As part of their efforts to promote sustainability and carbon neutrality, the HKEX has recently released new climate disclosure requirements for listed companies in Hong Kong. We explore the proposed requirements and their potential impact on the affected companies.

Hong Kong has been taking significant steps towards promoting sustainability and reducing carbon emissions, with a government target of carbon neutrality by 2025. To support this goal, the financial sector aims to implement mandatory climate-related disclosures that are aligned with the Task Force on Climate-related Financial Disclosures (TCFD) by 2025. This increasing demand for quality sustainability and climate-related disclosures from companies has led to a fourfold increase in the amount of green and sustainable debt and sustainability-linked loans issued in Hong Kong from 2020 to 2021.1

In response to this challenge, the Hong Kong Exchange and Clearing Limited (HKEX) has proposed new climate disclosure requirements for listed companies in Hong Kong through a consultation paper published on 14 April 2023. The proposed requirements aim to enhance transparency and promote a better understanding of climate-related risks and opportunities faced by companies in Hong Kong’s capital markets.

The HKEX’s proposal is part of a broader, global trend towards increased disclosures of climate-related risks and opportunities, driven by the growing demand from investors, regulators, and other stakeholders. The proposal provides a comprehensive list of consultation questions and HKEX has requested for interested parties to provide feedback on the proposed requirements by 30 June 2023.

This article explores HKEX’s proposed requirements and their potential impact on listed companies in Hong Kong.

Why the focus on climate disclosures?

Climate change poses significant risks to businesses and the global economy. Companies are not immune to these risks, and they can have a material impact on their financial performance and long-term sustainability. Thus, companies must disclose their exposure to such climate-related risks and opportunities to allow stakeholders to make informed decisions.

Proposed climate disclosures

HKEX proposes that listed companies in Hong Kong be required to disclose their governance, strategy, risk management, and metrics and targets related to climate change. This is a step up from the current “comply or explain” approach.

The proposed requirements will be in line with the exposure drafts of the International Sustainability Standards Board (ISSB) Climate Standard and ISSB General Standard, which are expected to be finalised by the end of the second quarter of 2023.

To prepare issuers for the climate-related reporting requirements based on the ISSB Climate Standard, the proposed requirements will cover four pillars:

- Disclose governance processes, controls, and procedures for managing climate-related risks and opportunities

- Establish clear governance structures and processes, assign clear roles and responsibilities for decision-making and oversight, and implement processes for ongoing monitoring and reporting

- Disclose climate-related risks and opportunities, and their impact on the issuer’s business operations and strategy

- Disclose the issuer’s response to identified risks and opportunities, including changes to business model and strategy, and climate-related targets

- Disclose the process used to identify, assess, and manage climate-related risks and opportunities

- Integrate climate-related risks and opportunities into existing risk management processes

- Develop mitigation and adaptation strategies for identified climate-related risks

- Disclose scope 1, 2, and 3 greenhouse gases (GHG) emissions and other cross-industry metrics

- Provide information on assets or business activities vulnerable to climate-related risks or aligned with opportunities and disclose the internal carbon price, if maintained

- Consider industry-based disclosure requirements prescribed under international environmental, social and governance (ESG) reporting frameworks

Implementation plan

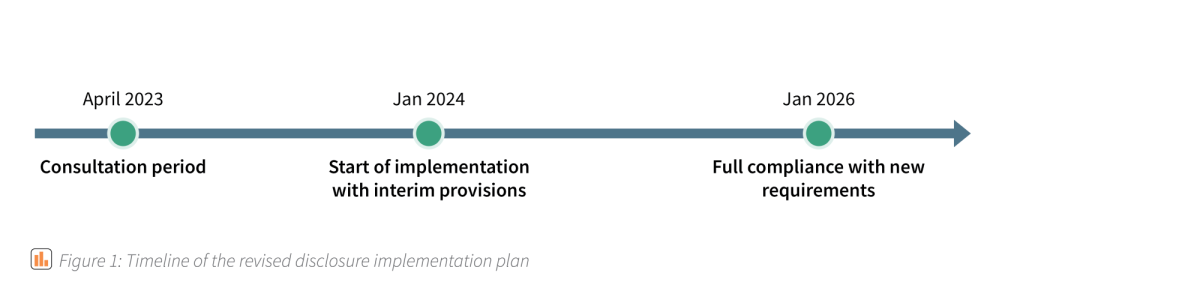

Based on the responses to the consultation, the revised disclosure requirements are expected to take effect in 2024. Considering the varying levels of ESG expertise in developing the ESG reporting framework across companies, some disclosure requirements will have interim provisions.

However, issuers are expected to be fully compliant with all new climate-related disclosures starting from 2026. HKEX also shares that implementation guidance will be issued to assist issuers in understanding and complying with the new requirements. They also encourage companies to start exploring the trends that define the future of ESG and to develop a roadmap to integrate ESG considerations into their business strategies.

Speak with our experts to find out how Synpulse can support you as your partner in sustainability.