Part 3: 3rd Party Data Assessments

Property underwriters are under pressure to generate renewals and new business with limited resources – and the coronavirus isn’t making life any easier. How can technology help?

If you’re trying to assess property more efficiently in the pre-binding phase, there are huge pools of data already available. Find out more about third-party data assessments.

Remote Inspection Technologies

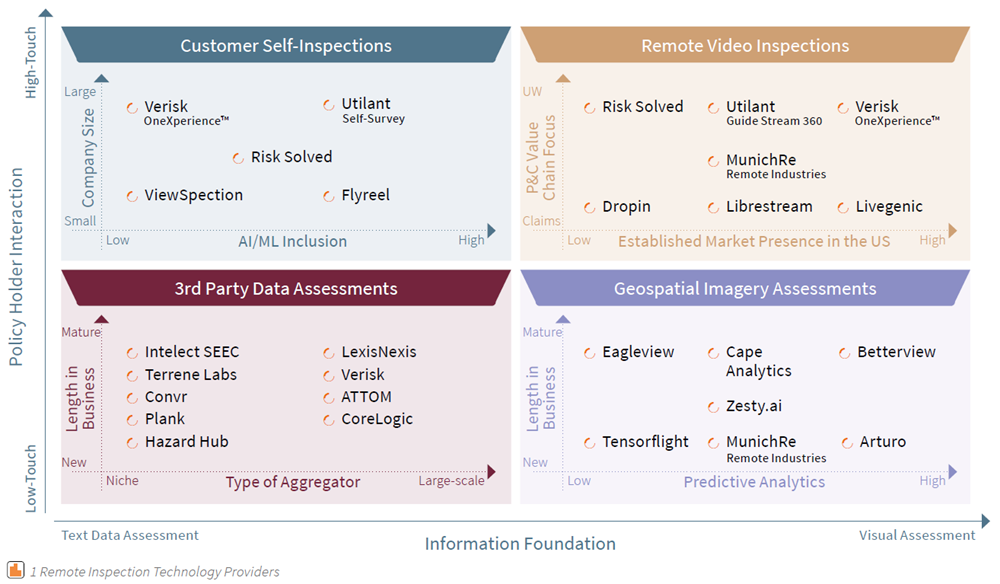

Remote inspection technologies are the way forward – read part 1 of this article series for more insights. Over the past few years, we at Synpulse have performed vendor analysis studies for multiple clients and worked with various technology providers. We’ve seen with overwhelming clarity that adding a remote inspection capability into the underwriting process significantly improves and streamlines the end-to-end underwriting process. We’ve also found that it’s helpful to organize these technologies into four categories (diagram 1):

- Geospatial Imagery Assessments – read all about it in part 2 of this article series

- 3rd Party Data Assessments

- Customer Self-Inspections

- Remote Video Inspections

3rd Party Data Assessments

In this article we focus on the second of the four main categories of remote inspection technology, third-party data assessments.

One major way for underwriters to streamline their risk assessment process is by prefilling the standard risk assessment data even before the assessment begins. 3rd party data assessment solutions allow insurers to streamline and accelerate the onboarding process for new prospect business. They can be deployed in a carrier’s renewal process to identify high-risk renewals for review. Once fully integrated, these systems enable underwriters to screen an entire existing book of business and identify accounts with attributes that indicate a high propensity for loss or that are outside a carrier’s defined underwriting appetite.

There are multiple data aggregation solution providers available that have specialized in the home owners, small commercial, and mid-market property segment. Here are some examples:

- Terrene Labs builds on the capability of prefilled data: it adds the ability to configure the insurers risk appetite and get the information required to evaluate or proactively quote the business. It offers a so-called risk selection engine that automates custom selection rules based on an appetite profile through an API. Users can also choose manual settings if they want to tweak the rules on their own.

- Convr (formerly DataCubes) is a commercial underwriting decision automation platform that helps underwriters use prefilled data to significantly reduce admin work. Combining rich data sets with cutting-edge data science allows real-time underwriting decisions to improve productivity, profitability, efficiency, and accuracy.

- IntellectSEEC uses prefilled data and an intelligent workbench to triage and process submissions based on big data and a risk analysis framework. Its workflow orchestration, with contextual risk assessment, allows underwriters, brokers, and risk specialists to collaborate, and improves data quality on agency submitted proposals.

- Planck integrates directly with agents’ or brokers’ workflow and feeds all the relevant data to underwriting systems and rating models. Additionally, it mines the open web and public records in real time, and leverages a combination of image processing, natural language processing, unstructured data analysis, and other artificial intelligence technologies to extract valuable information and create insights for underwriters.

