A Multitalent for More Rational Trading and Settlement of Securities

Outsourcing securities settlement is not a binary decision.

Who hasn’t done an analysis to work out whether completely outsourcing securities settlement to a dedicated transaction bank makes business sense? What process changes it would involve? In many cases, the savings are too small, the necessary adjustments too involved, the impact on service quality too drastic, and the risks of being dependent on the provider seemingly too great

So, the inevitable happens: the project is shelved, to be revisited a year or two later.

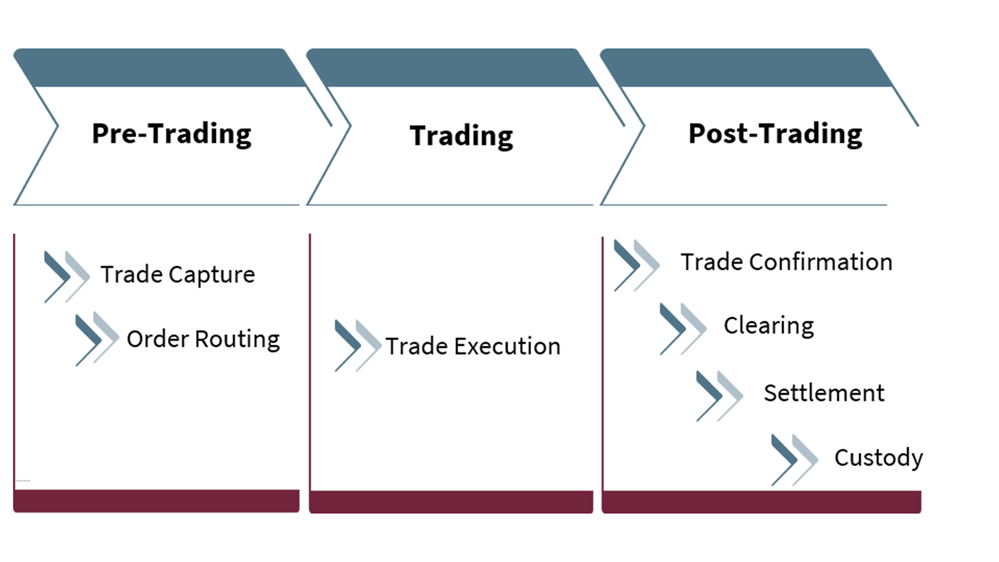

The fact is, however, that in the process chain between pre-trading, trading, and post-trading (trade confirmation, clearing, settlement, and custody), there is plenty of easy rationalisation potential. What’s more is that this potential can be realised without having to outsource the core trading and settlement processes.

Three-tier procedure assures alignment with strategy

First, the external and internal costs must be assessed. This involves drawing up an inventory of external relationships, trading partners, and custodians involved in the processing of transactions. Then comes an analysis of the process chain itself (see Figure 1). This is a front-to-back analysis to identify measures that will boost process efficiency and reduce costs, as well as assess the impact of these measures on internal and external clients’ perception of quality.

Based on the findings of the cost and process analysis, the global brokerage and/or global custody mandate is defined in detail and put out to tender.

Markus Urben, Global Head of Custody Banks at UBS, has this to say: “For banks, there’s no way around reviewing their strategy from a market access perspective and questioning the value added by making rather than buying. This also includes running your own trading desks, any stock exchange memberships, and the number of broker and custody relationships you have. All too often, I am still seeing that these reviews are limited to the commercial component of fees and commissions rather than taking in a holistic analysis of the entire business situation.”

Point of leverage: reducing broker relationships

Another consideration, in addition to the operational savings mentioned by Markus Urben is avoiding the costs of implementing new regulation. Ultimately, this involves rethinking of existing ways of doing things.

The specialists all agreed on this. As Matthias Schiesser, Head of Electronic Trading Solutions at Bank Vontobel, has put it: “At Vontobel, we guarantee compliance with the entire range of domestic and international regulatory requirements and access to all the major liquidity pools (multilateral trading facility, Systematic Internaliser, etc.). We’re permanently investing in a state-of-the-art trading, algo, transaction cost analysis (TCA), and business continuity management (BCM) infrastructure – something that has become even more important in these volatile times.

“With more than a million outstanding structured products, we rely on these processes to meet the very highest requirements. Many brokers, banks, and exchange members are unable or unwilling to bear the economic cost of these investments. Under the Markets in Financial Instruments Directive II (MiFID II), brokers are obligated to always guarantee the best price, taking into account the trading costs and the indicated price (bid/ask).

