The HKMA released guidelines on due diligence processes for green and sustainable products on 9 December 2022. The regulator highlighted key principles and best practices for incorporating appropriate governance to identify greenwashing risks.

With the growing demand for green and sustainable products in the market, the Hong Kong Monetary Authority (HKMA) undertook a round of thematic examinations on 9 December 2022, and shared five high-level principles to help financial institutions identify and mitigate greenwashing risks1. Before we discuss what banks should do in response to these guidelines, let us first examine HKMA’s findings.

HKMA’s due diligence processes for green and sustainable products

The guidelines follow the series of publications that the HKMA has released with regard to environmental, social, and governance (ESG) recommendations and policy developments in recent years.

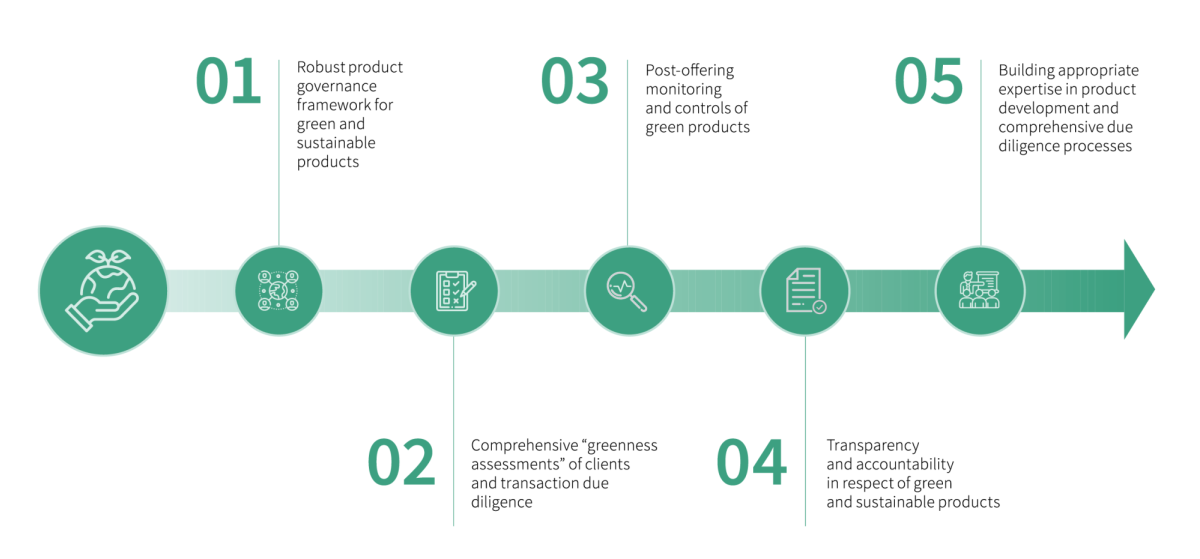

The following contains the five high-level principles identified by the Hong Kong regulator.

Robust governance framework for green and sustainable products

Financial institutions (FIs) need to adopt a robust governance framework to ensure their products are consistent with their overall climate strategy.

Examples of observed good practices:

- Set up an independent governance committee to assess and approve green products

- Embed climate-related risks, including greenwashing risks in their product due diligence process

- Develop internal product-specific guidelines for the design, origination, and classification of green products

Comprehensive “green assessments” of clients and transaction due diligence

To ensure that the requirements for green and sustainable products are met, FIs must conduct thorough assessments of "greenness" and climate-related risk.

Examples of observed good practices:

- Include an assessment of climate-related risks and eligibility for green products as part of know-your-customer (KYC) and credit approval

- Seek additional evidence such as third-party certifications to assess the greenness of projects and the use of proceeds

Post-offering monitoring and controls of green products

FIs must conduct post-offering monitoring to ensure that their products remain sustainable through their lifecycle in order to reduce greenwashing risk.

Examples of observed good practices:

- Conduct regular reviews of product portfolios, including assessing greenness performance, allocation, and the use of proceeds

- Request for independent external verification on the use of proceeds

- Establish policies to evaluate and “declassify” products if they fail to adhere to green terms set in the facility agreement

Transparency and accountability with respect to green and sustainable products

To mitigate the risk of perceived greenwashing, FIs must disclose information about their sustainable business, including their initiatives, funding, and allocation of relevant green proceeds.

Examples of observed good practices:

- Ensure proper disclosure of climate-related strategies, policies, and governing product classification frameworks

- Publish product-specific portfolio-level impact reports and utilisation or allocation reports of green projects funded

- Make climate-related disclosures in accordance with the Task Force on Climate-related Financial Disclosures’ (TCFD) international standards to enhance overall transparency

Building appropriate expertise in product development and comprehensive due diligence processes

FIs must allocate sufficient resources to build the necessary expertise to ensure that product due diligence processes and risk

assessments are conducted.

