Loading Insight...

Insights

Insights

Why the need for state-of-the-art engagement banking?

In this post, the first of a series of five, we look at why digital will be the dominant channel for banking clients going forwards and why institutions should be responding with a new engagement banking platform.

The perfect storm

In recent years, numerous factors have increased the need for businesses, in general, to move from physical to digital. The COVID-19 pandemic has further accelerated this development, with corporations looking to digital-first solutions, as face-to-face interaction became more and more difficult. This trend can also be observed in the banking industry.

Here, the figures indicate the growing use of digital channels and a surge in the use of mobile banking over the past year.

- In 2021, digital banking adoption in Asia-Pacific (APAC) is 88%, up from 65% in 2017.

- 80% of APAC consumers expect to maintain or increase their use of mobile and online channels, post-COVID-19.

- 42% of respondents in a recent survey anticipate visiting their bank branch either less, or not at all, when the pandemic ends.1

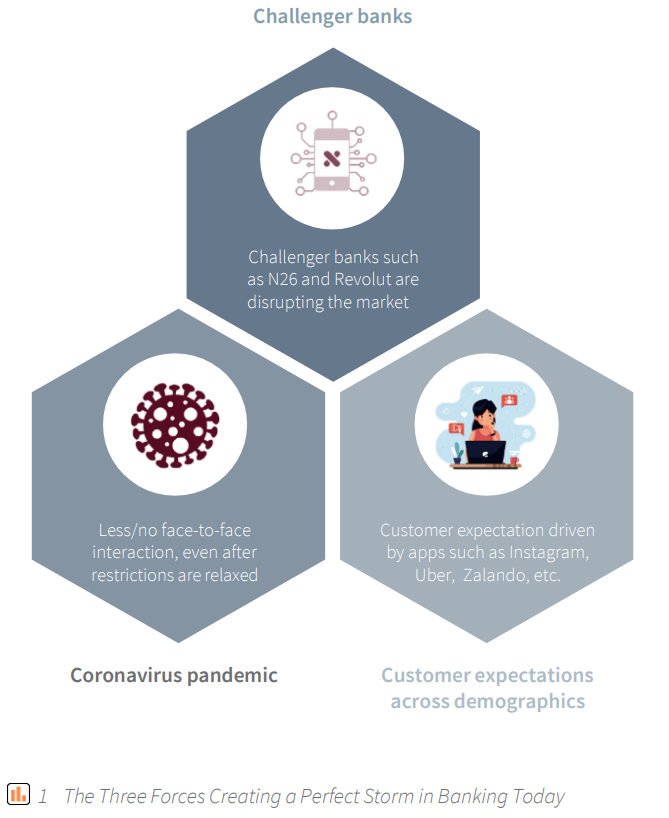

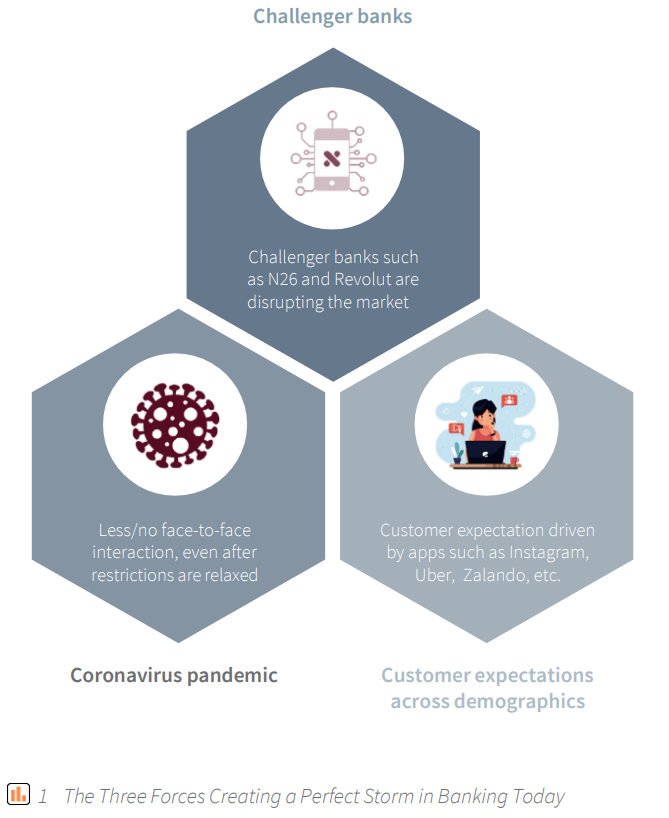

A user-first digital platform has become a hygiene factor as opposed to a pure differentiator. Why? As the diagram in Figure 1 shows, the market and customer forces have combined to create a perfect storm.

