Loading Insight...

Insights

Insights

his is the fourth article in a series of five, where we look at the second of the three valuable lessons learned from our real-life experience with helping a client set up an engagement banking platform.

Takeaway 2: Clearly structure teams and interactions for efficiency and visibility

As the second of our three takeaways, we have observed that banks need to clearly structure their teams and interactions for optimised efficiency and visibility.

Our digital transformation programmes on the Backbase EBP use a new methodology to apply the bank’s strategy to leverage its mission or “purpose for existence” and to create a sense of urgency within the programme. The methodology helps us create a top-down, outside-in vision of the programme, which in turn is instrumental in enabling all the team members to shape their own personal and individual visions of their programmes. Creating a shared vision results in outstanding drive and the build-up of momentum throughout the programme.

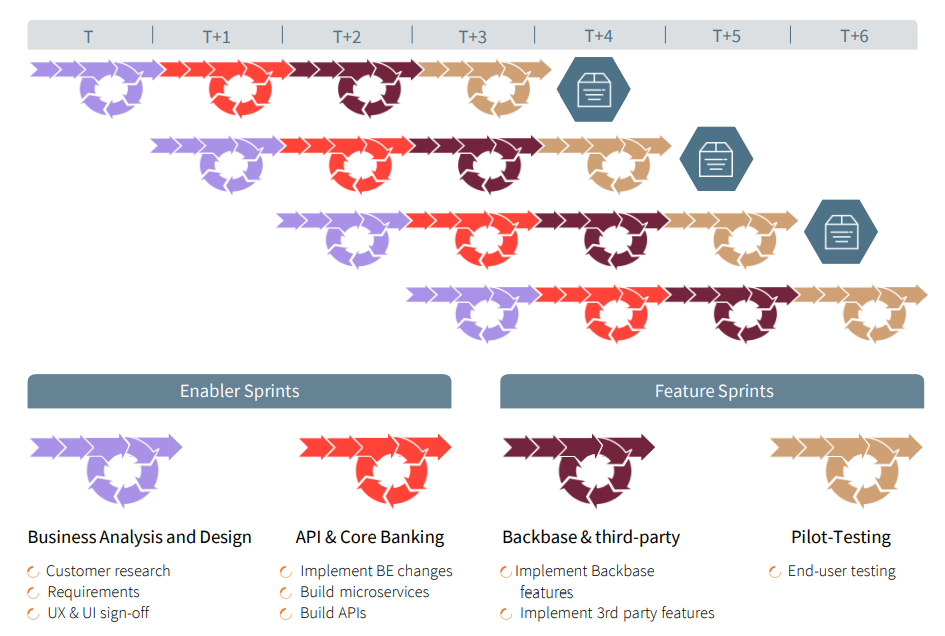

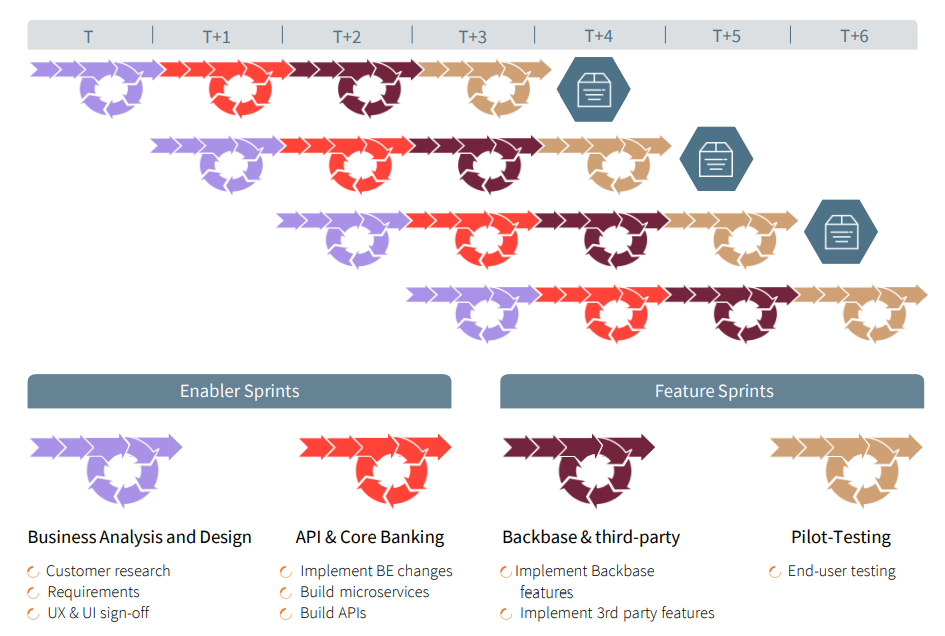

High momentum and drive have a lot to do with clear team collaboration and efficient communication. Here are the preconditions needed so that your Backbase delivery squads can release new mobile banking functionality with sprint T+2 (each sprint lasting two weeks):