“As we see it, this is not a requirement all market participants can meet. In this regard, we and other sourcing brokers can help our partners to dramatically cut regulatory costs while improving quality. The make or buy decision will be a key question in the next few years.”

However, there are great potential savings to be had even by only reducing the number of trading partners. Specialists at Credit Suisse, Bank Vontobel, and UBS say that simply cutting back to a maximum of two brokers per product (FX, derivatives, and securities) yields quick benefits in the form of lower unit costs and relevant external savings, increasing the volume per broker, which inevitably leads to better terms.

In the view of the experts, the advantages of targeted sourcing in trading are obvious:

- Significant reductions in the costs of interfaces, reconciliation, and maintenance

- A reduction in external trading costs and the option of contractual settlements

- Quicker, MiFID-compliant execution of trades in line with the best price rules

- No development work for new regulatory standards in TCA, SOR, and algorithmic trading

- Constant regulatory compliance, since the broker has to guarantee the requirements are implemented correctly

- Greater transparency in trade execution for the benefit of the bank and its clients

A consistent reduction in the number of external trading partners creates substantial cost advantages without significant limitations. Matthias Schiesser has also put these savings at up to 50%. “There are also savings, thanks to lower fees, a reduction in internal production costs, and massively reduced costs of data,” he shared.

Point of leverage: optimising the global custodian network

The post-trading activities in the process chain, especially in settlement and custody processes, are likewise impacted by the reduction in the number of broker relationships. The savings potential also significantly increased by more efficient connections. For this reason, a bank should use any reduction in the number of broker relationships to also review its custodian network and optimise it wherever possible.

All these lead to a considerable reduction in efforts and expenses, primarily in deliveries, corporate actions, and entitlements, reconciliations, and many other areas.

Classic scale effects also play a special role in terms of global custody. Banks, such as UBS, Credit Suisse, and Bank Vontobel, enjoy much lower purchase prices from their custodians than most banks that maintain their own custodian network. Alternatively, there are other providers that have established themselves as major custody providers. The experts reckon potential savings of between 10% and 30% that can be achieved by systematically streamlining the custodian network in conjunction with negotiating prices.

It’s in the nature of things that these savings will vary depending on the investment market.

Martin Kobler, Head of Financial Institutions at Credit Suisse, explained, “Consolidating external broker and custodian relationships does not just have cost benefits. In our experience, it also makes it easier to standardise and automate processes, as they can be connected to partners efficiently in operational and technical terms. This makes trading and settlement more secure and leads to a higher level of standardisation in practically all areas of the process chain.”

Kobler also shared: “Deliberately harnessing these synergies has also led us to rethink our transaction banking offering, augmenting it with new channels, such as APIs and new services (e.g., suitability and regulatory services).”

The cost-savings in trading are normally greater than in custody. If the global broker and the global custodian are one and the same person, process flows and the costs they entail can again be significantly reduced.

Markus Urben shared his experience about contractual settlement, saying, “Contractual settlement is a matter of course for Swiss banks at the client level – so why not also on the market side, especially with a view to the Central Securities Depositories Regulation (CSDR) from 2022? I do not know any bank that would give up this cherished efficiency.”

About Synpulse

United States economist Peter Drucker once opined that “there is nothing so useless as doing efficiently that which should not be done at all.” It’s imperative for a process analysis of the entire process chain from customer order to custody to be carried out unconditionally and independently.

This not only gives you a better idea of your own setup and how efficient it is. It is also essential when it comes to subsequently checking processes for effectiveness and efficiency, as well as the basis for running a tender. “Efficiency is doing things right; effectiveness is doing the right things,” Peter Drucker also remarked.

Synpulse, a preeminent consultant to banks, has many years of experience in evaluating leading providers of both global brokerage and global custody. Having captured process chains at all types of banks with its BANKINABOX® process for years, we have one of the most comprehensive libraries around efficient processes in all areas.

Our experts have the practical experience to guide and support you from the first to the last step, making sure targeted sourcing becomes a reality for you rather than getting stuck on the shelf.

We have put together the most important questions for you for each step in the process. This enables you to formulate the requirements for your partners and precisely carry out the process evaluation on a solid basis. We would be glad to provide you with this questionnaire on request.