The global COVID-19 pandemic has forced a new normal upon everyone. Operating models that used to work are simply no longer effective nor efficient in a post-COVID world.

When the pandemic first struck in 2020, organisations worldwide, including the financial services sector, were forced to adopt a remote working arrangement overnight by governments in a bid to control the spread of the virus. More than a year later, organisations have moved towards a flexible operating model, one that supports extensive or full-time work from home for nearly all employees.

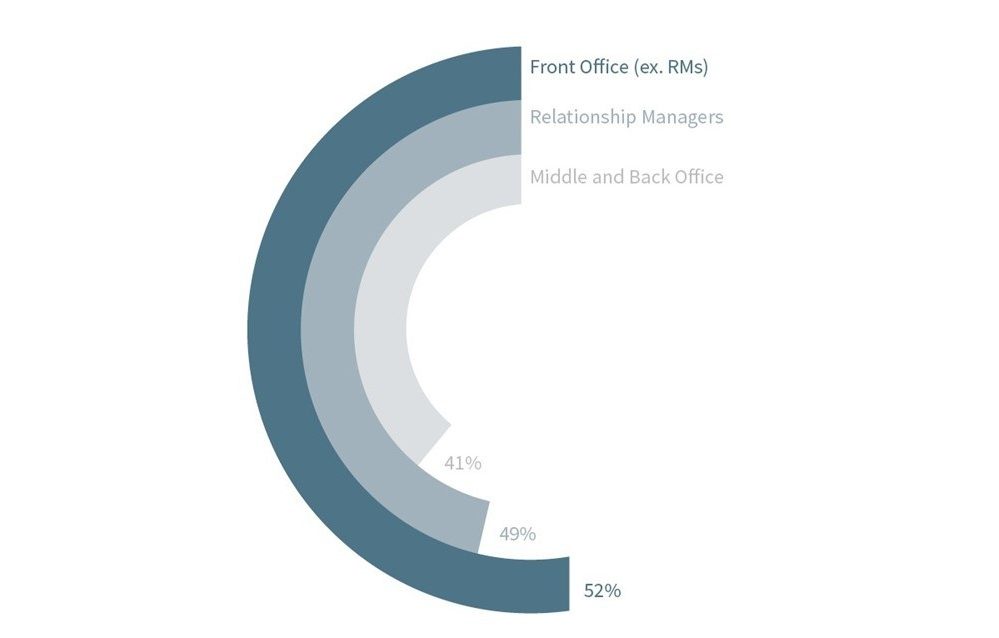

This shift to remote working, while not a new concept, was a huge change for many businesses, and all signs point to it becoming a norm as business organisations and societies adjust to life after COVID. 82% of businesses in Hong Kong plan to keep remote working as a working arrangement going forward1 . Several large private banks including HSBC and Standard Chartered are also offering remote working as an option to their employees2. Nearly half of middle and back-office staff have been working from home for some time3.

Despite some drawbacks, businesses and their employees are finding the arrangement to have many advantages. The unusual circumstances offer private banks strategic opportunities such as centralisation, outsourcing, optimisation, and automation that can drive their business beyond simply ensuring business continuity to improving business capability in an ever so competitive environment.

Who was able to work from home during the pandemic?

