Underwriters are under a lot of pressure. They are now expected to produce more detailed and concise work in expanding markets. But their existing technology still does the job, so the question is, why? Has the “if it ain’t broke, don’t fix it” model run out of road?

Why implement an underwriting workbench?

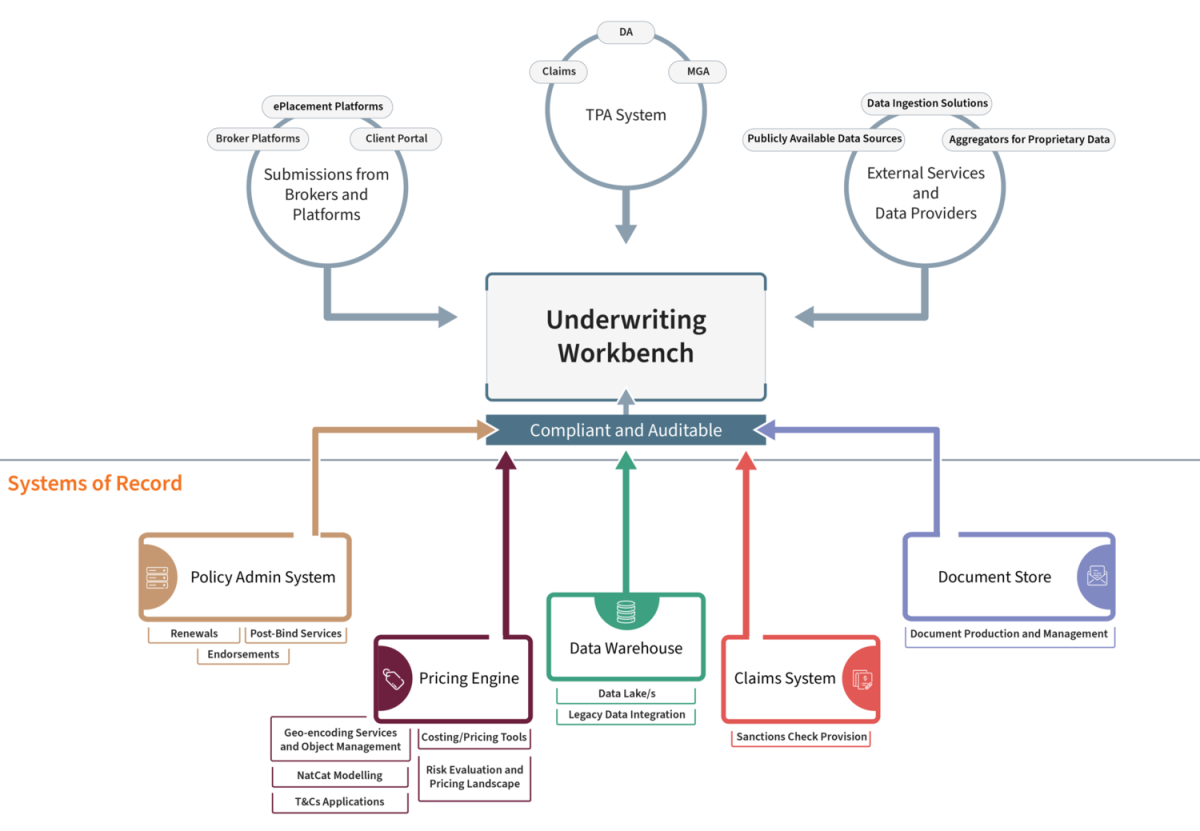

The current hot topic within the insurance underwriting world is akin to a race-car driving cockpit for underwriters – the underwriting workbench. It’s a digital control panel and collaboration tool that offers a “one-stop” nucleus for the underwriting lifecycle.

The underwriting workbench enables a more efficient distribution of work and access to digitalised documentation. It also provides a holistic view of data stream insights. While many underwriting systems are being replaced, the advantage of having a “one-stop” centre is a no-brainer – or is it?

