Part 2: Geospatial Imagery

Geospatial imagery assessments can take the legwork out of assessing properties. Find out more about the strengths and limitations of the technology.

Remote Inspection Technologies

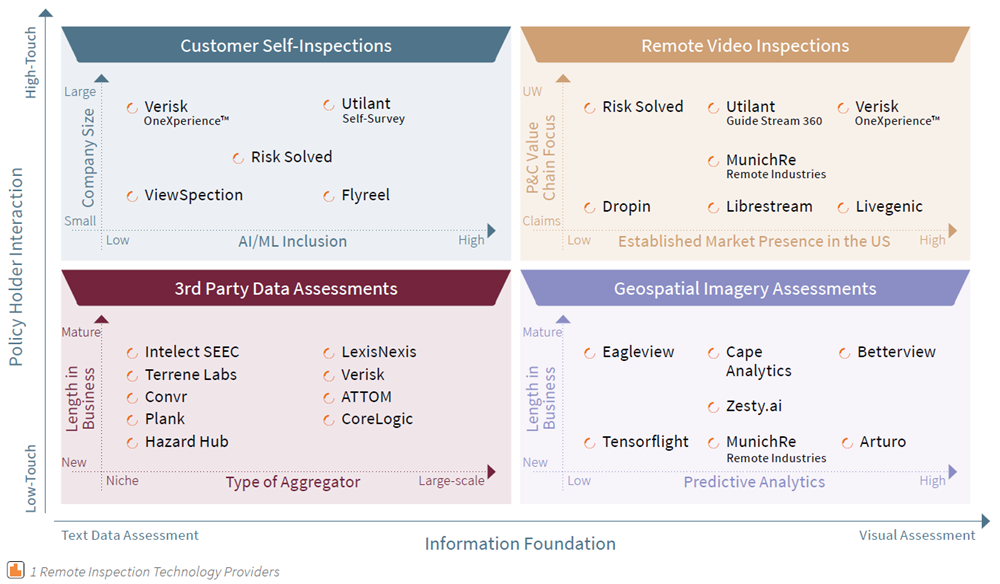

Remote inspection technologies are the way forward. You can read part 1 of this article series for more insights. Over the past few years, we at Synpulse have performed vendor analysis studies for multiple clients and worked with various technology providers. We’ve seen with overwhelming clarity that adding a remote inspection capability into the underwriting process significantly improves and streamlines the end-to-end underwriting process. We’ve also found that it’s helpful to organise these technologies into four categories (diagram 1):

- Geospatial Imagery Assessments

- 3rd Party Data Assessments

- Customer Self-Inspections

- Remote Video Inspections

Geospatial Imagery Assessments

The first of the four main categories of remote inspection technologies is geospatial imagery assessments, which can take the legwork out of assessing properties.

For many years insurance carriers have relied on onsite claims adjuster to review locations in their portfolio that have been impacted by natural catastrophes. In recent years, insurer introduced drone imagery and manned aircraft geospatial imagery to assess impacted areas more efficiently. The trend has been to use more of these images not just for claims, but for underwriting as well.

Geospatial imagery gives you high-resolution images that provide data for outside measurements such as the condition of a roof, its material construction, and the physical layout of the property and its surrounding. What they can’t do is supply information on the interior and quantify the quality of the HVAC, plumbing, and electrical system.

Here’s a summary of some of the key providers of geospatial imagery assessments and the salient features of their solutions:

- Betterview uses high-resolution geospatial imagery to score properties on their predicted probability of loss over time. This is helpful early-on in the underwriting risk assessment. Its primary focus is the US markets: homeowners in single family homes or multi-family homes, and small to medium commercial properties. This year, Betterview has released a set of new features such as multi building analysis and detection polygons to help insurers better visualise property risks and increase efficiency and transparency.

- Cape Analytics leverages geospatial imagery and augments the analysis with integrated computer vision and deep learning using a database of more than 110 million US buildings to provide expanded insights to insurers. This machine learning technology gives insurers instant access to more powerful and accurate insights to empower online quoting, up-level underwriting decisions, and improve property renewal cycles.

- Munich Re’s Remote Industries hurricane tool suite uses advanced technologies to help insurers better manage the claims assessment and adjustment process. Additionally, Munich Re’s rich data set of high-resolution aerial imagery accessed through their GIC (Geospatial Intelligence Center) membership, combined with artificial intelligence and machine learning technologies can also help to steer Underwriting decisions with data-driven insights. Primarily focusing on the market in the United States and the Caribbean, Remote Industries offers a set of valuable tools to better analyse the risk exposure (pre-event) and damage assessments (post-event).