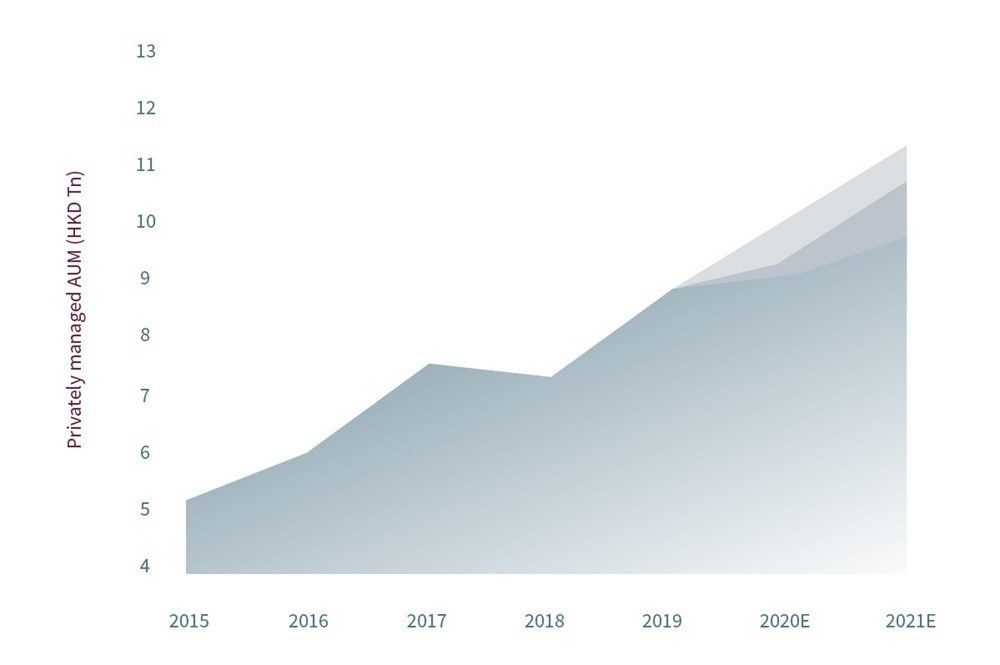

How does the AUM growth trend look like for Hong Kong Private Wealth Managers?

Optimising process geographics with centralisation

During the start of the pandemic, most departments in private banks were able to transit to a work-from-home setup as soon as the banks were able to provide remote access to their staff. The experience of reacting to this change has proven to be valuable for private banks as they were pushed to operate outside of secure office environment, creating a perfect testing ground for the move towards a future remote working operating model.

In a way, it can be said that through the pandemic, every bank has executed a proof of concept for nearshoring and outsourcing. For tasks that are not bound by law or regulation to any particular country, opportunities have naturally started to emerge. Why upkeep two groups of staff across two offices if these operational tasks are effectively the same?

However, before processes can be centralised to a single location, they must be harmonised. Markets with similar regulations and clientele tend to have similar processes, but over time, procedures at different locations evolve and become fragmented.

However, before processes can be centralised to a single location, they must be harmonised. Markets with similar regulations and clientele tend to have similar processes, but over time, procedures at different locations evolve and become fragmented.

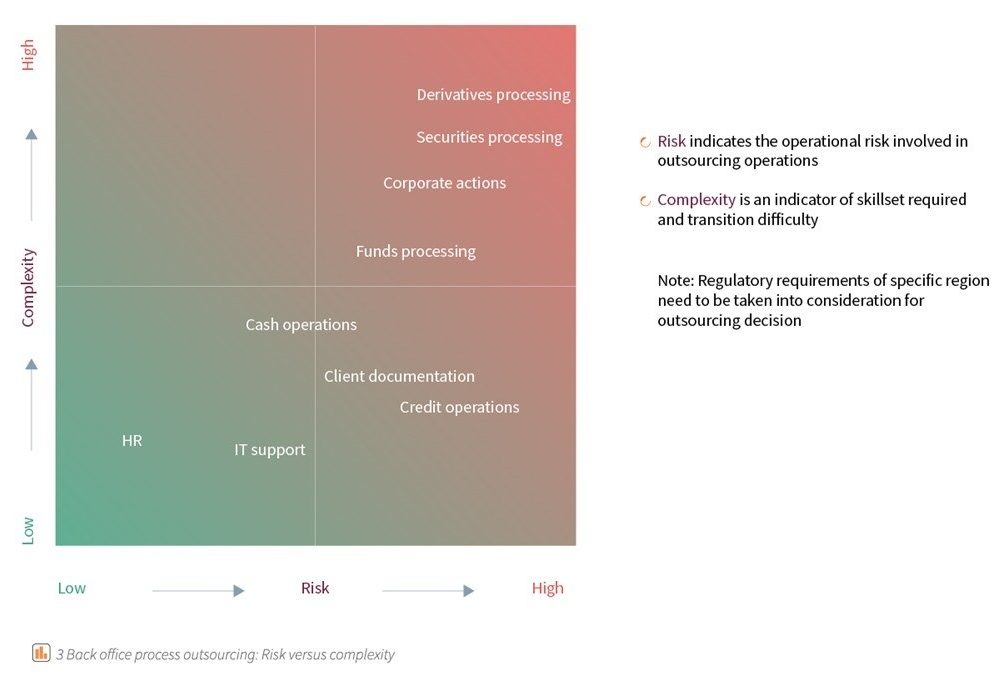

An example of a back office process outsourcing assessment: Risk versus complexity

From fragmented digital workflows towards automation at scale

As banks transitioned into the work-from-home model, it became apparent that many processes requiring smooth in-person communication and documentation on paper weren’t ready for this change. This challenge was especially evident for smaller private banks, which were relatively more impacted due to the less sophisticated infrastructure4 .