To help you decide, here are the benefits of having an underwriting workbench:

- Inbound data are cleansed and structured so that systems can immediately ingest them without manual manipulation.

- Actionable items pass seamlessly between colleagues and functions, providing transparency through a defined workflow.

- Submissions are triaged – work items are assigned to the correct person or department for improved case management.

- A workbench solution brings multiple facets of efficiencies and transparent data insights, enabling a slicker throughput for clients. Information are presented via a clear, consistent UI, using progress bars, lists, and notifications to prompt action on high-priority tasks.

- Time-consuming manual activities, like searching through files and emails, are removed.

- Repetitive administrative tasks are automated (e.g., rekeying claim information into multiple systems or triggering a second pair of eyes to check on a completed quote).

- The need for an underwriter to switch between systems and communication channels is eliminated, reducing the time taken and likelihood of mistakes.

These benefits are compelling, but not all commercial insurers have chosen to invest in an underwriting workbench. Despite the convenience of having an intuitive tool, there are challenges that insurers have to overcome. These include finding the right vendor fit, integrating with existing systems, remapping of legacy data, and aligning with internal functions (e.g., claims, compliance, and risk engineering).

Don’t forget that there’s an “if it ain’t broke, don’t fix it” attitude within the insurance underwriting world too. If existing systems and processes can still get the job done, there is no urgency to consider overhauling them. But sometimes implementing a new technology may prove to be a superior solution.

Can an underwriter of the future afford to wait to implement an underwriting workbench?

Through superior data insights gained, the underwriting workbench enables a more informed and robust decision making. Using a combination of optical character recognition (OCR), natural language processing (NLP), and machine learning, more data points become available for analysis.

Information can be searched or scraped from the prior year scanned policies. This includes handwritten line percentages and pdf versions of risk engineering and due diligence reports. The quick reading of these data enables the underwriter to identify trends not previously available without considerable manual effort.

There’s also a single hub that augments internal system data with data from third-party providers. An underwriting workbench can fetch exposure data from an exposure management tool, like Sequel Impact, ExposureIQ, or Exact. It can also run company financial rating check from databases such as Standard & Poor’s, Dun & Bradstreet, and Moody, to supplement in-house data effectively and efficiently.

This single hub builds a 360-degree view of the risk being underwritten and delivers more superior insights than those derived from in-house data alone. Integration with third-party data sources, usually via API, also means that underwriters do not need to switch between tools. Moreover, they can have seamless access to vast amounts of data.

The underwriting workbench also brings together multiple systems in standardised or custom-built dashboards and reports. This empowers the underwriter to combine and overlay data views for valuable insights (e.g., looking at total insured values by location on a heat map for flood risk or paid claims against those incurred by underwriting year).

Trends and outliers can be identified over time, benchmarking is made easier, and the book can be scrutinised by product or geography.

Some decisions made on a risk-by-risk basis through pre-defined rules are also automated, allowing underwriters to focus on optimising the performance of their entire portfolio. For example, a workbench can decline risks on behalf of the underwriter and prioritise others into buckets based on expected profitability.

How to win against the competition

The market for workbench solutions is competitive. A variety of options leave carriers with an important decision to make – which solution brings the most benefits to their business?

When supporting clients to make this decision, we consider how far a solution provider can meet their business and functional requirements. We also look at their data and technology landscape, considering the working style compatibility to ensure a successful implementation.

Synpulse’s proprietary evaluation framework helps our clients find a solution that is right for them. We make sure that it fits their long-term strategy, business model, and resource constraints. We take care of the prep work to allow our clients to maximise the benefits of their selected workbench as early as possible.

Before day one of implementation, we conduct a thorough assessment of the existing underwriting value chain, including a full mapping of processes and throughput times. We also identify bottlenecks and time wasted on low-skilled administrative tasks.

In our experience, such valuable step has proven to reveal duplicated work, laborious administrative trackers, and unnecessary reporting fields. Knowing all these increases the efficacy of the technology solution implemented.

If you are looking to be an underwriter of the future then please get in touch with one of our consultants via LinkedIn!