- The client journey and UX/UI design must be completed

- The bank’s products must be ready in the backend

- The bank’s integration layer must be ready to expose the REST APIs, also known as RESTful APIs (e.g., product and backend data), which are needed by the mobile application

Figure 1 below shows a conceptual overview of our team sprint plan that ensures a clear process and efficient interaction, as well as prevents blockers or “idle times”. After each step, the definition of ready must be fulfilled in order to guarantee a smooth transition to the next step.

Figure 1. Sequence of sprints and requirements so that the Backbase delivery squad can release new mobile banking functionality with sprint T+2 and enter pilot testing in sprint T+3

This working rhythm is key for any digital transformation, as it allows the high-level vision of the digital transformation programme to be broken down into sprint goals for the respective individual teams. Once established, it leads to high levels of both momentum and motivation within your digital transformation teams.

In our next post, we’ll be looking at the third key takeaway on building up your skills.

Banks, which have launched on the Backbase engagement banking platform, have improved their KPIs significantly, with 90% lower channel maintenance costs, 33% lower IT costs for new app builds, and 60% faster time to market.

The digital bank is the bank of the future. When planning or running such a programme, our recommendation is to focus on a plan beyond delivery, establish clear ways of working between all the teams involved, and attract and build up specific platform skills early.

If you’re interested in finding out more and learning how this approach can benefit the digital transformation of your bank, feel free to contact us.

his is the fourth article in a series of five, where we look at the second of the three valuable lessons learned from our real-life experience with helping a client set up an engagement banking platform.

Takeaway 2: Clearly structure teams and interactions for efficiency and visibility

As the second of our three takeaways, we have observed that banks need to clearly structure their teams and interactions for optimised efficiency and visibility.

Our digital transformation programmes on the Backbase EBP use a new methodology to apply the bank’s strategy to leverage its mission or “purpose for existence” and to create a sense of urgency within the programme. The methodology helps us create a top-down, outside-in vision of the programme, which in turn is instrumental in enabling all the team members to shape their own personal and individual visions of their programmes. Creating a shared vision results in outstanding drive and the build-up of momentum throughout the programme.

High momentum and drive have a lot to do with clear team collaboration and efficient communication. Here are the preconditions needed so that your Backbase delivery squads can release new mobile banking functionality with sprint T+2 (each sprint lasting two weeks):

- The client journey and UX/UI design must be completed

- The bank’s products must be ready in the backend

- The bank’s integration layer must be ready to expose the REST APIs, also known as RESTful APIs (e.g., product and backend data), which are needed by the mobile application

Figure 1 below shows a conceptual overview of our team sprint plan that ensures a clear process and efficient interaction, as well as prevents blockers or “idle times”. After each step, the definition of ready must be fulfilled in order to guarantee a smooth transition to the next step.

Figure 1. Sequence of sprints and requirements so that the Backbase delivery squad can release new mobile banking functionality with sprint T+2 and enter pilot testing in sprint T+3

This working rhythm is key for any digital transformation, as it allows the high-level vision of the digital transformation programme to be broken down into sprint goals for the respective individual teams. Once established, it leads to high levels of both momentum and motivation within your digital transformation teams.

In our next post, we’ll be looking at the third key takeaway on building up your skills.

Banks, which have launched on the Backbase engagement banking platform, have improved their KPIs significantly, with 90% lower channel maintenance costs, 33% lower IT costs for new app builds, and 60% faster time to market.

The digital bank is the bank of the future. When planning or running such a programme, our recommendation is to focus on a plan beyond delivery, establish clear ways of working between all the teams involved, and attract and build up specific platform skills early.

If you’re interested in finding out more and learning how this approach can benefit the digital transformation of your bank, feel free to contact us.