Loading Insight...

Insights

Insights

With traditional banks struggling to respond to their customers, the need for a unified technology platform has now become even more essential.

n engagement banking platform (EBP) enables a truly engaging customer experience, at any touchpoint. It reconnects customers with their banks by making employees an essential part of the equation. It also creates a unified ecosystem that focuses on unique value creation, not the maintenance of siloed solutions or layered offerings.

Banks that leverage an EBP drastically decrease the costs and back-office inefficiencies. They also experience a massive improvement in time to market, developing the ability to release valuable innovation in days or weeks. However, launching a digital proposition on an EBP typically comes with a number of similar strategic challenges.

In essence, banks need to drastically simplify and modernise their operations and delivery capabilities. At the same time, they need to take back control of the customer experience. With client needs changing and the pressure to manage the costs increasing continuously, banks are forced to undergo a digital transformation that goes beyond a platform or technology change.

One example is the strategic challenge for the bank’s management and its employees in the “war for talent”. Banks are competing for talent not only with fintech firms, but also with technology companies. Banks are also struggling with technical debt, legacy environments, and certain inertia when it comes to cultural changes, such as working with agile methodologies. This old way of working also makes it difficult to attract new talent.

Prominent challenges for banks

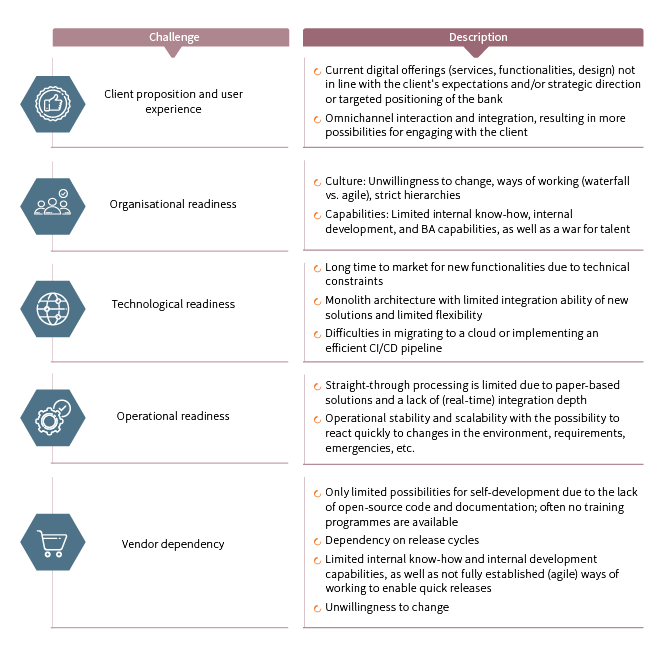

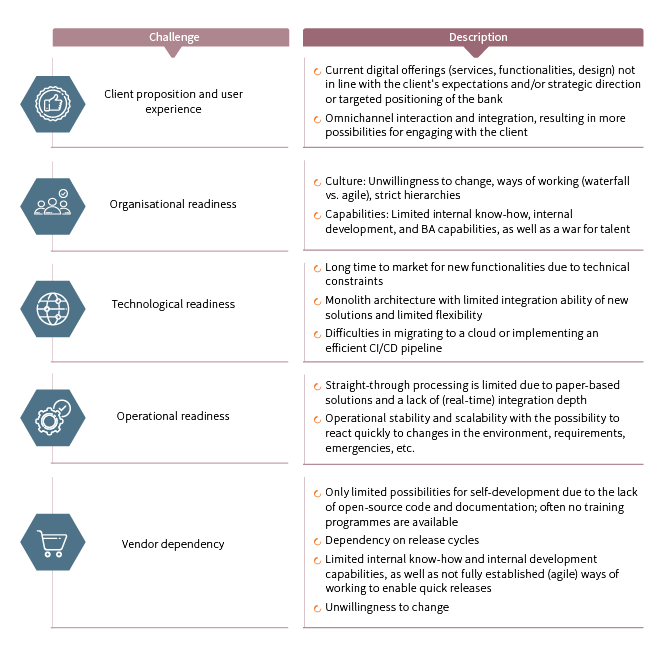

In Figure 1, you will see the most prominent challenges for banks. These challenges, when not addressed, have led to the failure of digital transformations even though new platforms were implemented. The knock-on effects include higher costs, longer time to market, and lower client satisfaction. As you will see, introducing an EBP involves a transformation of the whole bank.