While leading private banks have strong technical platforms, a significant amount of manual work still exists across the industry. Smaller private banks do not have the scale to invest as heavily in technology and are thus lagging behind with largely manual processes. However, the remote disruption has forced every industry player, regardless of size, to take steps towards a digitalised, paper-less operating model.

This shift brings significant benefits as digitalised processes (even aged and poorly optimised ones) become easier to analyse and improve. A highly manual settlement process may have been workable by a close team before, but remote work and the spiking trade volumes reflect the need for automation as manual processes aren’t scalable and carry a high risk of human error.

One thing the pandemic has shown is that even small private banks can drive relatively large technical changes quickly when under pressure, which can come as a stroke of luck. As more and more tasks are moved to digital workflows, it is critical to remember that copy-pasting manual processes to digital platforms should be avoided. Redundancies must be eliminated, and the workflows streamlined to take full advantage of digital platforms and their potential for automation with straight-through processing.

Now that many processes have been forced to become digital, transferring workflows from emails and excel files to complete workflow platforms are now much easier as the impact faced by the end-users from such transformation projects is smaller. This gives private banks an unprecedented opportunity to adopt digital platforms, and with that change, the chance to dive deep into process optimisation and automation. In our experience, a significant portion of processes in the back office are still highly manual, and often contain more steps than necessary. Simple solutions like Robotic Process Automation (RPA) allow for quick wins in this area.

Operating model disruption

The first key step to improve productivity and cost-income efficiency via centralisation and automation is to look closely at the bank’s operating model. What are the primary processes, how are they carried out regularly, and which platforms are they used on? From there, we can understand where and how to optimise the model for the remote working era.

By analysing the operating model in detail, the organisation will learn:

- Where the operational pain points are

- What processes can be optimised

- What processes can be automated

- What functions can be moved across geographies

Armed with this in-depth understanding and detailed modern Target Operating Model (TOM), the potential that exists for centralisation-nearshoring and automation can be exploited. Theoretical strategies then become tangible short-to-medium term improvements in profitability and operational efficiency.

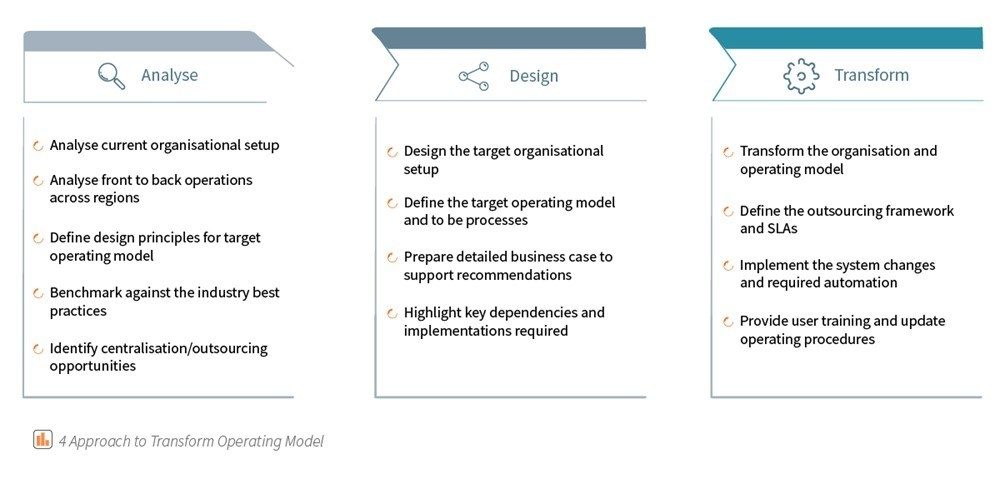

The Synpulse approach and offering

With over 25 years of private banking and wealth management experience globally, we have assisted various clients in transforming their operating models to generate greater value. Our in-house developed TOM methodology coupled with our BANKINABOXTM offering is a best-in-class framework that can revamp a bank’s operating model that would thrive in current market conditions.

Our framework can assess the gaps including automation maturity in bank’s operations by benchmarking to industry best practices and design the future TOM with nearshoring and outsourcing hubs to drive the digital transformation journey of the bank.

1 Hong Kong Business. Almost 82% Hong Kong businesses plan to keep remote working post-COVID-19. Accessed 1 December 2021.

2 Bloomberg. HSBC lets Hong Kong staff work up to four days a week from home. 18 November 2021.

3 KPMG and Private Wealth Management Association. Hong Kong Private Wealth Management Report 2020. Accessed 1 December 2021.

4 Asian Private Banker. 2020 Private Banking COO Survey