Our third VIRTUALBANKING core belief centres around the key features of modern technology architecture, the cloud, and an API-ready environment that promotes open banking.

Banks that have successfully undergone digital transformation have reaped the rewards of enhanced customer experience and efficient operations. A typical digital banking experience has key features that include 24/7 real-time and on-demand customer service.1

However, the question remains: How did these digital banks manage to achieve this transformation? The secret lies within their architectural framework.

Cloud in digital banking

To fully leverage the benefits of digital banking, many banks have adopted a hybrid cloud strategy. By utilising the public cloud, banks can benefit from cost savings through flexible, scalable, and cost-effective solutions while still adhering to strict regulations and ensuring a high level of security through their private cloud infrastructure. The cloud empowers banks with on-demand access to computing services via the Internet, eliminating the need to host these services in on-premise data centres.

The first advantage of cloud-native systems is their agility. Cloud-native systems reduce delivery times for digital programmes or new products that are introduced in response to changing market conditions, emerging revenue opportunities, and evolving customer needs.

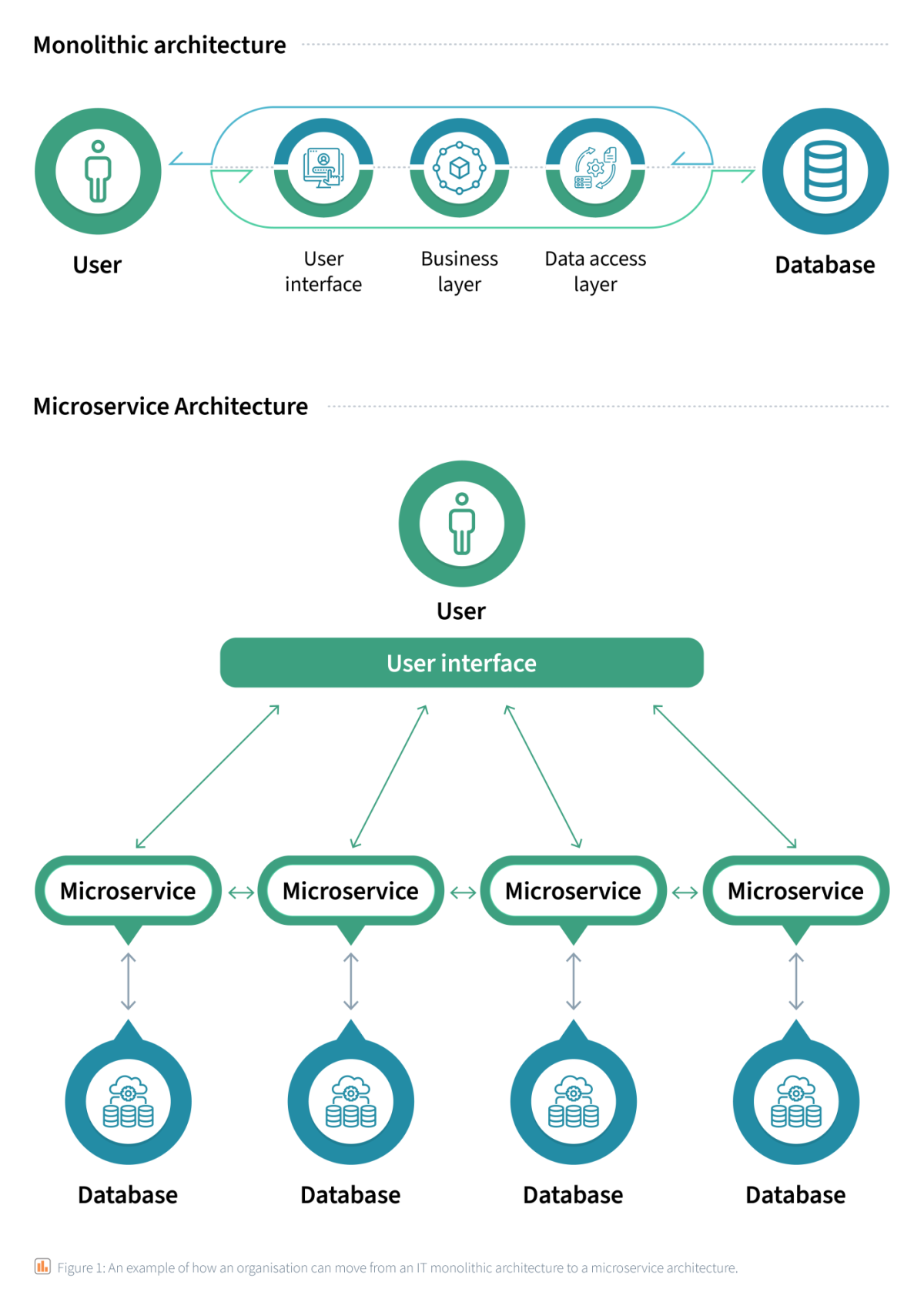

When it comes to updating legacy systems, the process often involves writing multiple layers of script on top of the existing systems. In contrast, the cloud-based core banking platforms provide an environment conducive to agile and resilient product development, testing, and launch. This is partly due to the use of microservices in cloud-native banking systems, where applications are built as independent deployable units.

Development teams can break down the work into smaller components and work on different modules simultaneously without the risk of overlaps. As a result, banks can efficiently roll out new products, software updates, and monthly releases at a faster pace.

Moreover, investing in modern cloud architecture allows banks to reshape the cost curve and achieve significant longer-term cost savings. Legacy on-premise data systems become increasingly expensive to maintain over time due to regular maintenance costs and costly upgrades that increase fixed expenses.