Figure 1. The three forces creating a perfect storm in banking today

Thanks to innovative solutions offered by tech companies, fintechs, and challenger banks, digital interactions have already become the default communication method for many people. Whilst some research has shown that the human element is still prevalent in banking – and indeed key in some interactions – due to an aging population and large swaths of rural areas with limited internet access, we see that the younger generations have started to expect “digital only”. In fact, 20% of digital banks globally were located in the APAC region.2

This trend has been accelerated by the lockdown during the COVID-19 pandemic, which forced all banking customers to use digital channels to varying degrees of success. Therefore, the dilemma lies in meeting the varying needs of customers in the present, whilst preparing for a future bank that will primarily consist of digital customer engagements.

The perfect storm created by the three forces – the challenger banks, the COVID-19 pandemic, and the customer expectations across demographics – requires expert navigation. Through our combined extensive experience in the market, Synpulse and Backbase are ideally positioned to provide this expertise and help banks to respond to these three forces and accelerate their digital transformation.

The basis of the solution is an engagement banking platform (EBP). Let us first look at the strategic preconditions you should keep in mind to make your digital transformation a successful one.

Digital banking will be the dominant channel for your clients going forwards

Banks, which have launched on the Backbase engagement banking platform, have improved their KPIs significantly, with 90% lower channel maintenance costs, 33% lower IT costs for new app builds, and 60% faster time to market.

The digital bank is the bank of the future. When planning or running such a programme, our recommendation is to focus on a plan beyond delivery, establish clear ways of working between all the teams involved, and attract and build up specific platform skills early.

If you’re interested in finding out more and learning how this approach can benefit the digital transformation of your bank, feel free to contact us.

Why the need for state-of-the-art engagement banking?

In this post, the first of a series of five, we look at why digital will be the dominant channel for banking clients going forwards and why institutions should be responding with a new engagement banking platform.

The perfect storm

In recent years, numerous factors have increased the need for businesses, in general, to move from physical to digital. The COVID-19 pandemic has further accelerated this development, with corporations looking to digital-first solutions, as face-to-face interaction became more and more difficult. This trend can also be observed in the banking industry.

Here, the figures indicate the growing use of digital channels and a surge in the use of mobile banking over the past year.

- In 2021, digital banking adoption in Asia-Pacific (APAC) is 88%, up from 65% in 2017.

- 80% of APAC consumers expect to maintain or increase their use of mobile and online channels, post-COVID-19.

- 42% of respondents in a recent survey anticipate visiting their bank branch either less, or not at all, when the pandemic ends.1

A user-first digital platform has become a hygiene factor as opposed to a pure differentiator. Why? As the diagram in Figure 1 shows, the market and customer forces have combined to create a perfect storm.

Figure 1. The three forces creating a perfect storm in banking today

Thanks to innovative solutions offered by tech companies, fintechs, and challenger banks, digital interactions have already become the default communication method for many people. Whilst some research has shown that the human element is still prevalent in banking – and indeed key in some interactions – due to an aging population and large swaths of rural areas with limited internet access, we see that the younger generations have started to expect “digital only”. In fact, 20% of digital banks globally were located in the APAC region.2

This trend has been accelerated by the lockdown during the COVID-19 pandemic, which forced all banking customers to use digital channels to varying degrees of success. Therefore, the dilemma lies in meeting the varying needs of customers in the present, whilst preparing for a future bank that will primarily consist of digital customer engagements.

The perfect storm created by the three forces – the challenger banks, the COVID-19 pandemic, and the customer expectations across demographics – requires expert navigation. Through our combined extensive experience in the market, Synpulse and Backbase are ideally positioned to provide this expertise and help banks to respond to these three forces and accelerate their digital transformation.

The basis of the solution is an engagement banking platform (EBP). Let us first look at the strategic preconditions you should keep in mind to make your digital transformation a successful one.

Digital banking will be the dominant channel for your clients going forwards

Banks, which have launched on the Backbase engagement banking platform, have improved their KPIs significantly, with 90% lower channel maintenance costs, 33% lower IT costs for new app builds, and 60% faster time to market.

The digital bank is the bank of the future. When planning or running such a programme, our recommendation is to focus on a plan beyond delivery, establish clear ways of working between all the teams involved, and attract and build up specific platform skills early.

If you’re interested in finding out more and learning how this approach can benefit the digital transformation of your bank, feel free to contact us.