Loading Insight...

Insights

Insights

In this article, we explore the challenges posed by the current payment system and delve into the transformative potential of real-time payments in Canada's financial landscape.

Real-time payments (RTP) is now becoming a ubiquitous term in the payments landscape. More than 70 countries support RTP, but each with a different trajectory. In APAC, countries are expanding beyond domestic RTP to enable easier cross-border payments by interlinking their payment schemes (for instance, India’s UPI[1] and Thailand’s PromptPay[2] are linked with Singapore’s PayNow system). On the contrary, countries such as Canada are in the process of modernizing their payment infrastructure and launching Real-Time Rail (RTR), a national payment processing system.

Navigating challenges in the current legacy payments system

Although the path to creating an RTP ecosystem is replete with challenges, such as revamping the legacy infrastructure to connect to a modern RTP system (refer to section three of this article), the lack of instant payments is what limits Canadian retail banks in various ways:

Figure 1: The challenges in the current legacy payments system

Canada's RTR aims to address such challenges. Developed and implemented by the Canadian Payments Association, the innovative system will make it possible for individuals, businesses, and financial institutions (FIs) to process real-time payments seamlessly, 24/7, throughout the nation.

The impact of Real-Time Rail

Real-time payments are set to transform Canada's financial landscape, revolutionizing the way transactions are conducted. Unlike the current Interac system, which lacks real-time clearing and settlement capabilities, the introduction of RTR will enable instant and efficient payment processing, bringing faster and more convenient transactions to Canadian consumers.

Impact on financial institutions[3]:

- Faster and more efficient payments

- Enhanced transaction visibility and control by leveraging ISO 20022 data standard

- Improved cash flow management, enabling customers to have an up-to-date view of their finances

- Innovation and new products and services leveraging RTP capabilities

- Reduced payment friction and costs

- Adherence to regulatory implications

Impact on Canadian consumers:

- Instant payments with immediate fund transfers will eliminate the waiting period associated with traditional payment methods

- Improved financial visibility into the account balances and transaction history

- Real-time refunds and disbursements

- Increased payment options

- Enhanced security and fraud detection

While Canada is yet to experience the benefits, some other countries have already revolutionized their payment ecosystem by introducing RTP. Some of them are discussed below:

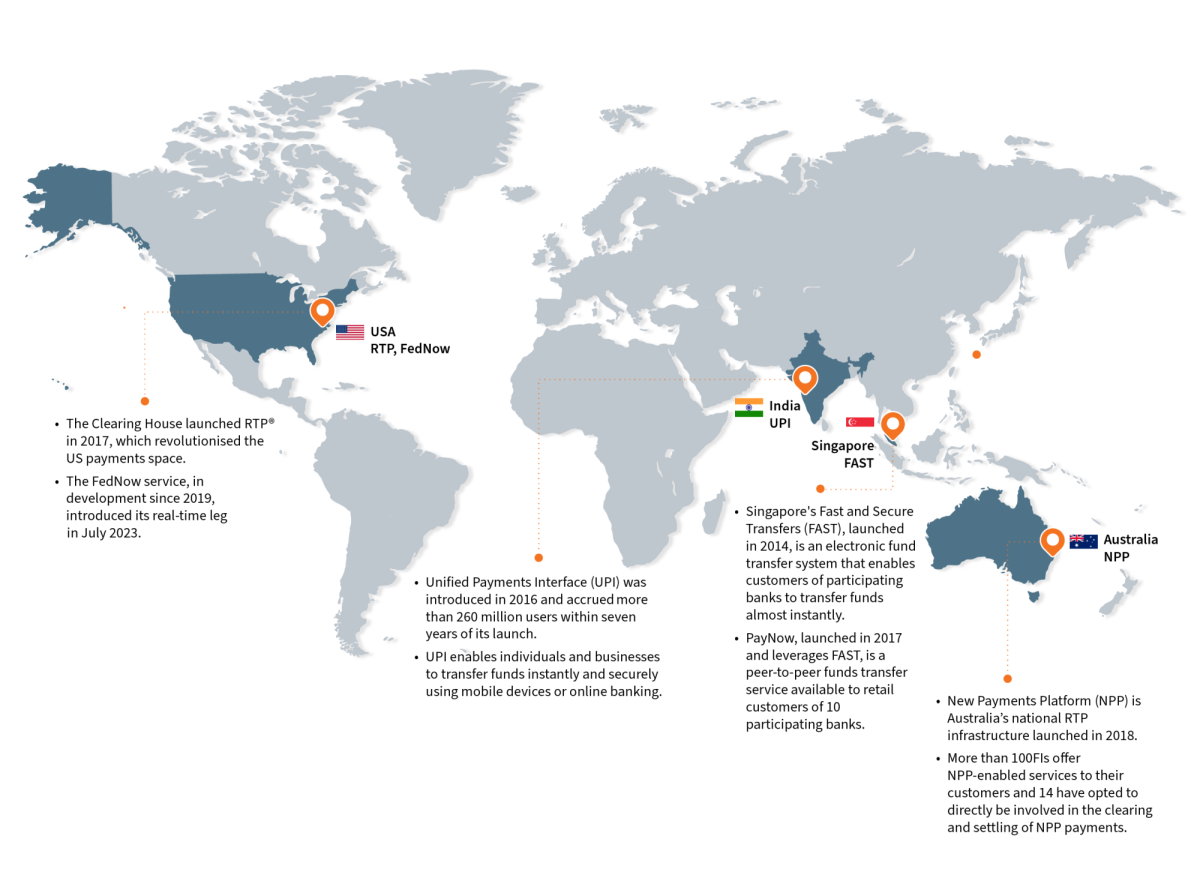

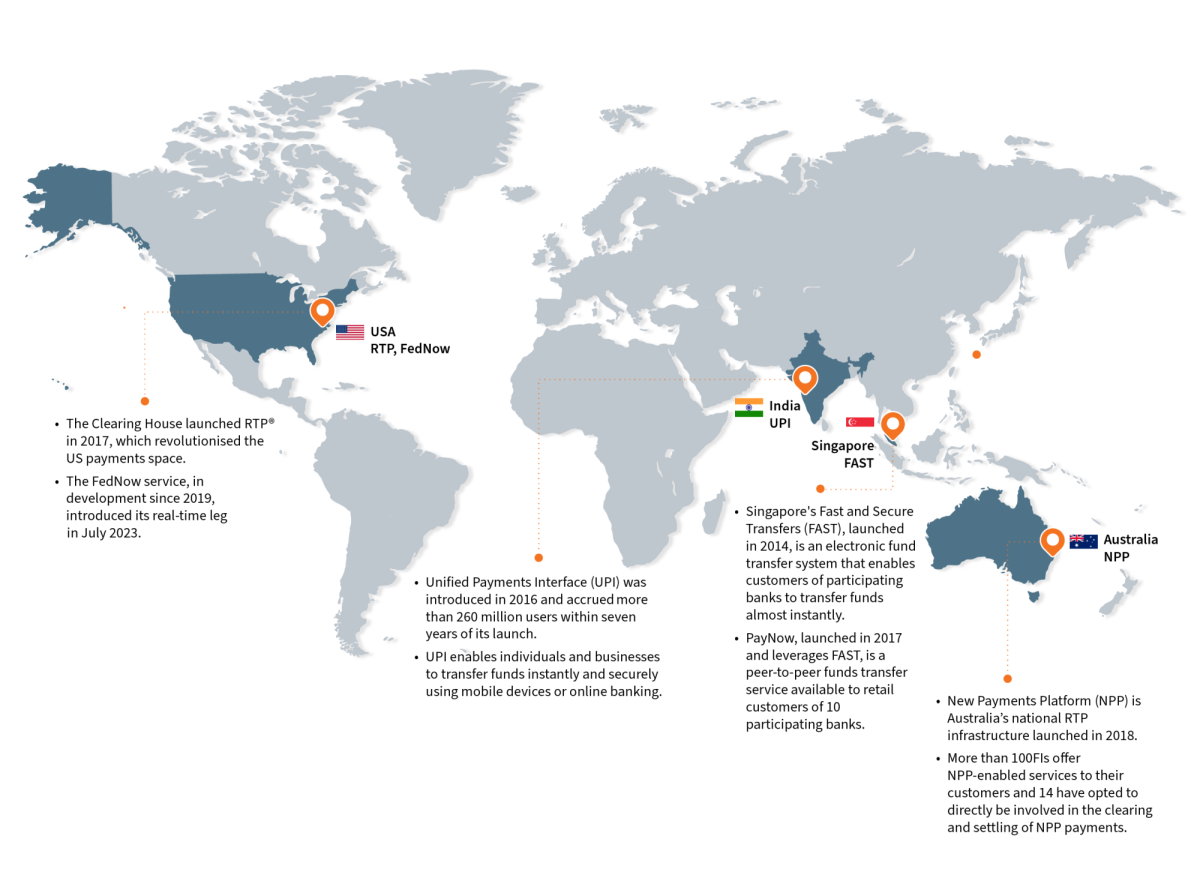

Figure 2: Some other countries modernizing payments with RTP

Preparing for Real-Time Rail

Navigating the regulatory requirements

To ensure a well-regulated and inclusive RTR ecosystem, the Bank of Canada and the Department of Finance have set forth specific requirements. FIs seeking to participate in the RTR must align with these requirements, creating a foundation for fair competition, transparent operations, and enhanced customer experience.

Bank of Canada: Settlement account requirements[4]

- Obtain a membership with Payments Canada

- Enter an RTR settlement account agreement with the Bank of Canada

- Demonstrate applicable payments-based business model

- Adhere to the bank's KYC requirements

- FIs must fall under one of two categories: federally, or provincially, regulated FIs or permitted non-bank payment service providers

- Demonstrate sufficient funding for the payment capacity account and compliance with the bank's financial health requirements

Payments Canada: RTR consultation[5]

In addition to the Bank of Canada’s requirements, prospective RTR participants must also meet Payments Canada's consultation criteria. This includes an application process, demonstrating appropriate risk mitigation capabilities, and fulfilling the applicable Payments Canada RTR operational, technical, and security requirements.

Building an effective technology infrastructure

To enable seamless and secure RTP, FIs need to adopt a comprehensive and scalable technology infrastructure. The key components that make up an effective tech stack for RTP include:

- Scalable and flexible core banking system that serves as the foundation for RTP, allowing FIs to efficiently handle high transaction volumes and support rapid growth.

- Advanced payment gateway that securely connects FIs with payment networks and supports multiple payments, enabling RTP transactions.

- Robust fraud detection that can analyze vast amounts of data in real-time, identify suspicious patterns, and promptly flag potentially fraudulent activities. Robust risk management capabilities are crucial for mitigating operational, financial, and reputational risks associated with RTP.

- Data integration and analytics capabilities will allow FIs that can analyze vast amounts of data in real-time, identify suspicious patterns, and promptly flag potentially fraudulent activities. Robust risk management capabilities are crucial for mitigating operational, financial, and reputational risks associated with RTP.

- Compliance modules that enable automated compliance checks, real-time monitoring, and reporting functionalities to ensure that transactions meet legal and regulatory standards.