By embracing cloud solutions, banks can transition to a model where a larger proportion of technology costs become variable rather than fixed. This shift allows banks to redirect their resource efforts and reinvest the cost savings into growth initiatives.

API and open banking

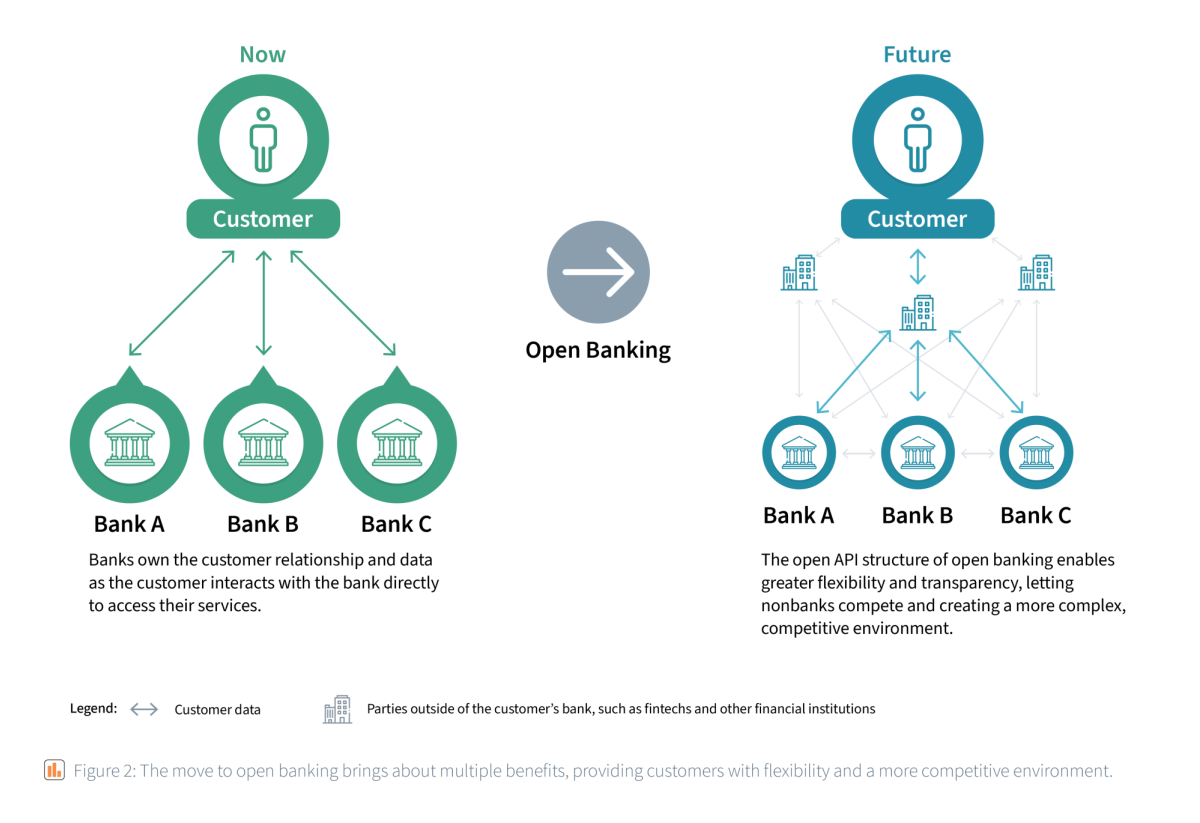

Another hallmark of modern banking architecture is open banking, the practice where banks open access to their core banking services through other third-party channels via APIs. This enables greater transparency and flexibility in managing their finances, and faster and more secure transactions.

Open banking heavily relies on cloud-native banking systems, which serve as the cornerstone for processing large volumes of data in real-time. Additionally, the significance of API connectivity cannot be overstated.

The problem with legacy stacks is they either have bespoke point-to-point integrations or are incompatible with new vendors or systems. Both factors make integration with new systems and vendors difficult, resulting in longer integrations.

With API connectivity in the cloud, there is greater flexibility for new system integrations, allowing banks to quickly absorb and process immense volumes of data from a myriad of different sources, facilitating real-time processing. In this age where customers increasingly demand for a more personalised customer experience, real-time services catered to customers is key for banks to retain a competitive advantage in the market.

That said, open banking APIs are not without security risks. Common concerns are data breaches due to poor security, hacking, or insider threats. As more firms adopt cloud solutions in recent years, we see an increase in attacks on cloud-based networks. To mitigate these risks, open banking regulations are in place to ensure that firms have a robust security system before coming on board the network.

The importance of modern architecture and cloud in today’s banking landscape

The adoption of modern architecture and cloud technology has become increasingly vital for banks to thrive and maintain relevance in the face of growing competition, including from non-bank players. One of the notable outcomes of this shift is the rise of Banking as a Service (BaaS), facilitated by APIs, enabling businesses without core banking infrastructure to offer a range of banking offerings to their customers. This development has proven to be a game changer, allowing non-financial institutions to snag a piece of the market share.2

By embracing modern architecture and harnessing the power of the cloud, banks can unlock critical sources of value that drive growth. In today’s landscape where banks face mounting competition from non-bank players, it is imperative for banks to go digital and leverage modern strategies and architecture to stay relevant and competitive.

1 Firas Ghunaim, How To Design The IT Architecture of a Digital Bank (Sitech, April 2022).

2 Banking as a Service (BaaS): the Platform Approach to Banking (International Banker, 10 September 2020).