- HazardHub provides a hazard database created from “national coverage for risks that destroy and damage property, including perils from air (wind, hail, tornado, lightning), water (flood, coastal storm surge), earth (earthquake, brownfield), and fire (wildfire and fire protection).”

There are also a number of large-scale industry data aggregators that help provide a more expanded view of the data and property history, which can be useful in the pre-underwriting phase:

- LexisNexis provides tools that aggregate claim and loss history, public records, and home/neighborhood area into a ranked risk index (CLUE and Home Inspection Index). It also has a product that turns geospatial data, historic fire department responses, and historic loss data into an accurate, up-to-date fire score (Fire and Disaster Response Score).

- Verisk SmartSource prefills reliable data instantaneously from continually processed databases and automatically purges unreliable data from its vast database. In combination with Verisk’s Survey Services, cost-effective, on-site property and liability risk-assessments conducted by expert field representatives, risk characteristics, exposure data, and hazardous condition information are used to steer underwriting decisions automatically.

- CoreLogic provides industry merged credit reports, including property data, liens, judgements, etc. It has data on 99% of US properties and over 100 million mortgage loan applications to identify undisclosed property-related obligations, and can verify employment and income using data from the IRS.

- Finally, ATTOM data solutions, well known for its extensive data sets for real estate, provides access to big data repositories to help underwriters expand the available set of risk assessment inputs. Underwriters can analyze the claims frequency, and therefore reduce adverse selection, and streamline inspection, loss and control decisions.

Conclusion

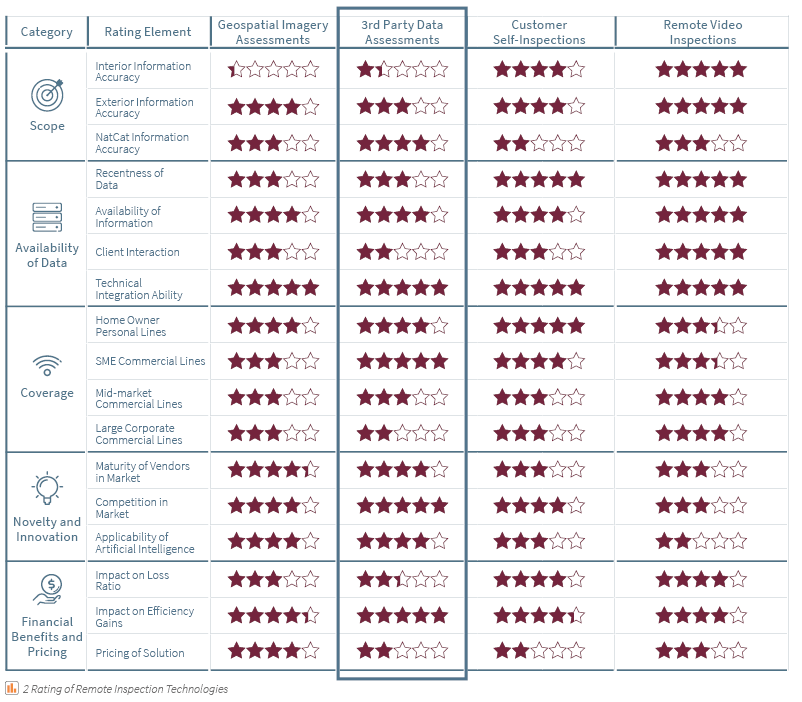

We put together an overview comparing the pros and cons of the various remote inspections solutions (diagram 2):

Click below to continue reading and get all our insights on the additional remote inspection technologies as well as our detailed rating & conclusion on all four:

How Synpulse Can Help

At Synpulse we’ve helped dozens of major insurers in the vendor research phase and implementation delivery to bring new tools to their enterprise. Often this takes the form of initial conversations to understand the real problem areas of the underwriting and risk engineering teams and use workshops and interviews to find a target solution and the accompanying approach. We have had extensive experience with insurers of every size, and we often see that a new perspective is very helpful in transforming teams and organizations. Now is a crucial time for every insurer to strategically position themselves with the right risk assessment technology to remain competitive in 2020.

If you’re interested in learning more about the opportunities available in terms of remote inspection, get in touch with us now to discuss:

- How you can identify the best solution to match your current situation and pain points

- How these tools can better equip you to respond to Covid-19

- How these tools fit into your operating model to enable or replace site visits

- How much you have to spend and which tool will give you the most value for your investment

- How you could incorporate these tools into your existing system landscape to create an automated E2E journey