Examples of observed good practices:

- Provide green and climate-related training and internal guidance notes for staff across different seniority levels and functions

- Dedicate sufficient resources to build expertise in awareness and identifying climate-related risks in due diligence procedures

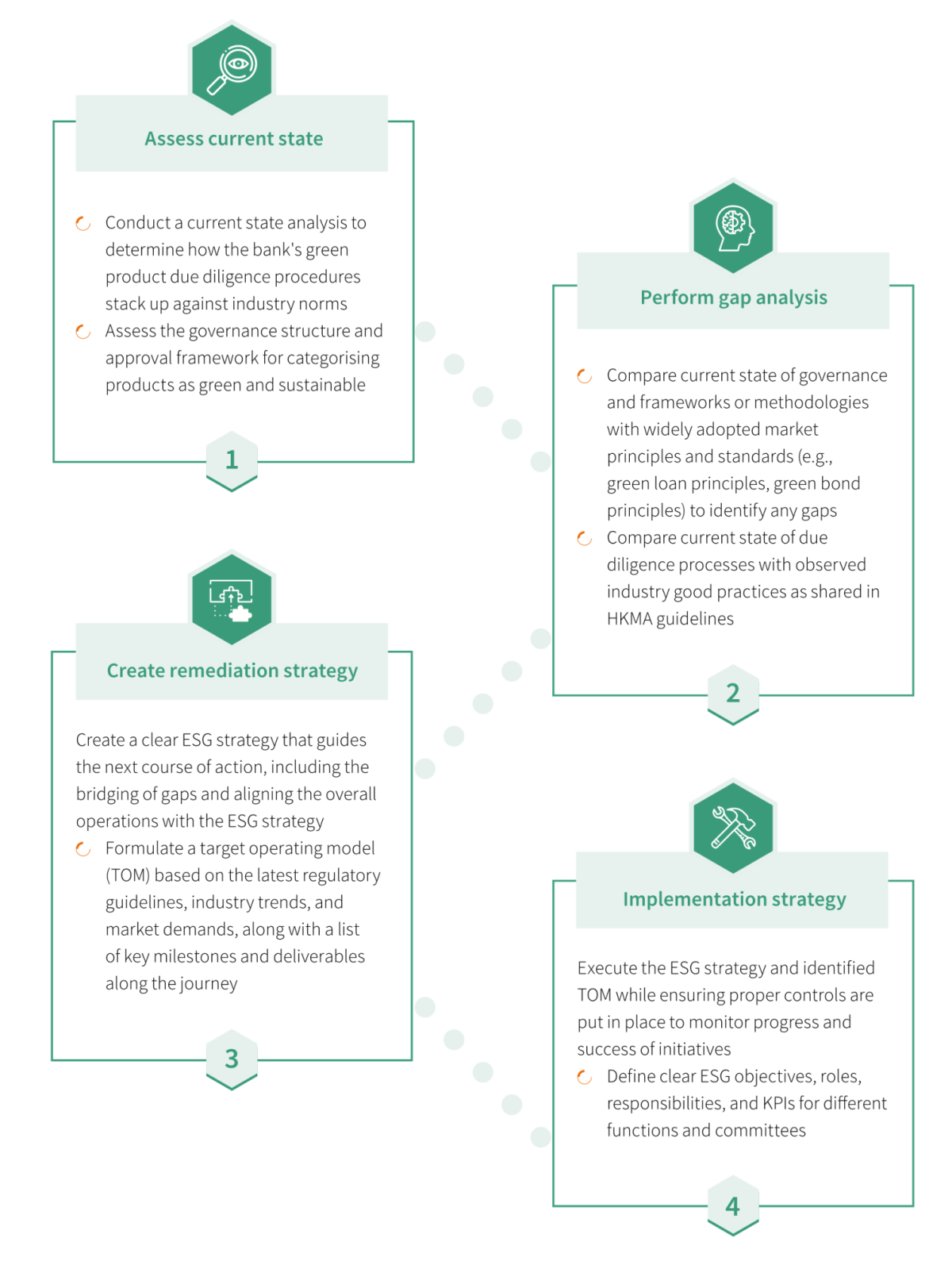

What are the next steps that banks can take in response to these guidelines?

ESG concerns are prompting FIs to adopt new policies and guidelines to achieve long-term viability and resilience. This poses a challenge for banks that do not have the operational and strategic expertise in sustainable finance. As the momentum for green finance increases, banks need to take the necessary steps to ensure their products meet both local and international ESG standards.

Begin your ESG transformation with the right partner

Synpulse is a global consultancy partner that delivers tailor-made solutions for a wide range of financial institutions. We can help guide your bank’s transformation journey by leveraging our extensive industry knowledge of ESG regulations, strong connections with major industry players, and technical expertise to build an ESG-compliant framework.

Extensive knowledge of ESG regulations

- We can help you navigate the dynamic regulatory landscape with our strong grasp of ESG-related topics in the APAC region

- We have a deep understanding of global regulations and can provide guidance on alignment with global standards

Strong connections with major industry players

- We can leverage our strong connections with major industry players to provide insights on key trends, existing gaps, and best practices in ESG.

- We know the challenges of key industry players when trying to integrate ESG into their existing risk management frameworks

Technical experience to build ESG-compliant framework

- We have developed a strategy to define a target operating model (TOM) with a clear ESG strategy at its core

- We can help you transform existing data into actionable insights to enhance your risk management framework and overall ESG strategy

1 The Hong Kong Monetary Authority. Due Diligence Processes for Green and Sustainable Products. 9 December 2022.