- Tensorflight is another company using automated computer image analysis on existing satellite and street view imagery to accurately extract commercial property data, including construction type, geolocation, roof characteristics, and building square footage. Tensorflight offers detailed, near-instant risk-related information on a global scale.

- Arturo delivers physical property characteristics and predictive analysis and uses activity patterns to better determine risk. Arturo publishes its model performance and harnesses feedback loops to auto-improve quality and performance over time. Insurers that work globally and in expanding markets have access to Arturo’s exclusive proprietary data both in the US and worldwide.

- EagleView provides a 60-petabyte library of oblique and orthogonal Pictometry® aerial imagery dating back to 2001, and the capacity to process tens of thousands of roof measurement reports per day. Their patented high-resolution image capture techniques, 3D aerial measurement software, and machine learning processes help carriers reduce field visits.

- Lastly, Zesty.ai is an AI-enabled property analytics and risk assessment platform for P&C carriers. Based on more than 130 billion data points, Zesty.ai predicts the potential impact of natural catastrophes on individual properties with a strong focus on wildfires. Using the latest advances in computer vision, artificial intelligence, and deep learning, it derives extensive property characteristics and models the impact of natural catastrophes.

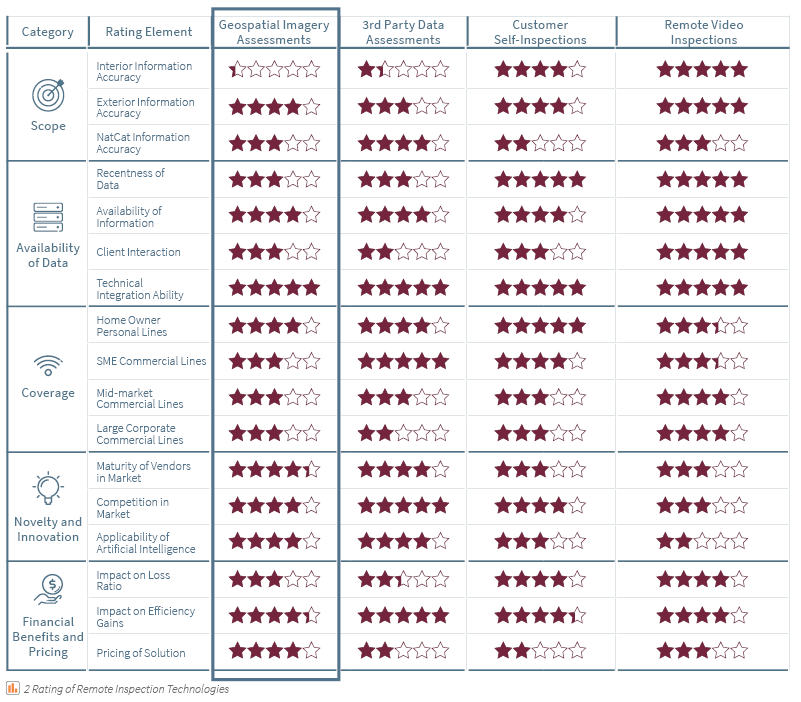

We put together an overview comparing the pros and cons of the various remote inspections solutions (diagram 2):

Click below to continue reading and get all our insights on the additional remote inspection technologies as well as our detailed rating & conclusion on all four:

How Synpulse Can Help

At Synpulse, we’ve helped dozens of major insurers in the vendor research phase and implementation delivery to bring new tools to their enterprise. Often this takes the form of initial conversations to understand the real problem areas of the underwriting and risk engineering teams and use workshops and interviews to find a target solution and the accompanying approach. We have had extensive experience with insurers of every size, and we often see that a new perspective is very helpful in transforming teams and organisations. Now is a crucial time for every insurer to strategically position themselves with the right risk assessment technology to remain competitive in 2020.

If you’re interested in learning more about the opportunities available in terms of remote inspection, get in touch with us now to discuss:

- How you can identify the best solution to match your current situation and pain points

- How these tools can better equip you to respond to Covid-19

- How these tools fit into your operating model to enable or replace site visits

- How much you have to spend and which tool will give you the most value for your investment

- How you could incorporate these tools into your existing system landscape to create an automated E2E journey

Click here to keep reading & download the entire article for free.