligence to play the risk assessor. It uses proprietary computer vision to document the contents and condition of the property. As the user is guided through the inspections, the software takes notes on things such as hazards, risks, features, and materials, and fills out a detailed property and contents report that is immediately available to the underwriter. The solution allows you to configure workflows for self-service inspections and claims that will help streamline your operations.

Remote Video Inspections

With the prevalence of video and live-stream communication, several companies have integrated such tools to guide the insured or potential customer through a typical risk assessment at the actual property. While many of these companies have initially targeted the claims assessment and adjustment process, there’s a pattern of using the same products for live-stream inspections during the underwriting process.

Here’s a brief overview of the market:

- Utilant’s newest product, Guide Stream 360, helps the risk engineer walk the policyholder through a structured risk assessment, and records the video for archiving purposes. A huge benefit is that the individual doesn’t need to install a mobile app but can access the service using a browser. When the video is up and running, additional features allow the guide to take and highlight pictures and inject recommendations.

- Risk Solved has extended its global risk management platform with secure and live video streaming for remote surveys and inspections. Debbie Baker explains: “At the press of a button, a remote survey request is generated with a calendar invite to initiate a live video call.” Using the native mobile phone capabilities, snapshots of specific areas of interest can be taken and annotated.

- Verisk’s OneXperience™ Virtual Inspection solution empowers insurers to conduct live-feed video surveys of commercial and residential properties. The browser and app-based solution allow you to digitally engage with clients and capture, annotate, and highlight granular details on potential risks throughout the recording. In combination with ClaimXperience®, the platform facilitates a full value chain integration along the policy life cycle from quote to claim.

- MunichRe’s Remote Industries have developed a Remote Inspection video tool. Initially designed to provide loss adjustment capabilities through remote video assessments, it now also leverages this technology to support the underwriting submission process. Flashlight, zoom, or picture highlighting features reveal and capture hazardous areas to better document and evaluate the actual conditions at the property.

- Livegenic, another solution provider helping carriers do virtual inspections and process claims, can easily be repurposed to support the customer onboarding process. It’s the same technology and set of features that makes it easy for risk engineers to perform a risk assessment.

- DropIn is another company primarily designed for claims review which many underwriters are now successfully using in the risk assessment phase.

- Even platforms like Librestream are growing in popularity for risk assessments. A robust technology originally designed for technicians to walk factory floors or do inspections at field sites can now also be used by risk engineers and underwriters.

Conclusion

We put together an overview comparing the pros and cons of the various remote inspections solutions (diagram 2):

How Synpulse Can Help

At Synpulse we’ve helped dozens of major insurers in the vendor research phase and implementation delivery to bring new tools to their enterprise. Often this takes the form of initial conversations to understand the real problem areas of the underwriting and risk engineering teams and use workshops and interviews to find a target solution and the accompanying approach. We’ve had extensive experience with insurers of every size, and we often see that a new perspective is very helpful in transforming teams and organisations. Now is a crucial time for every insurer to strategically position themselves with the right risk assessment technology to remain competitive in 2020.

If you’re interested in learning more about the opportunities available in terms of remote inspection, get in touch with us now to discuss:

- How you can identify the best solution to match your current situation and pain points

- How these tools can better equip you to respond to Covid-19

- How these tools fit into your operating model to enable or replace site visits

- How much you have to spend and which tool will give you the most value for your investment

- How you could incorporate these tools into your existing system landscape to create an automated E2E journey