- A scalable infrastructure comprising a robust server architecture, network infrastructure, and cloud-based technologies that can handle high transaction loads and provide seamless availability.

Strategic vendor partnerships will play a crucial role in building an effective technology infrastructure. These partnerships provide access to cutting-edge technology, integration support, domain expertise, and best practices to seamlessly integrate and attain interoperability with RTR. Moreover, vendors offer valuable risk mitigation solutions and ensure scalability to meet the growing transaction volumes.

A paradigm shift in Canada’s financial landscape

The RTR not only offers enhanced customer experiences but also creates a level playing field for fair competition and transparent operations. As Canada's financial sector prepares to embark on this real-time journey, it is imperative for FIs to proactively integrate these three essential elements: compliance, technology, and partnerships. By doing so, FIs can unlock new opportunities, elevate operational efficiency, and deliver real-time experiences that will redefine the way Canadians engage with their finances.

In this article, we explore the challenges posed by the current payment system and delve into the transformative potential of real-time payments in Canada's financial landscape.

Real-time payments (RTP) is now becoming a ubiquitous term in the payments landscape. More than 70 countries support RTP, but each with a different trajectory. In APAC, countries are expanding beyond domestic RTP to enable easier cross-border payments by interlinking their payment schemes (for instance, India’s UPI[1] and Thailand’s PromptPay[2] are linked with Singapore’s PayNow system). On the contrary, countries such as Canada are in the process of modernizing their payment infrastructure and launching Real-Time Rail (RTR), a national payment processing system.

Navigating challenges in the current legacy payments system

Although the path to creating an RTP ecosystem is replete with challenges, such as revamping the legacy infrastructure to connect to a modern RTP system (refer to section three of this article), the lack of instant payments is what limits Canadian retail banks in various ways:

Figure 1: The challenges in the current legacy payments system

Canada's RTR aims to address such challenges. Developed and implemented by the Canadian Payments Association, the innovative system will make it possible for individuals, businesses, and financial institutions (FIs) to process real-time payments seamlessly, 24/7, throughout the nation.