Figure 1. Challenges faced by banks in terms of digital transformation

Build or buy

Besides the challenges outlined, one prominent question banks usually debate over is whether to buy the platform or build it themselves. Often, they’re tempted to build it themselves in the hope of reducing vendor dependency, but they underestimate the effort and skills required to build a fully digital platform.

As the scope of EBPs has grown significantly in the last decade, the build-your-own approach has become more complex and resource-heavy. Global vendors like Backbase, in contrast, devote their full attention to digital platforms. Banks can profit from the resulting economies of scale. A further advantage is that Synpulse and Backbase can help the customer reduce time to market, thanks to their experience with large delivery projects.

In our experience, it makes the most sense for a bank to procure the latest state-of-the-art software technology of a global platform, and then focus on the differentiating factors in its customer experiences. Vendor dependency in this setup is then more efficiently addressed by choosing a solution that uses open technologies, provides a versatile marketplace of integrated fintech solutions, and allows bank staff to be trained and deliver customised or new modules themselves.

The task of migrating and creating a digital banking platform, web and mobile, is comparable with the core banking transformations of the noughties. Expertise in such transformation projects, a structured and proven approach, as well as full determination, are necessary to successfully land programmes of this size and complexity.

In our next article, we’ll focus on the three key takeaways when setting up an engagement banking platform.

With traditional banks struggling to respond to their customers, the need for a unified technology platform has now become even more essential.

n engagement banking platform (EBP) enables a truly engaging customer experience, at any touchpoint. It reconnects customers with their banks by making employees an essential part of the equation. It also creates a unified ecosystem that focuses on unique value creation, not the maintenance of siloed solutions or layered offerings.

Banks that leverage an EBP drastically decrease the costs and back-office inefficiencies. They also experience a massive improvement in time to market, developing the ability to release valuable innovation in days or weeks. However, launching a digital proposition on an EBP typically comes with a number of similar strategic challenges.

In essence, banks need to drastically simplify and modernise their operations and delivery capabilities. At the same time, they need to take back control of the customer experience. With client needs changing and the pressure to manage the costs increasing continuously, banks are forced to undergo a digital transformation that goes beyond a platform or technology change.

One example is the strategic challenge for the bank’s management and its employees in the “war for talent”. Banks are competing for talent not only with fintech firms, but also with technology companies. Banks are also struggling with technical debt, legacy environments, and certain inertia when it comes to cultural changes, such as working with agile methodologies. This old way of working also makes it difficult to attract new talent.

Prominent challenges for banks

In Figure 1, you will see the most prominent challenges for banks. These challenges, when not addressed, have led to the failure of digital transformations even though new platforms were implemented. The knock-on effects include higher costs, longer time to market, and lower client satisfaction. As you will see, introducing an EBP involves a transformation of the whole bank.

Figure 1. Challenges faced by banks in terms of digital transformation

Build or buy

Besides the challenges outlined, one prominent question banks usually debate over is whether to buy the platform or build it themselves. Often, they’re tempted to build it themselves in the hope of reducing vendor dependency, but they underestimate the effort and skills required to build a fully digital platform.

As the scope of EBPs has grown significantly in the last decade, the build-your-own approach has become more complex and resource-heavy. Global vendors like Backbase, in contrast, devote their full attention to digital platforms. Banks can profit from the resulting economies of scale. A further advantage is that Synpulse and Backbase can help the customer reduce time to market, thanks to their experience with large delivery projects.

In our experience, it makes the most sense for a bank to procure the latest state-of-the-art software technology of a global platform, and then focus on the differentiating factors in its customer experiences. Vendor dependency in this setup is then more efficiently addressed by choosing a solution that uses open technologies, provides a versatile marketplace of integrated fintech solutions, and allows bank staff to be trained and deliver customised or new modules themselves.

The task of migrating and creating a digital banking platform, web and mobile, is comparable with the core banking transformations of the noughties. Expertise in such transformation projects, a structured and proven approach, as well as full determination, are necessary to successfully land programmes of this size and complexity.

In our next article, we’ll focus on the three key takeaways when setting up an engagement banking platform.