Part 2: Strategic Challenges When It Comes to Providing Digital Banking Your Clients Love

This is the second article in a series of five where we’ll look at the fundamental obstacles to create a digital experience that bank clients will love.

Why Are Banks Failing to Provide Satisfying Client Experiences?

The “perfect storm” described in our previous post is rapidly forcing banks to deliver a compelling digital proposition to remain relevant. For most banks, simply improving the existing proposition will not be enough. It will fail to address the combined threats of challenger banks, changing demographics and customer expectations, and lasting changes resulting from the coronavirus pandemic.

Traditional banks often struggle to respond to customers if they lack a unified technology platform. Banks traditionally operate in siloed channels: web, mobile, and branches. This leads to duplicated effort and technology where end-customers experience friction because information isn’t shared across channels. In line with this siloed approach, many banks rely on their technology departments to simply make changes to legacy systems in response to market changes.

Instead, banks need to think holistically, taking ownership of the full customer experience from beginning to end. They need to move away from siloed legacy systems to a single unified platform based on modern architecture. This unified platform approach enables banks to aggregate value from the core systems, open banking APIs and fintechs to orchestrate the end-customer experience, which empowers the bank’s employees and its clients. We call this an engagement banking platform (EBP).

An EBP enables a truly engaging customer experience at any touchpoint. It re-connects customers with their banks by making employees an essential part of the equation. And it creates a unified ecosystem that focuses on unique value-creation, not maintenance of siloed solutions or layered offerings.

Banks that leverage an EBP drastically decrease costs and back-office inefficiencies. They also experience a massive improvement in time to market, developing the ability to release valuable innovation in just days or weeks. However, launching a digital proposition on an EBP typically comes with a number of similar strategic challenges.

In essence, banks need to drastically simplify and modernize their operations and delivery capabilities. At the same time, they need to take back control of the customer experience. With client needs changing and the pressure to manage costs increasing continuously, banks are forced to undergo a digital transformation that goes beyond a platform or technology change.

One example is the strategic challenge for the bank’s management and its employees in the “war for talent.” Banks are competing for talent not only with fintech firms, but also with technology companies. Banks are also struggling with technical debt, legacy environments, and a certain inertia when it comes to cultural changes such as working with agile methodologies. This old way of working also makes it difficult to attract new talent.

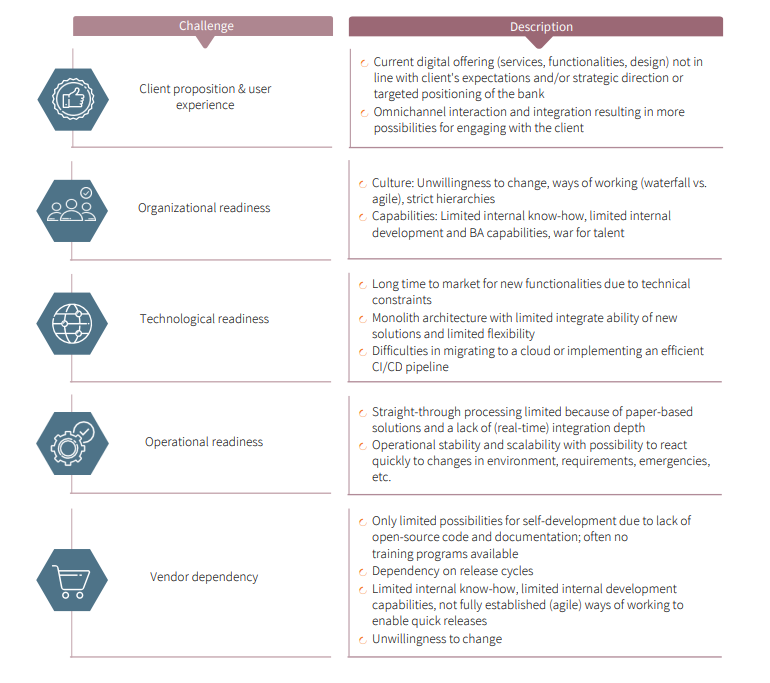

Below you’ll see the most prominent challenges for banks. These challenges, when not addressed, have led to the failure of digital transformations even though new platforms were implemented. The knock-on effects include higher costs, longer time to market, and lower client satisfaction. As you will see, introducing an EBP involves a transformation of the whole bank.

In addition to the difficulties mentioned above, one important issue banks frequently discuss is whether to purchase the platform or construct it themselves. Often, they’re tempted to build it themselves in the hope of reducing vendor dependency but underestimate the effort and skills required to build a fully digital platform.

As the scope of such EBPs has grown significantly in the last decade, the build-your-own approach has become more complex and resource-heavy. By contrast, Global vendors like Backbase devote their full attention to digital platforms. Banks can profit from the resulting economies of scale. A further advantage is that Synpulse and Backbase can help the customer reduce time to market thanks to their experience with other similar projects.

In our experience, it makes the most sense for a bank to procure the latest state-of-the-art software technology for a global platform and then focus on the differentiating factors in its customer experiences. Vendor dependency in this setup is then more efficiently addressed by choosing a solution that uses open technologies, provides a versatile marketplace of integrated fintech solutions, and allows bank staff to deliver customized or new modules themselves.

Migrating and creating a digital banking platform, web, and mobile are comparable with the core banking transformations of the early 2000s. It’s vital to have experience with such transformation projects and use a proven approach to successfully land programs of notable size and complexity.

In our next article, we’ll be focusing on the first of three key takeaways based on a real-life digital transformation program that Synpulse delivered with Backbase.

Digital banking will be the dominant channel for your clients going forward

Banks which have launched on the Backbase experience banking platform have improved their KPIs significantly, with 90% lower channel maintenance costs, 33% lower IT costs for new app builds and 60% faster time to market.

The digital bank is the bank of the future. When planning or running such a program, our recommendation is to focus on a plan beyond delivery, establish clear ways of working between all the teams involved, and attract and build up specific platform skills early.

If you’re interested in finding out more and learning how this approach can benefit the digital transformation of your bank, feel free to contact us for a call.