The impact of Real-Time Rail

Real-time payments are set to transform Canada's financial landscape, revolutionizing the way transactions are conducted. Unlike the current Interac system, which lacks real-time clearing and settlement capabilities, the introduction of RTR will enable instant and efficient payment processing, bringing faster and more convenient transactions to Canadian consumers.

Impact on financial institutions[3]:

- Faster and more efficient payments

- Enhanced transaction visibility and control by leveraging ISO 20022 data standard

- Improved cash flow management, enabling customers to have an up-to-date view of their finances

- Innovation and new products and services leveraging RTP capabilities

- Reduced payment friction and costs

- Adherence to regulatory implications

Impact on Canadian consumers:

- Instant payments with immediate fund transfers will eliminate the waiting period associated with traditional payment methods

- Improved financial visibility into the account balances and transaction history

- Real-time refunds and disbursements

- Increased payment options

- Enhanced security and fraud detection

While Canada is yet to experience the benefits, some other countries have already revolutionized their payment ecosystem by introducing RTP. Some of them are discussed below:

Figure 2: Some other countries modernizing payments with RTP

Preparing for Real-Time Rail

Navigating the regulatory requirements

To ensure a well-regulated and inclusive RTR ecosystem, the Bank of Canada and the Department of Finance have set forth specific requirements. FIs seeking to participate in the RTR must align with these requirements, creating a foundation for fair competition, transparent operations, and enhanced customer experience.

Bank of Canada: Settlement account requirements[4]

- Obtain a membership with Payments Canada

- Enter an RTR settlement account agreement with the Bank of Canada

- Demonstrate applicable payments-based business model

- Adhere to the bank's KYC requirements

- FIs must fall under one of two categories: federally, or provincially, regulated FIs or permitted non-bank payment service providers

- Demonstrate sufficient funding for the payment capacity account and compliance with the bank's financial health requirements

Payments Canada: RTR consultation[5]

In addition to the Bank of Canada’s requirements, prospective RTR participants must also meet Payments Canada's consultation criteria. This includes an application process, demonstrating appropriate risk mitigation capabilities, and fulfilling the applicable Payments Canada RTR operational, technical, and security requirements.

Building an effective technology infrastructure

To enable seamless and secure RTP, FIs need to adopt a comprehensive and scalable technology infrastructure. The key components that make up an effective tech stack for RTP include:

- Scalable and flexible core banking system that serves as the foundation for RTP, allowing FIs to efficiently handle high transaction volumes and support rapid growth.

- Advanced payment gateway that securely connects FIs with payment networks and supports multiple payments, enabling RTP transactions.

- Robust fraud detection that can analyze vast amounts of data in real-time, identify suspicious patterns, and promptly flag potentially fraudulent activities. Robust risk management capabilities are crucial for mitigating operational, financial, and reputational risks associated with RTP.

- Data integration and analytics capabilities will allow FIs that can analyze vast amounts of data in real-time, identify suspicious patterns, and promptly flag potentially fraudulent activities. Robust risk management capabilities are crucial for mitigating operational, financial, and reputational risks associated with RTP.

- Compliance modules that enable automated compliance checks, real-time monitoring, and reporting functionalities to ensure that transactions meet legal and regulatory standards.

- A scalable infrastructure comprising a robust server architecture, network infrastructure, and cloud-based technologies that can handle high transaction loads and provide seamless availability.

Strategic vendor partnerships will play a crucial role in building an effective technology infrastructure. These partnerships provide access to cutting-edge technology, integration support, domain expertise, and best practices to seamlessly integrate and attain interoperability with RTR. Moreover, vendors offer valuable risk mitigation solutions and ensure scalability to meet the growing transaction volumes.

A paradigm shift in Canada’s financial landscape

The RTR not only offers enhanced customer experiences but also creates a level playing field for fair competition and transparent operations. As Canada's financial sector prepares to embark on this real-time journey, it is imperative for FIs to proactively integrate these three essential elements: compliance, technology, and partnerships. By doing so, FIs can unlock new opportunities, elevate operational efficiency, and deliver real-time experiences that will redefine the way Canadians engage with their finances.